2025 BST Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BST's Market Position and Investment Value

Blocksquare (BST), as a leading blockchain-based real estate tokenization system, has made significant strides since its inception in 2018. As of 2025, Blocksquare's market capitalization has reached $3,253,616.93, with a circulating supply of approximately 46,613,423 tokens, and a price hovering around $0.0698. This asset, known as a "bridge to decentralized real estate finance," is playing an increasingly crucial role in revolutionizing the real estate investment landscape.

This article will provide a comprehensive analysis of Blocksquare's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BST Price History Review and Current Market Status

BST Historical Price Evolution

- 2024: BST reached its all-time high of $0.9842 on March 30, 2024, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with BST hitting its all-time low of $0.058 on April 11, 2025.

- 2025: As of October 13, 2025, BST has shown some recovery, trading at $0.0698, representing a 20.34% increase from its all-time low.

BST Current Market Situation

BST is currently trading at $0.0698, with a 24-hour trading volume of $32,919.77. The token has experienced a significant price increase of 9.96% in the last 24 hours, indicating positive short-term momentum. However, when looking at longer time frames, BST shows a negative trend with a 4.22% decrease over the past week and a substantial 23.91% decline over the last 30 days. The market capitalization stands at $3,253,616.93, ranking BST at 2037 in the overall cryptocurrency market. With a circulating supply of 46,613,423 BST tokens out of a total supply of 100,000,000, the current market dynamics reflect a mix of short-term gains and longer-term challenges for the Blocksquare project.

Click to view the current BST market price

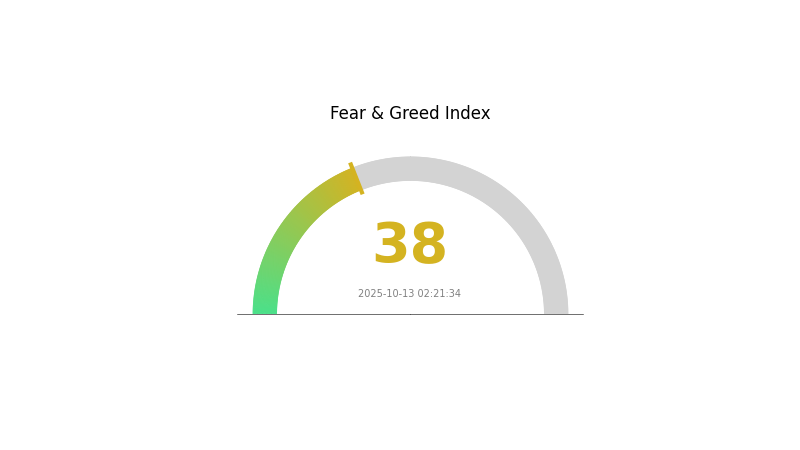

BST Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 38, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. During such periods, it's crucial to conduct thorough research and consider dollar-cost averaging strategies. Remember, market sentiment can shift rapidly, so stay informed and manage your risk wisely. Gate.com offers various tools to help navigate these market conditions effectively.

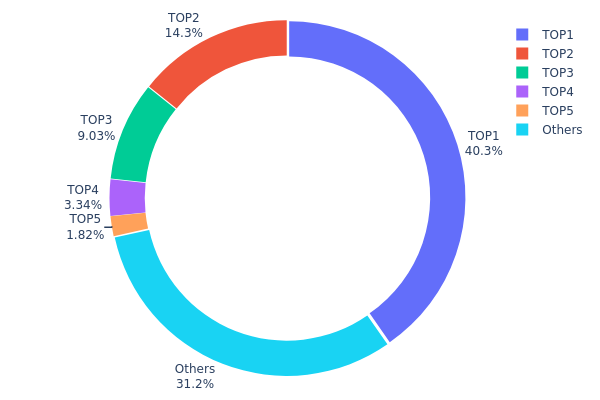

BST Holdings Distribution

The address holdings distribution data reveals a significant concentration of BST tokens among a few top addresses. The top address holds 40.33% of the total supply, with the top 5 addresses collectively controlling 68.76% of BST tokens. This high level of concentration raises concerns about potential market manipulation and volatility.

Such a concentrated distribution structure could lead to increased price fluctuations if large holders decide to sell or move their holdings. It also suggests a relatively low level of decentralization, which may impact the token's resilience to market shocks. The presence of a single address holding over 40% of the supply particularly stands out as a potential risk factor for market stability.

While the remaining 31.24% distributed among other addresses provides some balance, the overall structure indicates a need for careful monitoring of major holder activities. This concentration could affect market dynamics and may influence investor confidence in BST's long-term prospects.

Click to view the current BST Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6f1e...9f7f8a | 25419.11K | 40.33% |

| 2 | 0x9642...2f5d4e | 8993.11K | 14.27% |

| 3 | 0x0e85...df51a6 | 5688.96K | 9.02% |

| 4 | 0x1802...48daec | 2102.57K | 3.33% |

| 5 | 0x57ba...ecc73e | 1144.79K | 1.81% |

| - | Others | 19671.88K | 31.24% |

II. Key Factors Influencing BST's Future Price

Supply Mechanism

- Halving: The halving event reduces the new supply of Bitcoin by half every four years, potentially boosting its price.

- Historical Pattern: Previous halvings have led to significant price increases in the following years.

- Current Impact: The most recent halving in 2024 has decreased the block reward to 3.125 BTC, slowing the annual supply growth to 1.1%.

Institutional and Whale Dynamics

- Institutional Holdings: The approval of spot Bitcoin ETFs in January 2024 has led to increased institutional investment in Bitcoin.

- Corporate Adoption: More companies are integrating Bitcoin into their operations and balance sheets.

- National Policies: Some countries are considering or have already adopted Bitcoin as a reserve asset, potentially impacting its global demand.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, can affect Bitcoin's price through their influence on global liquidity.

- Inflation Hedging Properties: Bitcoin is increasingly viewed as a hedge against inflation, particularly in times of economic uncertainty.

- Geopolitical Factors: Global political tensions and economic instability can drive investors towards Bitcoin as a safe-haven asset.

Technological Development and Ecosystem Building

- Lightning Network: The continued development of the Lightning Network is improving Bitcoin's scalability and transaction speed.

- Taproot Upgrade: This upgrade enhances Bitcoin's privacy and smart contract capabilities.

- Ecosystem Applications: The growth of DeFi platforms integrating Bitcoin and the development of Bitcoin-based NFTs (Ordinals) are expanding its utility.

III. BST Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.06535 - $0.07027

- Neutral estimate: $0.07027 - $0.08362

- Optimistic estimate: $0.08362 - $0.09697 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Potential growth phase with fluctuations

- Price range forecast:

- 2026: $0.05352 - $0.10954

- 2027: $0.06664 - $0.10238

- 2028: $0.05471 - $0.12236

- Key catalysts: Increased adoption, technological improvements, and market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.10427 - $0.127 (assuming steady market growth)

- Optimistic scenario: $0.127 - $0.14309 (with strong adoption and market performance)

- Transformative scenario: $0.14309 - $0.15875 (with exceptional market conditions and widespread adoption)

- 2030-12-31: BST $0.15875 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09697 | 0.07027 | 0.06535 | 0 |

| 2026 | 0.10954 | 0.08362 | 0.05352 | 19 |

| 2027 | 0.10238 | 0.09658 | 0.06664 | 38 |

| 2028 | 0.12236 | 0.09948 | 0.05471 | 42 |

| 2029 | 0.14309 | 0.11092 | 0.10427 | 58 |

| 2030 | 0.15875 | 0.127 | 0.07239 | 81 |

IV. Professional Investment Strategies and Risk Management for BST

BST Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in real estate tokenization

- Operation suggestions:

- Accumulate BST during market dips

- Monitor Blocksquare's project developments and partnerships

- Store BST in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage downside risk

- Take profits at predetermined levels

BST Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple RWA tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BST

BST Market Risks

- Volatility: BST may experience significant price fluctuations

- Liquidity: Limited trading volume may affect entry/exit positions

- Correlation: Performance may be tied to broader real estate market trends

BST Regulatory Risks

- Regulatory uncertainty: Changing regulations may impact tokenized real estate

- Compliance: Potential challenges in adhering to evolving legal frameworks

- Cross-border restrictions: Varying regulations across jurisdictions

BST Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Blockchain scalability: Ethereum network congestion may affect transactions

- Interoperability: Challenges in integrating with traditional real estate systems

VI. Conclusion and Action Recommendations

BST Investment Value Assessment

BST offers exposure to the growing tokenized real estate market, with potential long-term value. However, investors should be aware of short-term volatility and regulatory uncertainties.

BST Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about tokenized real estate ✅ Experienced investors: Consider BST as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate BST for potential real estate market exposure

BST Trading Participation Methods

- Spot trading: Buy and sell BST on Gate.com

- DeFi participation: Explore liquidity provision on Oceanpoint.fi

- Long-term holding: Accumulate BST for potential future real estate market growth

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is BST stock a good buy?

Based on current technical indicators, BST stock is not a good buy. Its RSI (14) of 76.50 suggests overbought conditions, indicating a potential sell signal.

What is the stock price prediction for Big Bear AI Holdings?

Based on current forecasts, Big Bear AI Holdings (BBAI) stock is expected to trade between $6.70 and $7.47 in 2025, with potential growth to $4.08-$7.38 by 2030.

What is the BT share price prediction for 2030?

Based on current market analysis, BT share price is predicted to reach an average of $6.5658 in 2030, with a potential high of $7.963.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction for 2025, with forecasts reaching $122,937. Chainlink follows with a significant increase to $59.67.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

ZERO vs CRO: A Comprehensive Comparison of Two Leading Blockchain Ecosystems

P00LS vs OP: A Comprehensive Comparison of Two Leading Blockchain Protocols

Top 7 Cloud Gaming Services

Sylwester Suszek: The Story of Poland's Cryptocurrency King

Comprehensive Guide to Private Keys in Cryptocurrency