2025 AGLD Price Prediction: Expert Analysis and Market Forecast for Adventure Gold Token

Introduction: Market Position and Investment Value of AGLD

Adventure Gold (AGLD), serving as the governance token for the Loot Project initiated by the community, has established its presence since its launch in 2021. As of 2025, AGLD boasts a market capitalization of approximately $23.06 million, with a circulating supply of around 87.42 million tokens, maintaining a price point near $0.2484. This asset, recognized as a "community-driven governance token," plays an increasingly important role in the NFT and on-chain gaming ecosystem.

This article will conduct a comprehensive analysis of AGLD's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Adventure Gold (AGLD) Market Analysis Report

I. AGLD Price History Review and Market Status

AGLD Historical Price Evolution

Adventure Gold (AGLD) has experienced significant volatility since its launch in September 2021. The token reached its all-time high of $7.70 on September 3, 2021, reflecting strong initial market enthusiasm following the Loot NFT project launch. The token subsequently entered a prolonged bear market phase, with the price declining substantially over the subsequent years. AGLD hit its all-time low of $0.208231 on November 10, 2022, during the broader cryptocurrency market downturn. Since that low point, the token has recovered modestly but remains far below its historical peak, demonstrating the challenging market environment for community-driven NFT governance tokens.

AGLD Current Market Status

As of December 20, 2025, AGLD is trading at $0.2484, representing a 24-hour increase of 5.25% from $0.2358 to $0.2512. The token's market capitalization stands at $21,715,128.24, with a fully diluted valuation of $23,056,488.25. The circulating supply comprises 87,420,001 AGLD tokens out of a total supply of 92,820,001, with a maximum supply capped at 96,000,000 tokens. Circulating supply represents 91.06% of the maximum supply. The 24-hour trading volume reached $18,334.12, indicating moderate liquidity across the 26 exchanges where AGLD is listed. AGLD currently ranks #832 by market capitalization with a market dominance of 0.00072%. Short-term performance shows positive momentum with a 1-hour gain of 0.27%, though longer-term trends remain challenging with 7-day and 30-day losses of -14.71% and -19.84% respectively. The 1-year performance reflects continued weakness at -79.27% from the previous year's levels. The token maintains 15,535 active holders, with the contract address deployed on the Ethereum blockchain (0x32353a6c91143bfd6c7d363b546e62a9a2489a20).

Click to view current AGLD market price

AGLD Market Sentiment Indicator

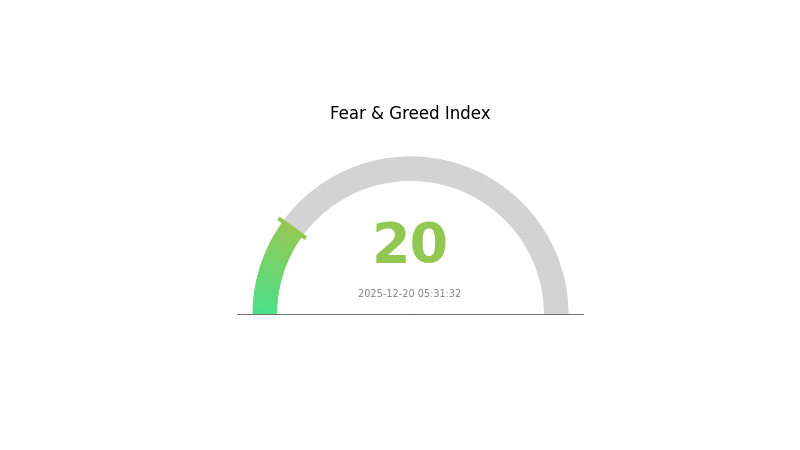

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates strong bearish sentiment among investors, suggesting potential panic selling and risk aversion. Market participants are highly cautious, presenting a contrarian signal for contrarian investors. Such extreme fear periods historically precede market reversals. Investors should stay informed through Gate.com's market data tools and make strategic decisions based on thorough analysis rather than emotional reactions.

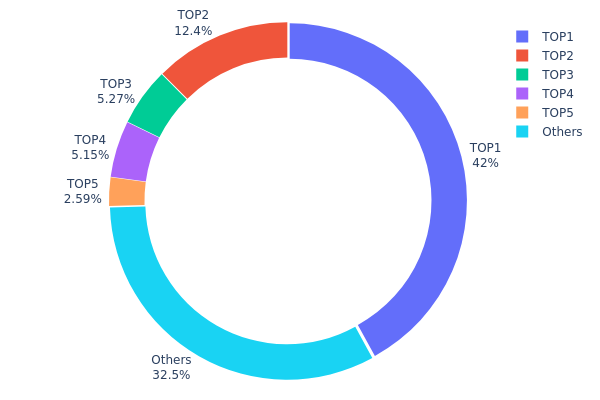

AGLD Holdings Distribution

The address holdings distribution chart illustrates the concentration pattern of AGLD tokens across different wallet addresses, serving as a critical metric for assessing token decentralization, market structure stability, and potential manipulation risks. By analyzing the top holders and their respective percentages, investors can evaluate the vulnerability of the token to large-scale liquidation events or coordinated trading activities that could significantly impact market dynamics.

The current holdings distribution of AGLD reveals a notably concentrated token structure. The top holder controls 42.02% of total supply, while the top two addresses collectively represent 54.46% of all tokens in circulation. This level of concentration is substantial and warrants careful consideration. The top five addresses account for 67.45% of the total AGLD supply, leaving only 32.55% distributed among all other holders. Such extreme concentration in a relatively small number of addresses indicates that the token operates with significant centralization risk at the wallet level.

This concentrated distribution pattern presents meaningful implications for market structure and price dynamics. With more than two-thirds of the token supply held by just five addresses, the potential for sudden price movements triggered by large token transfers or sales from these major holders remains elevated. The dominance of these whale addresses creates an asymmetric information environment where coordinated actions by top holders could substantially influence market sentiment and volatility. For a token aspiring toward broader decentralization, this distribution suggests that AGLD's on-chain structure has yet to achieve meaningful token democratization, and the market remains susceptible to concentration-driven risks that could undermine long-term stability and participant confidence.

Click to view current AGLD holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbd48...e24a72 | 38998.90K | 42.02% |

| 2 | 0xf977...41acec | 11553.55K | 12.44% |

| 3 | 0x3214...28c237 | 4887.08K | 5.26% |

| 4 | 0x91d4...c8debe | 4784.09K | 5.15% |

| 5 | 0xe49b...5f1f32 | 2400.00K | 2.58% |

| - | Others | 30186.37K | 32.55% |

II. Core Factors Affecting AGLD's Future Price

Supply Mechanism

- Block Reward Halving: Adventure Gold's price trajectory is driven by supply and demand dynamics, with block reward halvings being a significant factor influencing price movements.

- Current Impact: The halving mechanism directly affects the circulating supply of AGLD, which in turn influences market pricing and investor sentiment.

Market Sentiment and Adoption

- Market Sentiment: Investor emotion and confidence have a direct impact on AGLD price movements. Market sentiment shifts can drive significant price volatility in both directions.

- Regulatory and Adoption Events: Real-world events such as regulatory developments, enterprise adoption, government adoption, and security incidents at cryptocurrency exchanges can materially affect AGLD pricing.

Technical Analysis Indicators

- Moving Averages: Many traders monitor the 50-day, 100-day, and 200-day moving averages to determine potential price direction in the coming days and weeks. When AGLD trades above these averages, it is generally viewed as a bullish signal, while sustained breaks below these levels may indicate potential bearish pressure.

III. 2025-2030 AGLD Price Forecast

2025 Outlook

- Conservative Forecast: $0.23866 - $0.2486

- Base Case Forecast: $0.2486

- Optimistic Forecast: $0.31821 (requires sustained ecosystem development and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.16154 - $0.32025 (14% upside potential)

- 2027: $0.17808 - $0.41652 (21% growth expected)

- 2028: $0.19395 - $0.53157 (44% appreciation anticipated)

- Key Catalysts: Enhanced tokenomics implementation, expanding gaming ecosystem partnerships, improved market liquidity on platforms like Gate.com, and broader Web3 gaming adoption

2029-2030 Long-term Outlook

- Base Case Scenario: $0.37857 - $0.54781 (79% cumulative gain by 2029)

- Optimistic Scenario: $0.49659 - $0.71509 (99% potential appreciation by 2030, assuming sustained network growth and institutional interest)

- Transformative Scenario: $0.71509+ (contingent on major gaming industry partnerships, mainstream adoption acceleration, and significant TVL expansion)

- 2030-12-31: AGLD trading near $0.71509 (strong bullish consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.31821 | 0.2486 | 0.23866 | 0 |

| 2026 | 0.32025 | 0.2834 | 0.16154 | 14 |

| 2027 | 0.41652 | 0.30183 | 0.17808 | 21 |

| 2028 | 0.53157 | 0.35917 | 0.19395 | 44 |

| 2029 | 0.54781 | 0.44537 | 0.37857 | 79 |

| 2030 | 0.71509 | 0.49659 | 0.27809 | 99 |

Adventure Gold (AGLD) Professional Investment Strategy and Risk Management Report

IV. AGLD Professional Investment Strategy and Risk Management

AGLD Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community-oriented NFT enthusiasts and governance token believers

- Operational Recommendations:

- Accumulate AGLD during market downturns when the token trades significantly below its all-time high of $7.7

- Hold positions through governance participation in the Loot Project ecosystem

- Reinvest any governance rewards back into AGLD to compound holdings over time

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action: AGLD has experienced a -79.27% decline over the past year, indicating a challenging market environment for active traders

- Volume Analysis: Current 24-hour volume stands at $18,334.12, suggesting moderate liquidity for position entry and exit

- Trading Considerations:

- Monitor the token's recent 24-hour gain of 5.25% as a potential indicator of short-term momentum

- Exercise caution given the significant bearish trend over the 7-day (-14.71%) and 30-day (-19.84%) periods

AGLD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of digital asset portfolio

- Active Investors: 2-5% of digital asset portfolio

- Professional Investors: 5-10% of digital asset portfolio

(2) Risk Hedging Approaches

- Position Sizing: Limit individual AGLD holdings to no more than the recommended allocation percentage to prevent catastrophic losses

- Portfolio Diversification: Balance AGLD exposure with more established cryptocurrencies and traditional assets

(3) Secure Storage Solutions

- Hardware Wallet Approach: For significant holdings, consider self-custody solutions that provide full key control

- Exchange Storage: Gate.com offers secure custody options for active traders who require quick liquidity access

- Security Precautions: Enable two-factor authentication on all accounts, maintain private keys offline, and never share seed phrases with any third party

V. AGLD Potential Risks and Challenges

AGLD Market Risk

- High Volatility: The token has declined 79.27% year-over-year, demonstrating extreme price volatility and potential for further downside

- Liquidity Risk: With 26 exchange listings and relatively modest 24-hour trading volume, AGLD faces potential liquidity constraints during market stress

- Market Sentiment: The current market cap of $23.1 million represents a small market segment, making AGLD susceptible to sudden price swings from large trades

AGLD Regulatory Risk

- Governance Token Classification: Regulatory authorities may reclassify governance tokens, potentially affecting AGLD's legal status and trading availability

- Jurisdictional Uncertainty: Different countries maintain varying approaches to NFT and governance token regulation, creating compliance challenges

- Exchange Delisting Risk: Regulatory changes could prompt exchanges to remove AGLD trading pairs, reducing accessibility and liquidity

AGLD Technical Risk

- Ecosystem Dependency: AGLD's value is intrinsically linked to the Loot Project's continued development and community engagement

- Smart Contract Vulnerabilities: Any technical vulnerabilities in the AGLD smart contract (deployed at 0x32353a6c91143bfd6c7d363b546e62a9a2489a20 on Ethereum) could pose security risks

- Network Congestion: As an Ethereum-based token, AGLD is subject to Ethereum network congestion and associated gas fee fluctuations

VI. Conclusion and Action Recommendations

AGLD Investment Value Assessment

Adventure Gold represents a governance token for a pioneering community-driven NFT project. While the Loot Project demonstrated innovative community-first principles, AGLD has experienced significant depreciation, declining 79.27% annually. The token's viability depends heavily on continued Loot Project adoption and community participation. Investors should recognize that this is a speculative asset with limited fundamental drivers compared to larger cryptocurrency projects. The modest market capitalization and trading volume indicate a nascent project that remains largely experimental in nature.

AGLD Investment Recommendations

✅ Beginners: Start with minimal exposure (less than 1% of your digital asset allocation) only if you have a strong interest in NFT governance mechanisms and can afford complete loss of capital.

✅ Experienced Investors: Consider AGLD as a high-risk, high-reward portfolio component, utilizing technical analysis to identify entry points during significant downturns and establishing clear exit strategies.

✅ Institutional Investors: Evaluate AGLD through the lens of NFT ecosystem development, assessing the Loot Project's long-term viability and governance effectiveness before any meaningful allocation.

AGLD Trading Participation Methods

- Gate.com Direct Trading: Access AGLD trading pairs on Gate.com for immediate spot trading with competitive fees and reliable execution

- Dollar-Cost Averaging: Implement systematic monthly purchases of AGLD at predetermined amounts to reduce the impact of price volatility

- Limit Order Strategy: Utilize limit orders on supported exchanges to accumulate AGLD at predetermined price levels rather than market purchases

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Why is AGLD pumping?

AGLD is surging due to strong market performance and increased investor confidence. Recent price gains of approximately 19% over the past week reflect positive market momentum and growing trading volume interest in the token.

Does Adventure gold have a future?

Yes, Adventure Gold has promising prospects. The project is actively developing new features like farming in upcoming updates, demonstrating continuous innovation and commitment to long-term growth and ecosystem expansion.

Will Adventure gold go back up?

Adventure Gold is expected to experience price recovery driven by increased adoption, gaming ecosystem expansion, and broader market sentiment improvements. With growing community engagement and development milestones, AGLD shows potential for upward price movement in the coming months.

What is AGLD crypto?

AGLD is a governance and utility token for the Loot NFT ecosystem, enabling decentralized gaming and community participation. It empowers users within this innovative blockchain-based project.

What factors influence AGLD price movements?

AGLD price movements are driven by market sentiment, trading volume, speculative trends, broader cryptocurrency market dynamics, and technological developments within the Adventure Gold ecosystem. Long-term value depends on fundamental performance and community adoption.

How does AGLD compare to other gaming tokens?

AGLD stands out with its fixed-supply mechanism and focused gaming and NFT ecosystem. Unlike other gaming tokens with gradual releases, AGLD's scarcity model creates stronger value retention potential, making it uniquely positioned in the competitive gaming token space.

ALU vs FLOW: Evaluating Different Computational Architectures for Modern Machine Learning Applications

2025 ALUPrice Prediction: Market Analysis and Future Outlook for Aluminum Commodity Trends

ZCX vs ENJ: A Comprehensive Analysis of Two Leading Cryptocurrency Tokens in the Gaming Ecosystem

BTT vs ENJ: Comparing Two Leading Gaming Cryptocurrencies in the Blockchain Space

Is Sekuya (SKYA) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

RFUEL vs ENJ: A Comparative Analysis of Two Leading Blockchain Gaming Tokens

Is Gunz (GUN) a good investment?: A Comprehensive Analysis of Price Performance, Market Potential, and Risk Factors

Is Bitlayer (BTR) a good investment?: A Comprehensive Analysis of Performance, Technology, and Market Potential

Exploring Secure Web3 Wallet Solutions

Exploring Jambo: Features and Benefits of a Leading Crypto Platform

Ultimate Guide to Web3 Gaming in the Pixelverse