2025 RARE Price Prediction: Expert Analysis and Market Outlook for the SuperRare Token

Introduction: Market Position and Investment Value of RARE

SuperRare (RARE) operates as an NFT trading platform dedicated to collecting and trading unique single edition digital art works, enabling artists to monetize their creative output while retaining secondary market royalties. Since its launch in 2021, RARE has established itself as a distinctive player in the digital art ecosystem on the Ethereum blockchain. As of December 2025, RARE's market capitalization stands at approximately $20.96 million with a circulating supply of around 819.55 million tokens, currently trading at $0.02096 per token. This platform, distinguished as a "creator-centric NFT marketplace," continues to facilitate the authentication, ownership, and trading of verified digital art collections in the decentralized economy.

This article will provide a comprehensive analysis of RARE's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasting and actionable investment strategies for market participants seeking exposure to this digital art tokenization segment.

SuperRare (RARE) Market Analysis Report

I. RARE Price History Review and Market Status

RARE Historical Price Evolution Trajectory

- October 11, 2021: All-Time High (ATH) reached at $3.64, marking the peak of market enthusiasm during the NFT boom period.

- October 11, 2025: All-Time Low (ATL) recorded at $0.01801027, reflecting sustained downward pressure over the extended bear market cycle.

- 2021-2025: Price experienced significant decline from peak to trough, with approximately 81.089% depreciation over the one-year period, demonstrating substantial retracement from historical highs.

RARE Current Market Situation

As of December 21, 2025, RARE is trading at $0.02096 with a 24-hour trading volume of $205,044.99. The token shows positive momentum in the short term, gaining 2.24% over the past 24 hours and 0.05% in the last hour. However, longer-term performance remains challenged, with the token declining 11.07% over the past seven days and 27.54% over the previous 30 days.

The current market capitalization stands at approximately $17.18 million with a fully diluted valuation of $20.96 million. The circulating supply represents 81.95% of the total supply of 1 billion tokens. With 11,866 token holders and availability on 24 exchanges, RARE maintains a market dominance of 0.00065% within the broader cryptocurrency ecosystem.

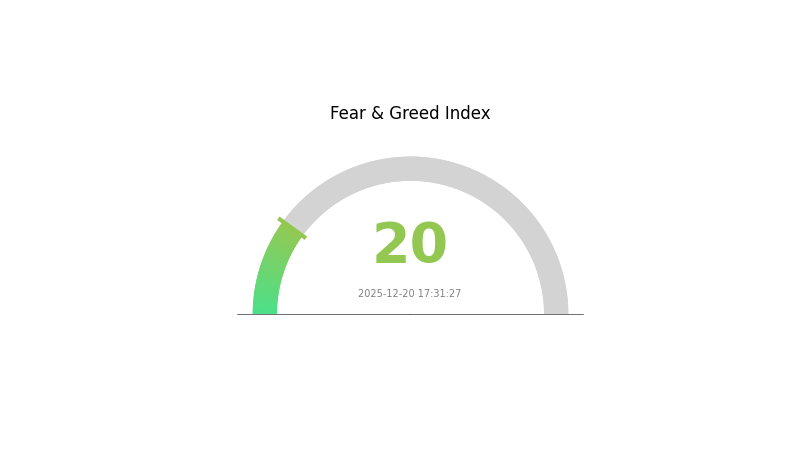

The token's trading range for the day spans from $0.0202 to $0.02101, indicating moderate volatility. Market sentiment currently reflects "Extreme Fear" conditions with a VIX reading of 20, suggesting heightened risk aversion across digital asset markets.

Click to view current RARE market price

RARE Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear as of December 20, 2025, with the Fear and Greed Index dropping to 20. This historically low reading signals heightened market anxiety and pessimism among investors. During periods of extreme fear, contrarian traders often view this as a potential buying opportunity, as markets tend to overreact to negative sentiment. However, caution is advised, as extreme fear can persist or deepen before recovery. Monitor market conditions closely on Gate.com for real-time data and trading opportunities.

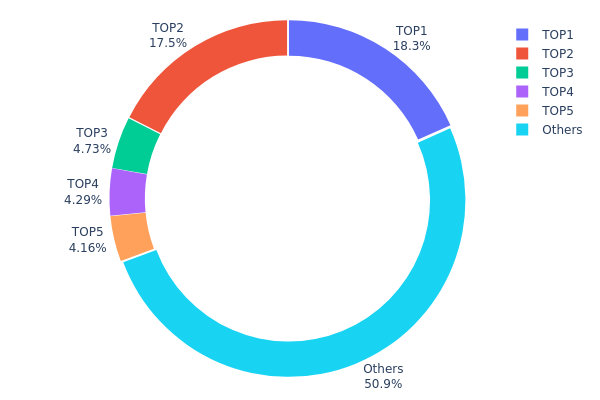

RARE Holdings Distribution

Click to view current RARE holdings distribution

The holdings distribution chart illustrates the concentration of RARE tokens across different blockchain addresses, providing crucial insights into the token's ownership structure and market dynamics. By analyzing the top holders and their proportional stakes, investors can assess the degree of decentralization and identify potential concentration risks that may influence token liquidity and price stability.

RARE exhibits moderate concentration characteristics, with the top two addresses collectively holding 35.87% of total supply. The leading address (0xf977...41acec) commands 18.33% while the second-largest holder (0x860a...b48da9) controls 17.54%, suggesting a relatively balanced distribution among major stakeholders. The subsequent three addresses hold progressively smaller positions ranging from 4.73% to 4.15%, indicating a gradual decline in concentration levels. Notably, addresses ranked three through five collectively represent 13.16% of holdings, while the remaining 50.97% is distributed among other addresses, signifying that the majority of RARE tokens are dispersed across a broader holder base.

This distribution pattern reflects a reasonably healthy market structure with meaningful decentralization. While the combined stake of top-two holders at approximately 36% warrants monitoring, the substantial portion held by dispersed addresses mitigates extreme concentration risks. The existence of multiple medium-sized holders alongside a significant "others" category suggests adequate liquidity depth and reduced susceptibility to single-actor price manipulation, thereby contributing to relative market stability and genuine price discovery mechanisms.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 183376.68K | 18.33% |

| 2 | 0x860a...b48da9 | 175483.75K | 17.54% |

| 3 | 0xb521...b36323 | 47310.37K | 4.73% |

| 4 | 0x76ec...78fbd3 | 42870.61K | 4.28% |

| 5 | 0xf931...dd8ba6 | 41572.54K | 4.15% |

| - | Others | 509386.05K | 50.97% |

II. Core Factors Influencing RARE's Future Price

Supply Mechanism

-

Global rare earth production dynamics: Global rare earth ore production reached approximately 17 million tons in 2018, representing a 28.8% year-over-year increase from 13.2 million tons in 2017. Global rare earth refined mineral consumption was approximately 14.3 million tons, while refined and separated product consumption reached 14.4 million tons in 2017.

-

China's dominant market position: China maintains over 70% of global rare earth supply share, retaining absolute advantages across resource varieties, reserves, and downstream markets. Illegal rare earth production has been partially suppressed under comprehensive policy measures, with the 2018 rare earth ore quota increased by 1.5 million tons reflecting environmental protection and anti-smuggling enforcement efforts over previous years.

-

ASEAN import dependency: Since 2017, ASEAN countries, particularly Myanmar, have become primary sources for heavy rare earth ore imports, accounting for approximately 20% of total quota allocation. However, these mining regions are primarily located in politically unstable areas, creating elevated geopolitical and environmental risks that continue to generate import uncertainties.

-

Emerging overseas supply: Overseas mining operations are predominantly light rare earth focused, with heavy rare earth content below 5% in major producing mines such as MountWeld and MountainPass. However, overseas rare earth ore accounted for nearly 30% of global supply in 2018, with major producers including Mountain Pass (United States) and Lynas' MountWeld operations, collectively producing approximately 35,000 tons of REO annually.

Geopolitical Factors

-

China-US strategic competition: Rare earth elements serve as strategic leverage in Sino-American geopolitical dynamics, with light rare earth elements (lanthanum, cerium, neodymium) widely applied in emerging energy sectors including electric vehicles and wind power generation, creating critical demand patterns.

-

Political risk concentration: Significant portions of overseas rare earth extraction occur in regions with military governments and unstable governance structures, amplifying supply chain vulnerability and creating persistent uncertainty in international rare earth procurement strategies.

Technology Development and Ecosystem Construction

- Rare earth refining breakthroughs: Recent technological advancements in rare earth refining and extraction processes are enhancing market competitiveness and improving production efficiency. Industry leaders are achieving significant technological progress in rare earth separation and purification, strengthening their competitive positioning in global markets.

Three、2025-2030 RARE Price Forecast

2025 Outlook

- Conservative Forecast: $0.01761 - $0.02097

- Base Case Forecast: $0.02097

- Optimistic Forecast: $0.02873 (requires sustained market momentum and positive sentiment)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Forecast:

- 2026: $0.01392 - $0.03454 (18% upside potential)

- 2027: $0.01604 - $0.03712 (41% cumulative gains)

- 2028: $0.02940 - $0.03641 (59% cumulative gains)

- Key Catalysts: Ecosystem development, increased adoption of underlying technology, market sentiment improvement, and potential partnership announcements

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02618 - $0.04887 (66% cumulative gains by 2029, assuming stable market conditions and consistent project execution)

- Optimistic Scenario: $0.04189 - $0.04315 (99% cumulative gains by 2030, assuming accelerated adoption and favorable market conditions)

- Transformative Scenario: $0.04887+ (potential for further upside given breakthrough developments, significant institutional interest, or major ecosystem milestones)

Note: Price predictions are based on historical data analysis and market modeling. Investors should conduct their own research and consider risk management strategies when trading on platforms such as Gate.com. Actual prices may vary significantly from forecasts due to market volatility and unforeseen events.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02873 | 0.02097 | 0.01761 | 0 |

| 2026 | 0.03454 | 0.02485 | 0.01392 | 18 |

| 2027 | 0.03712 | 0.0297 | 0.01604 | 41 |

| 2028 | 0.03641 | 0.03341 | 0.0294 | 59 |

| 2029 | 0.04887 | 0.03491 | 0.02618 | 66 |

| 2030 | 0.04315 | 0.04189 | 0.02472 | 99 |

SuperRare (RARE) Professional Investment Strategy and Risk Management Report

Four: RARE Professional Investment Strategy and Risk Management

RARE Investment Methodology

(1) Long-term Hold Strategy

- Target Audience: Digital art enthusiasts, NFT collectors, and investors with medium to long-term investment horizons who believe in the NFT and digital art market potential

- Operational Recommendations:

- Accumulate RARE tokens during market downturns, particularly when prices decline below historical support levels

- Hold tokens for a minimum of 12-24 months to benefit from potential ecosystem growth and NFT market recovery

- Reinvest any trading rewards or yield back into RARE positions to compound returns

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor support levels around $0.02 and resistance at $0.021 based on current 24-hour price ranges

- Track volume patterns to identify breakout opportunities in the NFT trading sector

- Wave Operation Key Points:

- Execute buy orders during negative market sentiment when 7-day price changes decline below -11%

- Take profit targets at 15-25% gains above recent support levels

- Maintain stop-loss orders at 10% below entry points to manage downside risk

RARE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Active Investors: 2-5% of total crypto portfolio allocation

- Professional Investors: 5-10% of total crypto portfolio allocation

(2) Risk Hedging Solutions

- Stablecoin Reserve Strategy: Maintain 30-40% of allocated capital in stablecoins to execute counter-position trades during extreme volatility

- Dollar-Cost Averaging (DCA): Execute regular purchases at fixed intervals regardless of market conditions to reduce timing risk

(3) Secure Storage Solutions

- Hardware Wallet Strategy: Store RARE tokens in secure self-custody solutions for amounts exceeding $5,000 in value to minimize exchange counterparty risk

- Hot Wallet Management: Use Gate Web3 Wallet for active trading amounts, enabling seamless transaction execution while maintaining reasonable security standards

- Security Considerations: Enable multi-signature protocols where available, use strong encryption passwords, enable withdrawal whitelisting, and never share private keys or seed phrases with any third parties

Five: RARE Potential Risks and Challenges

RARE Market Risk

- Extreme Price Volatility: RARE has experienced 81.09% decline over the past year and 27.54% decline in the past 30 days, indicating significant market risk and unpredictable price movements

- Low Trading Volume: 24-hour volume of approximately $205,044 is relatively low, creating potential liquidity constraints for large position exits

- Market Sentiment Dependency: NFT market adoption cycles directly impact RARE valuation, with reduced collector interest leading to rapid price deterioration

RARE Regulatory Risk

- NFT Regulatory Uncertainty: Varying jurisdictional approaches to digital assets and NFTs create compliance challenges for the SuperRare platform

- Platform Operational Risk: Changes in Ethereum network regulations or Layer 2 scaling regulations could impact platform functionality and token utility

- Securities Classification: Potential future regulatory determinations that RARE or NFT-related tokens constitute securities could restrict trading and holding

RARE Technical Risk

- Smart Contract Vulnerability: Platform relies on Ethereum smart contracts which may contain undiscovered vulnerabilities or exploitation vectors

- Blockchain Dependency: Complete reliance on Ethereum network performance means network congestion or technical issues directly impact platform functionality

- Market Liquidity Risk: Limited token holders (11,866 addresses) and low 24-hour trading volume create potential slippage risks during market stress events

Six: Conclusion and Action Recommendations

RARE Investment Value Assessment

SuperRare (RARE) represents a specialized exposure to the digital art NFT ecosystem, specifically targeting creators and collectors seeking authenticated, blockchain-verified digital artwork ownership. The platform's mission to enable artists to monetize creative work while maintaining secondary market royalty streams presents a unique value proposition within the Web3 space. However, the project faces significant headwinds including 81% year-over-year price decline, low trading liquidity, and NFT market maturation challenges. The current market capitalization of approximately $20.96 million reflects reduced market enthusiasm compared to 2021 peaks. Potential investors should recognize this as a high-risk, niche investment suitable only for those with specific interest in the digital art space and strong risk tolerance.

RARE Investment Recommendations

✅ Beginners: Allocate only 0.5-1% of crypto portfolio if interested in NFT sector exposure; use dollar-cost averaging over 6-12 months to reduce timing risk; prioritize security by storing holdings in Gate Web3 Wallet or equivalent secure solutions

✅ Experienced Investors: Implement tactical position sizing (2-5% of crypto allocation); use technical analysis to identify accumulation zones during volume spikes; maintain disciplined profit-taking at 20-30% gains; consider correlation hedging with other NFT-related assets

✅ Institutional Investors: Conduct comprehensive due diligence on SuperRare platform metrics, creator activity levels, and marketplace transaction volumes; consider RARE as component of broader NFT exposure strategy rather than standalone investment; implement sophisticated hedging strategies using derivatives for large positions

RARE Trading Participation Methods

- Gate.com Spot Trading: Execute buy/sell orders directly on Gate.com platform which provides access to RARE/USDT and other trading pairs with competitive pricing

- Direct Platform Participation: Engage with SuperRare.com ecosystem by purchasing digital artworks that automatically grant RARE token exposure

- Liquidity Pool Participation: Consider providing liquidity through compatible decentralized protocols to generate yield while maintaining RARE exposure

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Consult professional financial advisors before committing capital. Never invest amounts exceeding your capacity to absorb total loss.

FAQ

What is the rare price prediction for 2030?

Based on historical price analysis, RARE is predicted to potentially reach $1.00 by 2030, representing a significant increase from current levels. This forecast assumes continued market adoption and positive development momentum over the next five years.

How much is rare crypto worth?

As of December 2025, RARE token is valued at approximately $0.024 USD. The price fluctuates based on market demand and trading volume. For real-time pricing, check current market data directly.

What factors influence RARE token price movements?

RARE token price is driven by market liquidity, supply and demand dynamics, and trading volume. Automated Market Makers (AMMs) set prices based on liquidity pool composition. Market sentiment and speculative trading also significantly impact price movements.

What is the historical price performance of RARE?

RARE has demonstrated volatile performance, trading around $0.037 in October 2025 with peaks near $0.039. The token shows typical crypto market cycles with fluctuating daily movements, reflecting market demand and broader digital asset trends.

What are the risks associated with investing in RARE?

RARE investment risks include market volatility, regulatory changes, liquidity fluctuations, and geopolitical factors. Cryptocurrency markets are highly speculative and unpredictable. Token value depends on adoption rates, competition, and technological developments. Always conduct thorough research before investing.

why is crypto crashing and will it recover ?

Crypto Crash or Just a Correction?

Best Crypto To Buy, Outperforming XRP

Aethir (ATH) All-Time High Value in PKR: 2025 Update for Pakistani Investors

ETH vs HBAR: Comparing Scalability Solutions in the Next Generation of Blockchain Technology

ETH vs ZIL: A Comparative Analysis of Ethereum and Zilliqa Blockchain Platforms

Unlocking the Future of Loyalty: Web3 Rewards and Programs

Unlocking Real Estate Investment: Lower Barriers Through Tokenization Platform Innovation

Is SUPERFORTUNE (GUA) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Outlook

Is Chrema Coin (CRMC) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability

Is Swell Network (SWELL) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential