2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

Introduction: ASTER's Market Position and Investment Value

ASTER (ASTER), as a next-generation decentralized exchange, has emerged as a significant player in the cryptocurrency market since its inception. As of 2025, ASTER's market capitalization has reached $2.43 billion, with a circulating supply of approximately 1.66 billion tokens, and a price hovering around $1.46. This asset, often referred to as a "one-stop onchain trading platform," is playing an increasingly crucial role in both spot and perpetual contract trading.

This article will provide a comprehensive analysis of ASTER's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ASTER Price History Review and Current Market Status

ASTER Historical Price Evolution

- 2025 (September 19): ASTER reached its all-time low of $0.6083

- 2025 (September 24): ASTER hit its all-time high of $2.428

- 2025 (October): ASTER experienced significant volatility, with price fluctuations between $1.3011 and $1.5302 in the past 24 hours

ASTER Current Market Situation

As of October 15, 2025, ASTER is trading at $1.4647, ranking 55th in the cryptocurrency market. The token has seen a 4.28% increase in the last 24 hours, with a trading volume of $55,850,748.60. ASTER's market capitalization stands at $2,428,033,190, with a circulating supply of 1,657,700,000 ASTER tokens.

The current price represents a significant recovery from its all-time low but remains well below its all-time high. ASTER has shown remarkable growth over the past 30 days, with a staggering 1,640.03% increase. However, it has experienced a 25.86% decline in the past week, indicating recent market volatility.

The token's fully diluted valuation is $11,717,600,000, with a total supply of 8,000,000,000 ASTER. The circulating supply represents 20.72% of the total supply, suggesting potential for future token releases.

ASTER's market dominance is currently at 0.28%, reflecting its position in the broader cryptocurrency ecosystem. The project has garnered attention from 171,557 holders, indicating growing interest in the Aster decentralized exchange platform.

Click to view the current ASTER market price

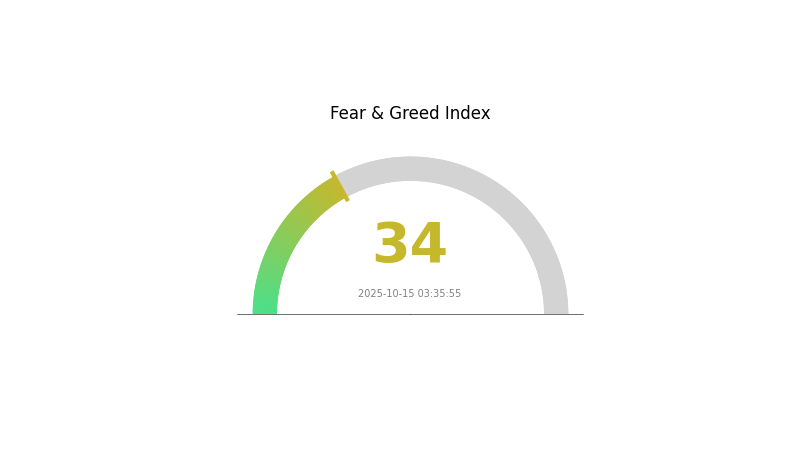

ASTER Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 34, indicating a fearful atmosphere. This suggests investors are hesitant and potentially seeking safer options. During such periods, it's crucial to remain vigilant and avoid making impulsive decisions. While fear can present buying opportunities for the bold, it's essential to conduct thorough research and manage risks carefully. Remember, market sentiment can shift rapidly, so stay informed and consider diversifying your portfolio to navigate these uncertain times.

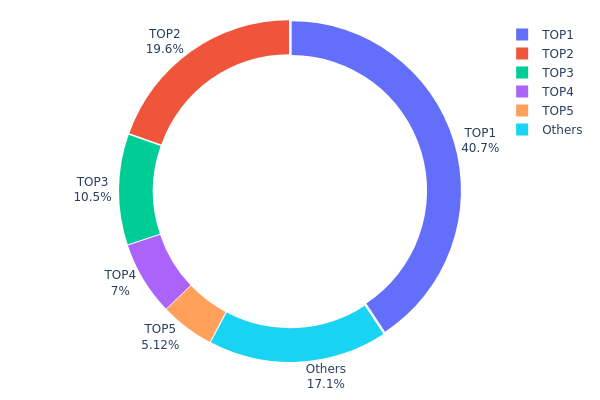

ASTER Holdings Distribution

The address holdings distribution data for ASTER reveals a highly concentrated ownership structure. The top address holds a substantial 40.70% of the total supply, while the top five addresses collectively control 82.94% of all ASTER tokens. This concentration level raises concerns about the token's decentralization and potential market manipulation risks.

Such a concentrated distribution can lead to significant price volatility and market instability. Large holders, often referred to as "whales," have the power to influence token prices through their trading activities. This concentration also suggests that ASTER's on-chain governance may be dominated by a small number of entities, potentially compromising the project's decentralization ethos.

While some level of concentration is common in many cryptocurrencies, ASTER's current distribution indicates a relatively low level of decentralization. This could impact market liquidity and increase the risk of price manipulation. Investors and stakeholders should monitor any changes in this distribution pattern, as a more dispersed ownership structure would generally be considered healthier for the token's long-term stability and adoption.

Click to view the current ASTER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe8c3...51a892 | 3256000.00K | 40.70% |

| 2 | 0xdfa6...2a3463 | 1568000.00K | 19.60% |

| 3 | 0x1284...a87974 | 841994.29K | 10.52% |

| 4 | 0x798b...9269f7 | 560000.00K | 7.00% |

| 5 | 0x8894...e2d4e3 | 409828.71K | 5.12% |

| - | Others | 1364177.00K | 17.06% |

II. Key Factors Influencing ASTER's Future Price

Supply Mechanism

- Token Distribution: The current token distribution shows that 96% of the supply is concentrated in a few addresses, which may impact future price movements.

- Historical Pattern: The initial price surge of 7660% from $0.025 to $1.94 demonstrates high volatility and speculative interest.

- Current Impact: The concentrated token distribution may lead to price volatility if large holders decide to sell.

Institutional and Whale Dynamics

- Institutional Holdings: YZi Labs holds a stake in ASTER, though the exact percentage is not disclosed.

- Corporate Adoption: Gate.com has shown support for ASTER, potentially influencing its adoption and price.

- Government Policies: No specific government policies related to ASTER are mentioned, but general crypto regulations may impact its price.

Macroeconomic Environment

- Monetary Policy Impact: The overall crypto market sentiment, influenced by global monetary policies, will likely affect ASTER's price.

- Inflation Hedging Properties: As a crypto asset, ASTER may be viewed as an inflation hedge, potentially impacting its demand.

Technical Development and Ecosystem Growth

- Multi-Chain Support: ASTER has expanded beyond BNB Chain to support Arbitrum, OP, Linea, and Solana, with plans for more chains.

- Aster Chain: The development of Aster Chain aims to provide transparency and verifiability for on-chain transactions while maintaining privacy.

- Ecosystem Applications: The platform focuses on perpetual contracts trading, which currently dominates market demand.

III. ASTER Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.10 - $1.30

- Neutral prediction: $1.40 - $1.60

- Optimistic prediction: $1.80 - $1.97 (requires strong market sentiment and adoption)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.96 - $2.25

- 2027: $1.53 - $2.62

- Key catalysts: Increased adoption, technological advancements, and market expansion

2028-2030 Long-term Outlook

- Base scenario: $2.30 - $2.65 (assuming steady market growth)

- Optimistic scenario: $2.87 - $3.20 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $3.50+ (under extremely favorable conditions and widespread integration)

- 2030-12-31: ASTER $3.21 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.97127 | 1.4711 | 1.10333 | 0 |

| 2026 | 2.25475 | 1.72119 | 0.96386 | 17 |

| 2027 | 2.62412 | 1.98797 | 1.53074 | 35 |

| 2028 | 2.55971 | 2.30605 | 2.07544 | 57 |

| 2029 | 2.8708 | 2.43288 | 1.58137 | 66 |

| 2030 | 3.20872 | 2.65184 | 1.61762 | 81 |

IV. Professional Investment Strategies and Risk Management for ASTER

ASTER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate ASTER tokens during market dips

- Set price targets and take partial profits at predetermined levels

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage risk

ASTER Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ASTER

ASTER Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Potential difficulty in executing large trades without significant price impact

- Competition: Emergence of new DEX platforms could impact ASTER's market share

ASTER Regulatory Risks

- Regulatory uncertainty: Evolving global crypto regulations may affect ASTER's operations

- Compliance requirements: Potential need for KYC/AML implementation on DEX platforms

- Legal status: Risk of classification as a security in some jurisdictions

ASTER Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Network congestion: High gas fees or slow transactions during peak usage

- Interoperability issues: Challenges in connecting with other blockchain networks

VI. Conclusion and Action Recommendations

ASTER Investment Value Assessment

ASTER shows potential as a next-generation DEX platform, but faces significant competition and regulatory uncertainties. Long-term value proposition is tied to its ability to innovate and capture market share, while short-term risks include high volatility and potential technical challenges.

ASTER Investment Recommendations

✅ Beginners: Start with small positions, focus on learning DEX operations

✅ Experienced investors: Consider allocating as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence, monitor regulatory developments

ASTER Trading Participation Methods

- Spot trading: Buy and hold ASTER tokens on Gate.com

- Liquidity provision: Participate in liquidity pools on the Aster DEX platform

- Yield farming: Explore staking opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for astr in 2030?

Based on expert analysis, ASTR price in 2030 is predicted to range between $0.1387 and $0.1608, with potential for further growth to $0.5815 by 2033.

What is the price target for Aster DM in 2025?

Based on current projections, Aster DM's price target for 2025 is estimated to be around $0.75, with potential to reach $1 if market conditions are favorable.

What is the price prediction for ASTS 2025?

Based on analyst forecasts, ASTS price is predicted to reach around $1.50 by 2025. This estimate considers current market trends and company performance.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed by Ethereum (ETH) and Solana (SOL).

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

XRP Price Analysis 2025: Market Trends and Investment Outlook

Toncoin Price Prediction for 2025: Will TON Reach New Heights?

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

Everything You Need to Know About Sybil Attacks

Games You Can Earn From – TOP 11 Games

Phil Konieczny – Who Is He? What Is His Wealth? Why Does He Wear a Mask?

What is ZULU: A Comprehensive Guide to South Africa's Warrior Culture and Heritage

What is LANDSHARE: A Revolutionary Platform for Sustainable Agriculture and Community Land Access