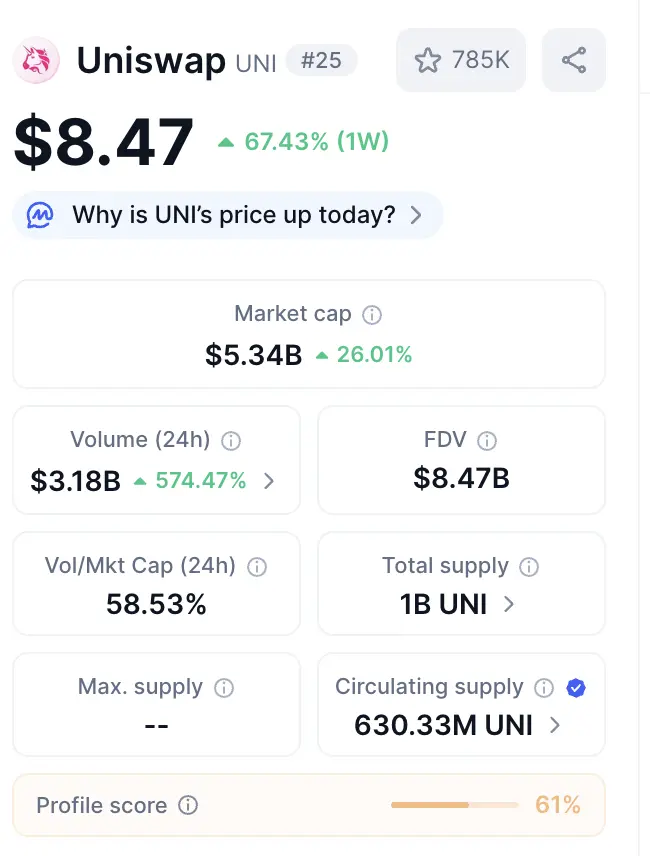

$UNI Can I enter? 🦄

Arctic Bear

$UNI opinion:

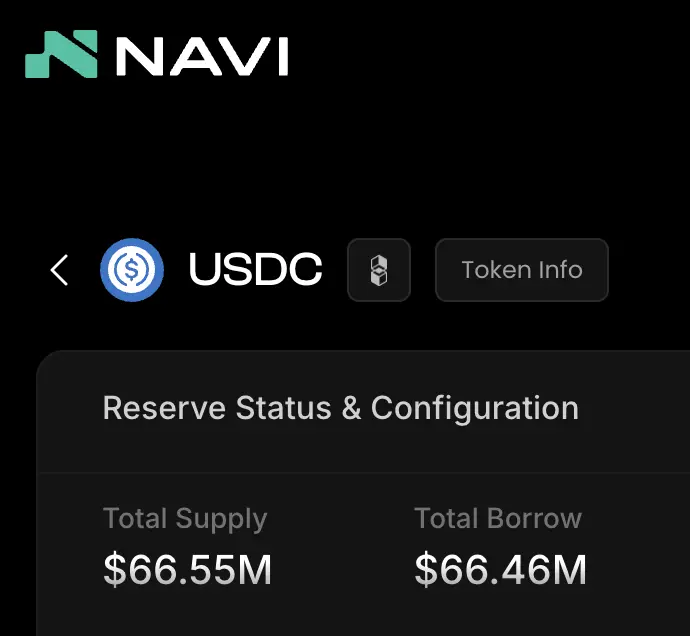

Coins with stable income + profit buyback are worth paying attention to.

Following $PUMP, $HYPE, $ASTER, today adding $UNI.

Having a genuine user base + protocol revenue = long-term logic is sound.

But in the short term:

• Institutional transfer of coins to exchanges = possible sell-off

• 40% increase = risk of chasing the high

Defensive approach:

Spot grid trading benefits from volatility, avoid chasing highs, let the price fluctuate back and forth.

Long-term optimism does not mean entering now.