DigitalPerson

Im DigitalPerson and I broadcast crypto 24x7 We constantly update information, discuss trends and strategies to keep you up to date with the latest news. Join us anytime, day or night, and learn every

DigitalPerson

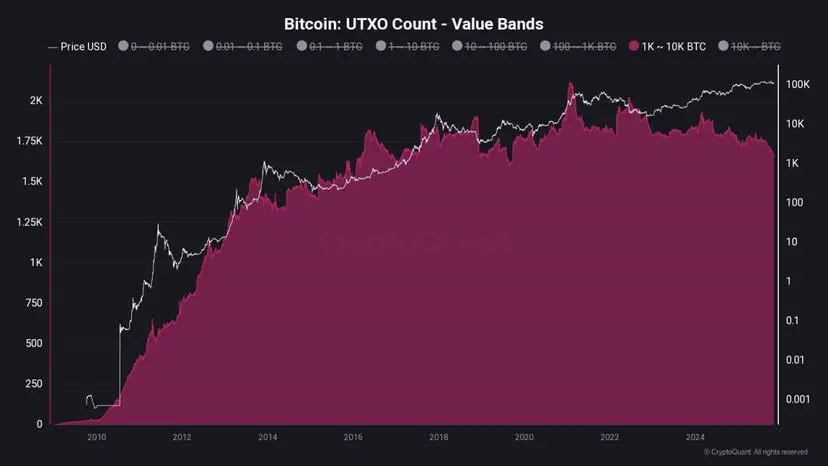

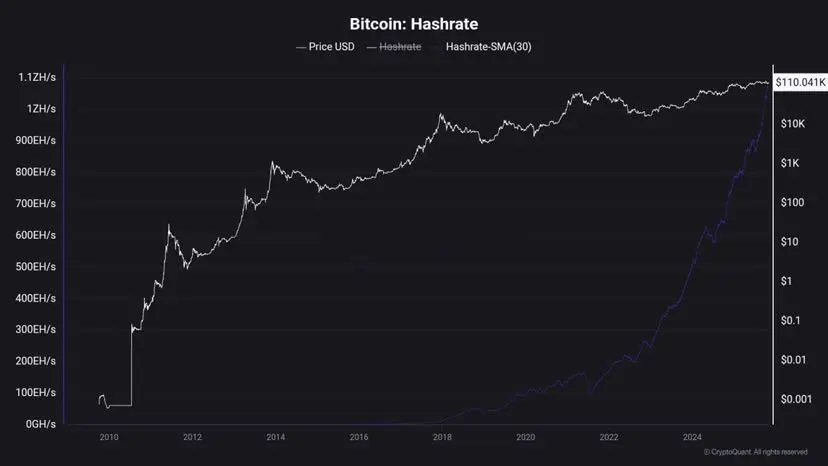

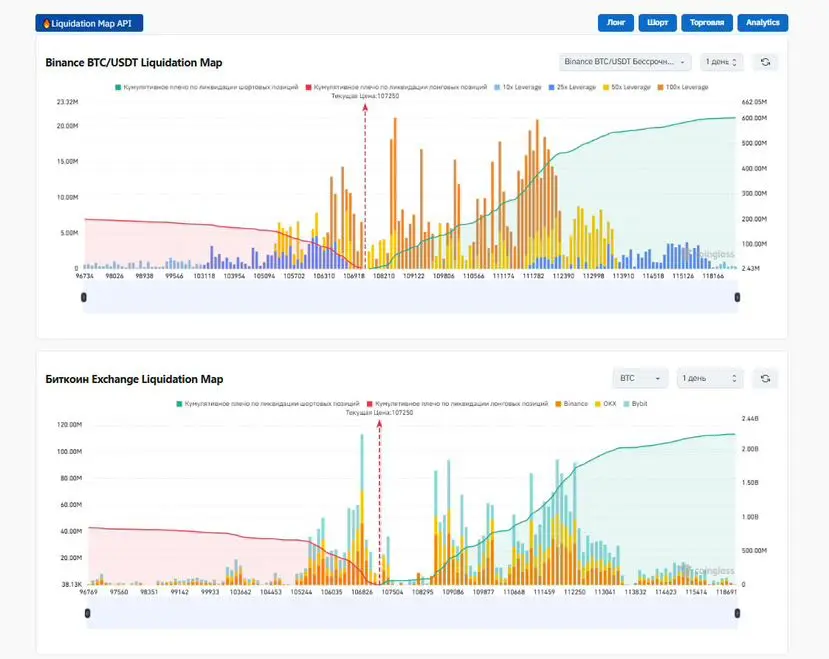

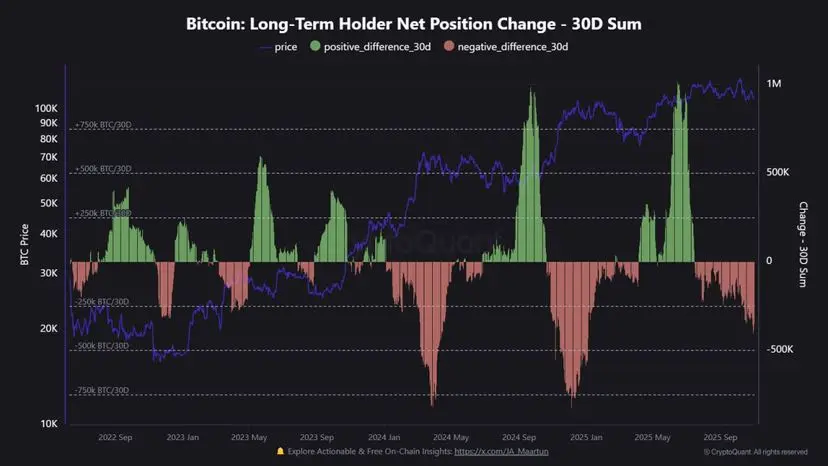

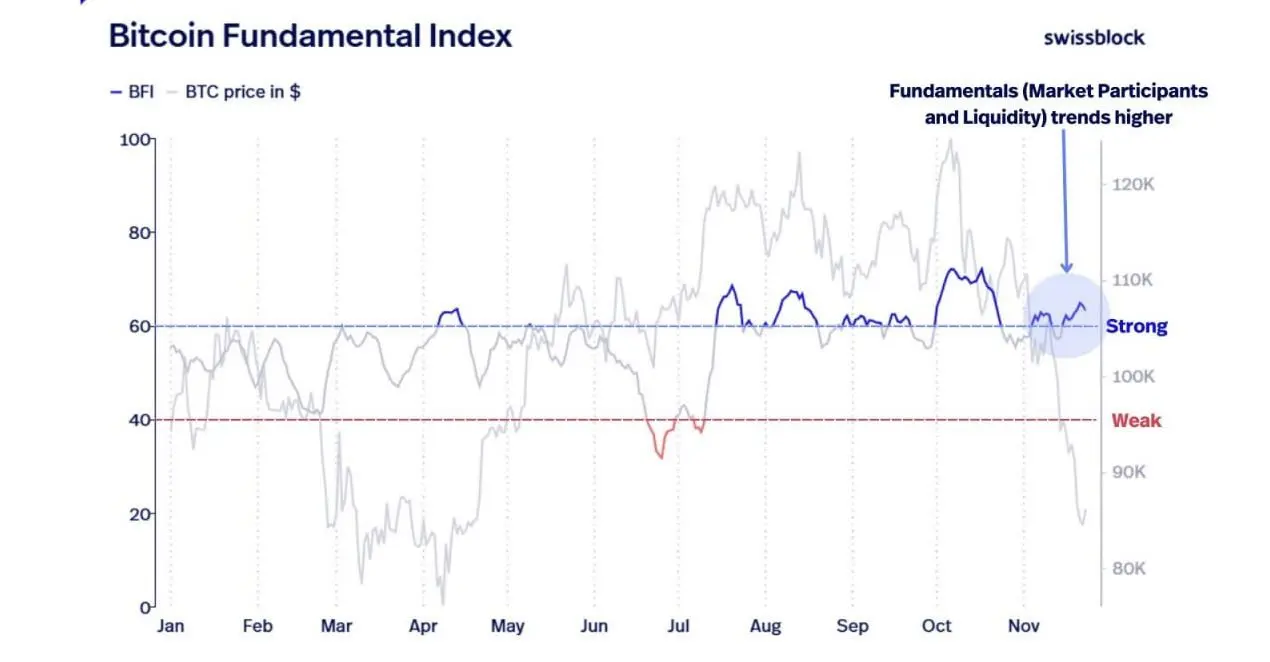

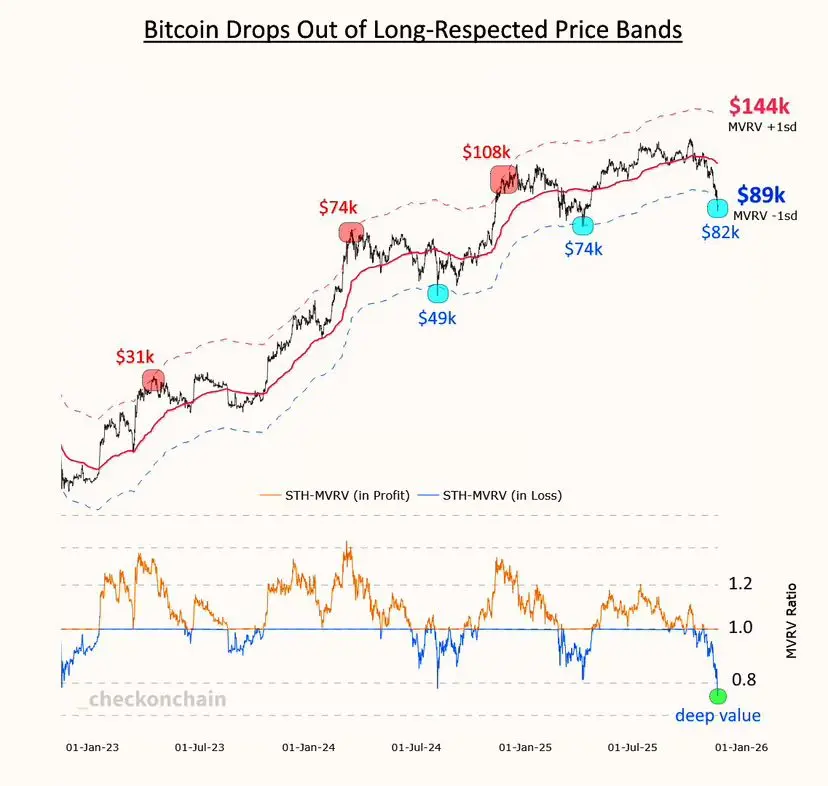

Plan for Bitcoin: Survive the "liquidity hunger" with an eye on future rise

The current period of tightening global liquidity is a tough test for all risk assets, including Bitcoin. You are right: the macroeconomic background is pressuring, but the fundamental indicators of the network speak of hidden strength. Your plan should not be about panic, but about strategically using this phase of consolidation.

1. Acknowledge the reality of the macro environment.

The Federal Reserve System (FRS) and other central banks are conducting a policy of quantitative tightening (QT) and raising interest rate

The current period of tightening global liquidity is a tough test for all risk assets, including Bitcoin. You are right: the macroeconomic background is pressuring, but the fundamental indicators of the network speak of hidden strength. Your plan should not be about panic, but about strategically using this phase of consolidation.

1. Acknowledge the reality of the macro environment.

The Federal Reserve System (FRS) and other central banks are conducting a policy of quantitative tightening (QT) and raising interest rate

BTC1.74%

- Reward

- like

- Comment

- Repost

- Share

The Cryptocurrency Solana demonstrates an intriguing dichotomy. Despite its market value decreasing by 49% from the local maximum reached on September 17, a unique bullish divergence has formed on the charts. This occurs against the backdrop of a rise in key network activity metrics: the number of interacting addresses is increasing, and the creation of new wallets $SOL continues a steady upward trend. These fundamental metrics indicate a sustained interest from investors, which may foreshadow a price reversal despite the current bearish phase. $SOL

SOL4.89%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 5

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Jump in 🚀- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 5

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Bulran 🐂- Reward

- 4

- 1

- Repost

- Share

DigitalPerson :

:

Hold on tight 💪