2025 AVL Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: AVL's Market Position and Investment Value

Avalon (AVL) is building a premier on-chain financial center for Bitcoin, providing a seamless ecosystem that includes Bitcoin-backed lending, Bitcoin-backed stablecoins, income-generating accounts, and credit cards. As of December 2025, AVL has achieved a market capitalization of $78,350,000 with a circulating supply of approximately 254,250,001 tokens, currently trading at around $0.07835. This innovative asset is playing an increasingly critical role in transforming Bitcoin into an active economic asset in the global market.

This article will conduct a comprehensive analysis of AVL's price trends from 2025 to 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Avalon (AVL) Market Analysis Report

I. AVL Price History Review and Current Market Status

AVL Historical Price Evolution Trajectory

Based on the available data, Avalon (AVL) was published on December 11, 2025, at an initial price of $0.08. The token has experienced significant volatility since its launch:

-

December 2025 (Launch Period): AVL entered the market at $0.08, marking the beginning of its trading history on Gate.com and other exchanges.

-

February 12, 2025 (All-Time High): AVL reached its peak price of $1.5795, representing a remarkable 1,874% increase from the launch price, demonstrating strong early market enthusiasm and investor demand.

-

December 19, 2025 (All-Time Low): AVL declined to $0.07115, marking a 91.41% decrease from the launch price over the year, indicating significant market correction and decreased investor interest.

AVL Current Market Status

As of December 20, 2025, AVL is trading at $0.07835, showing a modest recovery with a +4.16% increase over the past 24 hours. The token demonstrates the following characteristics:

Price Performance Metrics:

- 1-Hour Change: +0.18%

- 24-Hour Range: $0.07488 - $0.08139

- 7-Day Performance: -12.80%

- 30-Day Performance: -56.49%

- Year-to-Date Performance: -91.41%

Market Capitalization and Supply Dynamics:

- Market Cap: $19,920,487.58

- Fully Diluted Valuation (FDV): $78,350,000

- Circulating Supply: 254,250,001 AVL (25.43% of total supply)

- Total Supply: 1,000,000,000 AVL

- Market Cap to FDV Ratio: 25.43%

Trading Activity:

- 24-Hour Volume: $332,970.62

- Number of Supported Exchanges: 16

- Token Holders: 1,736

Market Position:

- Global Ranking: #870

- Market Dominance: 0.0024%

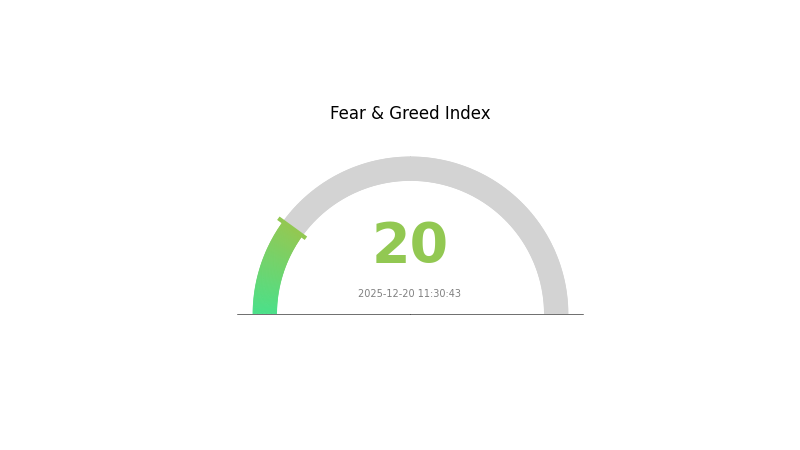

The token exhibits signs of market distress, with the sentiment indicator showing "Extreme Fear" (VIX: 20), reflecting the broader bearish sentiment in cryptocurrency markets during this period.

Click to view current AVL market price

AVL Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 20. This indicates severe risk aversion among investors, suggesting potential capitulation selling and widespread pessimism. During such periods, long-term investors often view significant price declines as buying opportunities. However, caution is warranted as extreme fear can signal further downside before stabilization occurs. Monitor market developments closely and consider your risk tolerance before making investment decisions on Gate.com.

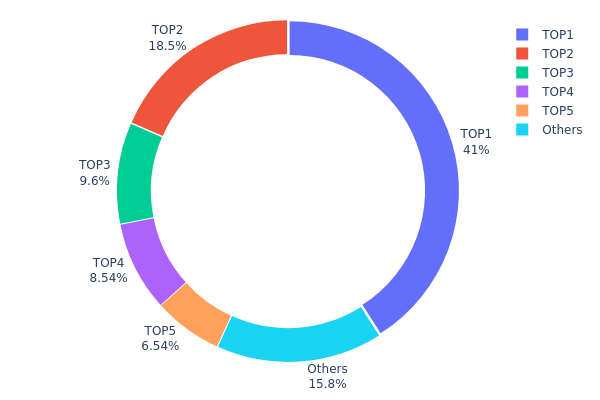

AVL Holdings Distribution

The address holdings distribution chart illustrates the concentration of AVL tokens across different wallet addresses on the blockchain. This metric is crucial for assessing the degree of decentralization and potential market risks associated with token concentration. By analyzing the distribution pattern, investors and analysts can evaluate whether a significant portion of the token supply is concentrated in a few hands, which could impact price stability and market dynamics.

The current AVL holdings distribution reveals a moderately concentrated token structure. The top address holds approximately 40.97% of the total supply, while the second-largest holder maintains 18.51%. Together, the top five addresses control approximately 84.15% of the circulating tokens, with the remaining 15.85% dispersed among other holders. This concentration level indicates that AVL exhibits characteristics typical of projects in their developmental or governance consolidation phases, where key stakeholders—such as project founders, institutional investors, or governance participants—maintain substantial positions to ensure protocol stability and decision-making authority.

This distribution pattern presents both opportunities and challenges for the market ecosystem. While concentrated holdings among fewer addresses may facilitate coordinated development initiatives and governance efficiency, they also increase the potential for significant price volatility should these major holders decide to liquidate positions. The substantial stake held by the leading address (0x0000...00dead) warrants particular attention, as such concentrated positions could theoretically influence market sentiment and price movements. However, the presence of a diversified secondary tier of holders and a meaningful "Others" category suggests some level of organic distribution beyond the top tier, which partially mitigates systemic concentration risk.

View current AVL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 80317.89K | 40.97% |

| 2 | 0x2076...d9fcd3 | 36294.74K | 18.51% |

| 3 | 0xc12e...c178ad | 18827.44K | 9.60% |

| 4 | 0xa312...4ab647 | 16737.08K | 8.53% |

| 5 | 0xb9b1...3f7b4b | 12827.00K | 6.54% |

| - | Others | 31026.05K | 15.85% |

II. Core Factors Impacting AVL's Future Price

Institutional and Whale Dynamics

- Early Token Holder Activity: As of April 14, 2025, AVL's trading price stood near $0.4173, reflecting a 20.6% decline over the previous week. This price drop was primarily driven by increased selling pressure from early token holders and large wallet addresses (commonly referred to as "whales"). Their trading behavior significantly influences price movements.

Macroeconomic Environment

- Market Sentiment Impact: AVL's price is influenced by overall market sentiment, trading volume, and broader macroeconomic trends. Policy regulation and government oversight also play key roles in price volatility.

- Technical Market Signals: In 2025, AVL exhibited a typical bearish crossover pattern—the 50-day moving average crossing below the 200-day moving average—signaling a clear bearish trend. Prior to this formation, the token price experienced significant declines.

Technology Development and Ecosystem Building

- Bitcoin Financial Integration: Avalon Labs is actively advancing the financialization of Bitcoin, constructing a seamless, transparent, and scalable financial ecosystem. Its innovative services include Bitcoin-backed lending, stablecoins, yield-generating accounts, and credit card solutions, positioning the platform as a future financial hub for Bitcoin.

III. AVL Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.06879 - $0.07817

- Base Case Forecast: $0.07817

- Optimistic Forecast: $0.10944 (requiring sustained ecosystem adoption and market recovery)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, transitioning into growth acceleration as network utility expands

- Price Range Forecast:

- 2026: $0.05628 - $0.12382 (19% potential upside)

- 2027: $0.05549 - $0.13493 (38% potential upside)

- Key Catalysts: Enhanced protocol developments, increased institutional participation on platforms like Gate.com, expanding DeFi applications, and improving macroeconomic conditions

2028-2030 Long-term Outlook

- Base Case Scenario: $0.06337 - $0.16696 by 2028 (55% appreciation potential), advancing to $0.13452 - $0.16143 by 2030 (90% total gain)

- Optimistic Scenario: $0.15453 - $0.16696 range (substantial growth driven by mass adoption and mainstream integration)

- Bull Case Scenario: $0.14442 - $0.16143 achieved through transformative ecosystem breakthroughs, widespread enterprise adoption, and favorable regulatory environment

- 2030-12-31: AVL approaching $0.16143 (consolidation phase with sustained upward momentum)

Note: These projections represent market analysis based on historical trends and current data. Cryptocurrency markets remain highly volatile and subject to regulatory, technological, and macroeconomic variables. Investors should conduct independent research and consult financial advisors before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10944 | 0.07817 | 0.06879 | 0 |

| 2026 | 0.12382 | 0.0938 | 0.05628 | 19 |

| 2027 | 0.13493 | 0.10881 | 0.05549 | 38 |

| 2028 | 0.16696 | 0.12187 | 0.06337 | 55 |

| 2029 | 0.15453 | 0.14442 | 0.11553 | 84 |

| 2030 | 0.16143 | 0.14947 | 0.13452 | 90 |

Avalon (AVL) Professional Investment Strategy & Risk Management Report

IV. AVL Professional Investment Strategy and Risk Management

AVL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors and Bitcoin-focused believers who believe in the long-term potential of Bitcoin-backed financial infrastructure

- Operational Recommendations:

- Accumulate AVL during market downturns when volatility is high, particularly when price falls below $0.08

- Hold positions for a minimum of 12-24 months to capture the value realization of Avalon Labs' ecosystem development

- Reinvest any protocol rewards or yields generated from Bitcoin-backed lending and stablecoin products back into AVL positions

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.07115 (all-time low) and $1.5795 (all-time high) to identify potential breakout opportunities

- Moving Averages: Use 50-day and 200-day moving averages to identify trend reversals and momentum shifts in AVL trading pairs

- Wave Operation Key Points:

- Execute buy positions during price consolidation phases around support levels with stop losses set at -5% below entry

- Take profit targets at resistance levels or when the token shows +15-20% gains within short-term trading windows

AVL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total crypto portfolio

- Active Investors: 5-8% of total crypto portfolio

- Professional Investors: 10-15% of total crypto portfolio with hedging instruments

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Invest fixed amounts at regular intervals (weekly or monthly) to reduce exposure to price volatility and timing risk

- Portfolio Diversification: Balance AVL holdings with other Bitcoin infrastructure plays and stablecoins to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Option: Use Gate.com Web3 Wallet for frequent trading and yield farming activities within Avalon's ecosystem

- Cold Storage Method: Transfer the majority of long-term AVL holdings to hardware wallets for maximum security against exchange hacks or smart contract vulnerabilities

- Security Considerations: Enable two-factor authentication on all exchange accounts, never share private keys, and regularly audit wallet addresses for unauthorized access attempts

V. AVL Potential Risks and Challenges

AVL Market Risks

- Liquidity Risk: With 24-hour trading volume of only $332,970.61 and relatively limited exchange presence (16 exchanges), large buy or sell orders could result in significant price slippage

- Price Volatility: AVL has experienced a -91.41% decline over the past year and a -56.49% drop over 30 days, indicating extreme price instability unsuitable for risk-averse investors

- Market Adoption Risk: The success of Avalon Labs depends on achieving significant adoption of Bitcoin-backed lending and stablecoin products, which remain in early development phases

AVL Regulatory Risks

- Stablecoin Regulation: Bitcoin-backed stablecoins may face increased regulatory scrutiny as governments develop clearer frameworks for asset-backed digital currencies

- Securities Classification Risk: Regulatory bodies could classify AVL tokens as securities, subjecting the project to stricter compliance requirements and potentially limiting trading on certain platforms

- Cross-Border Compliance: Operating a financial services platform across multiple jurisdictions requires navigating complex and evolving regulatory requirements, creating uncertainty for long-term viability

AVL Technology Risks

- Smart Contract Vulnerability: As an ERC-20 token deployed on Ethereum, AVL and associated DeFi protocols face potential security risks from smart contract bugs or exploits

- Scalability Challenges: The project must efficiently handle Bitcoin integration and cross-chain operations without compromising security or transaction speed

- Ecosystem Dependency: Avalon Labs' success relies on seamless integration with Bitcoin's infrastructure, which could face technical limitations or require continuous protocol updates

VI. Conclusion and Action Recommendations

AVL Investment Value Assessment

Avalon Labs presents an interesting long-term thesis centered on transforming Bitcoin into an active economic asset through on-chain financial services. The project's vision of providing Bitcoin-backed lending, stablecoins, yield accounts, and credit cards addresses a genuine market need. However, the current market conditions reflect significant skepticism: the token has lost 91.41% of its value over the past year, maintains limited liquidity, and operates in a highly speculative space where regulatory and technical risks remain substantial. The token's circulating supply of 254.25 million represents 25.43% of total supply, suggesting moderate dilution concerns. Investors should view AVL as a high-risk, high-reward speculative opportunity rather than a stable value proposition.

AVL Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-2% portfolio allocation) through dollar-cost averaging on Gate.com over 3-6 months to reduce timing risk. Use only capital you can afford to lose completely.

✅ Experienced Investors: Consider 5-8% portfolio allocation with active monitoring of ecosystem development milestones. Implement trailing stop losses to protect against downside volatility while maintaining upside exposure.

✅ Institutional Investors: Conduct deep technical due diligence on Avalon Labs' smart contracts and Bitcoin integration architecture before committing 10-15% allocations. Consider negotiated entry prices through OTC channels during volatile periods.

AVL Trading Participation Methods

- Direct Exchange Trading: Purchase AVL on Gate.com using USDT, USDC, or ETH trading pairs with limit orders to minimize slippage

- Yield Generation: Once acquired, explore yield-generating opportunities through Avalon's Bitcoin-backed lending protocols (if available) to generate additional returns

- Dollar-Cost Accumulation: Implement automated recurring purchases through Gate.com to build positions gradually and reduce exposure to short-term price fluctuations

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial circumstances. Consider consulting professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

What is the price prediction for AVL token?

Based on current market analysis, AVL token is predicted to reach approximately $0.137594 by 2025, representing potential gains of around 52.6%. For 2029, projections suggest AVL could rise to $0.557491 in optimistic scenarios, reflecting long-term growth potential driven by market momentum and adoption trends.

Is AVL a good investment or buy?

AVL shows promising fundamentals with strong trading volume and growing adoption in the crypto ecosystem. Its technological innovations and market positioning make it an attractive investment opportunity for those seeking exposure to emerging blockchain projects.

What factors influence AVL token price movements?

AVL token price is influenced by ecosystem development progress, particularly in AI and DeFi initiatives, market demand dynamics, overall cryptocurrency market trends, and trading volume.

2025 YALA Price Prediction: Analyzing Growth Factors and Market Potential for This Emerging Digital Asset

Is bitSmiley (SMILE) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is bitSmiley (SMILE) a good investment?: Analyzing the potential of this emerging cryptocurrency in today's market

Is Avalon (AVL) a good investment?: A Comprehensive Analysis of Performance, Market Potential, and Risk Factors

Bitcoin And AUD

when a crypto coin gets an ETF..

How to Set Price Alerts for Cryptocurrency on Mobile and Desktop

ONG price prediction analysis: Is Ontology Gas undervalued after token burning?

Introduction to Spark Token and Flare Network for Beginners

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

Can You Mine Bitcoin on Your Smartphone?