2025 THE Price Prediction: Expert Analysis and Market Forecast for Ethereum's Next Bull Run

Introduction: THE Market Position and Investment Value

Thena (THE) is a trading hub and liquidity layer built on BNB Chain and opBNB, offering a comprehensive ecosystem of trading and financial services. Since its launch in January 2024, THE has established itself as a significant player in the decentralized finance space. As of December 20, 2025, THE boasts a market capitalization of approximately $22.73 million with a circulating supply of 120.45 million tokens, trading at $0.1887 per token. This innovative platform is recognized as a "Multi-Product DEX Ecosystem" and continues to play an increasingly important role in enabling decentralized asset trading and liquidity provision.

This comprehensive analysis will examine THE's price trajectory from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

I. THE Price History Review and Current Market Status

THE Historical Price Trajectory

- November 2024: THE reached its all-time high (ATH) of $4.20 on November 27, 2024, representing a significant peak in the token's market performance.

- October 2025: THE declined to its all-time low (ATL) of $0.0748 on October 10, 2025, marking a substantial correction from previous highs.

- December 2025: THE has recovered to $0.1887 as of December 20, 2025, demonstrating a rebound phase following the October lows.

THE Current Market Status

As of December 20, 2025, THE is trading at $0.1887 with a 24-hour trading volume of $145,615.55. The token has experienced a 1.5% increase over the past 24 hours, while showing 5.47% growth over the 7-day period and 21.54% appreciation over the last 30 days. However, THE remains down 84.3% year-over-year, reflecting significant downward pressure over the extended timeframe.

The current market capitalization stands at $22,729,318, with a fully diluted valuation of $51,303,361. THE maintains a circulating supply of 120,452,136 tokens out of a total supply of 271,877,907 tokens, representing approximately 36.93% circulation ratio. The token is ranked #813 by market cap with a market dominance of 0.0016%.

THE is listed on 25 exchanges and is held by 60,220 wallet addresses, demonstrating a distributed holder base. The 24-hour trading range shows THE fluctuating between $0.1855 and $0.1931.

Click to view current THE market price

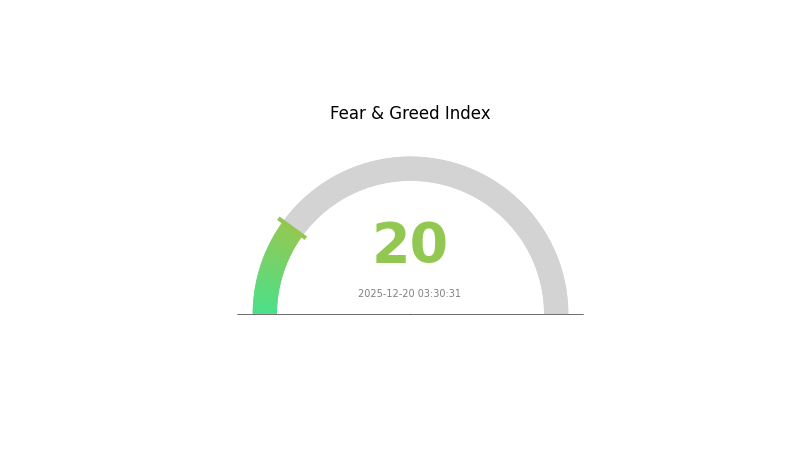

THE Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with a Fear and Greed Index reading of just 20. This indicates significant pessimism and risk aversion among investors. Such extreme readings typically signal capitulation, where panic selling dominates market sentiment. During periods of extreme fear, contrarian investors often identify potential buying opportunities at depressed prices. However, proceed with caution and conduct thorough research before making investment decisions. Market psychology can shift rapidly, so understanding both fear and greed cycles is essential for long-term trading success on platforms like Gate.com.

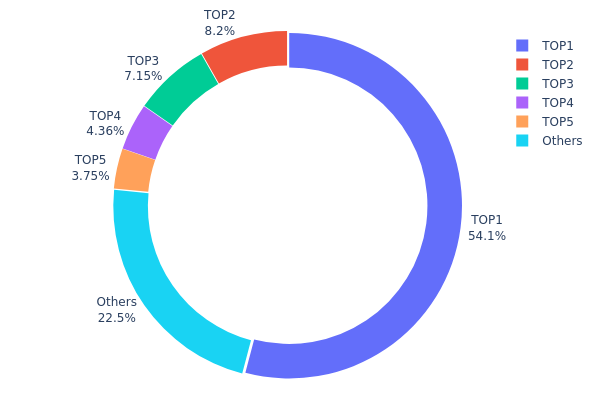

THE Holdings Distribution

The address holdings distribution represents the concentration pattern of THE tokens across the blockchain, illustrating how token ownership is allocated among top holders and the broader ecosystem. This metric serves as a critical indicator of market structure, potential systemic risks, and the degree of decentralization within the network.

THE demonstrates pronounced concentration characteristics, with the top holder commanding 54.08% of total supply—a significant concentration threshold that warrants close monitoring. The cumulative holdings of the top five addresses account for approximately 77.53% of all tokens in circulation, indicating substantial centralization risk. The second-largest holder maintains 8.20% of the supply, followed by progressively smaller positions, while the remaining addresses collectively control only 22.47%. This distribution pattern suggests that token governance and price discovery mechanisms remain heavily influenced by a limited number of major stakeholders.

This concentration architecture presents material implications for market dynamics and stability. The dominant position held by the largest address creates a structural vulnerability to potential price volatility, as significant liquidation or accumulation activities from this entity could substantially impact market conditions. Furthermore, the steep decline in holdings from top positions to the remaining address pool indicates asymmetric wealth distribution, potentially limiting organic market participation and reducing the resilience of on-chain governance mechanisms. The current holdings structure reflects a phase where THE maintains relatively early-stage token distribution characteristics, with decentralization metrics suggesting that broader distribution initiatives or vesting schedules may be necessary to achieve healthier market equilibrium.

View current THE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfbbf...1c070d | 151268.02K | 54.08% |

| 2 | 0x5a52...70efcb | 22945.42K | 8.20% |

| 3 | 0xf977...41acec | 20000.00K | 7.15% |

| 4 | 0xf052...9c58aa | 12195.65K | 4.36% |

| 5 | 0x86e0...33739f | 10478.25K | 3.74% |

| - | Others | 62803.97K | 22.47% |

II. Core Factors Influencing Bitcoin's Future Price

Supply Mechanism

-

Bitcoin Halving: Bitcoin's supply mechanism includes a halving event that occurs every four years, reducing mining rewards by half. The initial mining reward was 50 BTC per 10 minutes, reduced to 25 BTC in November 2012, and further decreased to 3.125 BTC as of April 2024. The most recent halving in 2024 reduced the inflation rate to below 1%.

-

Historical Pattern: Following the 2024 halving, historical data demonstrates that the second year after a halving typically marks a significant bull period for Bitcoin price appreciation. The supply-demand imbalance created by reduced issuance has historically driven substantial price increases.

-

Current Impact: With the next halving scheduled for 2028, continued supply scarcity is expected to intensify. Exchange reserves have declined from 3.1 million BTC to 2.4 million BTC, suggesting tightening liquidity and potential upward pressure on prices.

Institutional and Major Holders Dynamics

-

Institutional Adoption: The approval of Bitcoin Exchange-Traded Funds (ETFs) and entry of major institutional players including BlackRock and Fidelity have significantly enhanced Bitcoin's legitimacy and accessibility. These developments have strengthened confidence in Bitcoin as an institutional-grade asset.

-

Government Policy: The Trump administration has adopted a pro-cryptocurrency stance, appointing cryptocurrency supporters to key positions including the SEC chairmanship. The administration has pledged to make the United States the "global Bitcoin center" and committed to incorporating Bitcoin into national strategic reserves, while relaxing regulatory constraints on cryptocurrency.

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve interest rate decisions play a crucial role in Bitcoin's price dynamics. Lower interest rates environment and Fed rate reductions have historically created favorable conditions for cryptocurrency appreciation, as investors seek alternative assets beyond traditional markets.

-

Inflation Hedge Properties: Bitcoin is increasingly recognized as a "digital gold" and hedge against inflation. During periods of economic uncertainty and inflationary pressures, Bitcoin serves as a value store similar to traditional precious metals, attracting capital flows as investors protect purchasing power against currency devaluation.

-

Geopolitical Factors: International conflicts and geopolitical tensions increase safe-haven demand, benefiting assets like Bitcoin. Additionally, global central bank behavior reflecting "de-dollarization" trends supports gold-like assets including Bitcoin as alternative reserves.

Three、2025-2030 THE Price Forecast

2025 Outlook

- Conservative Forecast: $0.11352 - $0.1892

- Neutral Forecast: $0.1892

- Optimistic Forecast: $0.25164 (requiring sustained market confidence and ecosystem development)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and stabilization phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.13445 - $0.25568

- 2027: $0.15949 - $0.32137

- 2028: $0.21817 - $0.37201

- Key Catalysts: Enhanced protocol adoption, ecosystem expansion, macroeconomic recovery, and institutional interest in the asset class

2029-2030 Long-term Outlook

- Base Case Scenario: $0.24114 - $0.42362 (assuming moderate adoption acceleration and favorable regulatory environment)

- Optimistic Scenario: $0.29605 - $0.53213 (assuming significant ecosystem breakthroughs and mainstream institutional participation)

- Transformational Scenario: $0.53213+ (extreme positive conditions including mass adoption, technological innovations, and macroeconomic tailwinds)

- 2030-12-31: THE reaches $0.53213 (highest projected valuation milestone achieved)

Note: These forecasts are based on historical data analysis and market trends. Actual price movements may vary significantly due to market volatility, regulatory changes, and unforeseen macroeconomic factors. Investors should conduct thorough research and consider their risk tolerance before making investment decisions on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.25164 | 0.1892 | 0.11352 | 0 |

| 2026 | 0.25568 | 0.22042 | 0.13445 | 16 |

| 2027 | 0.32137 | 0.23805 | 0.15949 | 26 |

| 2028 | 0.37201 | 0.27971 | 0.21817 | 48 |

| 2029 | 0.42362 | 0.32586 | 0.24114 | 72 |

| 2030 | 0.53213 | 0.37474 | 0.29605 | 98 |

Thena (THE) Professional Investment Strategy & Risk Management Report

IV. THE Professional Investment Strategy and Risk Management

THE Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Value-focused investors seeking exposure to decentralized trading infrastructure on BNB Chain

- Operational Recommendations:

- Accumulate during market downturns, particularly when THE price consolidates below the 30-day moving average

- Hold through ecosystem expansion phases, especially as WARP Launchpad launches and attracts new liquidity

- Reinvest passive income generated from THENA spot DEX participation to compound returns over 12+ month horizons

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price levels at $0.1855 (24h low) and $0.1931 (24h high) for swing trade entries and exits

- Volume Analysis: Track 24-hour trading volume of $145,615.55 as an indicator of market participation; increased volume above this baseline suggests potential breakout opportunities

- Swing Trading Key Points:

- Capitalize on THE's 7-day positive momentum (+5.47%) while maintaining strict stop-loss discipline at 3-5% below entry positions

- Utilize ALPHA perpetuals DEX (supporting up to 60x leverage) for experienced traders, though leverage should not exceed 2-5x for capital preservation

THE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio allocation to THE, positioning it as a speculative allocation within a diversified crypto basket

- Active Investors: 5-8% allocation, with systematic rebalancing when THE exceeds 10% of total portfolio value

- Professional Investors: 10-15% allocation with dynamic hedging strategies tied to overall BNB Chain ecosystem performance metrics

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance THE holdings with exposure to established layer-1 blockchains and stablecoins to reduce single-chain concentration risk

- Position Sizing: Limit individual trade sizes to 1-2% of total portfolio per transaction to manage volatility exposure given THE's -84.3% year-over-year performance decline

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 wallet for frequent traders requiring liquidity access for ALPHA perpetuals or ARENA competition participation

- Cold Storage Approach: For long-term holders, utilize BNB Chain-compatible hardware verification methods with private key management protocols

- Security Considerations: Enable multi-signature authentication, regularly verify contract addresses on BSCScan (0xf4c8e32eadec4bfe97e0f595add0f4450a863a11), and maintain awareness of smart contract audit status through official documentation at docs.thena.fi

V. THE Potential Risks and Challenges

THE Market Risk

- Liquidity Risk: With a market capitalization of $22.73 million and circulating supply of 120.45 million tokens, THE faces concentration risk; sudden large withdrawals could create unfavorable slippage conditions

- Volatility Exposure: THE experienced extreme downside of -84.3% over the past year, demonstrating high price volatility that may exceed investor risk tolerance thresholds

- Market Sentiment Dependency: With only 25 exchange listings (including Gate.com), THE's price movements remain sensitive to sentiment shifts and could experience rapid devaluation during bear market phases

THE Regulatory Risk

- Jurisdictional Uncertainty: As a DEX and perpetuals trading platform, THENA faces evolving regulatory scrutiny regarding financial derivatives and leverage products across multiple jurisdictions

- Compliance Evolution: Regulatory changes impacting BNB Chain or perpetuals trading globally could necessitate product modifications or service restrictions affecting THE's utility and token value

- Derivative Restrictions: Potential regulatory crackdowns on leverage products (particularly the 60x leverage offered through ALPHA) could substantially impact protocol revenue and token economics

THE Technical Risk

- Smart Contract Vulnerability: While operating on established BNB Chain infrastructure, protocol-specific smart contracts require continuous auditing; any discovered vulnerabilities could trigger token value deterioration

- Liquidity Pool Risk: THENA's dependent on concentrated liquidity provision across trading pairs; insufficient liquidity depth could result in high slippage and poor trading execution

- Cross-Chain Integration: As THE spans both BNB Chain and opBNB, bridge vulnerabilities or synchronization failures between chains could compromise ecosystem functionality

VI. Conclusion and Action Recommendations

THE Investment Value Assessment

THE represents a specialized investment opportunity within the BNB Chain ecosystem, offering exposure to decentralized trading infrastructure with differentiated products (spot DEX, perpetuals, and competition platform). However, the token's -84.3% yearly decline and relatively limited market capitalization ($22.73M) indicate significant downside risk historically. The project's value proposition depends critically on achieving meaningful liquidity migration to its products, successful WARP Launchpad implementation, and sustained adoption across competitive DEX markets. Investors should view THE primarily as a long-term infrastructure bet requiring extended time horizons (18-24+ months) rather than near-term speculative positioning.

THE Investment Recommendations

✅ Beginners: Start with 1-2% portfolio allocation through Gate.com, focusing exclusively on spot THENA DEX participation rather than ALPHA leveraged products. Accumulate gradually during weakness below $0.15 support levels.

✅ Experienced Investors: Maintain 5-8% allocation with tactical swing trading around the identified support/resistance zones ($0.1855-$0.1931). Consider limited leverage exposure through ALPHA (maximum 2-5x) only after completing full documentation review.

✅ Institutional Investors: Establish 10-15% positions with structured entry protocols tied to BNB Chain TVL expansion milestones. Implement algorithmic rebalancing when THE's market cap fluctuates beyond historical ranges. Coordinate with hedge strategies on BNB Chain concentration exposure.

THE Trading Participation Methods

- Gate.com Spot Trading: Execute direct THE/USDT and THE/BNB spot trades with real-time order execution and competitive fee structures

- Liquidity Provision: Supply liquidity to THENA spot DEX for passive yield generation, with impermanent loss awareness required

- ALPHA Perpetuals (Advanced): Engage perpetuals trading on Gate.com or directly through ALPHA DEX for experienced traders with strict leverage discipline

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and circumstances. Professional financial consultation is strongly recommended. Never invest funds you cannot afford to lose completely.

FAQ

What is the PI price prediction for 2025?

Pi Network (PI) is currently trading at $0.2018. Market forecasts suggest PI could range from $0.27 to $0.42 by mid-2025, with an average prediction around $0.40. Some analysts project potential declines to $0.0395 in bearish scenarios, reflecting the token's volatility and uncertain adoption trajectory.

What is THE cryptocurrency and what are its fundamentals?

THE is a digital utility token built on blockchain technology, designed to provide governance and access rights within its ecosystem. Its fundamentals include decentralized architecture, community-driven governance, and utility-based tokenomics that support sustainable long-term value growth.

What factors could influence THE price in 2025?

THE price could be influenced by market adoption rates, blockchain developments, macroeconomic conditions, regulatory changes, trading volume fluctuations, and overall crypto market sentiment throughout 2025.

What are the risks associated with THE price predictions?

Price predictions involve market volatility, regulatory uncertainty, and limited data reliability. Predictions may not reflect actual market conditions, potentially leading to financial losses. Always conduct thorough research before making investment decisions.

How does THE compare to other similar cryptocurrencies in terms of price potential?

THE demonstrates strong price potential driven by its innovative blockchain technology and growing ecosystem adoption. Compared to similar projects, THE's unique tokenomics and community-driven development position it favorably for significant appreciation in the coming years.

Will Crypto Recover in 2025?

2025 BNB Price Prediction: Analyzing Market Trends, Ecosystem Expansion, and Key Factors Driving BNB's Future Value

2025 DYDX Price Prediction: Evaluating Growth Potential and Market Factors for the Leading Derivatives Exchange Token

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 1INCH Price Prediction: Will This DeFi Protocol Token Reach New Heights in the Decentralized Exchange Market?

2025 CETUS Price Prediction: Analyzing Growth Potential and Market Factors in the Evolving DeFi Landscape

Ethereum 2.0 Upgrade: Timeline and Key Impacts Unveiled

Understanding Jasmy Coin: Origin and Background

Understanding Flag Token Price Trends in Crypto Markets

Maximizing Returns with Crypto Lending Solutions

How to Purchase TRUMP Token: A Step-by-Step Guide