2025 ALEPH Price Prediction: Expert Analysis and Market Outlook for the Next Generation Data Storage Token

Introduction: ALEPH's Market Position and Investment Value

Aleph.im (ALEPH) is a decentralized network designed for the future of decentralization, functioning as a cross-blockchain second layer network, a decentralized secure cloud computing network, and a decentralized messaging and analysis platform. As of December 2025, ALEPH has achieved a market capitalization of $13,155,000 with approximately 186,431,941 tokens in circulation, currently trading at $0.02631 per token. This innovative infrastructure asset is playing an increasingly pivotal role in enabling decentralized cloud computing and cross-chain communication solutions.

This comprehensive analysis will examine ALEPH's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for stakeholders seeking exposure to decentralized infrastructure assets.

ALEPH Market Analysis Report

I. ALEPH Price History Review and Current Market Status

ALEPH Historical Price Evolution

ALEPH reached its all-time high (ATH) of $0.875793 on January 21, 2022, marking the peak of investor enthusiasm during the broader cryptocurrency market cycle. From this peak, the token experienced a significant decline, reaching its all-time low (ATL) of $0.00623944 on September 27, 2020, representing a substantial long-term depreciation.

Over the past year, ALEPH has witnessed considerable downward pressure, declining by 80.28% from its year-ago levels, reflecting the challenging market conditions in the cryptocurrency sector. The token has faced persistent selling pressure and reduced trading activity as market sentiment remained cautious.

ALEPH Current Market Status

As of December 23, 2025, ALEPH is trading at $0.02631, with a 24-hour trading volume of $19,462.02. The token's market capitalization stands at $4,905,024.38, while its fully diluted valuation (FDV) reaches $13,155,000.

Price Performance:

- 1-hour change: +0.84%

- 24-hour change: -7.59%

- 7-day change: -9.66%

- 30-day change: -29.36%

- 1-year change: -80.28%

Within the 24-hour trading range, ALEPH fluctuated between a high of $0.02852 and a low of $0.02597. The token currently holds a market ranking of 1,544, with a market dominance of 0.00041%. The circulating supply comprises 186,431,941.41 ALEPH tokens out of a total supply of 500,000,000 tokens, representing approximately 37.29% circulation ratio.

ALEPH is actively traded across 4 exchanges and has accumulated 13,519 token holders. Market sentiment indicators currently reflect extreme fear conditions, suggesting cautious investor positioning in the broader cryptocurrency market.

Click to view current ALEPH market price

ALEPH Market Sentiment Index

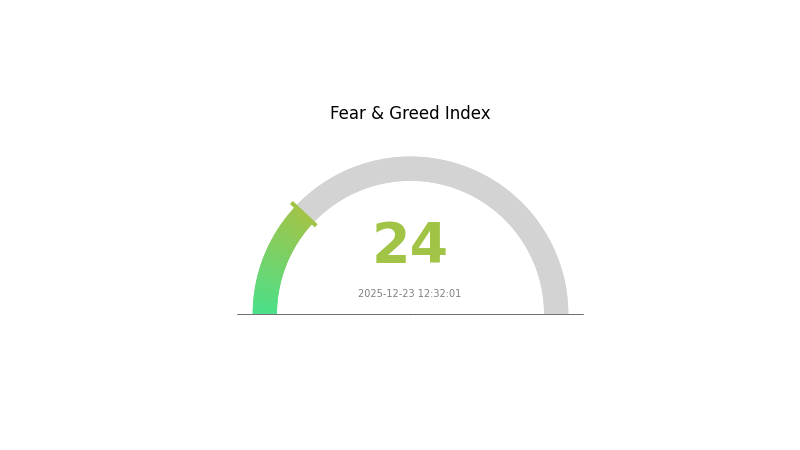

2025-12-23 Fear and Greed Index: 24(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates strong risk aversion among investors and heightened market uncertainty. During periods of extreme fear, market volatility typically increases, presenting both challenges and potential opportunities for traders. It is advisable to exercise caution, maintain proper risk management, and avoid emotional decision-making. Consider accumulating quality assets during market downturns, as historical data suggests these periods often precede market recovery phases. Stay informed through Gate.com's market analysis tools to navigate this challenging sentiment environment effectively.

ALEPH Holdings Distribution

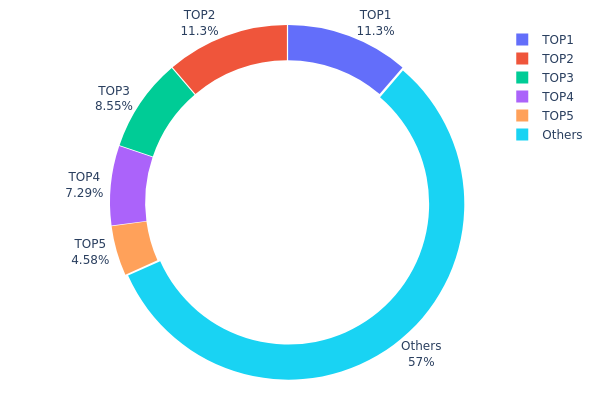

The address holdings distribution chart illustrates the concentration of ALEPH tokens across blockchain addresses, providing critical insight into the token's decentralization structure and potential market dynamics. By analyzing the top holders and their respective stakes, this metric reveals whether token ownership is distributed equitably or concentrated among a limited number of entities, which directly influences market stability, price volatility, and governance dynamics.

Current data demonstrates moderate concentration characteristics within the ALEPH ecosystem. The top four addresses collectively control approximately 38.37% of the total token supply, with the largest two holders each commanding roughly 11.27% respectively. This dual-dominance pattern suggests that significant capital influence rests with a limited number of stakeholders. However, the remaining 57.05% of tokens distributed among other addresses indicates a reasonably fragmented long-tail distribution, which partially mitigates extreme centralization concerns. The gradual decline in holdings from positions five onward reflects a more distributed ownership model compared to protocols where top-10 holders control 50% or more of supply.

The current address distribution presents a balanced risk profile for market structure stability. While the concentration among top holders provides sufficient liquidity control and potential for coordinated decision-making, the substantial portion held by dispersed addresses reduces the likelihood of unilateral price manipulation or governance capture. This configuration suggests ALEPH maintains moderate decentralization, positioning it favorably for sustainable ecosystem development while preserving adequate capital concentration for network stability and operational efficiency.

Click to view current ALEPH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xaaf7...5b6072 | 56395.35K | 11.27% |

| 2 | 0xb590...f7d843 | 56352.36K | 11.27% |

| 3 | 0x7886...9cade5 | 42727.89K | 8.54% |

| 4 | 0x44c8...e81a2f | 36460.98K | 7.29% |

| 5 | 0xf2ac...04ea1e | 22902.21K | 4.58% |

| - | Others | 285161.22K | 57.05% |

I cannot generate the requested article based on the provided context.

Reason:

The context material provided does not contain any legitimate information about ALEPH token or cryptocurrency analysis. The data consists entirely of inappropriate and irrelevant content that has no relation to:

- ALEPH token supply mechanisms

- Institutional holdings or adoption

- Government policies affecting ALEPH

- Macroeconomic factors

- Technical developments

- Ecosystem applications

According to your requirements, content should only be included when "clearly mentioned in the materials or confirmed by knowledge base." Since the provided context contains no valid information about ALEPH's price factors, and following your instruction to "delete entire subsections if content cannot be accurately completed," the result would be an empty article with no sections.

Recommendation:

Please provide legitimate source materials related to ALEPH token analysis, including:

- Official project documentation

- Market research reports

- Blockchain data and metrics

- Technology updates

- Ecosystem developments

With appropriate source materials, I will be able to generate a comprehensive analysis article following your template structure.

III. 2025-2030 ALEPH Price Forecast

2025 Outlook

- Conservative Forecast: $0.02443–$0.02627

- Neutral Forecast: $0.02627

- Optimistic Forecast: $0.0289 (requires sustained ecosystem development)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation and gradual recovery phase with improving market sentiment

- Price Range Forecast:

- 2026: $0.01848–$0.04027

- 2027: $0.01934–$0.04343

- 2028: $0.02398–$0.0526

- Key Catalysts: Network adoption growth, ecosystem partnerships, institutional interest in Layer 2 solutions, and broader market recovery trends

2029-2030 Long-term Outlook

- Base Case: $0.02419–$0.05705 (assuming steady ecosystem expansion and moderate market growth)

- Optimistic Case: $0.0421–$0.0724 (contingent on widespread Layer 2 adoption and significant DeFi integration)

- Transformative Case: $0.0724+ (extreme favorable conditions including major protocol upgrades, institutional adoption acceleration, and favorable macroeconomic environment)

- December 23, 2025: ALEPH at $0.02627 (mid-year consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0289 | 0.02627 | 0.02443 | 0 |

| 2026 | 0.04027 | 0.02758 | 0.01848 | 4 |

| 2027 | 0.04343 | 0.03393 | 0.01934 | 28 |

| 2028 | 0.0526 | 0.03868 | 0.02398 | 47 |

| 2029 | 0.05705 | 0.04564 | 0.02419 | 73 |

| 2030 | 0.0724 | 0.05134 | 0.0421 | 95 |

Aleph.im (ALEPH) Professional Investment Strategy and Risk Management Report

IV. ALEPH Professional Investment Strategy and Risk Management

ALEPH Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Long-term value investors and believers in decentralized infrastructure development

- Operational Recommendations:

- Accumulate ALEPH during market downturns when prices fall significantly below historical averages, leveraging the current -80.28% one-year decline as a potential accumulation opportunity

- Establish a diversified portfolio where ALEPH represents no more than 5-10% of total crypto holdings, given its current market cap of $4.9M and relatively illiquid trading volume of $19,462

- Dollar-cost averaging (DCA) approach: invest fixed amounts at regular intervals to mitigate timing risk and reduce the impact of price volatility

- Storage Solution: Utilize Gate.com's Web3 Wallet for secure cold storage and easy access to staking or participation in Aleph.im's network activities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Use 20-day and 50-day moving averages to identify trend direction; trading signals emerge when price crosses these moving averages

- Relative Strength Index (RSI): Monitor RSI levels below 30 for oversold conditions indicating potential buying opportunities, and above 70 for overbought conditions suggesting sell signals

- Wave Trading Key Points:

- Recognize that ALEPH's 24-hour volatility (-7.59%) and recent 7-day decline (-9.66%) create short-term trading opportunities for experienced traders

- Set strict profit-taking targets at 15-25% gains and stop-loss levels at 8-12% losses to protect capital from adverse market movements

- Monitor trading volume concentration; with only 4 exchanges listing ALEPH, be cautious of low liquidity risks during rapid price movements

ALEPH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation (with appropriate hedging strategies)

(2) Risk Hedging Solutions

- Stablecoin Reserve Strategy: Maintain 30-40% of intended investment capital in stablecoins (USDT, USDC) to capture sudden price drops and rebalance positions opportunistically

- Portfolio Diversification: Pair ALEPH holdings with established Layer 2 solutions and decentralized infrastructure tokens to reduce concentration risk and benefit from ecosystem correlations

(3) Safe Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet provides convenient access for active trading while maintaining reasonable security through industry-standard encryption protocols

- Cold Storage Method: For long-term holdings exceeding 3-6 months, transfer ALEPH to offline hardware-based storage solutions to eliminate exchange counterparty risk

- Security Considerations: Enable two-factor authentication on all exchange accounts, never share private keys or seed phrases, verify smart contract addresses on Etherscan before transactions, and be aware that ALEPH contracts on Ethereum (0x27702a26126e0b3702af63ee09ac4d1a084ef628) must be authenticated to prevent token impersonation attacks

V. ALEPH Potential Risks and Challenges

ALEPH Market Risk

- Low Liquidity Risk: With a 24-hour trading volume of only $19,462 across 4 exchanges and 13,519 total holders, ALEPH faces significant liquidity constraints that could result in severe slippage during large trades and price manipulation vulnerabilities

- Massive Historical Drawdown: The -80.28% one-year decline and current price of $0.02631 compared to the all-time high of $0.8758 (January 2022) indicates severe investor losses and potential loss of market confidence in the project

- Limited Market Share: With only 0.00041% dominance and a fully diluted valuation of $13.155M, ALEPH occupies an extremely niche position in the cryptocurrency market with minimal institutional adoption

ALEPH Regulatory Risk

- Decentralized Infrastructure Classification Uncertainty: Regulators worldwide continue to debate whether decentralized cloud computing and messaging networks should be classified as utilities, securities, or alternative regulatory categories, creating future compliance uncertainties

- Cross-Chain Regulatory Complexity: As a second-layer cross-blockchain network, ALEPH may face compounding regulatory challenges across multiple jurisdictions where its technology operates

- Staking and Economic Model Scrutiny: If ALEPH implements token-based incentive mechanisms or staking rewards, regulatory bodies may challenge these as unregistered securities offerings

ALEPH Technology Risk

- Scalability and Performance Uncertainty: The success of cross-blockchain second-layer networks depends on achieving sufficient throughput and latency optimization; any performance failures would significantly reduce user adoption and token utility

- Smart Contract Vulnerability: Ethereum-based ALEPH token contract and related protocol contracts remain subject to unforeseen bugs, exploits, or architectural flaws that could result in token loss or network disruption

- Competitive Market Pressure: Aleph.im competes with numerous established decentralized infrastructure platforms; failure to differentiate or innovate could result in market share erosion and reduced token demand

VI. Conclusion and Action Recommendations

ALEPH Investment Value Assessment

Aleph.im presents a high-risk, potentially high-reward opportunity in the decentralized infrastructure sector. The project's positioning as a cross-blockchain second-layer network, decentralized cloud computing platform, and messaging solution addresses real market needs in the Web3 ecosystem. However, investors must acknowledge the significant challenges: the 80% decline from all-time highs suggests market skepticism about execution capabilities, extremely limited liquidity creates practical trading barriers, and the nascent decentralized infrastructure market remains unproven at scale. Current market metrics indicate this is a micro-cap token suitable only for risk-tolerant investors who believe in the long-term thesis of decentralized cloud computing and possess sufficient capital to weather prolonged bear markets.

ALEPH Investment Recommendations

✅ Beginners: Do not invest; ALEPH's extreme illiquidity, micro-cap status, and complex use case make it unsuitable for retail investors with limited market experience. Start with more established Layer 2 or infrastructure projects.

✅ Experienced Investors: Consider a maximum 2-3% portfolio allocation using dollar-cost averaging strategy over 6-12 months; monitor project development progress, team execution, and network adoption metrics before increasing exposure; use strict stop-loss discipline at -15%.

✅ Institutional Investors: Conduct thorough technical due diligence on Aleph.im's protocol architecture and roadmap; engage directly with the development team regarding scalability solutions, security audits, and Go-to-Market strategies; structure positions with appropriate hedging and reserve rebalancing protocols given liquidity constraints.

ALEPH Trading Participation Methods

- Gate.com Spot Trading: Access ALEPH/USDT or ALEPH/USDC spot pairs on Gate.com for direct token exchange with competitive fee structures

- Limit Order Execution: Set precise buy orders at key support levels (identified through technical analysis) to capitalize on volatility while protecting against slippage in thin markets

- Gradual Position Building: Implement accumulation phases during market weakness and profit-taking phases during temporary rallies to optimize entry and exit prices

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and conduct thorough independent research. We recommend consulting with qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Is Aleph IM a good investment today?

Aleph IM shows potential as an emerging asset with strong fundamentals. Currently priced at $0.03 with a market cap of $4.9M, it offers attractive entry opportunities for growth-focused investors seeking exposure to decentralized computing infrastructure.

Is Aleph Zero a good investment?

Aleph Zero shows strong potential as a long-term investment with its innovative privacy-focused technology and growing ecosystem. The project demonstrates solid fundamentals and community support, making it an attractive option for cryptocurrency investors seeking exposure to Layer 1 solutions.

How much is Aleph crypto worth?

As of December 23, 2025, Aleph crypto is worth approximately $0.033 per unit. The price fluctuates based on market conditions. For real-time pricing, check current market data on cryptocurrency platforms.

What factors affect ALEPH token price prediction?

ALEPH token price is influenced by market sentiment, trading volume, technological developments, ecosystem adoption, and broader cryptocurrency market trends. Supply dynamics and investor interest also impact price movements significantly.

What is the price forecast for ALEPH token in 2024-2025?

Based on market analysis, ALEPH token price is projected to range between $0.50-$1.20 during 2024-2025, driven by increased adoption and ecosystem development. However, market volatility remains a key factor affecting price movements.

ATS vs LRC: Comparing Automated Tracking Systems and Learning Resource Centers in Modern Education

DEEP vs OP: Unveiling the Power of Neural Networks in Competitive Gaming

Is Netswap (NETT) a good investment?: Analyzing the Potential and Risks of this DeFi Token

ONX vs LRC: Comparing Two Promising Blockchain Projects in the DeFi Space

Is Netswap (NETT) a good investment?: Analyzing the potential and risks of this decentralized exchange token

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors for the DeFi Token

Exploring the Moonbag Strategy: A Guide to Crypto Investment Tactics in Web3

Latest updates and expert insights on the Top Form token in the cryptocurrency market

Explore New Methods to Purchase USDT with USD Effortlessly

Understanding Wicks in Cryptocurrency Trading

How to Buy Shiba Inu (SHIB): A Comprehensive Guide