2025 BELLS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: BELLS' Market Position and Investment Value

Bellscoin (BELLS), created by Dogecoin founder Billy Marcus (BillyM2K), represents a pioneering community-driven digital asset that predates Dogecoin by eight days, having launched in 2013. Since its inception, Bellscoin has maintained its commitment to decentralization without venture capital backing, initial coin offerings, or insider allocations. As of December 23, 2025, BELLS has achieved a market capitalization of approximately $5.16 million with a circulating supply of 61,010,487 tokens, trading at approximately $0.08456 per token. This unique digital currency, inspired by the in-game currency from Nintendo's Animal Crossing, continues to demonstrate the enduring appeal of grassroots cryptocurrency projects built on transparent, community-driven principles.

This comprehensive analysis will examine BELLS' price trajectory and market dynamics through 2030, integrating historical price patterns, tokenomics characteristics, supply dynamics, and broader cryptocurrency market conditions. By synthesizing these factors, this guide provides investors with data-driven price forecasts and actionable investment strategies to navigate the BELLS market effectively.

Bellscoin (BELLS) Market Analysis Report

I. BELLS Price History Review and Current Market Status

BELLS Historical Price Trajectory

Based on available data, Bellscoin has experienced significant volatility since its launch in 2013:

- All-Time High (ATH): $1.5245 reached on November 30, 2024

- All-Time Low (ATL): $0.07 recorded on November 21, 2025

- Year-to-Date Performance: The token has declined 87.63% over the past 12 months, reflecting substantial market pressure and depreciation from peak valuations

BELLS Current Market Status

As of December 23, 2025, Bellscoin is trading at $0.08456, positioning it at market rank #1511 with a total market capitalization of $4,812,477.03 USD. The token's circulating supply stands at 61,010,487 BELLS out of a maximum supply of 500,000,000 tokens, representing a circulation ratio of 12.20%.

Recent Price Movement:

- 1-Hour Change: +0.37%

- 24-Hour Change: -0.81% ($0.08433 - $0.0866 range)

- 7-Day Change: +3.27%

- 30-Day Change: -2.77%

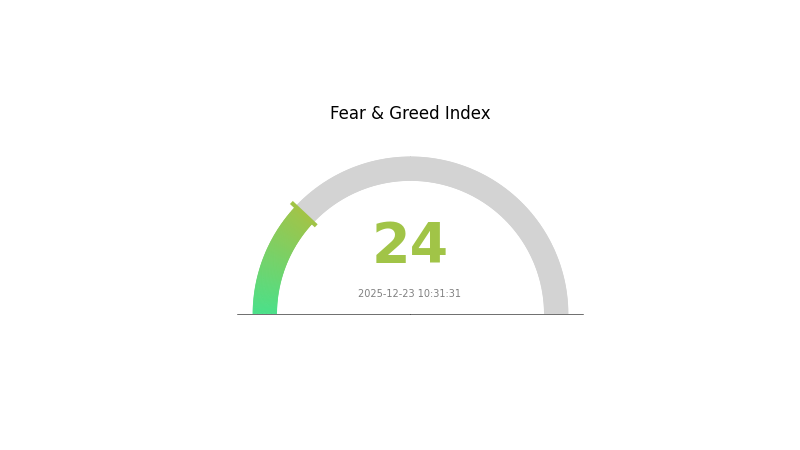

The 24-hour trading volume reaches $12,969.89 USD across 4 exchanges, indicating modest liquidity. The fully diluted valuation (FDV) is $42,012,477.03 USD, with the current market cap representing 12.20% of the FDV. Current market sentiment indicates "Extreme Fear" conditions in broader crypto markets (VIX: 24).

Click to view current BELLS market price

BELLS Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 24. This significantly low reading indicates widespread investor panic and pessimism across the market. Such extreme fear levels often present contrarian opportunities for experienced investors, as excessive pessimism can mark potential market bottoms. However, caution remains warranted as downward pressure may persist. Traders should monitor support levels closely and consider your risk tolerance. Visit Gate.com to track real-time market sentiment and make informed investment decisions during this volatile period.

BELLS Address Distribution

The address holding distribution represents the concentration of BELLS tokens across wallet addresses on the blockchain, serving as a critical indicator of token decentralization and market structure health. This metric tracks the percentage of total token supply held by top addresses, revealing potential concentration risks and the distribution of governance power within the network. A detailed analysis of these holdings provides valuable insights into whether the token supply is democratized across numerous participants or concentrated among a limited number of entities.

Click to view current BELLS address holdings

Note: The address holding distribution data for BELLS was not provided in the dataset submitted. To conduct a comprehensive analysis of concentration characteristics, potential over-concentration risks, and the impact on market structure and price volatility, the complete top address holding information is required. Once this data is available, we can evaluate whether token distribution reflects healthy decentralization or exhibits concerning centralization patterns that could influence market dynamics and price stability. The absence of specific holding percentages prevents assessment of whether large holders could potentially influence market movements or governance decisions, which are essential considerations for understanding the overall health and resilience of the BELLS token ecosystem.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting BELLS' Future Price

Macro-economic Environment

-

Global Tariffs and Political Instability: As of 2025, global tariff policies and political uncertainty are creating notably volatile market conditions. These factors may lead to unexpected price fluctuations that directly impact trading activity and investor sentiment around BELLS and other digital assets.

-

Community Sentiment and Market Demand: BELLS' price movements are significantly influenced by community engagement levels. In 2024, BELLS experienced substantial price volatility driven by shifts in community enthusiasm, demonstrating the token's sensitivity to social factors and retail investor participation.

III. BELLS Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.06919 - $0.07500

- Neutral Forecast: $0.08438

- Optimistic Forecast: $0.08776 (requires sustained market sentiment and increased adoption)

2026-2028 Medium-term Perspective

- Market Phase Expectation: Consolidation period with gradual recovery trajectory, characterized by volatility and market structure building

- Price Range Forecast:

- 2026: $0.05767 - $0.11619

- 2027: $0.09607 - $0.10619

- 2028: $0.07049 - $0.13165

- Key Catalysts: Protocol upgrades, ecosystem expansion, institutional adoption, and increased trading volume on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.10353 - $0.15883 (assuming steady ecosystem development and moderate market growth)

- Optimistic Scenario: $0.11765 - $0.16174 (contingent upon successful network scaling and widespread DeFi integration)

- Bullish Scenario: $0.13824+ (under conditions of breakthrough innovation, significant mainstream adoption, and favorable macroeconomic environment)

- 2025-12-23: BELLS trading volume surge on Gate.com (market stabilization indicator)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08776 | 0.08438 | 0.06919 | 0 |

| 2026 | 0.11619 | 0.08607 | 0.05767 | 1 |

| 2027 | 0.10619 | 0.10113 | 0.09607 | 19 |

| 2028 | 0.13165 | 0.10366 | 0.07049 | 22 |

| 2029 | 0.15883 | 0.11765 | 0.10353 | 39 |

| 2030 | 0.16174 | 0.13824 | 0.10092 | 63 |

Bellscoin (BELLS) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Bellscoin (BELLS) is a pioneering cryptocurrency created by Billy Marcus (BillyM2K), the founder of Dogecoin, launched in 2013—eight days before Dogecoin itself. Notably, Dogecoin is actually a fork of Bellscoin. The token was designed to emulate the in-game currency from the Nintendo game Animal Crossing, featuring unique tokenomics with decreasing miner rewards over time to enhance scarcity. As of December 23, 2025, BELLS trades at $0.08456 with a market capitalization of $5,159,046.78 and a 24-hour trading volume of $12,969.89.

II. Market Performance Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.08456 |

| 24-Hour Change | -0.81% |

| 7-Day Change | +3.27% |

| 30-Day Change | -2.77% |

| 1-Year Change | -87.63% |

| All-Time High | $1.5245 (November 30, 2024) |

| All-Time Low | $0.07 (November 21, 2025) |

| Market Cap | $5,159,046.78 |

| Fully Diluted Valuation | $4,812,477.03 |

| Market Dominance | 0.00015% |

| Circulating Supply | 61,010,487 BELLS |

| Total Supply | 56,911,980 BELLS |

| Maximum Supply | 500,000,000 BELLS |

| Market Ranking | #1511 |

Price Trend Analysis

BELLS has experienced significant volatility, with the token declining 87.63% over the past year from its all-time high of $1.5245. Recent short-term movements show mixed signals: a -0.81% decline in the last 24 hours, but a +3.27% recovery over the past week. The token currently trades near its recent low of $0.07, indicating substantial downward pressure from its historical peaks.

III. Bellscoin Fundamentals

Project Overview

Bellscoin represents one of the earliest experiments in community-driven cryptocurrency design. Created by Dogecoin founder Billy Marcus, BELLS predates Dogecoin and influenced its development. The project embodies a unique philosophy of decentralization without institutional backing.

Key Characteristics

Tokenomics:

- Decreasing miner rewards over time to introduce scarcity mechanisms

- Approximately 12.2% of maximum supply currently in circulation

- Fully decentralized supply distribution

Governance Model:

- No venture capital (VC) backing

- No initial coin offering (ICO)

- No insider allocations

- Community-driven development and decision-making

Network:

- Listed on 4 cryptocurrency exchanges

- Active community presence on X (Twitter) and dedicated blockchain explorer

IV. BELLS Professional Investment Strategy and Risk Management

BELLS Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Community enthusiasts, cryptocurrency history researchers, and investors seeking exposure to pioneering blockchain projects

Operation Recommendations:

- Allocate only a small percentage of total portfolio to BELLS due to its low market capitalization and high volatility

- Dollar-cost averaging purchases over extended periods to mitigate price volatility

- Store holdings in secure self-custodial solutions rather than exchange wallets

Storage Solution:

- Gate Web3 Wallet for secure, non-custodial storage with hardware wallet integration capabilities

(2) Active Trading Strategy

Technical Analysis Considerations:

- Given the limited 24-hour trading volume of approximately $12,969, liquidity constraints present significant challenges for position sizing

- Wide bid-ask spreads should be anticipated due to lower market depth

- Price movements may be subject to outsized influence from individual orders

Wave Trading Key Points:

- Trade only positions sized appropriately for available liquidity to avoid slippage

- Set strict entry and exit points given the 87.63% year-over-year decline indicating long-term downtrend

- Monitor support levels near the $0.07 all-time low and resistance at previous higher prices

BELLS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-0.5% portfolio allocation

- Active Investors: 0.5-2% portfolio allocation

- Professional Investors: 1-3% portfolio allocation (for research/diversification purposes only)

(2) Risk Hedging Approaches

- Position Sizing Discipline: Limit individual position size to amount that won't significantly impact overall portfolio if total loss occurs

- Portfolio Diversification: Balance BELLS holdings with established cryptocurrencies and traditional assets to reduce concentration risk

(3) Secure Storage Solutions

- Self-Custody via Gate Web3 Wallet: Enable secure storage with multi-signature capabilities and hardware wallet support for maximum security

- Exchange Custody Considerations: Short-term trading positions may be held on Gate.com, though this carries counterparty risk

- Critical Security Precautions:

- Never share private keys or seed phrases with any third party

- Enable two-factor authentication on all exchange accounts

- Use hardware wallets for significant holdings

- Verify website URLs before initiating transactions

- Maintain offline backup copies of recovery phrases

V. BELLS Potential Risks and Challenges

Market Risks

- Extreme Volatility: BELLS has experienced an 87.63% decline over the past year, indicating severe price instability and significant risk of further depreciation

- Severe Liquidity Constraints: With only $12,969.89 in 24-hour trading volume and approximately 61 million circulating tokens, limited liquidity creates substantial slippage risk and difficulty in executing large trades

- Minimal Market Capitalization: At only $5.16 million market cap, BELLS ranks #1511 globally—making it highly susceptible to market manipulation and sudden price swings from modest trades

Regulatory Risks

- Uncertain Regulatory Status: As a legacy cryptocurrency with limited adoption, changing regulatory frameworks in major jurisdictions could negatively impact trading venues and exchange listings

- Exchange Delisting Risk: The minimal trading volume and market cap may result in removal from exchange listings, eliminating primary trading venues

- Compliance Evolution: Future Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements could restrict trading accessibility

Technical Risks

- Reduced Development Activity: As an older project without active institutional backing or formal development team, technical maintenance and security updates may be limited

- Mining Concentration Risk: The decreasing miner rewards mechanism, while designed to increase scarcity, could accelerate network security degradation if mining becomes unprofitable

- Legacy Codebase Vulnerabilities: Operating with older blockchain technology infrastructure may lack protections against modern attack vectors and security threats

VI. Conclusion and Action Recommendations

BELLS Investment Value Assessment

Bellscoin holds primarily historical and collectible value as an early cryptocurrency project created by Dogecoin's founder. However, from a fundamental investment perspective, BELLS presents significant challenges:

The extreme 87.63% year-over-year price decline, minimal market capitalization of $5.16 million, severe liquidity constraints, and apparent lack of active development create a high-risk environment. The project's current market positioning suggests it functions more as a historical artifact than as a functional cryptocurrency with development roadmap or utility expansion prospects.

BELLS Investment Recommendations

✅ Beginners: Avoid Bellscoin as a primary investment vehicle. Instead, focus on established cryptocurrencies with stronger fundamentals, greater liquidity, and active development teams. If interested in cryptocurrency history, limit exposure to negligible portfolio percentages (under 0.1%).

✅ Experienced Investors: Consider BELLS only as a small speculative allocation (0.5-2% maximum) within a diversified portfolio. Applicable only for those specifically interested in early cryptocurrency history research or collectors seeking cryptocurrency assets. Implement strict stop-loss orders and position sizing discipline.

✅ Institutional Investors: BELLS is unsuitable for institutional portfolio allocation due to insufficient market capitalization, liquidity, and regulatory clarity. The minimal trading volume and market cap preclude meaningful institutional positions without causing significant market impact.

BELLS Trading Participation Methods

- Direct Spot Trading on Gate.com: Purchase BELLS directly through Gate.com's spot trading markets during trading hours, with careful attention to liquidity constraints and wide bid-ask spreads

- Limit Order Strategy: Use limit orders rather than market orders to avoid excessive slippage given low trading volume

- Self-Custodial Management: Transfer purchased BELLS from exchange to Gate Web3 wallet for secure, non-custodial storage following transaction completion

Risk Disclosure: Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and comprehensive financial analysis. Consult professional financial advisors before investing. Never invest capital exceeding amounts you can afford to lose completely.

FAQ

What is the Bella Protocol price prediction for 2025?

Bella Protocol is expected to reach a maximum price of $0.87951 in October 2025, with a minimum of $0.746034 based on current market analysis.

What factors influence BELLS token price movements?

BELLS token price is driven by supply and demand dynamics, market sentiment, cryptocurrency market trends, trading volume, and fundamental developments in the project ecosystem.

What is the historical price performance of BELLS?

BELLS ranged from $0.08384 to $0.08533 in the last 24 hours and $0.08014 to $0.08967 over the past week. Its all-time high was $3.74 on December 20, 2023, representing significant market volatility.

Is BELLS a good investment for 2024-2025?

BELLS shows strong potential for 2024-2025, with price predictions reaching $0.091793 by 2025. Growing adoption and increasing trading volume suggest positive momentum. However, cryptocurrency investments carry inherent volatility risks.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?