2025 OG Price Prediction: Will OpenGov Token Reach New Highs This Year?

Introduction: Market Position and Investment Value of OG

OG Fan Token (OG) is a functional token built on the Chiliz Chain, designed to provide fans of the OG E-sports team with tokenized shares to participate in team decision-making through the Socios platform. As of December 2025, OG has achieved a market capitalization of $61.24 million with a circulating supply of approximately 4.5 million tokens, trading at around $12.25 per token. This innovative fan engagement asset is playing an increasingly vital role in the sports and entertainment blockchain ecosystem.

This article will provide a comprehensive analysis of OG's price trajectory through 2030, integrating historical market patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors.

OG Fan Token (OG) Market Analysis Report

I. OG Price History Review and Market Status

OG Historical Price Trajectory

OG Fan Token has experienced significant volatility since its inception. The token reached its all-time high (ATH) of $24.78 on September 11, 2025, demonstrating strong market enthusiasm during that period. Conversely, the token hit its all-time low (ATL) of $1.18 on May 12, 2022, reflecting the challenging market conditions in the early phase of the token's lifecycle. This represents a remarkable recovery of approximately 1,979% from the lowest point to the peak.

Over the past year (1Y), OG has delivered positive returns, gaining 126.50% from its year-ago price levels, showcasing resilience and growth potential despite the broader crypto market volatility.

OG Current Market Position

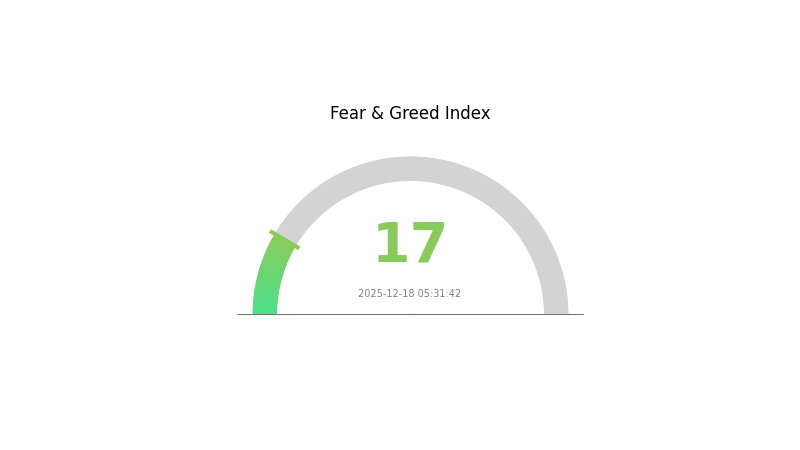

As of December 18, 2025, OG Fan Token is trading at $12.248, reflecting recent market pressure. The token is currently ranked 474 in the global cryptocurrency market by capitalization, with a fully diluted market valuation of $61,240,000. The market is experiencing heightened fear, with the VIX sentiment indicator at 17, categorized as "Extreme Fear."

Recent price performance shows downward pressure across multiple timeframes:

- 1-hour change: -1.46%

- 24-hour change: -4.63%

- 7-day change: -4.01%

- 30-day change: -11.05%

The 24-hour trading volume stands at approximately $457,785.84, indicating moderate liquidity. OG's circulating supply comprises 4,505,036 tokens out of a maximum supply of 5,000,000, representing a circulation ratio of 90.10%. The token is held by approximately 3,529 addresses, demonstrating a distributed holder base.

The current market capitalization is $55,177,680.93, with OG commanding a market dominance of 0.0019%. The high in the past 24 hours was $13.007, while the low reached $12.151, reflecting ongoing consolidation within a narrow trading range.

Click to view current OG market price

OG Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 17. This exceptionally low sentiment indicates intense panic among investors, suggesting potential capitulation in the market. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. However, extreme fear can also signal further downside risks in the near term. Market participants should exercise caution and implement proper risk management strategies. Such conditions typically precede significant price recoveries, making this a critical moment for portfolio positioning on Gate.com.

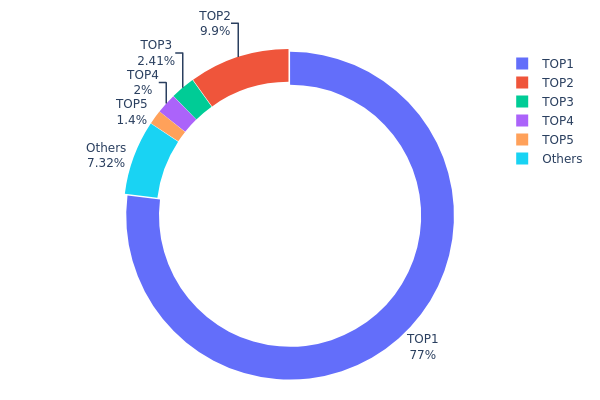

OG Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the top wallet addresses within the OG ecosystem. This metric serves as a critical indicator of market structure, revealing the degree of decentralization and potential vulnerability to large-scale liquidations or coordinated market movements. By examining how tokens are distributed among major holders, analysts can assess the stability of the asset's price dynamics and identify concentration risks that may impact market integrity.

OG exhibits a notably concentrated holdings structure, with the top holder commanding 76.97% of total supply—a level that signals substantial centralization risk. The top five addresses collectively control 92.68% of all OG tokens, leaving only 7.32% distributed among remaining network participants. This extreme concentration is characteristic of projects in early development stages or those with significant allocations retained by core teams and early investors. The dominant position of the leading address (0xF977...41aceC) at over 3.8 million tokens presents a considerable concentration that could amplify price volatility, as even modest portfolio adjustments by this holder could trigger substantial market swings.

The current distribution pattern suggests limited decentralization at the token holder level, which may constrain organic price discovery mechanisms and increase susceptibility to sudden sell pressure. While such concentration is not uncommon during project initialization phases, it underscores the importance of monitoring future token unlock schedules and holder migration patterns. The relatively small portion held by dispersed addresses (7.32%) indicates that the broader market structure remains heavily dependent on the actions and intentions of a small cohort of major stakeholders, thereby reducing the resilience of market microstructure against coordinated movements or strategic portfolio rebalancing.

Click to view the current OG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xF977...41aceC | 3848.66K | 76.97% |

| 2 | 0x6F45...41a33D | 494.96K | 9.90% |

| 3 | 0x07Eb...9240f2 | 120.50K | 2.41% |

| 4 | 0xA8dE...21a77C | 100.00K | 2.00% |

| 5 | 0x9877...A72Faa | 70.00K | 1.40% |

| - | Others | 365.87K | 7.32% |

II. Core Factors Influencing OG's Future Price

Supply Mechanism

- Structured Token Supply: OG adopts a structured token economic model designed to manage scarcity and token distribution over time.

- Current Impact: The structured supply mechanism is expected to influence price stability and long-term value retention by controlling the rate of new token releases into the market.

Macroeconomic Environment

- Inflation Hedge Characteristics: As a cryptocurrency asset, OG possesses certain inflation-hedging potential in specific economic environments. However, the actual effectiveness is subject to multiple market factors and macroeconomic conditions.

- Geopolitical Factors: Broader geopolitical changes and policy shifts in 2026 are expected to reshape the global investment landscape, which may indirectly affect cryptocurrency valuations and market sentiment.

III. 2025-2030 OG Price Forecast

2025 Outlook

- Conservative Forecast: $7.53 - $12.34

- Base Case Forecast: $12.34

- Optimistic Forecast: $17.15 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Accumulation and early growth phase with increasing institutional interest and market adoption

- Price Range Predictions:

- 2026: $10.77 - $20.35 (20% upside potential)

- 2027: $15.79 - $25.97 (43% cumulative increase)

- 2028: $17.19 - $27.64 (77% cumulative increase)

- Key Catalysts: Expanding use cases, strengthened network effects, increased liquidity through Gate.com and other platforms, positive regulatory developments

2029-2030 Long-term Outlook

- Base Scenario: $15.81 - $35.07 (101% cumulative increase by 2029, implying sustainable growth trajectory)

- Optimistic Scenario: $20.92 - $39.15 (144% cumulative increase by 2030, assuming broader market adoption and strengthened fundamentals)

- Transformative Scenario: $39.15+ (significant upside under conditions of mainstream adoption, major technological breakthroughs, or exceptional macroeconomic tailwinds)

- 2030-12-18: OG trading near $29.89 (approaching mid-term equilibrium with stable market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 17.15399 | 12.341 | 7.52801 | 0 |

| 2026 | 20.35154 | 14.7475 | 10.76567 | 20 |

| 2027 | 25.97329 | 17.54952 | 15.79457 | 43 |

| 2028 | 27.63698 | 21.7614 | 17.19151 | 77 |

| 2029 | 35.07285 | 24.69919 | 15.80748 | 101 |

| 2030 | 39.15069 | 29.88602 | 20.92022 | 144 |

OG Fan Token Investment Analysis Report

IV. OG Professional Investment Strategy and Risk Management

OG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Sports and entertainment enthusiasts, community-oriented investors, and fan token believers

- Operational recommendations:

- Accumulate OG tokens during market pullbacks to benefit from potential governance participation and NFT rewards

- Participate actively in Socios platform activities to earn additional rewards on top of token holdings

- Set a multi-year holding horizon to capture potential appreciation as OG esports team engagement grows

(2) Active Trading Strategy

- Technical analysis tools:

- Price momentum indicators: Monitor 24-hour and 7-day price trends to identify entry and exit points

- Volume analysis: Track 24-hour trading volume ($457,785.84) against historical averages to confirm trend strength

- Wave trading key points:

- Identify support levels near the 24-hour low ($12.151) and resistance near the 24-hour high ($13.007)

- Use the all-time high ($24.78 from September 2025) as a longer-term resistance reference point

OG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio allocation

- Active investors: 3-8% of portfolio allocation

- Professional investors: Up to 10% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Diversification strategy: Balance OG token exposure with other cryptocurrencies and traditional assets to reduce concentration risk

- Dollar-cost averaging: Deploy capital gradually over time rather than lump-sum purchases to mitigate timing risk

(3) Secure Storage Solutions

- Hardware wallet alternative: Consider Gate Web3 Wallet for secure non-custodial storage with multi-chain support

- Exchange storage: Maintain trading positions on Gate.com for active trading purposes with platform security protocols

- Security considerations: Never share private keys, enable two-factor authentication on all accounts, and verify contract addresses before transactions

V. OG Potential Risks and Challenges

OG Market Risk

- Fan token volatility: OG experienced a -4.63% decline in 24 hours and -11.05% over 30 days, reflecting high price sensitivity to team performance and community sentiment

- Liquidity concentration: With only 15 exchanges listing OG and a 24-hour volume of $457,785.83, liquidity may be insufficient for large trades

- Market cap constraints: The $61.24 million fully diluted valuation represents a relatively small market cap, making OG susceptible to price manipulation

OG Regulatory Risk

- Fan token classification uncertainty: Regulatory frameworks for fan tokens remain undefined in many jurisdictions, creating potential legal complications

- Sports industry compliance: Changes in sports regulations or Chiliz chain governance could impact OG's operational structure

- Geographic restrictions: Different countries may impose restrictions on fan token trading or ownership

OG Technical Risk

- Chiliz Chain dependency: OG operates on Chiliz Chain (a Proof-of-Authority sidechain), making it vulnerable to technical issues or governance changes on this network

- Smart contract vulnerabilities: While governance voting occurs through smart contracts, potential exploits or bugs could affect token functionality

- Cross-chain migration risk: Future protocol upgrades or shifts could require token migration with associated technical and financial risks

VI. Conclusion and Action Recommendations

OG Investment Value Assessment

OG Fan Token represents a unique investment opportunity at the intersection of esports, community engagement, and blockchain technology. The token's functionality within the Socios ecosystem provides tangible utility through governance participation, activity rewards, and future NFT staking opportunities. With a 126.50% year-over-year return, OG has demonstrated growth potential, though recent 30-day weakness (-11.05%) signals market caution. The relatively modest market cap and limited exchange listing present both opportunity for early adopters and liquidity challenges for larger investors. Success depends heavily on OG esports team performance, community engagement levels, and broader acceptance of fan tokens in the sports industry.

OG Investment Recommendations

✅ Beginners: Start with small allocations (1-2% of crypto portfolio) through Gate.com, participate in Socios platform to understand token utility, and practice long-term holding discipline

✅ Experienced investors: Employ dollar-cost averaging strategies, actively monitor Socios governance votes, and consider wave trading around identified support/resistance levels

✅ Institutional investors: Conduct thorough due diligence on OG esports team fundamentals, evaluate long-term community growth metrics, and implement structured position sizing with clear risk parameters

OG Trading Participation Methods

- Exchange trading: Trade OG directly on Gate.com with competitive spreads and reliable liquidity for position entry and exit

- Socios platform: Access OG Fan Token directly through the Socios application to participate in exclusive fan voting and earn rewards

- Community engagement: Join OG esports community channels to stay informed about governance decisions and upcoming token utility enhancements

Cryptocurrency investment carries extreme risk and is highly volatile. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with a professional financial advisor before making any investment decisions. Never invest more than you can afford to lose.

FAQ

Why is OG fan token pumping?

OG fan token is pumping due to strong community growth, increased adoption, and expanding utility. Rising investor interest and positive market sentiment are driving its upward momentum.

What is the price prediction for OG USDT in 2025?

Based on market analysis, OG is predicted to reach approximately $4.054 in 2025. This forecast reflects potential growth driven by market dynamics and adoption trends in the crypto ecosystem.

How much is 1 OG token?

As of December 18, 2025, 1 OG token is priced at $12.04, with a 2.90% change in the last 24 hours. The price may fluctuate based on market conditions and trading volume.

How much will 1 Dogecoin cost in 2025?

Based on expert analysis and historical data, Dogecoin is expected to reach approximately $0.19 in 2025. Current price stands at $0.15.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

Understanding KYC: Essential Verification for Cryptocurrency Platforms in India

Worldcoin thành World: Khám phá chuỗi Worldchain Layer 2 và dự án 1 tỷ đô la!

Optimal Times for Trading Cryptocurrencies

Comprehensive Guide to the Nexo Crypto Lending Platform

Guide to Transferring Assets to the Arbitrum Network