- Trending TopicsView More

79.83K Popularity

26.37K Popularity

62.97K Popularity

104.23K Popularity

34.13K Popularity

- Hot Gate FunView More

- MC:$3.54KHolders:10.00%

- MC:$3.54KHolders:20.00%

- MC:$3.43KHolders:10.00%

- MC:$3.51KHolders:20.05%

- MC:$3.5KHolders:20.04%

- Pin

- 🎄 Gate Square · Christmas Warmth Creation Event

❄️ Winter is cold, but Gate Square is here to warm you up!

Post continuously on Gate Square for a chance to win heartwarming Christmas gift boxes + over 1000 USDT position voucher!

📅 Event Period: Nov 20 04:00 – Nov 27 16:00 UTC

📌 Event Details:https://www.gate.com/campaigns/3297

🎅 How to Participate

1. Post on Gate Square using the hashtags #Gate广场圣诞送温暖 or #GateChristmasGiveaway

2. Content can include market moods, Christmas wishes, investment insights, encouragement posts, lifestyle shares, memes, and more.

3. Participants must post for a - 🚀 Gate Square Event: #GateNewbieVillageEpisode7

👤 Featured Creator: @吉川富郎君

💬 The secret of top traders: one word — Patience.

Share your trading journey | Track your gains and lessons | Grow with the Gate Family

⏰ Event Time: Nov 19 10:00 – Nov 26 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode7

3️⃣ Share your trading experiences, strategy insights, or growth reflections

— The more genuine and insightful your post, the higher your chance to win!

🎁 Rewards:

3 lucky participants → Gate X RedBull Cap + $20 Position Voucher

If del - 📢 Gate Square TAG Posting Challenge: #MySuggestionsforGateSquare

Post & WIN 100 USDT in rewards!

Gate Square is constantly improving!

Do you have feature suggestions, feedback, or ideas for new functionalities? Share your experiences and insights, and help more people discover the charm of Gate Square!

💡 How to Participate

1️⃣ Follow Gate_Square

2️⃣ Open the Gate APP and tap “Square” at the bottom

3️⃣ Tap the Post button and publish your post with the hashtag #MySuggestionsforGateSquare

✍️ Post Examples

1️⃣ Which features do you use the most? What is your experience?

2️⃣ Which features cou - 🚀 Gate Square “Gate Fun Token Challenge” is Live!

Create tokens, engage, and earn — including trading fee rebates, graduation bonuses, and a $1,000 prize pool!

Join Now 👉 https://www.gate.com/campaigns/3145

💡 How to Participate:

1️⃣ Create Tokens: One-click token launch in [Square - Post]. Promote, grow your community, and earn rewards.

2️⃣ Engage: Post, like, comment, and share in token community to earn!

📦 Rewards Overview:

Creator Graduation Bonus: 50 GT

Trading Fee Rebate: The more trades, the more you earn

Token Creator Pool: Up to $50 USDT per user + $5 USDT for the first 50 launche

November 20 | ETH trend analysis

Core Viewpoints

Current Price: $3,035 (as of November 20, 09:00)

Short-term outlook: Neutral to bearish. Technical analysis shows signs of stabilization on the 1-hour chart, but the 4-hour chart remains in a bearish structure. On-chain data indicates that net inflows to exchanges have increased, exerting selling pressure. Social sentiment is cautiously optimistic, but concerns about the end of the cycle persist. It is expected that ETH will fluctuate within the range of $2,900 to $3,100 over the next 24 hours, with slightly greater downside risk than upside potential.

Key Support:

Key Resistance:

Technical Analysis

multiple time frame signals

Derivatives Market

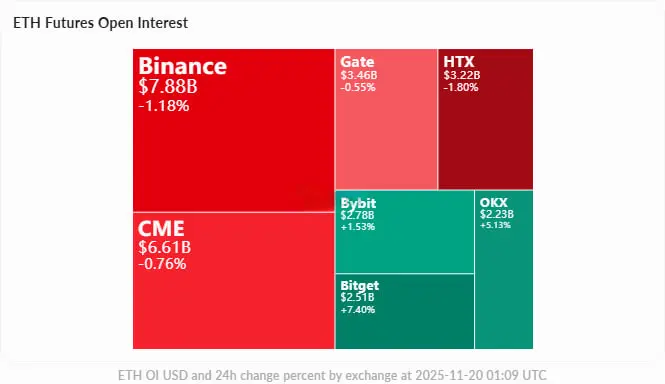

The total open contract volume is $3.81 billion, showing a 0.15% decrease in 24 hours, indicating a reduction in leverage commitment. The funding rate remains positive at 0.005-0.01%, with bulls paying bears, increasing the cost of holding long positions. In the past 24 hours, liquidations amounted to $223 million, of which long liquidations of $194 million dominated, reflecting downward pressure.

On-chain Data

Network Activity

Large Holder Trends

On November 19, the exchange had a net inflow of 58,122 ETH (approximately $175 million), the highest level in recent times, suggesting potential selling pressure. Bitmain's suspected wallet received 24,827 ETH but did not immediately flow out, indicating institutional strategic holding. BlackRock ETF saw an outflow of $523 million, continuing a four-week trend of $2.19 billion in sell-offs.

Market Sentiment

Social media shows mixed emotions, with expectations of a technical rebound coexisting with macro concerns. Vitalik's warning about the threat of quantum computing has triggered short-term FUD, but developments in privacy technology and narratives of supply tightening provide support. On the institutional level, BlackRock's plan to launch a staking ETH trust product boosts confidence, but panic at the end of the cycle limits upside potential.

Conclusion

ETH is facing dual pressures of technical consolidation and capital outflow in the short term, with the $3,000 psychological level being a key battleground. If it falls below this level, the strong support at $2,917 will be tested; on the upside, it needs to overcome the resistance at $3,094 and confirm accompanying trading volume. It is advisable to pay attention to the impact of macro events, such as the Federal Reserve's meeting minutes, on risk sentiment.