2025 BOB Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

Introduction: BOB's Market Position and Investment Value

BOB (BOB) is positioning itself as the Gateway to Bitcoin DeFi, unlocking real utility for the world's most important asset by fusing Bitcoin's unmatched security with Ethereum's versatility. Since its launch in November 2025, BOB has established itself as the premier destination for Bitcoin liquidity, applications, and institutional capital. As of December 20, 2025, BOB's fully diluted valuation stands at $128.14 million, with a circulating supply of 2.22 billion tokens and a current price of $0.012814. This innovative asset, recognized for its hybrid chain architecture combining zero-knowledge proofs with BTC staking, is playing an increasingly critical role in bridging Bitcoin to decentralized finance across 11+ blockchain networks.

This article will comprehensively analyze BOB's price trajectory from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

BOB Market Analysis Report

I. BOB Price History Review and Current Market Status

BOB Historical Price Movement Trajectory

Based on available data as of December 20, 2025, BOB has demonstrated significant price volatility since its launch:

- November 20, 2025: BOB reached its all-time low of $0.00802, marking a critical support level in the token's early trading history.

- December 4, 2025: BOB achieved its all-time high of $0.0295, representing approximately 268% appreciation from its floor price within just two weeks.

- December 20, 2025: Token price corrected to $0.012814, indicating a substantial pullback of approximately 56.6% from the all-time high.

BOB Current Market Sentiment

As of December 20, 2025 at 00:27:54 UTC, BOB presents the following market metrics:

Price Performance:

- Current Price: $0.012814

- 1-Hour Change: -1.45%

- 24-Hour Change: -0.52%

- 7-Day Change: -16.66%

Market Capitalization and Supply Metrics:

- Current Market Cap: $28,447,080

- Fully Diluted Valuation: $128,140,000

- Market Cap to FDV Ratio: 22.2%

- Circulating Supply: 2,220,000,000 BOB (22.2% of max supply)

- Total Supply: 10,000,000,000 BOB

- Market Dominance: 0.0040%

Trading Activity:

- 24-Hour Trading Volume: $382,562.11

- High (24H): $0.014248

- Low (24H): $0.012166

- Market Ranking: #721

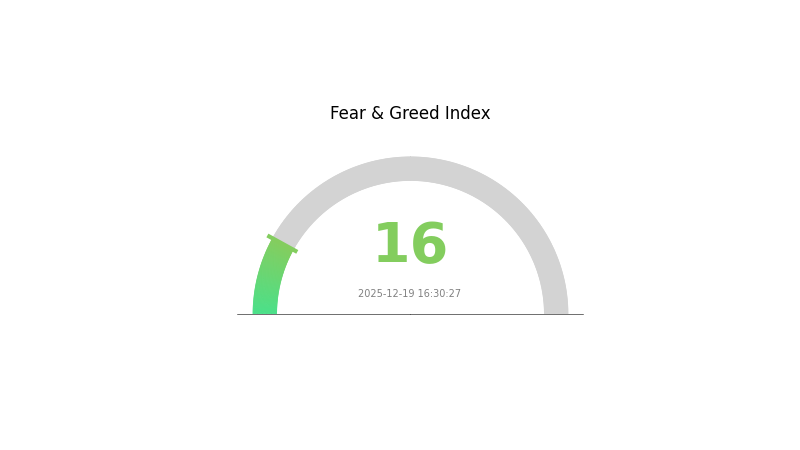

Market Sentiment: The current fear and greed index indicates "Extreme Fear" conditions, reflecting cautious market sentiment as of December 19, 2025.

View current BOB market price

BOB Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The market is experiencing extreme fear, with the index plummeting to 16. This exceptional low reading signals significant investor pessimism and heightened market uncertainty. Such extreme fear often presents contrarian opportunities for long-term investors, as markets typically recover from panic-driven sell-offs. However, caution remains advisable until clearer market direction emerges. Monitor key support levels and maintain risk management strategies during this volatile period.

BOB Holdings Distribution

Unable to provide a comprehensive analysis of BOB's address holdings distribution at this time. The data table provided appears to be empty, with no specific address information, holding quantities, or percentage allocations available for evaluation.

To conduct a thorough assessment of BOB's concentration characteristics, market structure implications, and decentralization metrics, the following data elements would be required: individual wallet addresses, their respective token quantities, and corresponding ownership percentages. This information is essential for evaluating whether holdings are excessively concentrated among top holders, assessing the potential for market manipulation, and determining the overall stability of the token's on-chain structure.

Once comprehensive holdings data is made available, analysis can address key factors such as Gini coefficient measurements, the distribution spread across top 10, top 100, and broader holder segments, and the comparison of concentration levels against industry benchmarks for similar blockchain assets.

Click to view current BOB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting BOB's Future Price

Supply Mechanism

- Fixed Supply Model: BOB operates with a fixed total supply, which establishes scarcity as a long-term price support mechanism. This structural design ensures that supply remains constant regardless of market demand fluctuations.

- Historical Pattern: Cryptocurrencies with fixed supply typically experience price appreciation as demand grows, particularly when adoption and utility expand within their respective ecosystems.

- Current Impact: The scarcity-driven model positions BOB to benefit from increased adoption in Bitcoin DeFi applications and multi-chain use cases, as constrained supply meets potentially rising demand.

Technology Development and Ecosystem Building

- Bitcoin DeFi Portal: BOB functions as a Bitcoin DeFi gateway designed to channel Bitcoin liquidity toward DeFi protocols, applications, and institutional users.

- Hybrid Chain Architecture: BOB implements a hybrid chain model utilizing Zero-Knowledge (ZK) proofs combined with BTC staking mechanisms, enhancing both security and capital efficiency.

- Core Value Proposition: The platform's central thesis posits that Bitcoin liquidity will increasingly flow toward DeFi and multi-chain applications. As global crypto adoption expands and Bitcoin maintains its position as the leading value storage asset, the secure mobilization of BTC capital into these ecosystems becomes increasingly valuable.

Macroeconomic Environment

- Bitcoin Market Dynamics: BOB's price trajectory remains intrinsically tied to Bitcoin's market position and performance. The protocol's success depends on Bitcoin maintaining its status as the leading cryptocurrency and value store within the broader digital asset ecosystem.

- Market Volatility: Recent price action demonstrates daily volatility ranges of approximately ±15%, reflecting the nascent and dynamic nature of BOB's trading markets.

III. BOB Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.01058 - $0.01275

- Base Case Forecast: $0.01275

- Optimistic Forecast: $0.01746 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual upward trajectory as market conditions stabilize and adoption metrics improve.

- Price Range Forecast:

- 2026: $0.00982 - $0.01707 (potential 17% upside)

- 2027: $0.01014 - $0.01995 (potential 25% upside)

- Key Catalysts: Ecosystem expansion, increased institutional interest, platform integration milestones, and macroeconomic stabilization supporting risk assets.

2028-2030 Long-term Outlook

- Base Case: $0.01153 - $0.02378 by 2028 (40% potential appreciation); progression to $0.0227 - $0.0278 by 2030 (99% cumulative gain from 2025 lows) assumes steady adoption and market normalization.

- Optimistic Scenario: $0.0301 by 2029 (63% gain) driven by accelerated platform adoption, successful ecosystem partnerships, and broader cryptocurrency market recovery.

- Transformational Scenario: $0.0301 - $0.0278+ range extension (extreme favorable conditions) contingent upon major technological breakthroughs, mainstream institutional adoption acceleration, or significant macroeconomic policy shifts favoring digital assets.

- 2030-12-20: BOB potential target range $0.0227 - $0.0278 (stabilization phase with compound growth realized).

Note: All price forecasts are speculative projections based on historical data analysis. Actual market performance may vary significantly based on regulatory environment, technological development, and broader market conditions. Investors should conduct independent research via Gate.com and other authorized platforms before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01746 | 0.01275 | 0.01058 | 0 |

| 2026 | 0.01707 | 0.01511 | 0.00982 | 17 |

| 2027 | 0.01995 | 0.01609 | 0.01014 | 25 |

| 2028 | 0.02378 | 0.01802 | 0.01153 | 40 |

| 2029 | 0.0301 | 0.0209 | 0.0138 | 63 |

| 2030 | 0.0278 | 0.0255 | 0.0227 | 99 |

BOB Token Professional Investment Report

I. Project Overview

Project Introduction

BOB is building the Gateway to Bitcoin DeFi, unlocking real utility for the world's most important asset. By fusing Bitcoin's unmatched security with Ethereum's versatility, BOB creates the premier destination for Bitcoin liquidity, applications, and institutions. BOB's hybrid chain uniquely combines ZK proofs and BTC staking to create native bridges to both Ethereum and Bitcoin (BitVM). BOB's multichain gateway lets users swap Bitcoin into any asset or deposit directly into DeFi across 11+ chains, powered by BTC intents.

Core Technical Architecture

- Hybrid Chain Design: Combines zero-knowledge proofs with BTC staking mechanisms

- Native Bridges: Establishes connections to both Ethereum and Bitcoin (BitVM) ecosystems

- Multichain Gateway: Enables Bitcoin swaps across 11+ blockchain networks

- Intent-Driven Protocol: Utilizes BTC intents for automated asset management

II. Market Performance Analysis

Current Market Data (As of December 20, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.012814 |

| Market Cap | $28,447,080 |

| Fully Diluted Valuation | $128,140,000 |

| 24-Hour Volume | $382,562.11 |

| Market Ranking | #721 |

| Circulating Supply | 2,220,000,000 BOB |

| Total Supply | 10,000,000,000 BOB |

| Circulation Ratio | 22.2% |

Price Trends

| Time Period | Change | Absolute Change |

|---|---|---|

| 1 Hour | -1.45% | -$0.000188536 |

| 24 Hours | -0.52% | -$0.000066981 |

| 7 Days | -16.66% | -$0.002561570 |

| 30 Days | 0% | $0.000000000 |

| 1 Year | 0% | $0.000000000 |

Historical Price Range

- All-Time High: $0.0295 (December 4, 2025)

- All-Time Low: $0.00802 (November 20, 2025)

- 24-Hour High: $0.014248

- 24-Hour Low: $0.012166

- Price Range Span: -72.8% from ATH

III. Fundamental Analysis

Project Strengths

- Bitcoin Integration Focus: Addresses the critical gap of unlocking DeFi utility on Bitcoin, the world's most important asset

- Innovative Hybrid Architecture: Combines zero-knowledge proofs with Bitcoin staking for enhanced security and interoperability

- Cross-Chain Capabilities: Enables seamless movement of Bitcoin across 11+ blockchain networks without intermediaries

- Institutional Appeal: Designed to attract institutional capital through institutional-grade security and liquidity

- Technology Stack: Leverages both BitVM and Ethereum compatibility for maximum flexibility

Market Positioning

- Market cap represents 0.0040% of total crypto market

- Circulating supply utilization at 22.2% indicates significant expansion potential

- Young project timeline (published September 2024) with rapid market acceptance

- Limited exchange presence (1 exchange listed) suggests early-stage distribution

IV. BOB Professional Investment Strategy and Risk Management

BOB Investment Methodology

(1) Long-term Holding Strategy

Given BOB's nascent stage and Bitcoin DeFi infrastructure positioning, long-term holders believe in the protocol's potential to capture value as Bitcoin DeFi adoption accelerates.

Considerations for Strategic Holders:

- Accumulation opportunities during pullbacks align with protocol development milestones

- Staking potential through BTC-backed mechanisms could provide yield generation

- Portfolio allocation as infrastructure play requires conviction in Bitcoin DeFi thesis

(2) Active Trading Strategy

For experienced traders monitoring BOB's price action:

Technical Analysis Focus:

- Volatility observation: 7-day decline of -16.66% indicates significant momentum shifts

- Support/Resistance levels: Track interactions with $0.012166 (24h low) and $0.014248 (24h high)

- Volume analysis: Monitor 24-hour trading volume of $382,562 for breakout confirmation

Trading Considerations:

- Early-stage volatility presents both opportunities and risks

- Limited liquidity relative to market cap suggests wide bid-ask spreads

- Project development announcements could trigger significant repricing

BOB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% portfolio allocation (speculative position sizing)

- Active Investors: 1-3% portfolio allocation (conviction-based sizing)

- Specialized Investors: 3-5% portfolio allocation (infrastructure specialist positioning)

(2) Risk Mitigation Approaches

- Dollar-Cost Averaging: Accumulate positions over time rather than lump-sum entry to reduce timing risk

- Profit-Taking Protocol: Establish exit targets at key resistance levels to secure gains during volatile moves

- Diversification: Balance BOB exposure with other Bitcoin infrastructure and broader DeFi positions

(3) Security Storage Recommendations

When storing BOB tokens:

- Best Practice: Use Gate.com's secure trading platform for active management and trading

- Self-Custody Consideration: For long-term holdings, institutional-grade security practices are essential

- Security Best Practices:

- Enable multi-factor authentication on exchange accounts

- Maintain private key security protocols if using self-custody

- Avoid sharing seed phrases or private keys

- Verify contract addresses before transfers

V. Potential Risks and Challenges

Market Risks

- High Volatility: 16.66% 7-day decline demonstrates significant price instability typical of early-stage protocols

- Limited Liquidity: Single exchange listing creates potential liquidity constraints and slippage concerns

- Market Adoption Uncertainty: Bitcoin DeFi adoption rates remain unproven compared to established Ethereum DeFi

Regulatory Risks

- Bitcoin Integration Scrutiny: Regulatory authorities may scrutinize protocols bridging Bitcoin to other chains

- Cross-Chain Bridge Regulation: Multichain operations face uncertain regulatory frameworks across jurisdictions

- Institutional Compliance: Evolution of institutional custody and staking regulations could impact growth trajectory

Technical Risks

- Zero-Knowledge Proof Security: Novel ZK implementations require ongoing auditing and verification

- BitVM Dependency: Reliance on emerging BitVM infrastructure creates execution risk

- Bridge Security: Cross-chain bridge protocols present attack surfaces requiring robust security measures

VI. Conclusion and Action Recommendations

BOB Investment Value Assessment

BOB represents a high-risk, high-potential infrastructure play targeting the critical intersection of Bitcoin and decentralized finance. The protocol's innovative approach to combining Bitcoin's security with DeFi functionality addresses a significant market gap. However, early-stage development, limited liquidity, and unproven adoption rates create substantial uncertainty. Success depends on Bitcoin DeFi adoption acceleration, protocol security maintenance, and cross-chain reliability.

The project's positioning within the nascent Bitcoin Layer 2 ecosystem offers long-term structural appeal, but near-term volatility and market concentration risks warrant cautious positioning and strict risk management protocols.

BOB Investment Recommendations

✅ For Newcomers: Start with minimal allocation (0.5-1% of crypto holdings) through dollar-cost averaging. Focus on understanding the Bitcoin DeFi thesis before committing capital. Use limit orders on Gate.com to accumulate at predetermined price levels.

✅ For Experienced Investors: Evaluate BOB within broader Bitcoin infrastructure strategy. Consider position sizing based on personal conviction regarding Bitcoin DeFi adoption timelines. Monitor protocol governance developments and cross-chain bridge updates.

✅ For Institutional Participants: Conduct comprehensive technical and security audits before institutional allocation. Evaluate custody solutions and assess regulatory clarity across relevant jurisdictions.

BOB Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and holding through Gate.com's trading platform with real-time market pricing

- Limit Order Strategy: Set predetermined buy/sell prices to execute trades during specific volatility levels

- Portfolio Monitoring: Track BOB performance against Bitcoin and broader DeFi benchmarks using Gate.com's analytics tools

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should conduct thorough due diligence and make decisions aligned with personal risk tolerance. Consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose.

FAQ

Can bob coin reach $1?

Yes, BOB coin can potentially reach $1. With sufficient adoption, ecosystem growth, and increased demand, price appreciation to $1 is achievable. Success depends on project development, community expansion, and market conditions.

What is the future of Bob coin?

Bob coin is projected to reach a maximum price of $0.0000092 by 2030, with an upward trend expected. The future outlook appears optimistic based on current market analysis and development momentum.

Is bob a good crypto investment?

Bob offers strong potential for growth driven by its BNB ecosystem integration and active community support. With increasing adoption and development momentum, Bob presents attractive opportunities for investors seeking exposure to innovative blockchain projects.

GOAT Network (GOATED): Bitcoin ZK-Rollup With Native Yield

What Makes GOAT Network GOATED

How Active is the Bitcoin Layer 2 Ecosystem in 2025?

How Secure is Merlin Chain (MERL) Against Smart Contract Vulnerabilities and Attacks?

How Does Merlin Chain (MERL) Innovate as a Bitcoin Layer 2 Solution?

What Factors Are Driving Cryptocurrency Price Volatility in 2025?

Earn Passive Income with Cryptocurrency Referral Programs

零知識證明技術在加密貨幣中的創新應用

Core DAO Token Price Forecast and Market Trends Exploration

Exploring Leading DeFi Solutions for 2025

Understanding Altcoin Season: Timing, Trends, and Impact