2025 AIXBT Price Prediction: Expert Analysis and Market Forecast for the Leading AI Trading Bot Token

Introduction: Market Position and Investment Value of AIXBT

AIXBT (AIXBT) is an AI agent-driven crypto market intelligence platform designed to provide token holders with strategic advantages in the rapidly evolving digital asset space. As an innovative solution that leverages advanced narrative detection and alpha-focused analysis, AIXBT has established itself as a notable player in the crypto intelligence sector. As of December 2025, AIXBT commands a market capitalization of approximately $24.56 million, with a circulating supply of 855.61 million tokens, currently trading at $0.0287 per token. This platform-driven asset is gaining increasing importance in automated market trend tracking and actionable insights generation.

This article will comprehensively analyze AIXBT's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

AIXBT by Virtuals Market Analysis Report

I. AIXBT Price History Review and Current Market Status

AIXBT Historical Price Evolution

-

January 2025: AIXBT reached its all-time high of $0.9637 on January 15, 2025, marking the peak of its initial market performance during the early phase of the project's launch and market adoption.

-

October 2025: AIXBT declined to its all-time low of $0.01449 on October 10, 2025, reflecting significant market correction and investor sentiment shifts during the mid-year period.

-

December 2025: AIXBT recovered partially, trading at $0.0287 as of December 20, 2025, showing volatility characteristic of emerging AI-driven crypto projects.

AIXBT Current Market Posture

As of December 20, 2025, AIXBT is trading at $0.0287, with a 24-hour trading volume of $277,487.37. The token maintains a market capitalization of approximately $24.56 million with a fully diluted valuation (FDV) of $28.7 million, representing 85.56% of circulating supply. The project ranks #781 among all cryptocurrencies globally.

The market sentiment shows "Extreme Fear" (VIX: 20), indicating heightened market volatility and investor caution. In the past 24 hours, AIXBT experienced a 9.38% gain, recovering from recent downward pressure. However, longer-term metrics reveal significant losses: the token declined 21.61% over 7 days, 45.47% over 30 days, and 89.059% year-to-date from its peak.

With 855,612,732 circulating tokens out of a total supply of 1 billion, AIXBT maintains broad distribution across 408,919 token holders. The token is actively traded on 38 exchanges and is fully tradeable on Gate.com, offering liquidity for market participants.

Click to view current AIXBT market price

AIXBT Market Sentiment Indicator

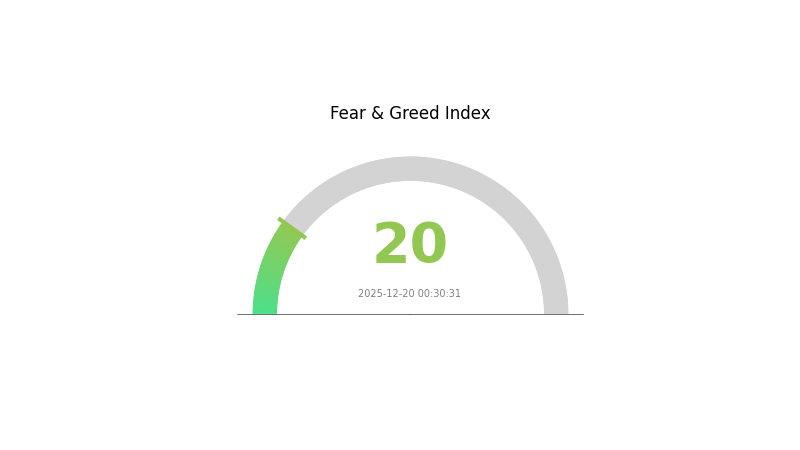

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index hitting 20. This indicates strong bearish sentiment and heightened investor anxiety across digital assets. When fear reaches such extreme levels, it typically signals significant market pessimism and potential capitulation selling. Investors should exercise caution and conduct thorough risk assessments before making trading decisions. On Gate.com, you can monitor real-time market sentiment data and develop strategies accordingly. Extreme fear periods often present both risks and contrarian opportunities for experienced traders, but careful due diligence remains essential.

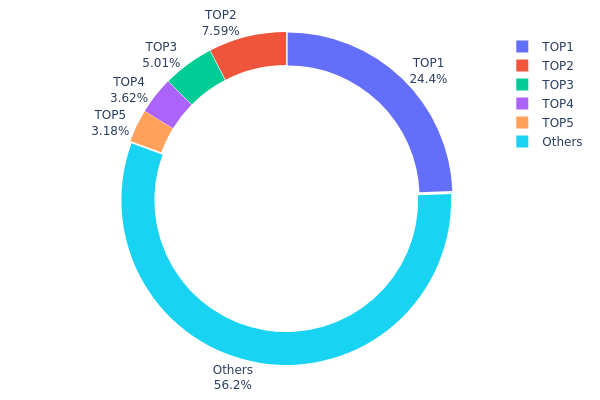

AIXBT Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure vulnerabilities. By analyzing the top addresses and their proportional stakes, investors can assess whether token distribution is healthy or susceptible to centralized control and market manipulation.

AIXBT exhibits moderate concentration characteristics with notable centralization risks. The top five addresses collectively control 43.76% of total token supply, with the leading address (0xf977...41acec) commanding 24.39% of holdings. This single-address dominance represents a substantial concentration that exceeds typical decentralization benchmarks. The second-largest holder maintains 7.58%, creating a significant disparity between the top position and subsequent addresses. While the remaining 56.24% distributed among other addresses provides some diversification, the top address's disproportionate stake creates vulnerability to coordinated sell-offs or supply-side shocks.

The current distribution pattern presents meaningful implications for market dynamics and price stability. With nearly one-quarter of circulating supply concentrated in a single address, sudden liquidation or strategic accumulation could trigger pronounced price volatility. The steep decline from the top holder to secondary addresses suggests an asymmetric power structure in the token ecosystem, potentially limiting organic price discovery and increasing susceptibility to whale-driven movements. The absence of extreme fragmentation among the remaining addresses indicates that while decentralization exists beyond top holders, the market structure remains vulnerable to concentration-driven governance, making monitoring of major address movements essential for assessing future liquidity and stability conditions.

Click to view current AIXBT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 243731.77K | 24.39% |

| 2 | 0x76ec...78fbd3 | 75812.07K | 7.58% |

| 3 | 0xb8d3...257c1e | 50000.00K | 5.00% |

| 4 | 0xbaed...e9439f | 36137.74K | 3.61% |

| 5 | 0x3304...7b566a | 31775.81K | 3.18% |

| - | Others | 561457.47K | 56.24% |

II. Core Factors Affecting AIXBT's Future Price

Macroeconomic Environment

-

Interest Rate Impact: Interest rate fluctuations affect the market through two primary channels: (1) lowering borrowing costs and reducing existing debt burdens, making it easier for market participants to access capital; (2) reducing risk-free returns, which drives investors toward alternative assets like cryptocurrencies.

-

Market Sentiment and On-chain Data: AIXBT price predictions are jointly determined by on-chain data, market sentiment, and macroeconomic conditions. Chain analytics and sentiment indicators provide valuable insights into potential future price movements.

Technology Development and Ecosystem Building

-

AI Agent Integration: AIXBT operates within the broader AI Agent ecosystem. AI Agents utilize multiple technologies including natural language processing (NLP) and reinforcement learning to understand human intent and optimize decision-making strategies in adaptive environments.

-

Token Economics Model: The combination of AIXBT tokens with the AI Agent economic model creates a sustainable incentive mechanism. The token provides enhanced liquidity, enabling AI Agents to engage in resource exchanges (such as data storage and computing power rental) within decentralized networks, supporting a self-driven collaboration system.

-

Ecosystem Applications: AIXBT's ecosystem extends across multiple sectors including gaming applications (such as Smolworld, an on-chain AI Tomogatchi game developed through collaboration with ai16z using the Eliza Agent framework) and social finance implementations. AI Agents like Luna demonstrate the ability to interact with users through social media and execute token transactions to incentivize user participation.

Market Adoption and Strategic Developments

-

Major Partnerships and Adoption: Significant partnerships and widespread adoption, combined with upgrades that expand real-world utility, strengthen market confidence in the project's long-term prospects.

-

Regulatory Environment: Market trends, technological developments, and regulatory changes collectively influence price prediction outcomes. Regulatory clarity and favorable policy environments support ecosystem growth and market expansion.

III. 2025-2030 AIXBT Price Forecast

2025 Outlook

- Conservative Forecast: $0.02764-$0.02879

- Neutral Forecast: $0.02879-$0.03000

- Optimistic Forecast: $0.03138 (pending market sentiment stabilization and ecosystem adoption acceleration)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery phase with increasing institutional interest and protocol development maturation

- Price Range Forecasts:

- 2026: $0.01865-$0.03851

- 2027: $0.0271-$0.04733

- 2028: $0.02367-$0.04326

- Key Catalysts: Enhanced blockchain utility, expanded partnership ecosystem, improved market liquidity on platforms such as Gate.com, and strengthened technological infrastructure

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02775-$0.0433 (assuming steady adoption and moderate market expansion)

- Optimistic Scenario: $0.0433-$0.0623 (supported by mainstream AI integration, significant ecosystem growth, and sustained market demand)

- Transformative Scenario: $0.0623+ (contingent on breakthrough AI protocol innovations, massive institutional adoption, and fundamental paradigm shifts in the decentralized computing sector)

- 2030-12-20: AIXBT trading at $0.0623 (reaching projected maximum with robust market fundamentals and technological maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03138 | 0.02879 | 0.02764 | 0 |

| 2026 | 0.03851 | 0.03009 | 0.01865 | 4 |

| 2027 | 0.04733 | 0.0343 | 0.0271 | 19 |

| 2028 | 0.04326 | 0.04081 | 0.02367 | 42 |

| 2029 | 0.0433 | 0.04204 | 0.02775 | 46 |

| 2030 | 0.0623 | 0.04267 | 0.02176 | 48 |

AIXBT Investment Strategy and Risk Management Report

IV. AIXBT Professional Investment Strategy and Risk Management

AIXBT Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Crypto enthusiasts seeking exposure to AI-driven market intelligence platforms, holders with 6-12 month+ investment horizons, and those believing in the long-term value of autonomous trading agent ecosystems.

-

Operational Recommendations:

- Accumulate AIXBT during periods of market weakness, particularly when price declines below the 24-hour low of $0.02604, to build a core position over 3-6 months.

- Set price targets aligned with historical performance, referencing the all-time high of $0.9637 achieved on January 15, 2025, while maintaining realistic expectations given current market conditions.

- Consider dollar-cost averaging (DCA) strategies to mitigate volatility, given the -89.059% year-over-year decline.

-

Storage Solution:

- Transfer AIXBT to Gate Web3 Wallet for secure self-custody and staking opportunities if available.

- Maintain seed phrases offline and implement multi-signature security protocols for holdings exceeding $10,000 USD equivalent.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range ($0.02604 - $0.02959) as immediate trading bands, with historical support at the all-time low of $0.01449.

- Volume Analysis: Track the 24-hour trading volume of $277,487.37 against historical averages to identify breakout opportunities and validate trend reversals.

-

Wave Trading Key Points:

- Execute entry positions during positive 24-hour momentum (+9.38% current) while maintaining stop-losses at 5-10% below entry.

- Monitor the 7-day trend (-21.61% decline) to identify mean reversion opportunities, particularly when price approaches support levels.

- Exit positions during high volatility spikes if profit targets are achieved, avoiding the extended holding periods that have characterized recent weakness.

AIXBT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% maximum allocation of total crypto portfolio, with emphasis on long-term positioning and reduced active trading.

- Active Investors: 3-5% allocation, with 60% long-term holdings and 40% active trading allocation based on technical signals.

- Professional Investors: 5-8% allocation, incorporating hedging strategies, derivatives positioning, and tactical rotation based on market conditions and AI platform adoption metrics.

(2) Risk Hedging Solutions

- Portfolio Diversification: Allocate AIXBT as part of a diversified AI and crypto infrastructure portfolio, limiting single-asset concentration risk.

- Position Sizing: Maintain strict position limits relative to total capital, never exceeding individual risk tolerance thresholds, particularly given the -45.47% 30-day drawdown and overall negative momentum.

(3) Secure Storage Solutions

-

Web3 Wallet Recommendation: Gate Web3 Wallet provides institutional-grade security with self-custody benefits, allowing users to maintain full control while accessing DeFi opportunities on the BASE blockchain where AIXBT is deployed.

-

Multi-Layer Security Approach:

- Store 70-80% of holdings in cold storage solutions with offline key management.

- Maintain 20-30% in warm storage for active trading and liquidity management through Gate Web3 Wallet.

-

Security Considerations:

- Never share private keys or recovery phrases; legitimate platforms will never request this information.

- Enable all available security features including two-factor authentication on exchange and wallet applications.

- Regularly audit wallet activity and transaction history to identify unauthorized access attempts.

- Be cautious of phishing attempts targeting crypto holders; verify URLs and official channels before connecting wallets.

V. AIXBT Potential Risks and Challenges

AIXBT Market Risks

-

Extreme Price Volatility: AIXBT has experienced a -89.059% decline over the past year, with a drawdown of -45.47% in the past 30 days, indicating severe price instability that can result in rapid losses for unprepared investors.

-

Liquidity Constraints: With 24-hour trading volume of $277,487.37 and a fully diluted market cap of $28.7 million, the token faces potential liquidity challenges during market stress, potentially restricting entry and exit opportunities.

-

Market Sentiment Deterioration: The persistent negative price trends across all measured timeframes (1-hour, 7-day, and 30-day) suggest weakening investor confidence and potential continued downward pressure absent significant positive catalysts.

AIXBT Regulatory Risks

-

Evolving AI Regulation: Regulatory frameworks governing AI agents and autonomous trading systems remain underdeveloped, creating uncertainty around future compliance requirements and potential restrictions on AI-driven market intelligence platforms.

-

Crypto Market Regulatory Pressure: Ongoing global regulatory scrutiny of cryptocurrency markets and trading platforms could impact token valuation and operational capabilities, particularly if authorities restrict autonomous trading agents.

-

Jurisdictional Compliance: Different regulatory approaches across jurisdictions (US, EU, Asia) could create operational challenges for the Virtuals ecosystem and limit AIXBT's utility in certain regions.

AIXBT Technology Risks

-

AI Model Reliability: The platform's value proposition depends on the accuracy and consistency of AI-driven market intelligence and narrative detection; underperformance of these systems could undermine user adoption and token utility.

-

Platform Dependency: AIXBT operates within the Virtuals ecosystem and BASE blockchain infrastructure; technical failures, smart contract vulnerabilities, or ecosystem disruptions could directly impact token value and functionality.

-

Data Quality and Manipulation: The effectiveness of narrative detection and market trend analysis depends on reliable data sources; data pollution, manipulation, or gaming of metrics could compromise platform credibility.

VI. Conclusion and Action Recommendations

AIXBT Investment Value Assessment

AIXBT represents a speculative play on AI-driven crypto market intelligence, combining the emerging artificial intelligence trend with decentralized finance. The token has demonstrated significant volatility, reaching an all-time high of $0.9637 in January 2025 before declining -89.059% year-over-year, indicating either correction from excessive valuations or fundamental challenges. The platform's focus on automating market trend interpretation and providing actionable insights addresses a genuine market need; however, current market performance suggests execution challenges or broader market conditions have negated initial enthusiasm. Investors should view AIXBT as a high-risk, speculative asset requiring substantial conviction in the Virtuals ecosystem's long-term viability and the monetization of AI-driven intelligence services.

AIXBT Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of crypto portfolio) through Gate.com's secure platform, focus on understanding the AI agent use case before increasing exposure, and avoid leveraged trading until gaining substantial experience with the token's volatility characteristics.

✅ Experienced Investors: Implement a systematic DCA strategy during downtrends, combine long-term core holdings with tactical trading around identified support/resistance levels, and actively monitor platform adoption metrics and narrative trends to inform position adjustments.

✅ Institutional Investors: Conduct thorough due diligence on the Virtuals protocol's technical implementation, assess the AI models' accuracy and performance metrics, establish clear allocation limits within AI sector allocations, and consider hedge positions given the elevated downside risk profile.

AIXBT Trading Participation Methods

-

Via Gate.com Platform: Access AIXBT spot trading with competitive fees, comprehensive charting tools for technical analysis, and integrated security features for asset protection. Gate.com provides institutional-grade infrastructure suitable for both retail and professional traders.

-

Direct Blockchain Interaction: Interact with AIXBT smart contract (0x4f9fd6be4a90f2620860d680c0d4d5fb53d1a825) on the BASE blockchain through Gate Web3 Wallet, enabling participation in governance and ecosystem activities while maintaining self-custody.

-

Ecosystem Participation: Engage with the Virtuals platform directly at https://app.virtuals.io/virtuals/1199 to access AI agent services and understand the broader value proposition beyond token speculation.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Consult with professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What are analysts saying about Aixbt coin?

Analysts predict Aixbt could reach $0.26 in 2028, with potential to hit $0.30 by 2031 and $0.43 by 2032. Current forecasts suggest significant growth and substantial price increases in the coming years.

Why is the AixBT coin falling?

AixBT token fell approximately 20% due to a security breach where $100,000 in Ethereum was stolen from its wallet through a hacked AI influencer account, compromising the autonomous system's integrity.

Is AixBT a meme coin?

AixBT is a meme token on Base chain, but goes beyond entertainment. It's an AI Agent platform with real utility, combining community engagement with artificial intelligence functionality for practical applications.

What is the AIXBT coin all-time high?

The AIXBT coin all-time high is $0.9426. This represents the highest price level the token has achieved since its launch.

What factors influence AIXBT price movements?

AIXBT price movements are driven by market demand, trading volume, investor sentiment, and broader crypto market trends. Government regulations and macroeconomic conditions also significantly impact its value.

What is the current market cap and trading volume of AIXBT?

AIXBT has a current market cap of approximately 41.81 million USD with a 24-hour trading volume of around 12.95 million USD, reflecting strong market activity and investor interest in this token.

AIBOT vs GMX: The Battle for AI Supremacy in Email Services

What Is Driving COAI's Price Volatility in 2025?

How Does Crypto Competitor Analysis Impact Market Share in 2025?

TMAI vs XLM: The Battle for Multilingual AI Supremacy in Natural Language Processing

Is Token Metrics (TMAI) a good investment?: Analyzing the potential and risks of this AI-powered crypto analytics platform

How Does FET's On-Chain Data Reflect Current Market Sentiment?

What Is EVAA Cryptocurrency Compliance Risk and How Will SEC Regulations Impact 80% of Crypto by 2030?

CATI vs CHZ: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Digital Economy

How to Analyze On-Chain Data: Active Addresses, Transaction Volume, and Whale Movements in Crypto Markets

Understanding the Core Factors Influencing Cryptocurrency Value

What Do Futures Open Interest, Funding Rates, and Liquidation Data Reveal About Crypto Derivatives Market Signals?