2025 PYM Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: PYM's Market Position and Investment Value

Playermon (PYM), as a key player in the NFT gaming sector, has been making waves since its inception. As of 2025, Playermon's market capitalization stands at $349,559.61, with a circulating supply of approximately 510,380,508.76 tokens, and a price hovering around $0.0006849. This asset, often referred to as a "play-to-earn pioneer," is playing an increasingly crucial role in the expanding universe of blockchain gaming and NFT ecosystems.

This article will provide a comprehensive analysis of Playermon's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PYM Price History Review and Current Market Status

PYM Historical Price Evolution

- 2021: PYM reached its all-time high of $0.456594 on November 22, marking a significant milestone for the project.

- 2025: The token hit its all-time low of $0.00018417 on June 28, indicating a substantial market correction.

PYM Current Market Situation

As of November 27, 2025, PYM is trading at $0.0006849. The token has shown mixed performance across different timeframes. In the past 24 hours, PYM has experienced a notable increase of 7.66%, with the price ranging between $0.000622 and $0.0006937. The 7-day trend also shows positive momentum with a 12.62% gain.

However, longer-term performance indicators reveal challenges. Over the past 30 days, PYM has declined by 24.33%, while the one-year performance shows a significant drop of 37.69%. This suggests that despite recent short-term gains, the token is still recovering from a broader downtrend.

PYM's current market capitalization stands at $349,559.61, with a circulating supply of 510,380,508.76 tokens. The fully diluted market cap is $684,900, based on a maximum supply of 1,000,000,000 PYM tokens.

The token's trading volume in the last 24 hours is $17,225.54, indicating moderate market activity. With 12,123 holders, PYM maintains a niche but dedicated community of investors and users.

Click to view the current PYM market price

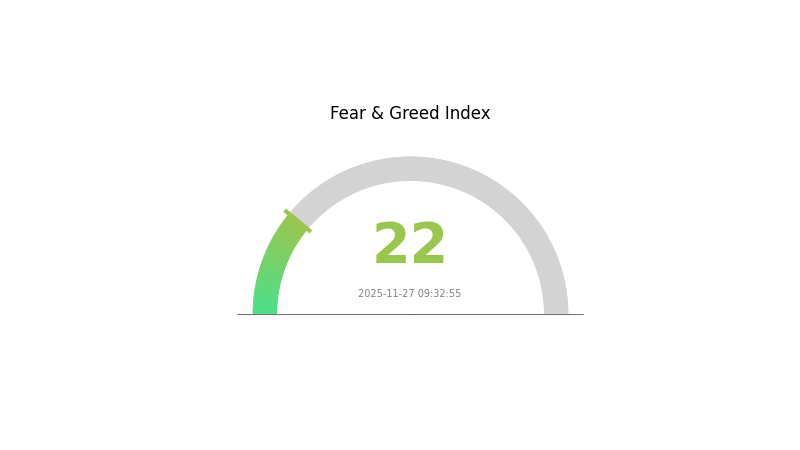

PYM Market Sentiment Indicator

2025-11-27 Fear and Greed Index: 22 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 22. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market conditions remain volatile. Traders should consider dollar-cost averaging and thorough research before making any decisions. Remember, while fear can create opportunities, it's crucial to manage risk and avoid emotional trading. Stay informed and consider diversifying your portfolio to navigate these uncertain times.

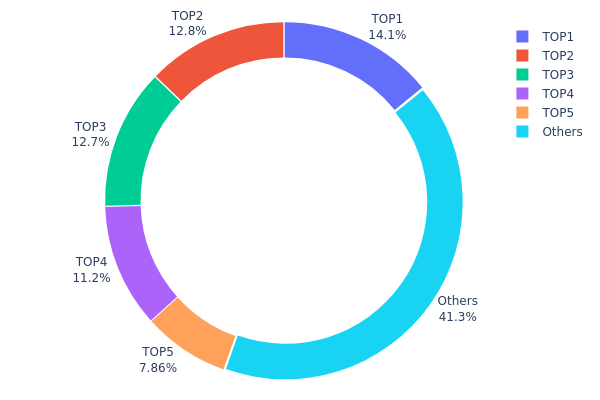

PYM Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of PYM tokens among various addresses. According to the data, the top five addresses collectively hold 58.65% of the total PYM supply, indicating a significant level of concentration. The largest holder possesses 14.12% of the tokens, followed closely by the second and third largest holders with 12.76% and 12.72%, respectively.

This high concentration of tokens in a few addresses raises concerns about potential market manipulation and price volatility. With nearly 60% of the supply controlled by just five addresses, there is a risk of large-scale sell-offs or coordinated actions that could significantly impact PYM's market price. Furthermore, this concentration suggests a lower degree of decentralization, which may be at odds with the principles of many cryptocurrency projects.

The distribution pattern also implies that the remaining 41.35% of tokens are spread among a larger number of smaller holders. While this provides some balance, the overall structure indicates a market that could be susceptible to the decisions of a few large stakeholders. This concentration may affect the on-chain governance and decision-making processes if PYM utilizes a token-based voting system.

Click to view the current PYM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4eec...834ca8 | 140000.00K | 14.12% |

| 2 | 0xb6f1...185198 | 126495.73K | 12.76% |

| 3 | 0xa70e...ebdbab | 126050.42K | 12.72% |

| 4 | 0x49d5...319000 | 111000.00K | 11.20% |

| 5 | 0x0d07...b492fe | 77855.75K | 7.85% |

| - | Others | 409446.11K | 41.35% |

II. Core Factors Affecting PYM's Future Price

Macroeconomic Environment

- Inflation Hedging Characteristics: As a cryptocurrency, PYM may potentially serve as a hedge against inflation in certain economic conditions. However, its effectiveness as an inflation hedge would depend on various factors and market dynamics.

Technical Development and Ecosystem Building

- Ecosystem Applications: While specific details are not provided, it's likely that PYM, like many cryptocurrencies, is working on developing decentralized applications (DApps) and ecosystem projects to increase its utility and adoption. The success of these initiatives could significantly impact PYM's future price.

III. PYM Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00045 - $0.00060

- Neutral forecast: $0.00060 - $0.00070

- Optimistic forecast: $0.00070 - $0.00073 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.00040 - $0.00104

- 2028: $0.00055 - $0.00110

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.00100 - $0.00121 (assuming steady market growth)

- Optimistic scenario: $0.00121 - $0.00143 (assuming strong market performance)

- Transformative scenario: $0.00143 - $0.00147 (assuming breakthrough developments)

- 2030-12-31: PYM $0.00147 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00073 | 0.00068 | 0.00045 | 0 |

| 2026 | 0.00085 | 0.00071 | 0.00053 | 3 |

| 2027 | 0.00104 | 0.00078 | 0.0004 | 13 |

| 2028 | 0.0011 | 0.00091 | 0.00055 | 32 |

| 2029 | 0.00143 | 0.001 | 0.0008 | 46 |

| 2030 | 0.00147 | 0.00121 | 0.00086 | 77 |

IV. PYM Professional Investment Strategy and Risk Management

PYM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate PYM tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in Gate web3 wallet for enhanced security

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Establish clear entry and exit points based on technical indicators

- Implement strict stop-loss orders to manage risk

PYM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for PYM

PYM Market Risks

- High volatility: PYM price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

PYM Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on gaming tokens

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax treatment of gaming tokens in different jurisdictions

PYM Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possible transaction delays during high-traffic periods

- Interoperability issues: Challenges in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

PYM Investment Value Assessment

PYM offers exposure to the growing blockchain gaming sector but comes with high volatility and regulatory uncertainties. Long-term potential exists, but short-term risks remain significant.

PYM Investment Recommendations

✅ Beginners: Allocate only a small portion of portfolio, focus on learning and understanding the project ✅ Experienced investors: Consider tactical positions based on technical analysis and market trends ✅ Institutional investors: Conduct thorough due diligence and consider PYM as part of a diversified gaming token portfolio

PYM Trading Participation Methods

- Spot trading: Buy and sell PYM tokens on Gate.com

- Staking: Participate in PYM staking programs if available

- Play-to-earn: Engage with the Playermon game ecosystem to earn PYM tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will pi coin reach $100?

It's highly unlikely for Pi coin to reach $100. Given its large supply and current market trends, a more realistic long-term price target might be in the range of $0.01 to $1.

How much will 1 pi be worth in 2025?

Based on market trends and expert predictions, 1 pi could potentially be worth around $0.50 to $1 by 2025, considering its growing adoption and ecosystem development.

Will pi coin reach 500$?

It's highly unlikely for Pi coin to reach $500. Given its large supply and current market trends, a more realistic long-term price target might be in the range of $0.1 to $1, if the project gains significant adoption and utility.

Will pi coin be worth anything?

Yes, Pi coin could potentially have value in the future. As the Pi Network grows and gains adoption, the coin may become tradable and acquire market value.

2025 PVU Price Prediction: Analyzing Market Trends and Future Potential of Plant vs Undead Token

2025 VON Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Is Vameon (VON) a good investment?: A Comprehensive Analysis of Price Trends, Market Potential, and Risk Factors for 2024

P2E vs Play-to-Earn: Maximizing Rewards in Crypto Gaming 2025

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

What Is the Future of YGG: A Comprehensive Analysis of Yield Guild Games' Fundamentals in 2025?

How do exchange inflows and outflows impact VSN token holdings and fund flow dynamics?

What is FLM: A Comprehensive Guide to Federated Learning Models and Their Applications in Modern AI

Understanding US Interest Rates: Effects on the Cryptocurrency Market

What is PIRATE: A Comprehensive Guide to Understanding Digital Piracy and Its Impact on the Global Economy

Enhancing DeFi Integration: Loop Network on Blockchain Platforms