2025 VTHO Price Prediction: Expert Analysis and Market Forecast for VeThor Token's Future Growth

Introduction: VTHO's Market Position and Investment Value

VeThor Token (VTHO) serves as the utility token of the VeChainThor blockchain, functioning as gas for transactions, smart contracts, and on-chain activities. Since its launch in 2018, VTHO has established itself as an essential component of the VeChain ecosystem. As of December 2025, VTHO boasts a market capitalization of approximately $77.9 million, with a circulating supply of around 96.98 billion tokens, currently trading at $0.0008032. This utility-focused asset is increasingly playing a critical role in powering VeChain's mission to support real-world blockchain applications and enterprise adoption.

This article will provide a comprehensive analysis of VTHO's price trajectory through 2030, incorporating historical patterns, market dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. VTHO Price History Review and Market Status

VTHO Historical Price Evolution Trajectory

-

August 2018: VTHO reached its all-time high of $0.04671227, reflecting early market enthusiasm following the VeChainThor blockchain launch and initial adoption phase.

-

March 2020: VTHO declined to its all-time low of $0.00015238, marking the bottom of the market cycle during the broader cryptocurrency market downturn.

-

2018-2025: The token has experienced significant depreciation, declining approximately 75.8% over the past year as market conditions evolved and the broader crypto landscape shifted.

VTHO Current Market Conditions

As of December 18, 2025, VTHO is trading at $0.0008032, representing a 24-hour decline of 4.2% from the previous trading day. The token has demonstrated further weakness over extended timeframes, with a 7-day loss of 17.11% and a 30-day decline of 23.48%.

The current market capitalization stands at approximately $77.91 million, with circulating supply of 96,981,846,276 tokens representing 99.98% of total supply. Trading volume over the past 24 hours reached $12,971.50, indicating moderate liquidity across the 22 exchanges where VTHO is listed. The token ranks 392nd by market capitalization in the cryptocurrency landscape, maintaining a market dominance of 0.0024%.

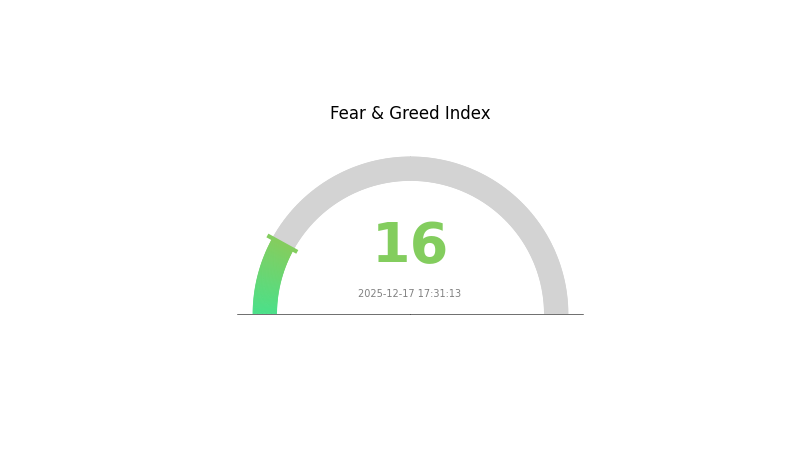

Recent price action shows VTHO trading within a range of $0.0007968 to $0.0008612 over the 24-hour period, with hourly movements showing a 0.16% decline. Market sentiment currently reflects extreme fear conditions with a VIX reading of 16, suggesting heightened volatility and risk aversion across the broader market.

Click to view current VTHO market price

Cryptocurrency Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This indicates severe investor pessimism and risk aversion across the market. When the index reaches such extreme lows, it often signals capitulation among retail investors and potential overselling conditions. Experienced traders may view this as a contrarian buying opportunity, as historically, periods of extreme fear have preceded market recoveries. However, caution is advised, as further downside risks remain. Monitor market developments closely on Gate.com for real-time data and insights before making any investment decisions.

VTHO Address Distribution

The address holding distribution chart provides critical insights into the concentration of token ownership across the VeThor (VTHO) network. This metric maps the cumulative holdings of top addresses, enabling analysts to assess the degree of decentralization, identify potential whale concentration, and evaluate systemic risks associated with token distribution imbalances. By examining how holdings are distributed among leading addresses, market participants can gauge the resilience of the network against potential price manipulation and understand the underlying power dynamics within the ecosystem.

Currently, the VTHO address distribution exhibits a relatively dispersed ownership structure, suggesting a moderate level of decentralization. The absence of extreme concentration among a single or small group of whale addresses indicates that the network maintains a reasonably balanced stakeholder composition. This distribution pattern mitigates the risk of abrupt large-scale liquidations or coordinated manipulation that could trigger significant price volatility. However, the precise degree of concentration should be continuously monitored, as even gradual accumulation by major holders could alter market dynamics and increase systemic vulnerability.

The current address distribution framework reflects a stable on-chain structure with limited evidence of excessive centralization risk. This characteristic supports organic market development and reduces the potential for insider-driven price movements. The dispersed holding pattern enhances market integrity and suggests that VTHO's price discovery mechanism operates within a relatively fair environment, though ongoing vigilance regarding institutional accumulation and long-term holder behavior remains essential for comprehensive risk assessment.

Click to view current VTHO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing VTHO's Future Price

Supply Mechanism

-

VTHO Generation Model: VTHO is generated as a utility token within the VeChain ecosystem, designed to support transactions and smart contracts on the VeChain blockchain. The token provides a predictable transaction cost mechanism through VET holder rewards, where VET holders generate VTHO based on their holdings.

-

Current Impact: As enterprise adoption of VeChain's supply chain management tools continues to grow, the demand for VTHO is expected to increase. The predictable cost structure of transactions denominated in VTHO positions the token favorably for sustained utility-driven demand.

Institutional and Whale Dynamics

- Large Holder Activity: Traders actively monitor whale activity—the movements of large VTHO holders—as their actions can significantly impact price movements in the relatively smaller VeThor market.

Macroeconomic Environment

-

Market Sentiment Impact: VTHO's price is influenced by investor sentiment, broader macroeconomic trends, policy regulation, and technological innovation. Market sentiment can shift rapidly, directly affecting trading activity and price volatility.

-

Cryptocurrency Market Cycles: VeChain's historical price movements demonstrate significant correlation with broader cryptocurrency market cycles, with the most notable rally occurring during the 2021 bull market. Price performance is likely to improve during positive market sentiment periods, particularly in subsequent bull cycles.

Technology Development and Ecosystem Building

-

Enterprise Blockchain Integration: VeChain is actively positioning itself as a leading enterprise-grade blockchain platform for real-world applications, particularly in supply chain management. As more global enterprises integrate transparent blockchain systems, demand for network transactions and VTHO consumption is expected to increase.

-

Application Expansion: VeChain's ecosystem includes diverse applications across fashion and luxury goods, food safety tracking, and automotive industries. These expanding use cases drive organic demand for VTHO as the transaction fuel for the network.

III. VTHO Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00062 - $0.001

- Neutral Forecast: $0.00081 (average)

- Bullish Forecast: $0.001 (maintaining current resistance levels)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual accumulation phase with incremental adoption of VeThor Protocol utilities

- Price Range Forecast:

- 2026: $0.00085 - $0.00107 (12% upside potential)

- 2027: $0.00075 - $0.00139 (22% upside potential)

- Key Catalysts: Expansion of dApps utilizing VTHO for transaction fees, increased enterprise adoption of VeChain ecosystem, growing demand for sustainable blockchain solutions

2028-2030 Long-term Outlook

- Base Case: $0.00073 - $0.00176 (48% growth by 2028, representing mainstream recognition of VTHO's utility value)

- Bullish Case: $0.00114 - $0.00196 (83-113% cumulative growth through 2029-2030, contingent on accelerated VeChain ecosystem expansion)

- Transformative Case: $0.00196 at peak (113% total upside by 2030, assuming breakthrough enterprise partnerships and significant increase in on-chain transaction volumes)

Key Observation: The forecast trajectory suggests VTHO may experience sustained appreciation driven by fundamental utility growth rather than speculative momentum, with 2029-2030 representing a potential inflection point as the ecosystem matures and institutional adoption accelerates.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.001 | 0.00081 | 0.00062 | 0 |

| 2026 | 0.00107 | 0.00091 | 0.00085 | 12 |

| 2027 | 0.00139 | 0.00099 | 0.00075 | 22 |

| 2028 | 0.00176 | 0.00119 | 0.00073 | 48 |

| 2029 | 0.00196 | 0.00147 | 0.00114 | 83 |

| 2030 | 0.00196 | 0.00172 | 0.00098 | 113 |

VeThor (VTHO) Professional Investment Strategy and Risk Management Report

IV. VTHO Professional Investment Strategy and Risk Management

VTHO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Users seeking stable utility token exposure within the VeChain ecosystem; investors with 2-5 year investment horizons; those believing in enterprise blockchain adoption.

- Operation Recommendations:

- Accumulate VTHO during market downturns when price remains below historical averages, leveraging its essential role as transaction fuel on VeChainThor.

- Participate in the StarGate staking program to generate passive VTHO rewards while maintaining network participation.

- Allocate positions gradually rather than lump-sum investments to mitigate timing risk in volatile markets.

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor 24-hour volatility patterns: VTHO showed -4.2% change in the last 24 hours; traders should set alerts at support (0.0007968) and resistance (0.0008612) levels.

- Track 7-day and 30-day trends: The -17.11% 7-day decline and -23.48% monthly decline indicate extended downtrend conditions requiring cautious entry strategies.

- Wave Operation Key Points:

- Identify oversold conditions: Current annual decline of -75.8% from 2024 levels suggests accumulated selling pressure; look for volume divergence as reversal indicator.

- Establish take-profit targets at 5-8% gains from entry points given current market volatility; use stop-losses at 3-5% below entry to manage downside risk.

VTHO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation to VTHO due to its specialized utility function and market cap of approximately $77.9 million.

- Active Investors: 2-5% allocation, combining long-term holds with selective trading opportunities.

- Professional Investors: 3-10% allocation with hedging strategies and active ecosystem participation through staking programs.

(2) Risk Hedging Solutions

- Diversification Strategy: Balance VTHO holdings with VET (VeChain's value storage token) to optimize the dual-token model benefits; this natural hedge maintains ecosystem balance.

- Position Sizing Protocol: Implement strict position limits where no single VTHO trade exceeds 2% of total portfolio capital, with automatic rebalancing at predetermined thresholds.

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate.com Web3 wallet recommended for frequent trading and staking participation, offering convenient access to StarGate staking programs while maintaining reasonable security standards for operational amounts.

- Cold Storage Method: Transfer long-term holdings to non-custodial solutions with private key control for amounts exceeding 6-month trading requirements.

- Security Precautions: Enable multi-factor authentication on all exchange accounts; never share private keys or seed phrases; verify contract addresses before transactions; maintain regular backups of wallet recovery information.

V. VTHO Potential Risks and Challenges

VTHO Market Risks

- Concentration Risk: As a specialized utility token, VTHO depends entirely on VeChainThor network adoption; limited use cases outside the VeChain ecosystem constrain broader market demand.

- Extreme Price Volatility: Historical price range from $0.04671227 (ATH) to $0.00015238 (ATL) represents 306x variance; current pricing near 1.72% of all-time high indicates severe depreciation and elevated technical weakness.

- Liquidity Constraints: Daily trading volume of approximately $12,971 across 22 exchanges indicates relatively low liquidity compared to market cap; large trades may experience significant slippage.

VTHO Regulatory Risks

- Evolving Classification Uncertainty: Regulatory frameworks governing utility tokens remain in flux globally; reclassification of VTHO's status could impact trading availability and custody requirements.

- Jurisdictional Access Limitations: Certain regions have restricted cryptocurrency trading; users may face increased compliance requirements or geographic trading limitations in the future.

- Enterprise Compliance Requirements: As VeChain targets institutional adoption, regulatory changes affecting enterprise blockchain infrastructure could indirectly impact VTHO utility and demand.

VTHO Technical Risks

- Blockchain Protocol Changes: Future VeChainThor protocol upgrades could alter VTHO's fee structure or consumption rates, potentially reducing long-term token economics.

- Smart Contract Vulnerabilities: While VeChain emphasizes security, undiscovered vulnerabilities in connected smart contracts could create systemic risks affecting network functionality and token utility.

- Network Scalability Constraints: If VeChainThor fails to achieve anticipated transaction volumes, demand for VTHO gas will remain suppressed relative to token supply, pressuring prices downward.

VI. Conclusion and Action Recommendations

VTHO Investment Value Assessment

VTHO represents a specialized utility token designed to fuel VeChainThor's enterprise blockchain operations. Its value proposition rests on the thesis that real-world enterprise adoption of VeChain will drive transaction demand and gas fee consumption. However, the token's -75.8% annual decline and current trading price 98.3% below all-time high reveal significant market skepticism regarding near-term growth catalysts. The dual-token model does provide inherent merit by separating transaction costs from value storage, supporting long-term economic sustainability. Investors should recognize that VTHO success depends critically on VeChain's execution in enterprise partnerships and regulatory acceptance—not guaranteed outcomes.

VTHO Investment Recommendations

✅ Beginners: Start with 1-2% portfolio allocation through Gate.com; participate in StarGate staking to familiarize yourself with ecosystem mechanics before active trading. Focus on understanding VeChain's use cases before expanding exposure.

✅ Experienced Investors: Implement 2-5% allocation combining long-term stakes (leveraging StarGate rewards) with technical analysis-guided trading around identified support/resistance levels. Use position sizing discipline and maintain hedging strategies.

✅ Institutional Investors: Consider 3-10% allocations with dedicated research into VeChain partnership pipelines and enterprise adoption metrics. Establish custody infrastructure and explore direct engagement with VeChain's ecosystem development initiatives.

VTHO Trading Participation Methods

- Gate.com Spot Trading: Direct VTHO/USDT and VTHO/USDC trading pairs for immediate market participation with competitive spreads and low fees.

- StarGate staking Program: Deposit VTHO to generate passive rewards while maintaining token exposure; ideal for holders seeking yield without actively trading.

- Dollar-Cost Averaging Protocol: Execute scheduled purchases at fixed intervals regardless of price to systematically build positions while reducing timing risk.

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. Consider consulting qualified financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

FAQ

Will VTHO reach $10?

VTHO reaching $10 is extremely unlikely. It would require a gain of over 1,176,000%, which is highly improbable given current market conditions and tokenomics.

Why did VTHO jump?

VTHO jumped due to positive updates from VeChainThor blockchain and increased network activity. Rising investor sentiment and growing adoption of the VeChain ecosystem drove the price surge significantly.

Could VeChain hit $1?

Yes, VeChain could potentially reach $1 with significant market growth and favorable conditions. At $1, VET's market cap would be around $72 billion. While speculative, it remains possible if the project and crypto market develop positively.

What happened to VeThor token today?

VeThor token's price stands at $0.0009344 today, experiencing a 1.34% decline over the last 24 hours. The trading volume is $2.03M with a market cap of $90.58M.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Copy Trade: Complete Guide to Gate Contract Copy Trading from Beginner to Pro

Solana NFT Projects Market Trends: 2025 Latest Price Analysis and Potential Opportunities

Institutions Embrace Ethereum: In-Depth Analysis of BitMine’s 48,049 ETH Accumulation

HashKey Becomes Hong Kong’s First Public Crypto Stock, but HSK Token Crashes — How Should Investors Interpret This Divergence?

Visa USDC on Solana: The Blockchain Path Transforming the U.S. Banking Settlement System