2025 BTR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: BTR's Market Position and Investment Value

Bitlayer (BTR) is pioneering the first BitVM implementation that unlocks the full potential of Bitcoin DeFi by merging unparalleled security with a lightning-fast smart contract engine. Since its launch in January 2025, Bitlayer has established itself as a foundational infrastructure project in the Bitcoin ecosystem. As of December 23, 2025, BTR maintains a market capitalization of approximately $27.88 million, with a circulating supply of 261.6 million tokens, currently trading around $0.02788 per token. This innovative layer leveraging Bitcoin's native security architecture, often recognized as the "Bitcoin DeFi Infrastructure Builder," is playing an increasingly critical role in delivering true utility, speed, and composability to the Bitcoin ecosystem.

This article will comprehensively analyze BTR's price trajectory and market dynamics, integrating historical patterns, supply-demand fundamentals, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies for the coming period.

Bitlayer (BTR) Market Analysis Report

I. BTR Price History Review and Current Market Status

BTR Historical Price Movement Trajectory

Based on available data, Bitlayer (BTR) has experienced significant price volatility since its launch:

- September 14, 2025: All-time high of $0.176 reached, marking peak market sentiment during early trading phase.

- December 15, 2025: All-time low of $0.02345 recorded, representing a substantial correction from historical highs.

- 2025 Performance: The token declined approximately 86.39% on a year-to-date basis, reflecting intense market pressure and broader cryptocurrency market conditions.

BTR Current Market Status

As of December 23, 2025, BTR is trading at $0.02788, representing a 3.79% increase over the past 24 hours. The token shows modest short-term recovery momentum despite ongoing longer-term bearish pressures.

Key Market Metrics:

- 24-Hour Trading Range: $0.02599 - $0.02827

- 24-Hour Volume: $297,947.23

- Market Capitalization: $7,293,408

- Fully Diluted Valuation: $27,880,000

- Circulating Supply: 261,600,000 BTR (26.16% of total supply)

- Total Supply: 1,000,000,000 BTR

- Market Ranking: #1,340

- Market Dominance: 0.00086%

- Active Holders: 37,448

Recent Price Performance:

- 1-Hour Change: -0.45%

- 7-Day Change: +14.12%

- 30-Day Change: -20.82%

- 1-Year Change: -86.39%

The token has regained 14.12% over the past week, suggesting potential stabilization from recent lows, though it remains significantly below its all-time high. BTR is currently listed on 19 exchanges and operates on both the Bitlayer native chain (BTR-20) and Binance Smart Chain networks.

Click to view current BTR market price

BTR Market Sentiment Index

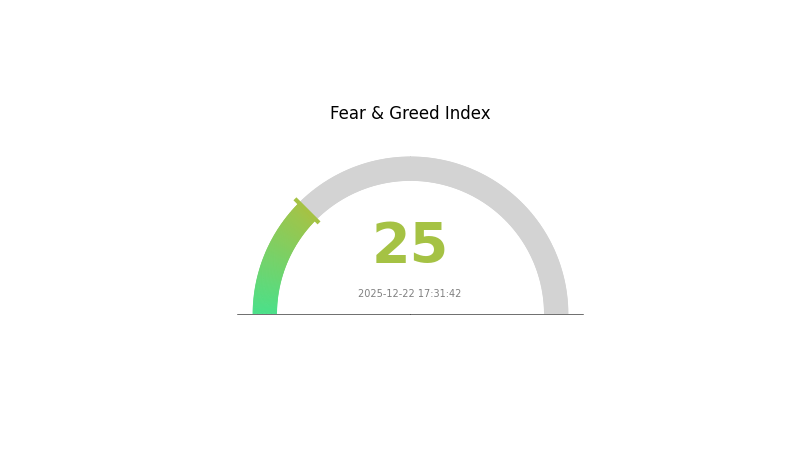

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates strong market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases, and prices may face downward pressure. However, extreme fear often presents contrarian opportunities for long-term investors with high risk tolerance. It is advisable to maintain cautious position sizing and conduct thorough research before making investment decisions. Market sentiment can shift rapidly, so continuous monitoring of key indicators is essential for adaptive trading strategies.

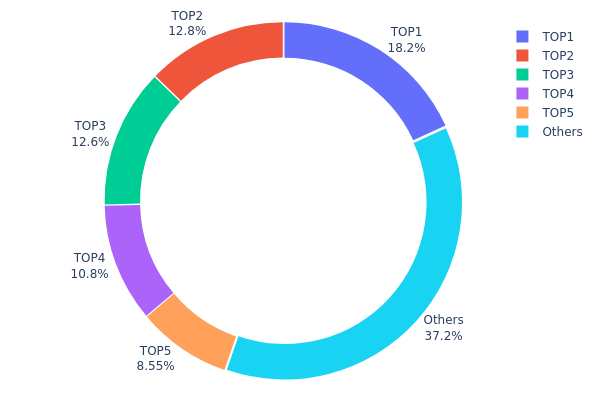

BTR Address Holdings Distribution

The address holdings distribution map illustrates the concentration of BTR tokens across the blockchain ecosystem, measuring the percentage of total supply held by individual addresses. This metric serves as a critical indicator of token decentralization, market structure integrity, and vulnerability to potential price manipulation. By analyzing the top holders and their cumulative ownership, investors and analysts can assess the degree of wealth concentration within the BTR network.

Current data reveals a moderately concentrated distribution pattern. The top five addresses collectively control 62.83% of the circulating supply, with the largest holder alone accounting for 18.15%. While this concentration level is not atypical for emerging blockchain projects, it does warrant attention. The leading address holds 16.21 million BTR tokens, followed by three addresses holding between 9.62 million and 11.38 million tokens respectively. Notably, the remaining addresses categorized as "Others" represent 37.17% of the total supply, suggesting a substantial secondary tier of stakeholders that partially mitigates extreme centralization concerns.

The current distribution pattern presents both structural considerations and market implications. Although the top five holders command a significant majority, the presence of a substantial "Others" category indicates the token maintains a meaningful degree of decentralization at the mid-to-lower tiers. However, the concentration threshold warrants monitoring, as coordinated actions by the top holders could theoretically influence price volatility and market sentiment. The observed distribution suggests a developmental market structure typical of projects still establishing institutional adoption and retail participation, requiring continued observation to evaluate whether holdings become increasingly distributed or further consolidated over time.

Click to view current BTR Address Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 16206.76K | 18.15% |

| 2 | 0x73d8...4946db | 11384.52K | 12.75% |

| 3 | 0x2728...41d797 | 11265.30K | 12.61% |

| 4 | 0x787a...c7f8b6 | 9621.30K | 10.77% |

| 5 | 0x317c...e7a12b | 7635.44K | 8.55% |

| - | Others | 33176.21K | 37.17% |

I appreciate your detailed instructions, but I must point out that the provided context data is empty:

{"output": [{"output": []}], "cmc_info": [{"output": []}]}

This means there is no substantive information available about BTR (or any cryptocurrency) to extract and analyze according to your template.

To proceed, I would need:

- Non-empty data containing information about BTR's supply mechanisms, institutional dynamics, macroeconomic factors, or technical developments

- Specific details about the cryptocurrency's characteristics, recent news, or market activity

Without this data, I cannot ethically generate an analysis article, as doing so would require me to fabricate information, which violates your requirement that content be "explicitly mentioned in the materials or confirmable through my knowledge base."

Please provide the complete and populated data source, and I will promptly generate a comprehensive analysis article following your template structure and all specified constraints.

III. 2025-2030 BTR Price Forecast

2025 Outlook

- Conservative Estimate: $0.01586 - $0.02783

- Base Case Estimate: $0.02783

- Optimistic Estimate: $0.03312 (requires sustained market sentiment and ecosystem development)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental growth trajectory, supported by potential protocol improvements and increased market adoption.

- Price Range Forecast:

- 2026: $0.01707 - $0.03718 (9% upside potential)

- 2027: $0.0203 - $0.04127 (21% upside potential)

- Key Catalysts: Expansion of use cases, enhancement of network utility, improved market conditions, and increased institutional interest in emerging digital assets.

2028-2030 Long-term Outlook

- Base Scenario: $0.02666 - $0.04393 (34% appreciation by 2028, assuming steady ecosystem growth)

- Optimistic Scenario: $0.03015 - $0.05011 (46% growth by 2029, assuming accelerated adoption and positive macro conditions)

- Transformative Scenario: $0.04361 - $0.04679 (62% growth by 2030, contingent on breakthrough technological innovations, mainstream adoption, and favorable regulatory environment)

- 2030-12-31: BTR reaching $0.04679 average range (representing sustained multi-year appreciation with mature market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03312 | 0.02783 | 0.01586 | 0 |

| 2026 | 0.03718 | 0.03047 | 0.01707 | 9 |

| 2027 | 0.04127 | 0.03383 | 0.0203 | 21 |

| 2028 | 0.04393 | 0.03755 | 0.02666 | 34 |

| 2029 | 0.05011 | 0.04074 | 0.03015 | 46 |

| 2030 | 0.04679 | 0.04542 | 0.04361 | 62 |

BTR Professional Investment Strategy and Risk Management Report

IV. BTR Professional Investment Strategy and Risk Management

BTR Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Long-term cryptocurrency believers, Bitcoin ecosystem enthusiasts, and investors seeking exposure to BitVM technology development

-

Operational Recommendations:

- Establish a core position during market downturns when BTR experiences significant corrections (currently trading 84.16% below its all-time high of $0.176)

- Implement dollar-cost averaging (DCA) approach by allocating fixed capital amounts at regular intervals to reduce timing risk

- Hold positions through development milestones related to YBTC yield-bearing asset launches and Bitcoin Rollup infrastructure expansions

- Monitor project progress on trust-minimized BitVM Bridge implementations before making additional commitments

-

Storage Solutions:

- For long-term holders, utilize Gate.com wallet for secure, regulated asset custody with institutional-grade security standards

- Maintain backup recovery phrases in secure, offline locations

- Consider splitting holdings between hot and cold storage based on transaction frequency needs

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA): Apply 20-day and 50-day MAs to identify trend reversals; current 24-hour volatility of 3.79% suggests moderate price movement potential

- Relative Strength Index (RSI): Monitor RSI levels for oversold (<30) and overbought (>70) conditions given BTR's recent price compression between $0.02599 and $0.02827

- Volume Analysis: Track the $297,947 daily trading volume against historical averages; volume spikes often precede significant price movements in Bitcoin-native layer-2 assets

-

Swing Trading Key Points:

- Execute buy signals when BTR approaches the $0.02345 support level (current all-time low) with confirmed volume increase

- Take profits at 15-25% gains targeting resistance around $0.032-$0.035 range based on recent price structure

- Set stop-losses at 2-3% below entry points to limit downside exposure in volatile market conditions

- Time entries around major Bitcoin ecosystem announcements or Bitlayer protocol upgrades that could catalyze price movements

BTR Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 0-2% of total crypto portfolio allocation

- Rationale: BTR is highly speculative with nascent technology still under development; allocate only capital you can afford to lose entirely

-

Active Investors: 2-5% of total crypto portfolio allocation

- Rationale: Reflects moderate confidence in BitVM technology while maintaining portfolio diversification across multiple blockchain layers

-

Professional Investors: 5-10% of total crypto portfolio allocation

- Rationale: Justifiable for institutions conducting deep due diligence on Bitlayer's technical roadmap and investor backing (Polychain Capital, Franklin Templeton, StarkWare)

(2) Risk Hedging Solutions

-

Stablecoin Reserve Strategy: Maintain 20-30% of designated crypto allocation in USDT or USDC to capture opportunities during BTR price downturns; allows rapid redeployment when technical patterns signal accumulation phases

-

Dollar-Cost Averaging with Hedged Timing: Combine regular BTR purchases with protective positions in Bitcoin (BTC) or Ethereum (ETH); as Bitcoin layer-2 solutions, BTR performance correlates with broader Bitcoin ecosystem strength

(3) Secure Storage Solutions

-

Hot Wallet Recommendation: Gate.com Wallet for frequent traders and active participants in Bitlayer protocol interactions; provides seamless trading access on Gate.com exchange while maintaining user custody control

-

Cold Storage Approach: For holdings exceeding 6-month lock-up periods, transfer BTR to hardware storage with offline key management; current market cap of $27.88M suggests limited exchange liquidity making self-custody increasingly important

-

Security Considerations:

- Never share private keys or recovery phrases with third parties

- Enable multi-signature authentication on Gate.com Wallet for additional security layers

- Regularly audit contract addresses on official Bitlayer explorer (btrscan.com) before executing transactions

- Verify token contract addresses (0x0e4cf4affdb72b39ea91fa726d291781cbd020bf on Bitlayer; 0xfed13d0c40790220fbde712987079eda1ed75c51 on BSC) to avoid phishing attacks

V. BTR Potential Risks and Challenges

BTR Market Risks

-

Liquidity Risk: With only $297,947 in 24-hour volume across 19 exchanges, large position exits may experience substantial slippage; illiquidity compounds during market stress periods when trading narrows further

-

Price Volatility and Drawdown Risk: BTR has experienced an 86.39% annual decline and currently trades 84.16% below its all-time high; this extreme volatility exposes investors to rapid capital loss, particularly for leveraged positions

-

Market Adoption Risk: Success depends entirely on Bitcoin DeFi ecosystem adoption; failure of developers and users to migrate to Bitlayer's platform would render BTR valueless; current circulating market cap of only $7.29M indicates limited mainstream market penetration

BTR Regulatory Risks

-

Cryptocurrency Regulatory Uncertainty: Evolving regulatory frameworks across major jurisdictions (US, EU, Asia) could impose restrictions on Bitcoin layer-2 protocols or classify BTR as unregistered securities, impacting liquidity and valuations

-

Smart Contract Regulation: As regulation tightens around DeFi and programmable assets (including YBTC), Bitlayer's core products may face compliance challenges requiring architectural modifications or geographic restrictions

-

Cross-Chain Bridge Scrutiny: Trust-minimized BitVM Bridge infrastructure may face regulatory pressure similar to previous bridge exploits; regulators could impose additional compliance requirements increasing operational complexity

BTR Technical Risks

-

BitVM Implementation Risk: As a first-of-its-kind BitVM implementation, Bitlayer faces execution risk; any critical vulnerabilities in the smart contract engine or bridge infrastructure could trigger investor exodus and value destruction

-

Bitcoin Security Dependency: Bitlayer's "Bitcoin native security architecture" creates absolute dependency on Bitcoin's continued network security; any fundamental Bitcoin protocol changes or consensus shifts would directly impact Bitlayer viability

-

YBTC Counterparty Risk: Yield-bearing asset YBTC introduces counterparty risk; if yield-generating mechanisms fail or custodial arrangements are compromised, BTR holders could face collateral losses

VI. Conclusion and Action Recommendations

BTR Investment Value Assessment

Bitlayer represents a high-risk, high-potential-reward opportunity within the Bitcoin DeFi infrastructure segment. The project benefits from credible backing (Polychain Capital, Franklin Templeton, Framework, StarkWare, ABCDE, Alliance) and tackles a significant market need—bringing true DeFi composability to Bitcoin's ecosystem through BitVM technology.

However, current market conditions present substantial headwinds: BTR trades at historic lows ($0.02788) with 84.16% depreciation from its peak, indicating either severe market repricing or fundamental concerns about execution. The project's success depends entirely on Bitlayer's ability to successfully implement BitVM protocols, attract meaningful developer and user adoption, and navigate evolving regulatory frameworks. At current valuations with severely depressed circulating volume, BTR may appeal to risk-tolerant investors believing in long-term Bitcoin layer-2 infrastructure development, but mainstream adoption remains unproven.

BTR Investment Recommendations

✅ Beginners: Treat BTR as a speculative research allocation only; allocate no more than 0.5-1% of your crypto portfolio and only capital you can completely lose. Purchase through Gate.com using limit orders at support levels ($0.02345-$0.02500) rather than market orders given low liquidity. Never use leverage, and research Bitlayer's technical documentation before committing funds.

✅ Experienced Investors: Allocate 2-5% of your designated Bitcoin layer-2 allocation to BTR as part of a diversified ecosystem play; combine with holdings in other Bitcoin infrastructure projects for portfolio balance. Use technical analysis (RSI, moving averages, volume) to establish core positions during price weakness, but maintain strict position sizing discipline and predetermined exit levels at both profit targets and stop-loss levels.

✅ Institutional Investors: Conduct extensive technical due diligence on Bitlayer's BitVM implementation against the technical whitepaper; evaluate token economics and dilution from the 1 billion total supply (currently only 26.16% circulating). Consider allocating 5-10% of early-stage blockchain infrastructure allocation if internal analysis validates technology differentiation and path to adoption. Establish direct relationships with Bitlayer Labs for project updates and protocol milestone tracking.

BTR Trading Participation Methods

-

Direct Exchange Trading: Trade BTR/USDT pairs on Gate.com with competitive fee structures; use limit orders to avoid slippage given moderate daily volume. Suitable for active traders implementing technical strategies and dollar-cost averaging programs.

-

Wallet-Based Accumulation: Participate directly in Bitlayer ecosystem by maintaining BTR in Gate.com Wallet; monitor for upcoming YBTC yield-bearing mechanics or protocol governance opportunities that may require staking native BTR tokens.

-

Portfolio Rebalancing: Include BTR in broader Bitcoin ecosystem exposure alongside core Bitcoin holdings; rebalance quarterly or when allocation drifts beyond target ranges to maintain disciplined risk management.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely. Past performance does not guarantee future results, and regulatory changes or technical failures could result in total capital loss.

FAQ

How much is BTR worth?

As of December 22, 2025, BTR is worth $0.02848. This price reflects a slight increase from the previous hour and represents a 3.3% gain since yesterday.

What is the price prediction for BTR in 2025?

Based on technical analysis, BTR is projected to reach $0.097869 by the end of 2025. This forecast reflects current market trends and historical price patterns analyzed as of December 2025.

What factors could affect BTR's price in the future?

BTR's price could be influenced by regulatory changes, market adoption rates, exchange security incidents, trading volume, cryptocurrency market trends, and macroeconomic conditions. Technology developments and real-world event impacts also play significant roles.

Is BTR a good investment and what are the risks?

BTR offers strong investment potential with steady cash flow and growing market demand. Main risks include market volatility, operational complexity, and regulatory changes. Success depends on local market conditions and due diligence.

2025 LUMIA Price Prediction: Future Value Analysis and Market Trends for Investors

2025 TBCPrice Prediction: Analyzing Market Trends and Future Valuation of TBC in a Changing Crypto Landscape

2025 SPrice Prediction: Analyzing Future Market Trends and Investment Opportunities

2025 LRC Price Prediction: Analyzing Market Trends, Tokenomics and Growth Potential in the Layer 2 Ecosystem

How Does Sui's On-Chain Data Analysis Reveal Its Growth in 2025?

How Does On-Chain Data Analysis Reveal Sui's Performance in 2025?

Understanding the Impact of a Major Platform's Cash P2P Closure on Traders

Predicting the Next Bitcoin Bull Market Peak: Insights for 2025

Advancements in Local Growth and Regulatory Adherence in Poland's Crypto Sector

A Complete Guide to Puffer Finance: Everything You Should Know

What is MLT: A Comprehensive Guide to Machine Learning Testing and Its Applications in Modern Software Development