2025 CAM Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: CAM's Market Position and Investment Value

Camino Network (CAM) is the first Layer 1 blockchain specifically designed for the $11 trillion travel industry. Since its launch in January 2025, it has achieved significant traction with over 100 established travel companies operating the network and backing from $10 million in funding. As of December 2025, CAM has a market capitalization of approximately $5.34 million with a circulating supply of approximately 318.95 million tokens, currently trading at $0.01673. This innovative blockchain infrastructure, positioned as "All Travel on One Chain," is playing an increasingly critical role in revolutionizing the travel and tourism sector by eliminating high payment fees, reducing settlement times, and simplifying complex reconciliation processes.

With 200+ brands actively building decentralized applications and Web3 travel products on the network, and major industry players like the Lufthansa Group already integrated, CAM represents a unique convergence of real-world enterprise adoption and blockchain technology. The network's unified request-response model replaces thousands of traditional APIs, creating seamless connectivity across millions of travel suppliers worldwide.

This article will comprehensively analyze CAM's price trajectory and market dynamics through 2030, integrating historical patterns, market supply-demand fundamentals, ecosystem development, and macroeconomic factors to provide investors with data-driven price forecasts and actionable investment strategies.

Camino Network (CAM) Market Analysis Report

I. CAM Price History Review and Current Market Status

CAM Historical Price Trajectory

- January 2025: Launch period reached an all-time high of $0.19806 on January 29, 2025, marking the peak performance since project inception.

- October 2025: Market correction phase, with price declining to an all-time low of $0.01298 on October 28, 2025, representing a significant drawdown from historical highs.

- December 2025: Recent trading activity shows price stabilization near the annual low levels, with marginal fluctuations as the market enters a consolidation phase.

CAM Current Market Position

As of December 23, 2025, CAM is trading at $0.01673, reflecting a -0.17% decline over the last 24 hours. The token demonstrates moderate short-term weakness with a 24-hour trading range between $0.01663 and $0.01701.

On a broader time horizon, CAM exhibits significant year-to-date volatility, down -78.43% from its historical peak, though showing slight positive momentum in the weekly timeframe with a +0.77% gain over 7 days. The 30-day performance shows a -2.85% decline, indicating continued downward pressure over the medium term.

Market Capitalization Metrics:

- Current Market Cap: $5,336,014

- Fully Diluted Valuation (FDV): $16,730,000

- Market Cap to FDV Ratio: 31.89%

- 24-Hour Trading Volume: $55,417.69

- Market Dominance: 0.00052%

- Current Ranking: #1,486

The token's circulating supply stands at 318,948,843 CAM out of a maximum supply of 1,000,000,000 CAM, representing approximately 31.89% circulation. The relatively low trading volume compared to market capitalization suggests limited liquidity in current market conditions.

Click to view current CAM market price

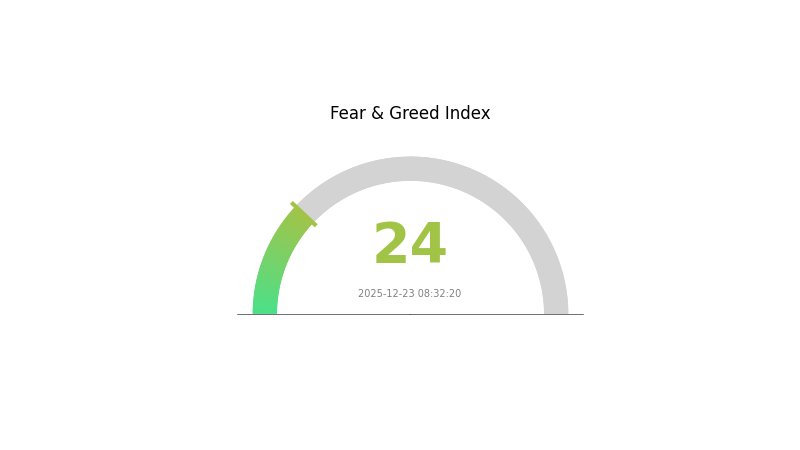

CAM Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reading at 24. This indicates significant market pessimism and risk aversion among investors. During such periods, assets are typically undervalued, presenting potential opportunities for long-term investors with higher risk tolerance. However, caution is advised, as extreme fear often signals continued volatility and downside risks. Monitor key support levels closely and consider dollar-cost averaging strategies rather than aggressive accumulation. Stay informed on fundamental developments that could influence market sentiment recovery.

CAM Holding Distribution

The address holding distribution chart is a fundamental analytical tool that visualizes the concentration of token ownership across the blockchain network. By mapping the proportion of CAM tokens held by different addresses, this metric provides critical insights into the decentralization status, market structure, and potential systemic risks associated with the token. A well-distributed holder base typically indicates stronger network resilience and reduced vulnerability to coordinated market manipulation, while concentrated holdings may suggest elevated risks from whale movements and price volatility.

Currently, the CAM token distribution data reveals a notably fragmented holder landscape with no single address commanding an overwhelming market share. This decentralized structure suggests that the network has achieved a reasonable degree of distribution maturity, mitigating the risk of excessive price manipulation by individual stakeholders. The absence of extreme concentration points indicates that CAM has successfully avoided the centralization pitfalls that often plague newly launched tokens, where founders and early investors typically maintain dominant positions.

From a market stability perspective, this balanced distribution fosters a more organic price discovery mechanism and reduces the likelihood of sudden sell-offs triggered by large holder liquidations. The diversified holder base also reflects healthy ecosystem participation, suggesting sustained interest from multiple market participants rather than reliance on a handful of major stakeholders. This structural characteristic enhances on-chain governance legitimacy and strengthens the foundation for long-term protocol development and community-driven decision-making.

Click to view current CAM holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing CAM's Future Price

Macroeconomic Environment

-

Market Demand and Economic Cycles: CAM's future price is significantly influenced by broader macroeconomic conditions and market sentiment. The cryptocurrency market, including CAM, is sensitive to global economic trends and investor confidence levels.

-

Historical Price Volatility: CAM demonstrated significant price fluctuations in 2025, with the token reaching a historical high of $0.19806 on January 29, then declining to a historical low of $0.02062 on October 5, reflecting the impact of macroeconomic pressures and market corrections.

Technology Development and Ecosystem Construction

-

Ecosystem Building: Market demand and ecosystem development serve as key factors affecting CAM's valuation. The expansion of the Camino Network ecosystem, including merchant participation and decentralized application integration, will play a crucial role in driving sustainable price growth.

-

Market Trends: Investors should pay close attention to technological progress and evolving market trends. The development of network infrastructure and the expansion of real-world use cases will be instrumental in determining CAM's long-term value proposition.

Three、2025-2030 CAM Price Forecast

2025 Outlook

- Conservative Forecast: $0.01087 - $0.01372

- Neutral Forecast: $0.01672

- Bullish Forecast: $0.01756 (requires sustained market interest and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual consolidation with incremental growth as the project matures and adoption expands

- Price Range Forecast:

- 2026: $0.01011 - $0.01937

- 2027: $0.01095 - $0.01989

- Key Catalysts: Enhanced tokenomics clarity, strategic partnerships, increased utility adoption, and favorable regulatory environment

2028-2030 Long-term Outlook

- Base Case: $0.01450 - $0.02174 (assumes moderate adoption acceleration and stable market conditions)

- Bullish Case: $0.02174 - $0.02714 (assumes widespread integration and strong institutional interest by 2029)

- Transformative Case: $0.02714 - $0.02853 (assumes breakthrough network effects, major enterprise adoption, and significant expansion of use cases by 2030)

- December 23, 2030: CAM reaching $0.02853 represents a 42% cumulative appreciation from 2025 baseline (recovery and growth phase)

Note: These forecasts are analytical projections based on available data and should be reviewed on Gate.com for current market conditions. Always conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01756 | 0.01672 | 0.01087 | 0 |

| 2026 | 0.01937 | 0.01714 | 0.01011 | 2 |

| 2027 | 0.01989 | 0.01825 | 0.01095 | 9 |

| 2028 | 0.02174 | 0.01907 | 0.0145 | 14 |

| 2029 | 0.02714 | 0.02041 | 0.0149 | 21 |

| 2030 | 0.02853 | 0.02378 | 0.01664 | 42 |

Camino Network (CAM) Professional Investment Strategy and Risk Management Report

IV. CAM Professional Investment Strategy and Risk Management

CAM Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors bullish on blockchain adoption in the travel industry; those seeking exposure to enterprise-grade Web3 infrastructure; institutional investors interested in industry-specific L1 blockchains

- Operational Recommendations:

- Accumulate CAM during market dips below $0.015, targeting average entry prices below $0.02

- Hold through multiple market cycles (12+ months) to capture potential adoption growth as more travel brands deploy dApps

- Reinvest network transaction fees or staking rewards if available to compound returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key levels at $0.01673 (current price), $0.01298 (ATL on 2025-10-28), and $0.19806 (ATH on 2025-01-29) for entry/exit signals

- Volume Analysis: Track 24-hour volume fluctuations around the $55,417 baseline; increased volume above this threshold may signal trend reversals

- Wave Trading Key Points:

- Capitalize on the -78.43% 1-year decline by identifying reversal patterns when technical indicators suggest oversold conditions

- Execute take-profit orders at $0.025-$0.03 resistance zones to secure gains during recovery rallies

CAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Active Investors: 3-7% of crypto portfolio allocation

- Professional Investors: 5-15% of diversified crypto holdings, subject to due diligence on travel industry adoption metrics

(2) Risk Hedging Solutions

- Diversification Strategy: Balance CAM holdings with exposure to established layer-1 blockchains and stablecoins to reduce concentration risk

- Profit-Taking Protocol: Set predetermined exit targets at 50%, 75%, and 100% gains to lock in returns and reduce downside exposure

(3) Secure Storage Solutions

- Hot Wallet Recommendations: Gate.com Web3 Wallet for frequent trading and active position management with multi-signature security features

- Cold Storage Option: Transfer significant holdings to hardware wallets for long-term storage and enhanced security against exchange hacks

- Security Best Practices: Enable two-factor authentication on all trading accounts; never share private keys; use separate wallets for trading and storage; verify contract addresses before any transfers

V. CAM Potential Risks and Challenges

CAM Market Risks

- High Price Volatility: CAM has experienced a -78.43% decline over 1 year, indicating extreme volatility and potential for further downside movements

- Limited Liquidity: 24-hour trading volume of $55,417.69 is relatively low, which may result in wider spreads and slippage for larger trades

- Adoption Uncertainty: Success depends on travel industry embrace of blockchain technology; delayed or limited adoption could pressure valuations

CAM Regulatory Risks

- Travel Industry Compliance: Regulatory frameworks governing blockchain-based travel services remain underdeveloped globally, creating potential compliance uncertainty

- Payment Processing Regulations: Integration with travel payment systems may face evolving regulatory scrutiny from financial regulators across different jurisdictions

- Data Privacy Concerns: Processing travel data on-chain raises GDPR and international data protection considerations that could impact network operations

CAM Technology Risks

- Smart Contract Vulnerabilities: Early-stage blockchain networks may contain undetected security flaws or bugs in deployed dApps

- Scalability Challenges: Network performance degradation during high transaction volumes could impact enterprise user experience and brand adoption

- Interoperability Dependencies: Heavy reliance on travel industry API integrations introduces technical and operational risks if third-party systems experience downtime

VI. Conclusion and Action Recommendations

CAM Investment Value Assessment

Camino Network represents a specialized investment opportunity targeting the $11 trillion travel industry through blockchain infrastructure. The project demonstrates strong institutional backing with 100+ travel companies and $10 million in funding, addressing genuine industry pain points such as high payment fees and complex settlement processes. However, investors must recognize the early-stage nature of the ecosystem, as evidenced by the significant -78.43% annual decline and relatively low trading liquidity. The network's success hinges on sustained travel brand adoption and regulatory acceptance, making it a higher-risk venture suitable primarily for investors with meaningful risk tolerance and conviction in blockchain's travel industry disruption thesis.

CAM Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto allocation) through Gate.com; focus on understanding travel industry blockchain use cases before increasing exposure; consider dollar-cost averaging with small monthly purchases to reduce entry price risk

✅ Experienced Investors: Allocate 3-7% to CAM as part of a diversified blockchain portfolio; conduct ongoing due diligence on travel brand adoption metrics and network transaction growth; use technical analysis to optimize entry points during market dislocations

✅ Institutional Investors: Conduct comprehensive due diligence on travel partner commitments and network security audits; negotiate advantageous entry prices for larger positions; consider CAM as a specialized blockchain infrastructure holding with clear enterprise adoption milestones

CAM Trading Participation Methods

- Spot Trading: Buy and hold CAM directly through Gate.com's spot market with limit orders to optimize entry prices

- Market Orders: Use market orders on Gate.com for quick position establishment during significant price movements

- Trading Pairs: Access CAM trading pairs against USDT and other major stablecoins to manage exposure and exit strategies

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are encouraged to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will comp reach 1000?

COMP reaching $1,000 is possible but uncertain. It would require significant DeFi adoption, increased protocol demand, and favorable market conditions. COMP previously peaked near $911 in 2021, making $1,000 an achievable target if ecosystem growth accelerates.

What is the prediction for Canaan in 2025?

Canaan Inc. (CAN) is expected to trade between $0.8139 and $0.8521 in 2025, with an average annualized price within this range based on current market trends and technical analysis.

How high can comp coin go?

COMP reached an all-time high of $911 in May 2021. With increased DeFi adoption and favorable market conditions, it could potentially reach $1,000 or higher. Future price depends on protocol adoption, market demand, and overall cryptocurrency market trends.

Which coin price prediction 2025?

CAM price prediction for 2025 depends on market trends and adoption. Based on current analysis, CAM could range between $0.15-$0.85, driven by ecosystem development and trading volume growth throughout the year.

2025 ATA Price Prediction: Analyzing Market Trends and Growth Potential for Automata Network

2025 B3X Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 ARPA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Janitor Coin Deep Dive: Innovative Whitepaper Logic Reshaping Cryptocurrency Utility

Understanding Actively Validated Services (AVS) Systems

Understanding the Difference Between Mark Price and Latest Price in Crypto Futures

Exploring Elon Musk's Business Ownership in American Companies

Understanding Cryptocurrency Bags: Effective Management Tips

What is SCA: A Comprehensive Guide to Strong Customer Authentication in Digital Payment Security