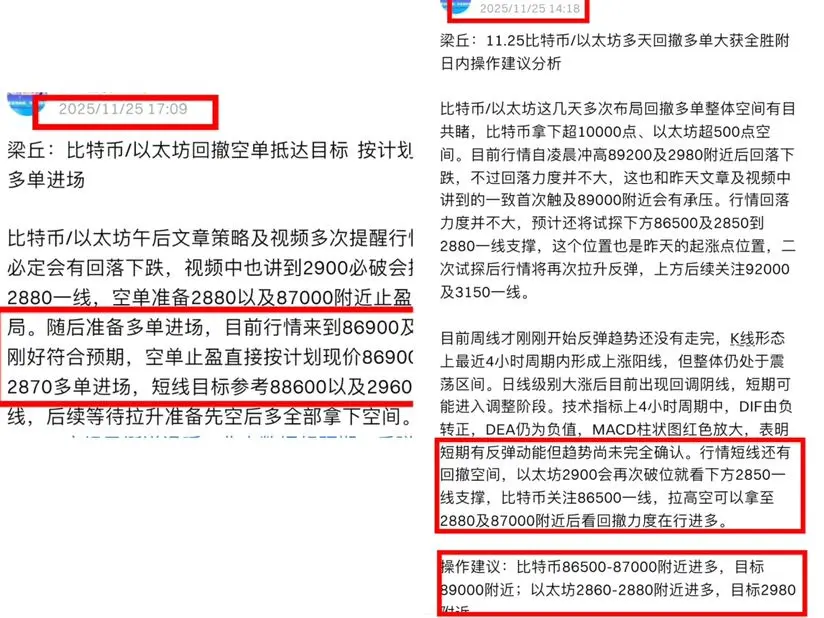

Liangqiu: 11.25 Bitcoin/Ether long order has achieved great success in the multi-day pullback, along with intraday operation suggestion analysis.

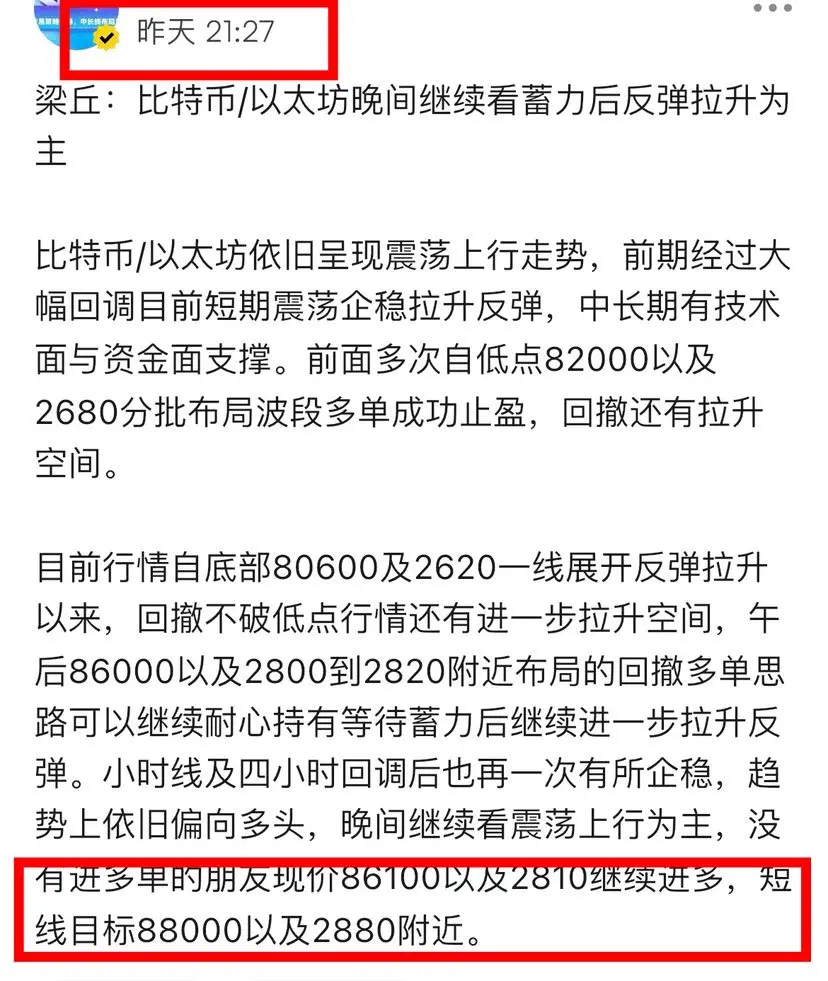

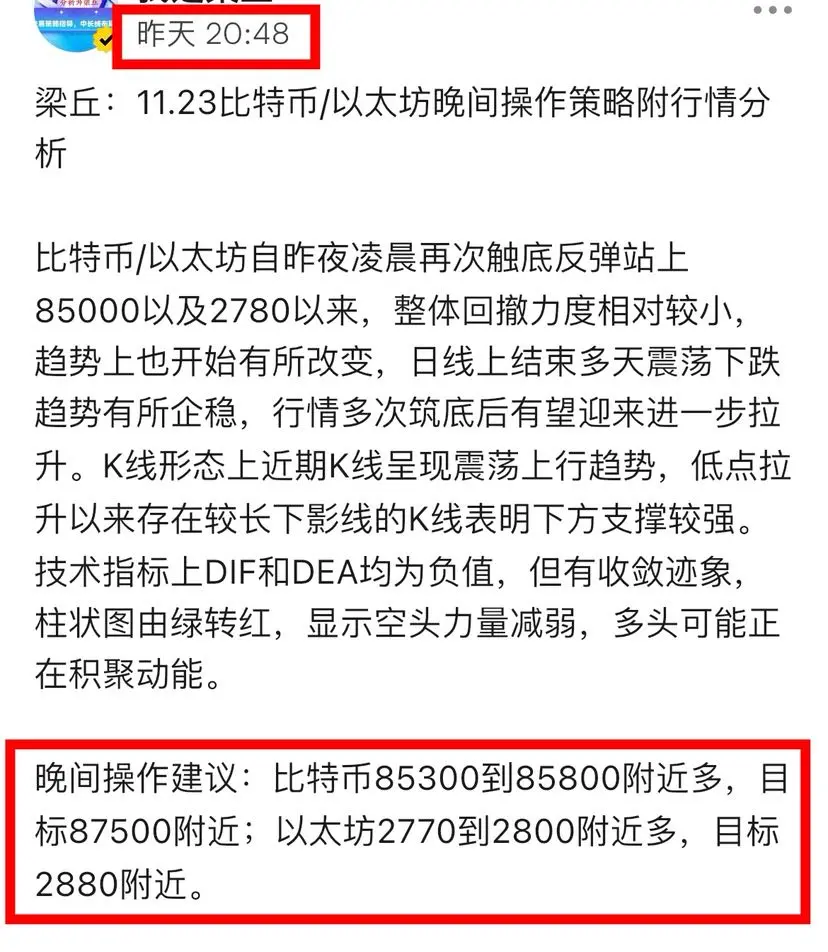

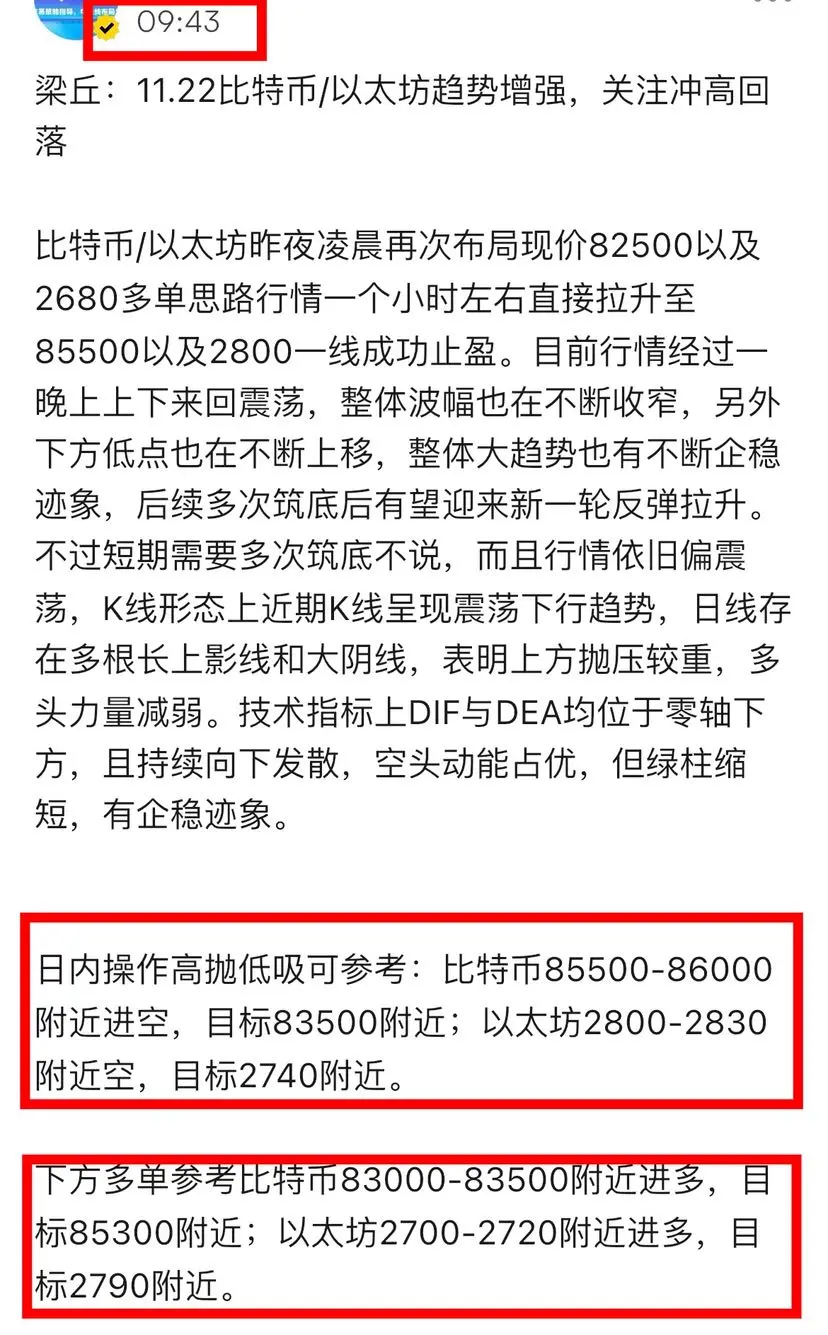

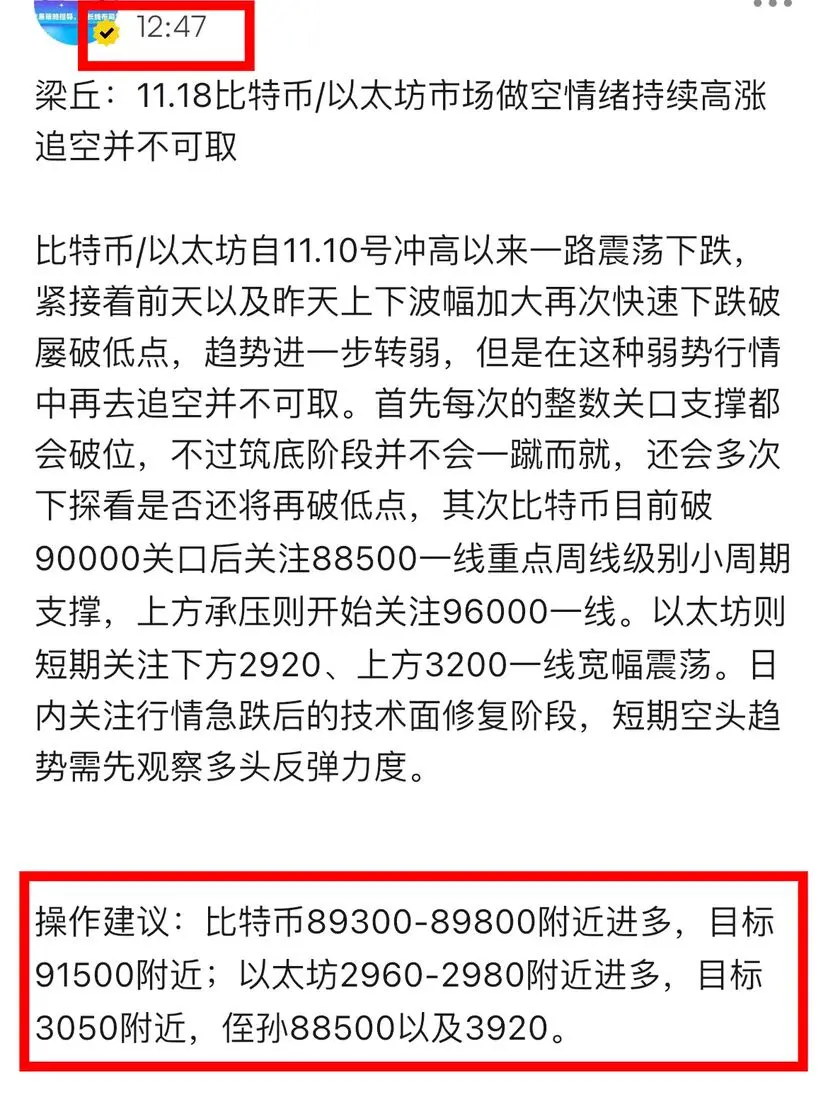

In the past few days, Bitcoin/Ethereum has repeatedly set up and pulled back long orders, and the overall space is evident. Bitcoin has surpassed 10,000 points, and Ethereum has exceeded 500 points. Currently, the market has retreated after peaking at 89,200 and around 2,980 early this morning, but the pullback is not significant, which is consistent with what was mentioned in yesterday's article and video that there would be pressure upon first touching around 89,000. The pullback is not large, and it is expected to test the support levels of 86,500 and the 2,850 to 2,880 range, which is also the starting point from yesterday. After a second test, the market is expected to rise and rebound again, with subsequent attention on the levels of 92,000 and 3,150.

Currently, the weekly chart has just started the rebound trend, which is not yet complete. In the K-line pattern, a bullish candle has formed in the recent 4-hour period, but overall it is still in a consolidation range. After a significant rise on the daily chart, a corrective bearish candle has appeared, and it may enter an adjustment phase in the short term. In terms of technical indicators on the 4-hour timeframe, DIF has turned positive from negative, while DEA remains negative. The MACD histogram is expanding in red, indicating short-term rebound momentum, but the trend has not been fully confirmed. There is still room for a pullback in the short term; if Ethereum breaks below 2900 again, we will look to the support at 2850. For Bitcoin, pay attention to the 86500 level, and for a long position, it can be held until around 2880 and 87000, then watch the strength of the pullback to enter more long positions.

Operational advice: Enter long orders for Bitcoin around 86500-87000, target around 89000; enter long orders for Ethereum around 2860-2880, target around 2980.

[The above analysis and strategies are for reference only. Please bear the risks yourself. The article review and publication do not have timeliness, and specifics are subject to real-time conditions.]

#Gate广场圣诞送温暖 #非农数据超预期 #反弹币种推荐 #加密市场回暖

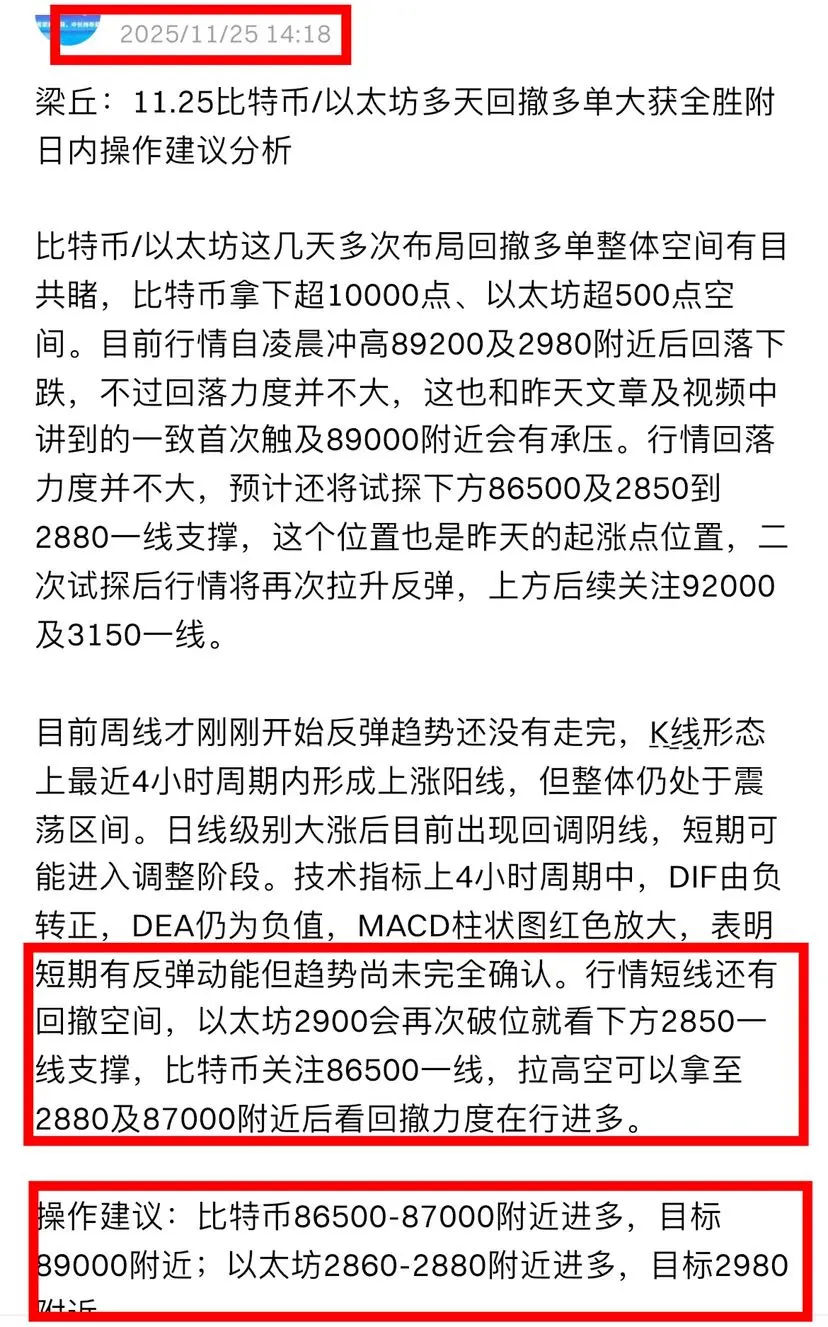

In the past few days, Bitcoin/Ethereum has repeatedly set up and pulled back long orders, and the overall space is evident. Bitcoin has surpassed 10,000 points, and Ethereum has exceeded 500 points. Currently, the market has retreated after peaking at 89,200 and around 2,980 early this morning, but the pullback is not significant, which is consistent with what was mentioned in yesterday's article and video that there would be pressure upon first touching around 89,000. The pullback is not large, and it is expected to test the support levels of 86,500 and the 2,850 to 2,880 range, which is also the starting point from yesterday. After a second test, the market is expected to rise and rebound again, with subsequent attention on the levels of 92,000 and 3,150.

Currently, the weekly chart has just started the rebound trend, which is not yet complete. In the K-line pattern, a bullish candle has formed in the recent 4-hour period, but overall it is still in a consolidation range. After a significant rise on the daily chart, a corrective bearish candle has appeared, and it may enter an adjustment phase in the short term. In terms of technical indicators on the 4-hour timeframe, DIF has turned positive from negative, while DEA remains negative. The MACD histogram is expanding in red, indicating short-term rebound momentum, but the trend has not been fully confirmed. There is still room for a pullback in the short term; if Ethereum breaks below 2900 again, we will look to the support at 2850. For Bitcoin, pay attention to the 86500 level, and for a long position, it can be held until around 2880 and 87000, then watch the strength of the pullback to enter more long positions.

Operational advice: Enter long orders for Bitcoin around 86500-87000, target around 89000; enter long orders for Ethereum around 2860-2880, target around 2980.

[The above analysis and strategies are for reference only. Please bear the risks yourself. The article review and publication do not have timeliness, and specifics are subject to real-time conditions.]

#Gate广场圣诞送温暖 #非农数据超预期 #反弹币种推荐 #加密市场回暖