2025 MASK Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of MASK

Mask Network (MASK) is a portal tool designed to help users achieve a seamless transition from Web2.0 to Web3.0. Since its inception in 2021, it has established itself as a significant bridge in the crypto ecosystem. As of December 2025, MASK maintains a market capitalization of approximately $53.7 million, with a circulating supply of 100 million tokens, currently trading at $0.537 per token. This innovative asset, recognized for enabling encrypted communication and decentralized applications on traditional social platforms, continues to play an increasingly important role in Web3 integration and DeFi accessibility.

The platform allows users to seamlessly send encrypted information, cryptocurrencies, and access decentralized applications such as DeFi protocols, NFTs, and DAOs directly on mainstream social media platforms, fostering a decentralized application ecosystem that bridges centralized and decentralized worlds.

This article will provide a comprehensive analysis of MASK's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this Web3 infrastructure asset.

Mask Network (MASK) Market Analysis Report

I. MASK Price History Review and Current Market Status

MASK Historical Price Evolution

-

February 2021: Project launch with initial price of $0.8, experiencing significant appreciation during the early DeFi and NFT boom period, reaching an all-time high (ATH) of $41.45 on February 25, 2021.

-

2021-2024: Extended bear market phase, with sustained downward price pressure as the broader cryptocurrency market cooled and investor sentiment shifted away from speculative Web3 projects.

-

December 2025: Continued decline reaching an all-time low (ATL) of $0.53435 on December 18, 2025, representing a dramatic -83.88% decline over the past year.

MASK Current Market Status

As of December 18, 2025, MASK is trading at $0.537, down 6.87% over the past 24 hours and 12% over the past 7 days. The token demonstrates weakness across multiple timeframes, with a -23.87% monthly decline and the aforementioned -83.88% yearly loss.

Market metrics:

- Market Capitalization: $53.7 million

- 24-Hour Trading Volume: $121,063.73

- Fully Diluted Valuation: $53.7 million

- Circulating Supply: 100,000,000 MASK

- Total Supply: 100,000,000 MASK (100% circulating)

- Token Holders: 14,128

- Market Dominance: 0.0017%

The token operates on the Ethereum blockchain with contract address 0x69af81e73a73b40adf4f3d4223cd9b1ece623074. MASK maintains presence across 41 cryptocurrency exchanges, indicating ongoing liquidity and accessibility despite recent price deterioration.

Current market sentiment reflects "Extreme Fear" conditions, signaling significant bearish positioning and potentially depressed valuations relative to historical levels.

Check current MASK market price on Gate.com

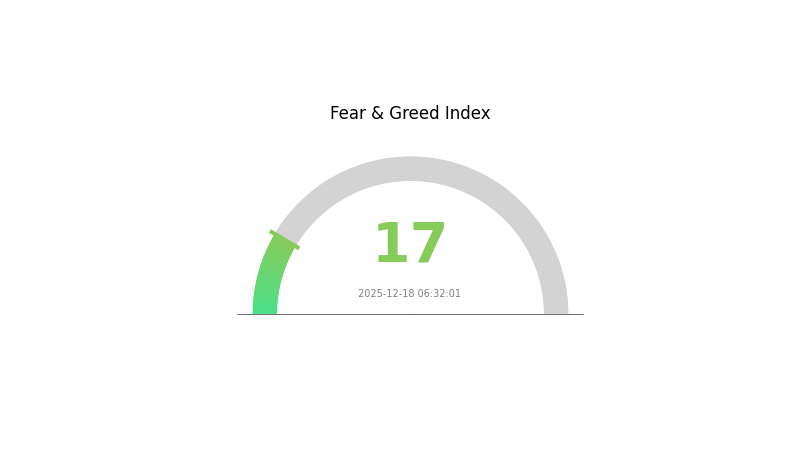

MASK Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The MASK market is currently in extreme fear territory with a fear and greed index of 17. This indicates investors are highly pessimistic, presenting potential buying opportunities for contrarian traders. When fear reaches extreme levels, assets are often oversold, creating attractive entry points for long-term investors. However, exercise caution as further downside is possible. Monitor market developments closely and consider dollar-cost averaging into positions rather than making large lump sum purchases during peak fear periods.

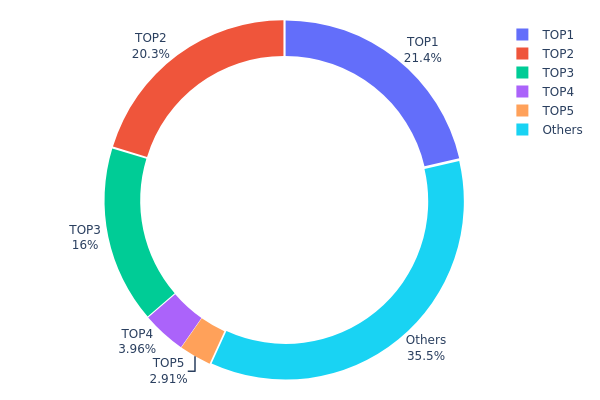

MASK Holdings Distribution

The address holdings distribution chart illustrates the concentration pattern of MASK tokens across blockchain addresses, revealing the degree of token centralization and the distribution of ownership power among top holders. This metric serves as a critical indicator for assessing market structure, liquidity dynamics, and potential manipulation risks within the MASK ecosystem.

Current data demonstrates a moderately concentrated holdings pattern, with the top three addresses commanding 57.66% of total token supply. The leading address holds 21.36%, followed closely by the second-largest holder at 20.29%, while the third major holder controls 16.01%. This three-address concentration level suggests meaningful centralization in MASK's token distribution. However, the remaining 35.47% of tokens dispersed among other addresses indicates a fragmented secondary tier of holders, which partially mitigates concerns about extreme concentration. The fourth and fifth-largest addresses hold only 3.96% and 2.91% respectively, demonstrating a significant drop-off in individual holder influence beyond the top three positions.

The current distribution landscape presents both structural considerations and market implications. While the top holders' combined 57.66% stake provides sufficient concentration to potentially influence price movements or governance decisions, the substantial retail holder base represented in the "Others" category suggests some level of decentralized participation. The disparity between the top three holders and secondary participants creates a bifurcated market structure where price discovery and volatility may be influenced by the actions of major stakeholders, though the non-negligible retail allocation reduces the risk of single-entity manipulation. This configuration reflects a moderate decentralization status, characteristic of projects in mid-stage maturity with established institutional or early investor stakes balanced against growing community participation.

Visit MASK Holdings Distribution on Gate.com for real-time updates.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb65c...c3e962 | 21363.50K | 21.36% |

| 2 | 0xcdd7...0cd3ec | 20290.55K | 20.29% |

| 3 | 0xf977...41acec | 16017.05K | 16.01% |

| 4 | 0xfc75...032b49 | 3960.93K | 3.96% |

| 5 | 0xbb87...a12563 | 2913.87K | 2.91% |

| - | Others | 35454.10K | 35.47% |

II. Core Factors Affecting MASK's Future Price

Technology Development and Ecosystem Construction

-

Web3 Ecosystem Growth: The increasing adoption of Web3 technology provides Mask Network with a growing potential user base. As a Web 3.0 project dedicated to building a bridge from the current internet to a new type of open network, Mask Network benefits from the expansion of decentralized application adoption and Web3 infrastructure development.

-

Innovative Product Model: Mask Network demonstrates innovation in its product model with solid progress and first-mover advantages within similar projects. The project maintains a established user base that supports long-term development and ecosystem expansion.

III. Price Forecast for MASK (2025-2030)

2025 Outlook

- Conservative Prediction: $0.3277 - $0.4500

- Neutral Prediction: $0.5372

- Optimistic Prediction: $0.5694 (requires sustained ecosystem development)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.3154 - $0.7802

- 2027: $0.4801 - $0.7601

- 2028: $0.6706 - $0.7420

- Key Catalysts: Protocol upgrades, expanding DeFi integration, increased institutional adoption, and growing user base within the ecosystem

2029-2030 Long-term Outlook

- Base Case Scenario: $0.3930 - $0.7859 (assumes steady adoption and market maturation)

- Optimistic Scenario: $0.6433 - $1.0595 (assumes accelerated ecosystem growth and positive regulatory environment)

- Transformation Scenario: $1.0595+ (assumes breakthrough developments in protocol functionality, major partnership announcements, and significant market expansion)

Note: Price forecasts are derived from historical trend analysis and market data. Investors should conduct thorough due diligence and monitor market conditions on Gate.com and other reliable sources before making investment decisions. Cryptocurrency markets remain highly volatile and unpredictable.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.56943 | 0.5372 | 0.32769 | 0 |

| 2026 | 0.78018 | 0.55332 | 0.31539 | 3 |

| 2027 | 0.76009 | 0.66675 | 0.48006 | 24 |

| 2028 | 0.74195 | 0.71342 | 0.67061 | 32 |

| 2029 | 0.7859 | 0.72769 | 0.39295 | 35 |

| 2030 | 1.05951 | 0.75679 | 0.64327 | 40 |

Mask Network (MASK) Professional Investment Strategy and Risk Management Report

I. Market Overview of MASK

Current Market Status

- Current Price: $0.537

- 24H Change: -6.87%

- Market Capitalization: $53,700,000

- Circulating Supply: 100,000,000 MASK

- Total Supply: 100,000,000 MASK

- Market Ranking: #481

- 24H Trading Volume: $121,063.73

Historical Price Performance

- All-Time High: $41.45 (February 25, 2021)

- All-Time Low: $0.53435 (December 18, 2025)

- 52-Week Change: -83.88%

- 30-Day Change: -23.87%

- 7-Day Change: -12%

Project Introduction

Mask Network is a portal designed to help users transition seamlessly from Web 2.0 to Web 3.0. It enables users to send encrypted information, cryptocurrencies, and access decentralized applications (DeFi, NFT, DAO) directly on traditional social media platforms, fostering a decentralized application ecosystem.

II. MASK Investment Strategy Framework

(1) Long-Term Holding Strategy

Target Investors: Web 3.0 enthusiasts, long-term technology believers, and diversified portfolio builders seeking exposure to decentralized application infrastructure.

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Implement systematic purchases at fixed intervals (weekly or monthly) to reduce timing risk and average entry costs across market cycles.

- Position Building: Establish core positions during market downturns when sentiment is pessimistic, taking advantage of the significant decline from all-time highs.

- Secure Storage: Utilize Gate Web3 wallet for non-custodial storage with multi-signature protection enabled for holdings exceeding $5,000.

(2) Active Trading Strategy

Technical Analysis Tools:

- Moving Averages (MA): Apply 50-day and 200-day moving averages on the hourly and daily charts to identify trend reversals and support/resistance levels.

- RSI (Relative Strength Index): Monitor RSI values below 30 for oversold conditions indicating potential reversal opportunities, and above 70 for overbought signals.

Swing Trading Key Points:

- Entry Signals: Execute positions when price touches 200-day moving average with RSI below 30, supported by volume confirmation.

- Exit Strategy: Take profits at 15-25% gains or when RSI exceeds 70, and implement stop-losses at 8% below entry points to manage downside risk.

III. MASK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate maximum 2-3% of total portfolio to MASK, viewing it as a high-risk, speculative position within diversified holdings.

- Aggressive Investors: Allocate 5-8% of portfolio to MASK as part of a Web 3.0 themed allocation, accepting higher volatility for potential upside.

- Professional Investors: Allocate 3-5% strategically, with tactical rebalancing based on fundamental developments and market cycles.

(2) Risk Hedging Solutions

- Diversification Approach: Combine MASK holdings with stable-value Web 3.0 infrastructure tokens to reduce portfolio volatility while maintaining thematic exposure.

- Position Sizing: Implement strict position sizing rules limiting individual trades to 1-2% of account capital, preventing catastrophic losses from adverse price movements.

(3) Secure Storage Solutions

- Hardware Wallet Alternative: Store significant MASK holdings in Gate Web3 Wallet with cold storage features and two-factor authentication enabled for enhanced security.

- Exchange Custody: For active trading positions, maintain holdings on Gate.com with withdrawal whitelist enabled and API key permissions strictly limited.

- Security Precautions: Never share private keys or seed phrases; enable all available security features; verify contract addresses before transactions (MASK contract on Ethereum: 0x69af81e73a73b40adf4f3d4223cd9b1ece623074).

IV. Potential Risks and Challenges

MASK Market Risks

- Extreme Volatility: MASK has experienced an 83.88% decline over the past year, demonstrating extreme price volatility that can result in substantial losses for retail investors holding during downturns.

- Low Liquidity Periods: With 24-hour trading volume of approximately $121,063, periods of concentrated selling can trigger significant price slippage, particularly for large retail orders.

- Limited Adoption: Despite its Web 3.0 focus, MASK faces challenges in achieving mainstream user adoption and network effects, impacting long-term utility and value realization.

MASK Regulatory Risks

- Social Media Platform Restrictions: Major social platforms including X (formerly Twitter) and others face evolving regulatory frameworks that could restrict or ban privacy-focused applications like Mask Network.

- Cryptocurrency Regulatory Uncertainty: Global regulatory frameworks for cryptocurrencies remain in flux, with potential restrictive legislation impacting token utility and trading.

- Compliance Requirements: As Mask Network operates across jurisdictions, new AML/KYC requirements could necessitate significant protocol modifications affecting user experience.

MASK Technology Risks

- Smart Contract Vulnerabilities: Like all blockchain applications, Mask Network infrastructure remains exposed to potential smart contract exploits or unforeseen technical failures.

- Centralization Concerns: Despite decentralization objectives, reliance on underlying social platforms and infrastructure presents single points of failure.

- Scalability Challenges: Current blockchain infrastructure limitations may restrict Mask Network's ability to serve mass-market audiences at competitive transaction costs.

V. Conclusion and Action Recommendations

MASK Investment Value Assessment

Mask Network represents a high-risk, long-term infrastructure play in the Web 3.0 ecosystem. While the project addresses a significant market need (seamless Web 2.0 to Web 3.0 transition), its current market position reflects significant challenges in adoption and utility realization. The substantial price decline from historical highs presents both substantial downside risk and potential opportunity for contrarian investors. Success depends critically on achieving meaningful integration with major social platforms and demonstrating sustainable user engagement metrics.

MASK Investment Recommendations

✅ Beginners: Adopt a "learn-and-hold" approach with minimal allocation (0.5-1% of portfolio), purchasing small amounts through Gate.com to understand token mechanics without significant capital exposure.

✅ Experienced Investors: Implement tactical DCA strategies during panic-sell events and volatile downturns, maintaining 2-5% portfolio allocation while actively monitoring on-chain metrics and adoption indicators.

✅ Institutional Investors: Conduct detailed fundamental analysis of user adoption metrics, transaction volumes, and developer activity before establishing positions; consider MASK as a small tactical allocation within diversified Web 3.0 infrastructure strategies.

MASK Trading Participation Methods

- Spot Trading on Gate.com: Execute buy/sell orders directly with real-time price discovery and access to multiple trading pairs.

- Limit Orders: Place buy orders at support levels (around $0.50-$0.54) to achieve optimal entry pricing during market weakness.

- Periodic Rebalancing: Implement quarterly portfolio reviews to maintain target allocation percentages aligned with risk tolerance.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. Consultation with professional financial advisors is strongly recommended. Never invest more capital than you can afford to lose completely.

FAQ

Does Mask Network have a future?

Yes, Mask Network has significant future potential. As a leading Web3 privacy and social infrastructure protocol, it continues expanding its ecosystem and user adoption. With growing demand for decentralized social networks and privacy solutions, MASK is well-positioned for long-term growth in the evolving Web3 landscape.

Why is the mask network going down?

Mask Network price fluctuations are driven by overall market volatility, sentiment shifts, and trading volume changes. Crypto markets experience natural corrections and cycles as investors adjust positions and respond to broader market conditions.

How high will Matic go in 2025?

Based on current market analysis, Matic could potentially reach $0.47 by end of 2025, with bullish scenarios suggesting it may surge toward $4.95 during favorable market conditions.

Who is the owner of Mask Coin?

Mask Coin was founded by Suji Yan, a renowned entrepreneur with strong technical background. Suji Yan leads the Mask Network project and is recognized as its owner and primary founder in the crypto community.

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

2025 AR Price Prediction: Analyzing Growth Factors and Market Dynamics in the Arweave Ecosystem

2025 SAROS Price Prediction: Analyzing Future Growth Potential and Market Trends for this Emerging Cryptocurrency

2025 SAROS Price Prediction: Comprehensive Analysis and Future Outlook for the Digital Asset Market

2025 API3 Price Prediction: Analyzing Market Trends and Growth Potential for the Decentralized Oracle Token

Paxful Review 2023: Features, Security, and User Experience

Mastering Web3 Wallet Management: A Guide for Using Tezos Platforms

Understanding Circulating Supply: A Key Metric in Crypto Economy

Can Render Tokens Climb to $100 in the Near Future?

Bee Network Q&A | Comprehensive, User-Friendly Guide