2025 BENQI Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: BENQI's Market Position and Investment Value

BENQI (QI) as a decentralized non-custodial liquidity market protocol on Avalanche, has since its launch in 2021 established itself as a key player in the DeFi ecosystem. As of December 2025, BENQI's market capitalization stands at approximately $22.54 million, with a circulating supply of 7.2 billion QI tokens, currently trading at $0.003131 per token. This innovative protocol, recognized as a "yield-generating DeFi infrastructure," continues to play an increasingly critical role in expanding decentralized finance through its lending markets and liquid staking solutions on the Avalanche C-chain.

This article will comprehensively analyze BENQI's price trajectories and market dynamics, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for navigating the cryptocurrency market.

BENQI Price Analysis Report

I. BENQI Price History Review and Market Status

BENQI Historical Price Trajectory

- August 2021: Project launch with initial price of $0.01, reaching all-time high (ATH) of $0.39417 on August 24, 2021, representing a 3,841% gain from launch price.

- 2021-2025: Significant price decline, with the token experiencing substantial bearish pressure over the four-year period.

- December 2025: Token reached new all-time low (ATL) of $0.00299356 on December 19, 2025, representing an 81.47% decline over the past year.

BENQI Current Market Status

As of December 20, 2025, BENQI is trading at $0.003131, reflecting minimal recovery of +3.12% over the past 24 hours from the recent low. The token demonstrates limited short-term volatility, with the 1-hour change at -0.16% and a 7-day decline of -12.82%.

Key Market Metrics:

- Current Price: $0.003131

- 24-Hour Range: $0.003039 - $0.003174

- Market Capitalization: $22,543,200

- Fully Diluted Valuation: $22,543,200 (100% circulating supply ratio)

- Circulating Supply: 7,200,000,000 QI tokens

- Maximum Supply: 7,200,000,000 QI tokens

- 24-Hour Trading Volume: $18,939.34

- Market Ranking: #817

- Market Dominance: 0.00070%

- Active Holders: 38,034

Price Performance:

- 1-Hour: -0.16%

- 24-Hour: +3.12%

- 7-Day: -12.82%

- 30-Day: -19.68%

- 1-Year: -81.47%

The token has declined significantly from its historical high of $0.39417 to current levels, representing a 99.21% loss from peak valuation. With moderate 24-hour trading volume relative to market cap, liquidity conditions remain constrained.

Click to view current BENQI market price

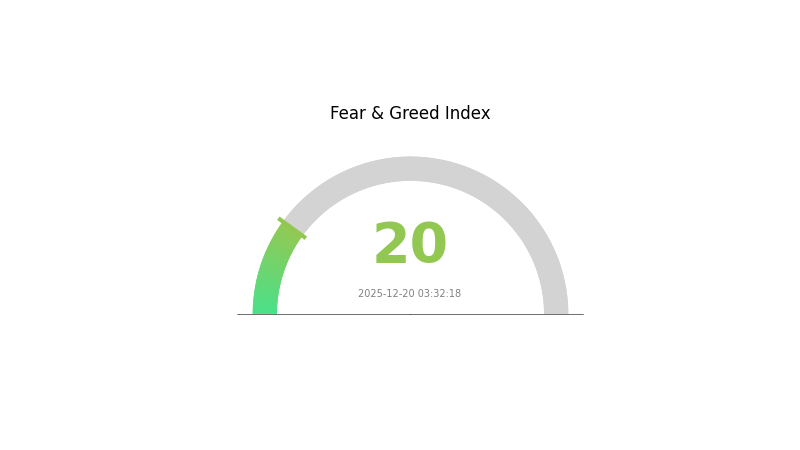

BENQI Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This indicates significant market pessimism and heightened risk aversion among investors. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. Market volatility tends to be elevated during these periods, creating both risks and potential entry points. Investors should exercise caution while monitoring market fundamentals. Consider using Gate.com's market analysis tools to track sentiment shifts and make informed trading decisions during this phase of market uncertainty.

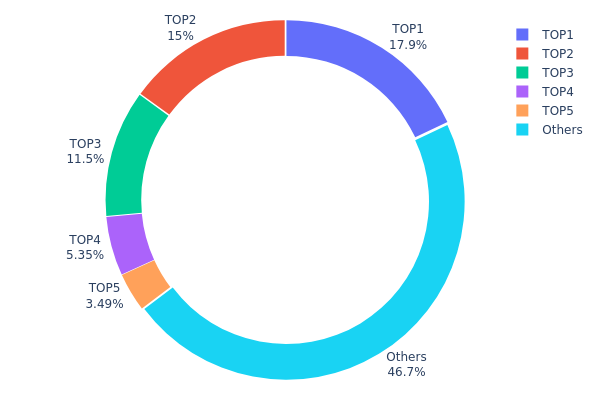

BENQI Holdings Distribution

The address holdings distribution illustrates the concentration of token ownership across the top wallet addresses within the BENQI ecosystem. This metric serves as a critical indicator for assessing decentralization levels, market structure stability, and the potential for coordinated price movements or market manipulation. By analyzing how token supply is distributed among holders, stakeholders can evaluate whether the network maintains a healthy degree of decentralization or faces concentration risks that may undermine market integrity and governance resilience.

BENQI's current holdings distribution reveals moderate concentration characteristics, with the top five addresses collectively controlling approximately 53.23% of the total token supply. The largest holder accounts for 17.94% of circulating tokens, while the second and third largest holders maintain positions of 15.00% and 11.47% respectively. This three-tier concentration pattern suggests that while significant token accumulation exists among leading addresses, the distribution does not exhibit extreme centralization. The remaining 46.77% of tokens dispersed across other addresses provides a meaningful counterbalance, indicating that no single entity possesses absolute control over the network's governance or economic parameters.

The current distribution architecture presents moderate implications for market dynamics and protocol sustainability. The presence of substantial holdings among top addresses creates potential catalysts for price volatility should these stakeholders execute large liquidation or acquisition orders. However, the substantial proportion of tokens held by dispersed addresses (46.77%) suggests sufficient liquidity distribution to absorb moderate market movements. This configuration indicates that while BENQI maintains reasonable decentralization characteristics, ongoing monitoring of top holder behavior and token migration patterns remains essential for assessing long-term governance robustness and market structure stability.

Click to view current BENQI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x142e...fe7fc2 | 1291841.50K | 17.94% |

| 2 | 0x9d6e...58a7b7 | 1080000.00K | 15.00% |

| 3 | 0x4aef...a013e8 | 826395.48K | 11.47% |

| 4 | 0x5a52...70efcb | 385000.00K | 5.34% |

| 5 | 0xeefb...8604cb | 251204.64K | 3.48% |

| - | Others | 3365558.38K | 46.77% |

II. Core Factors Affecting BENQI's Future Price

Technology Development and Ecosystem Building

- DeFi Ecosystem Expansion on Avalanche: The continuous expansion and maturation of the DeFi ecosystem on the Avalanche network will directly impact BENQI's subsequent price movements. As more DeFi protocols and applications are developed within the Avalanche ecosystem, BENQI's utility and adoption potential are expected to increase, potentially driving positive price momentum.

Macroeconomic Environment

-

Monetary Policy Impact: BENQI is subject to broader cryptocurrency market cycles and central bank policy decisions. Changes in monetary policy by major central banks can significantly influence overall crypto market sentiment and investment flows into DeFi protocols like BENQI.

-

Inflation Hedging Characteristics: Given BENQI's relatively recent history in the market, its ability to serve as an inflation hedge remains difficult to assess comprehensively at this stage.

-

Geopolitical Factors: Global geopolitical developments can indirectly affect crypto market dynamics and investor sentiment toward DeFi assets like BENQI through broader macroeconomic impacts.

Market Dynamics and Sentiment

-

Supply and Demand Dynamics: Token supply fluctuations and market demand directly influence BENQI's price trajectory and trading patterns.

-

Market Sentiment and Regulatory Environment: Price movements are driven by market sentiment influenced by news, social media discussions, and investor confidence levels. Additionally, regulatory developments and policy changes can significantly impact investor perception and investment decisions regarding BENQI.

III. 2025-2030 BENQI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00201-$0.00313

- Neutral Forecast: $0.00313

- Bullish Forecast: $0.00392 (requires sustained demand and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing institutional adoption of Avalanche ecosystem solutions

- Price Range Forecast:

- 2026: $0.00293-$0.00395

- 2027: $0.00217-$0.00434

- 2028: $0.00250-$0.00561

- Key Catalysts: Expansion of BENQI's lending and borrowing protocols, growth in Avalanche DeFi ecosystem adoption, increased liquidity provision on Gate.com and other major platforms, regulatory clarity for decentralized finance products

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00275-$0.00632 (assumes steady ecosystem growth and moderate market expansion)

- Bullish Case Scenario: $0.00535-$0.00774 (assumes accelerated DeFi adoption and successful protocol upgrades)

- Transformative Scenario: $0.00774+ (assumes breakthrough in cross-chain interoperability and mainstream financial institution participation in Avalanche ecosystem)

- 2030-12-20: BENQI approaching $0.00774 (reflects strong cumulative growth trajectory with 77% upside from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00392 | 0.00313 | 0.00201 | 0 |

| 2026 | 0.00395 | 0.00353 | 0.00293 | 12 |

| 2027 | 0.00434 | 0.00374 | 0.00217 | 19 |

| 2028 | 0.00561 | 0.00404 | 0.0025 | 28 |

| 2029 | 0.00632 | 0.00482 | 0.00275 | 54 |

| 2030 | 0.00774 | 0.00557 | 0.00535 | 77 |

BENQI Professional Investment Strategy and Risk Management Report

IV. BENQI Professional Investment Strategy and Risk Management

BENQI Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: DeFi protocol believers, yield-seeking investors, and risk-averse long-term holders

- Operational Recommendations:

- Accumulate BENQI tokens during market downturns when prices are significantly below historical averages, focusing on dollar-cost averaging (DCA) to reduce timing risk

- Participate in liquidity mining and staking rewards programs to generate additional yield on holdings while waiting for potential price appreciation

- Monitor Liquid Staking product development on Avalanche C-chain, as institutional adoption could drive future value growth

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor support and resistance levels based on 24-hour trading ranges (current range: $0.003039 to $0.003174)

- Track volume patterns to identify potential breakout opportunities above recent highs

- Wave Trading Considerations:

- Consider 7-day and 30-day price trends for medium-term positioning (noting current 7D: -12.82%, 30D: -19.68%)

- Establish profit targets and stop-loss orders at technical levels to manage downside risk in volatile markets

BENQI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of portfolio allocation

- Active Investors: 5-10% of portfolio allocation

- Professional/Institutional Investors: 10-15% of portfolio allocation with hedging strategies

(2) Risk Mitigation Strategies

- Portfolio Diversification: Combine BENQI holdings with established blue-chip cryptocurrencies to reduce concentration risk

- Gradual Position Building: Avoid large single purchases; spread acquisitions across multiple time periods to improve average entry prices

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for active trading and frequent transactions with DeFi protocols

- Self-Custody Approach: Store majority holdings in secure self-custody solutions for long-term positions

- Security Best Practices: Enable all available security features, use strong passwords, maintain backup seed phrases in secure offline locations, and never share private keys with third parties

V. BENQI Potential Risks and Challenges

Market Risks

- Extreme Historical Drawdown: BENQI has declined 81.47% over the past year and fallen from an all-time high of $0.39417 (August 24, 2021) to current levels, indicating significant market risk and potential further downside

- Low Trading Volume and Liquidity: With 24-hour volume of only $18,939.34 and market cap of $22.54 million, the token shows low liquidity which increases slippage risk and price volatility

- Avalanche Ecosystem Dependency: Protocol performance is heavily tied to Avalanche chain adoption; any decline in AVAX ecosystem activity could negatively impact BENQI's usage and value

Regulatory Risks

- DeFi Protocol Regulatory Uncertainty: Decentralized lending protocols face evolving regulatory scrutiny across multiple jurisdictions, potentially impacting protocol operations or token utility

- Staking and Yield Program Compliance: Regulatory classification of yield-generating activities as securities in certain jurisdictions could restrict BENQI's ability to offer current incentive programs

- Cross-border Usage Restrictions: Certain jurisdictions may restrict access to BENQI's lending and staking features, limiting market expansion opportunities

Technical Risks

- Smart Contract Vulnerability: As a DeFi protocol, BENQI faces inherent smart contract risks including potential security vulnerabilities, exploits, or unforeseen technical issues

- Protocol Scalability Challenges: Managing growing transaction volume and user bases while maintaining security and efficiency could present technical hurdles

- Liquid Staking Implementation Risk: The in-development Liquid Staking product introduces new technical complexity and potential failure modes that could impact protocol stability

VI. Conclusion and Action Recommendations

BENQI Investment Value Assessment

BENQI operates as a decentralized liquidity market protocol on Avalanche with meaningful DeFi functionality including lending markets and upcoming Liquid Staking capabilities. However, the token faces significant headwinds: it has experienced an 81.47% decline over the past year, trades at historical lows with minimal liquidity, and operates in an uncertain regulatory environment. The project's long-term value depends on successful Liquid Staking deployment, increased Avalanche ecosystem adoption, and sustainable governance participation. Current valuations may present opportunistic entry points for high-risk-tolerance investors with multi-year investment horizons, but the token remains highly speculative.

BENQI Investment Recommendations

✅ Beginners: Consider minimal allocation (1-2% of crypto portfolio) only after understanding DeFi mechanics and Avalanche ecosystem; prioritize learning about protocol risks before participating in lending or staking

✅ Experienced Investors: Evaluate 5-10% allocation as a tactical position with 12-24 month holding horizon; actively participate in governance to influence protocol direction and potentially monetize governance participation

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, regulatory status, and Liquid Staking product roadmap before consideration; structure positions with appropriate hedging mechanisms and diversification

BENQI Trading and Participation Methods

- Gate.com Spot Trading: Buy and sell BENQI directly through Gate.com's spot market for immediate exposure

- Lending Protocol Participation: Provide liquidity to BENQI lending markets to generate passive yield on digital assets

- Governance and Staking: Participate in protocol governance by holding QI tokens and potentially stake tokens in security modules for protocol rewards

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their risk tolerance and financial situation. Consult professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is benqi crypto?

Benqi is a decentralized money market built on the Avalanche network enabling permissionless lending and borrowing. Users can deposit assets to earn yields or borrow against collateral, creating liquidity opportunities in the DeFi ecosystem.

How high will BenQi go?

BenQi price potential depends on market adoption and DeFi ecosystem growth. Analysts suggest potential upside if governance participation increases and platform utility expands. Long-term targets range from current levels to multiples higher based on bullish scenarios.

What factors affect BENQI token price?

BENQI token price is influenced by supply and demand dynamics, market sentiment, cryptocurrency market trends, DeFi platform adoption, liquidity conditions, and overall blockchain ecosystem development.

What is BENQI's market cap and trading volume?

BENQI's market cap is $53.18 million with a circulating supply of 7.20 billion tokens. The 24-hour trading volume data is currently unavailable. Market metrics fluctuate based on market conditions and investor activity.

Is BENQI a good investment for 2025?

BENQI shows promising long-term potential with projected growth trajectory. Its fundamental utility in the Avalanche ecosystem and growing adoption make it an attractive option for 2025. Strong market positioning suggests positive investment prospects for the year.

Is Haedal Protocol (HAEDAL) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

Is Renzo (REZ) a Good Investment?: Analyzing the Growth Potential and Risks of This Emerging Cryptocurrency

Is Stader Labs (SD) a good investment?: A Comprehensive Analysis of Staking Returns, Tokenomics, and Market Potential in 2024

2025 SD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 KERNEL Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Is KernelDao (KERNEL) a good investment?: A Comprehensive Analysis of Token Value, Market Potential, and Risk Factors

Exploring Governance in Decentralized Autonomous Organizations (DAOs)

Explore Castle Age: Your Ultimate Web3 Gaming Adventure Guide

Innovative Blockchain Security and Monitoring Tools for Web3

Crypto Market Update: XRP Climbs Amid Bitcoin's Recovery

Understanding NFTs: A Comprehensive Guide in German Language