2025 CEEK Price Prediction: Expert Analysis and Market Outlook for Virtual Reality Token

Introduction: CEEK's Market Position and Investment Value

CEEK Smart VR Token (CEEK) is a blockchain-based platform dedicated to building AR/VR wearable devices for digital content creators, music artists, and sports figures. Since its launch in 2018, CEEK has established itself as a decentralized infrastructure connecting creators directly to fans in the virtual world. As of December 2025, CEEK's market capitalization stands at approximately $4.22 million, with a circulating supply of around 999 million tokens and a current price hovering near $0.004224.

This innovative asset, positioned as "DeFi for Music Artists, Sports and Content Creators," is playing an increasingly pivotal role in bridging virtual and real-world payments through its blockchain-powered smart contract framework. The platform enables artists and content creators to monetize their work through tokenized assets, virtual experiences, and interactive digital events hosted in CEEK's VR/AR studios.

This article will provide a comprehensive analysis of CEEK's price trends through 2030, examining historical performance patterns, market dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment guidance for market participants.

I. CEEK Price History Review and Market Status

CEEK Historical Price Evolution Trajectory

- 2020: CEEK token launched with an initial price of $0.03. The token reached its all-time low of $0.00074146 on February 14, 2020, during the early stage of the project.

- 2021: CEEK experienced significant growth throughout the year. The token reached its all-time high of $1.19 on November 29, 2021, representing a remarkable appreciation from its launch price.

- 2022-2025: Following the peak in late 2021, CEEK entered a prolonged correction phase. The token has declined approximately 87.55% over the past year, reflecting the broader market challenges and evolving investor sentiment in the digital asset space.

CEEK Current Market Position

As of December 24, 2025, CEEK is trading at $0.004224, representing a 24-hour decline of 1.73%. The token's market capitalization stands at approximately $4.22 million, with a circulating supply of 998,999,882 CEEK tokens out of a maximum supply of 1 billion tokens. The circulating supply ratio is 99.90%, indicating that nearly all tokens are already in circulation.

The 24-hour trading volume is recorded at $12,334.47, with the price fluctuating between $0.004128 and $0.004295 during the day. Over longer timeframes, CEEK has demonstrated significant weakness, declining 5.60% over the past 7 days and 20.16% over the past month.

CEEK maintains a market ranking of 1,633 among cryptocurrencies, with a market dominance of 0.00013%. The token maintains a presence across multiple blockchain networks, with contract addresses on both Ethereum (ETH) and Binance Smart Chain (BSC), facilitating broader accessibility across different blockchain ecosystems. The project has accumulated 22,943 token holders.

Click to view current CEEK market price

CEEK Market Sentiment Indicator

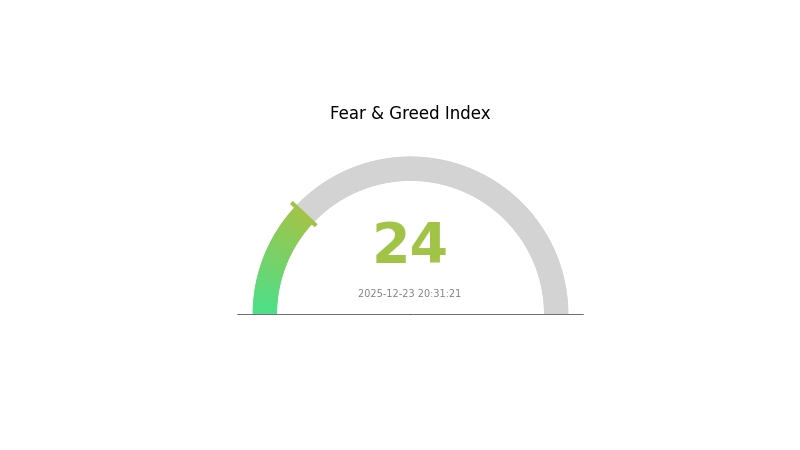

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This signals significant market pessimism and risk aversion among investors. During such periods, panic selling often intensifies, creating substantial downward pressure on asset prices. However, extreme fear can also present contrarian opportunities for long-term investors. Consider dollar-cost averaging into quality assets on Gate.com to capitalize on potential market recoveries. Monitor market developments closely and maintain a disciplined investment strategy amid this volatile sentiment.

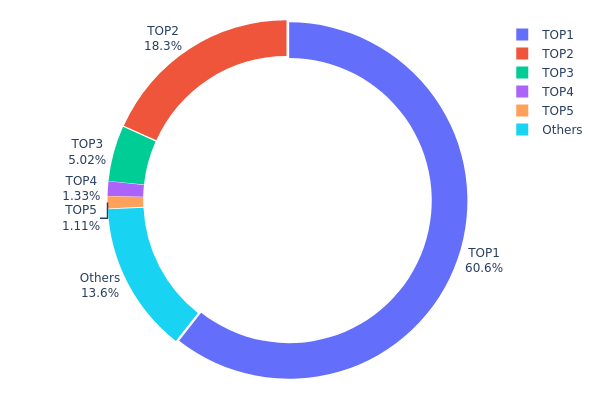

CEEK Holdings Distribution

The address holdings distribution chart illustrates the concentration of CEEK tokens across the blockchain network by mapping the top token holders and their respective share of total supply. This metric serves as a critical indicator of token decentralization, market structure stability, and vulnerability to potential price manipulation through large-scale liquidations or coordinated selling activities.

CEEK currently exhibits pronounced concentration characteristics, with the top holder commanding 60.59% of the total supply—a significantly elevated threshold that raises material concerns regarding token decentralization. The combined top five addresses account for approximately 86.33% of all tokens in circulation, while the remaining 13.67% is distributed across a fragmented base of smaller holders. This distribution pattern demonstrates extreme concentration risk, as the primary holder possesses sufficient capital to exert substantial influence over market dynamics. The second-largest holder retains an additional 18.31%, further compounding the concentration effect and establishing a two-entity dominance structure.

The current address distribution presents considerable implications for market stability and price discovery mechanisms. The pronounced wealth concentration creates structural vulnerabilities, including heightened susceptibility to large-scale redemptions that could trigger significant price volatility, reduced liquidity depth during stress periods, and asymmetric information advantages for dominant token holders. From a decentralization perspective, this structure reflects a relatively immature distribution phase, suggesting that CEEK remains heavily influenced by early stakeholders or institutional allocations rather than achieving organic distribution through broader market participation.

Visit to view the current CEEK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xaf18...fb6a38 | 605983.88K | 60.59% |

| 2 | 0xc368...816880 | 183136.75K | 18.31% |

| 3 | 0xc80a...e92416 | 50179.29K | 5.01% |

| 4 | 0xd09f...e6c95f | 13250.00K | 1.32% |

| 5 | 0x9642...2f5d4e | 11071.96K | 1.10% |

| - | Others | 136378.11K | 13.67% |

II. Core Factors Influencing CEEK's Future Price

Adoption Rate and Market Demand

-

Virtual Reality Technology Adoption: CEEK's future price is significantly influenced by adoption rates within the virtual reality entertainment sector. High user growth and increased adoption of VR technology platforms directly boost token value, while limited adoption may lead to price declines.

-

User Growth Metrics: Investors should closely monitor on-chain data and user growth indicators as key performance metrics for price trajectory assessment.

Partnership Dynamics and Ecosystem Expansion

-

Strategic Partnerships: Strong partnerships and successful scaling of collaboration relationships are crucial drivers of CEEK's value. Well-executed partnerships enhance ecosystem utility and attract developer and creator interest.

-

Risk of Partnership Failure: Conversely, partnerships failing to scale effectively, combined with reduced liquidity, can result in continued price consolidation or downward trends, which may diminish developer and creator engagement.

Market Sentiment and Narrative Drivers

-

Historical Price Context: Recent market dynamics show CEEK trading significantly below its 2021 peak levels, with prices being primarily driven by market narratives and sentiment shifts.

-

Competitive Landscape: Market trends and competition within the virtual reality and digital entertainment sectors play crucial roles in determining price movements and long-term viability.

III. 2025-2030 CEEK Price Forecast

2025 Outlook

- Conservative Forecast: $0.00359 - $0.00422

- Neutral Forecast: $0.00422

- Optimistic Forecast: $0.00477 (requires sustained platform adoption and community engagement growth)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.00427 - $0.00463 (+6% growth)

- 2027: $0.00274 - $0.00562 (+8% growth)

- 2028: $0.00326 - $0.00575 (+20% growth)

- Key Catalysts: Virtual reality ecosystem expansion, strategic partnerships, increased user adoption on immersive platforms, and enhanced tokenomics utility

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00293 - $0.00634 (+28% growth by 2029, achieving $0.00588 average valuation)

- Optimistic Scenario: $0.00382 - $0.00706 (+39% growth by 2030, supported by mainstream VR/metaverse integration and institutional interest)

- Transformative Scenario: $0.00706+ (contingent on breakthrough VR technology adoption, significant entertainment industry partnerships, and expanded use cases across major digital platforms)

- 2025-12-24: CEEK maintaining foundational price levels ($0.00359-$0.00477) while establishing long-term growth framework

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00477 | 0.00422 | 0.00359 | 0 |

| 2026 | 0.00463 | 0.0045 | 0.00427 | 6 |

| 2027 | 0.00562 | 0.00457 | 0.00274 | 8 |

| 2028 | 0.00575 | 0.00509 | 0.00326 | 20 |

| 2029 | 0.00634 | 0.00542 | 0.00293 | 28 |

| 2030 | 0.00706 | 0.00588 | 0.00382 | 39 |

CEEK Smart VR Token Investment Analysis Report

I. Executive Summary

CEEK Smart VR Token is a blockchain-based platform designed to connect music artists, athletes, and digital content creators directly with their fans in virtual reality environments. As of December 24, 2025, CEEK is trading at $0.004224, representing a market capitalization of approximately $4.22 million with a circulating supply of 998,999,882 tokens out of a total supply of 1 billion.

The token has experienced significant depreciation, declining 87.55% over the past year from its all-time high of $1.19 reached on November 29, 2021. Current trading volume stands at $12,334.47 in 24-hour activity, indicating limited market liquidity.

II. CEEK Project Overview

Project Foundation

CEEK is primarily focused on developing AR/VR wearable devices that enable artists to share resources and create brand content through VR/AR studios. The platform leverages blockchain technology to establish direct connections between content creators and their audiences in virtual environments.

Core Technology Framework

Blockchain Infrastructure:

- Token Standard: ERC-20 smart contract on Ethereum (ETH)

- Secondary Chain Support: Binance Smart Chain (BSC)

- Contract Address (ETH): 0xb056c38f6b7dc4064367403e26424cd2c60655e1

- Contract Address (BSC): 0xe0f94ac5462997d2bc57287ac3a3ae4c31345d66

Key Platform Features:

- Blockchain-based middleware enabling smart contracts to connect with external data sources

- Bridging virtual world payments with real-world payment systems

- Smart contract functionality for purchasing on-chain resources including audio-visual content and VR experiences

- Token utility for platform rewards, voting mechanisms, competitions, virtual merchandise, and transactions

Token Economics

| Metric | Value |

|---|---|

| Current Price | $0.004224 |

| Market Capitalization | $4,219,775.50 |

| Fully Diluted Valuation | $4,224,000.00 |

| Circulating Supply | 998,999,882 CEEK |

| Total Supply | 1,000,000,000 CEEK |

| 24-Hour Trading Volume | $12,334.47 |

| Market Dominance | 0.00013% |

| Token Holders | 22,943 |

III. Market Performance Analysis

Price Trends and Historical Performance

Historical Price Milestones:

- All-Time High (ATH): $1.19 on November 29, 2021

- All-Time Low (ATL): $0.00074146 on February 14, 2020

- Initial Publication Price: $0.03 (May 2018)

Recent Price Movement:

- 1-Hour Change: -0.09%

- 24-Hour Change: -1.73%

- 7-Day Change: -5.60%

- 30-Day Change: -20.16%

- 1-Year Change: -87.55%

Current Trading Range (24-Hour):

- High: $0.004295

- Low: $0.004128

Market Liquidity Assessment

With a 24-hour trading volume of $12,334.47 and a market cap of $4.22 million, CEEK exhibits extremely low liquidity. This represents a concerning liquidity-to-market-cap ratio, indicating significant slippage risk for substantial trades and limited market depth.

IV. CEEK Professional Investment Strategy and Risk Management

CEEK Investment Methodology

(1) Long-Term Holding Strategy

Target Audience: Investors with high risk tolerance interested in emerging VR/AR and blockchain technology convergence.

Operational Guidelines:

- Dollar-cost averaging (DCA) approach to mitigate volatility impact through periodic small purchases during market downturns

- Maintain conviction in the long-term potential of VR/AR content creator ecosystems despite current market challenges

- Establish clear entry and exit targets based on technology development milestones rather than short-term price movements

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure CEEK token storage with regular backups of private keys

- Consider hardware wallet backup for significant holdings to enhance security against exchange-related risks

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price zones at $0.004128 (24-hour support) and $0.004295 (24-hour resistance)

- Volume Analysis: Monitor 24-hour trading volume relative to historical averages to confirm price movements and identify potential breakouts

Swing Trading Considerations:

- Exercise extreme caution given the extremely low trading volume and market liquidity

- Anticipate significant slippage on orders exceeding $1,000 notional value

- Implement strict stop-loss orders at 15-20% below entry points to protect against adverse price movements

CEEK Risk Management Framework

(1) Asset Allocation Principles

Conservative Investors: 0.5-1% of total portfolio

- CEEK should represent a minimal speculative allocation given extreme illiquidity and 87.55% year-over-year depreciation

Aggressive Investors: 2-3% of total portfolio

- Suitable only for investors capable of sustaining complete capital loss without portfolio disruption

Institutional Investors: 0.1-0.5% of total portfolio

- Constrained by liquidity considerations and regulatory scrutiny of micro-cap assets

(2) Risk Hedging Strategies

Strategy 1 - Position Sizing Discipline: Limit individual trade sizes to less than 5% of daily trading volume to minimize slippage and market impact. This translates to maximum positions of approximately $600-$700 per trade given current volume levels.

Strategy 2 - Correlation Diversification: Combine CEEK holdings with more liquid Layer-1 blockchain assets and established VR/AR technology plays to reduce portfolio concentration risk.

(3) Secure Storage Solutions

Web3 Wallet Approach: Gate.com Web3 Wallet provides non-custodial storage with direct access to CEEK contracts across both Ethereum and BSC networks, enabling secure token management with full user control over private keys.

Security Precautions:

- Maintain encrypted backups of wallet seed phrases in physically secure locations

- Enable two-factor authentication on all associated exchange accounts

- Never share private keys or recovery phrases with any third party

- Verify smart contract addresses before token transfers to avoid phishing attacks

- Use hardware wallet for holdings exceeding $5,000 equivalent value

V. CEEK Potential Risks and Challenges

Market Risks

Extreme Illiquidity Risk: With $12,334 in 24-hour volume against a $4.22 million market cap, CEEK suffers from severe liquidity constraints. Large orders can dramatically impact pricing, and exit liquidity during market stress may be severely limited or unavailable.

Price Volatility and Depreciation: The token has declined 87.55% year-over-year and trades at 99.6% below its all-time high. This extended bearish trend suggests sustained demand weakness and potential further downside risk.

Low Trading Activity: With presence on only 2 exchanges and minimal daily volume, CEEK lacks the market infrastructure necessary for efficient price discovery or rapid position liquidation.

Regulatory Risks

VR Content Licensing Uncertainty: Regulatory frameworks governing virtual reality content distribution and artist compensation through blockchain platforms remain unclear across major jurisdictions, potentially impacting platform economics and token utility.

Securities Classification Risk: Depending on regulatory evolution, CEEK tokens could face potential reclassification as securities in certain jurisdictions, triggering compliance requirements or trading restrictions.

Cross-Border Compliance Challenges: As a platform connecting global creators and audiences, CEEK faces complex regulatory requirements across multiple countries regarding content moderation, payment processing, and user identity verification.

Technology Risks

Smart Contract Vulnerability Risk: While Ethereum smart contracts undergo regular audits, potential code vulnerabilities could result in token loss or platform disruption requiring emergency protocol changes.

Scalability Constraints: Current reliance on Ethereum's Layer-1 network may limit the platform's ability to support high-volume VR content streaming and real-time transactions, potentially necessitating Layer-2 migration with associated technical risks.

Blockchain Bridge Risk: Use of wrapped CEEK tokens across multiple chains (ETH and BSC) introduces bridge protocol risks that could impact token liquidity and cross-chain functionality.

VI. Conclusion and Action Plan

CEEK Investment Value Assessment

CEEK represents a speculative investment in emerging VR/AR content creator infrastructure. While the underlying concept of decentralized creator economies in virtual environments possesses theoretical long-term merit, current market conditions present substantial headwinds:

Challenges:

- Severe market depreciation (87.55% year-over-year) indicating lost investor confidence

- Extreme illiquidity limiting practical tradability and exit opportunities

- Minimal daily trading volume suggesting restricted adoption and market engagement

- Unclear platform monetization and creator incentive mechanics

Long-term potential drivers (if realized) would include:

- Mainstream adoption of VR/AR entertainment platforms

- Creator migration from centralized platforms seeking blockchain-based alternatives

- Integration of CEEK tokens into established entertainment distribution channels

The risk-reward profile currently favors risk avoidance for most investor categories.

CEEK Investment Recommendations

✅ Beginners: Avoid direct CEEK investment. If interested in VR/AR blockchain infrastructure, consider more established projects with superior liquidity, clearer use cases, and broader adoption metrics.

✅ Experienced Investors: Consider CEEK only as a micro-allocation (0.5-1% of portfolio) representing a long-term speculative bet on VR/AR creator economy growth. Establish a maximum loss threshold and maintain strict position discipline through dollar-cost averaging.

✅ Institutional Investors: Given severe liquidity constraints, illiquidity premiums, and limited infrastructure, institutional participation is not practically feasible without significant position size restrictions that would render the investment immaterial.

CEEK Trading Participation Methods

Method 1 - Gate.com Platform Access: Trade CEEK directly through Gate.com's spot market on Ethereum and BSC networks, enabling access to both token chains and professional trading tools including advanced order types and liquidity monitoring.

Method 2 - Direct Smart Contract Interaction: Experienced users can interact directly with CEEK smart contracts through Web3 wallets (including Gate.com Web3 Wallet) for maximum control and reduced intermediary risk.

Method 3 - Limited Entry Strategy: Utilize Gate.com's limit order functionality to establish positions only at predetermined price levels, avoiding market orders that would incur excessive slippage given minimal order book depth.

Cryptocurrency investment carries extreme risk. This analysis does not constitute investment advice. Investors should conduct independent research and consult professional financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely. CEEK's extreme illiquidity and severe depreciation represent substantial capital loss risk for potential investors.

FAQ

Is Ceek VR a good investment?

CEEK VR shows strong potential in the expanding metaverse sector. With growing adoption of VR technology and increasing metaverse interest, CEEK could offer significant upside opportunities for early investors seeking exposure to this emerging market.

What is a ceek token used for?

Ceek tokens are used to purchase VR concert tickets and gain VIP access to artists. They enable secure blockchain-based transactions for virtual entertainment experiences and exclusive fan interactions.

What is the current market cap and circulating supply of CEEK?

As of December 23, 2025, CEEK has a market cap of $3.50 million and a circulating supply of 805.72 million tokens. The 24-hour trading volume stands at $61.36K.

What factors could influence CEEK token price in the future?

CEEK token price will be influenced by market sentiment, trading volume, technological developments, user adoption rates, and overall crypto market conditions.

How does CEEK compare to other metaverse and VR tokens?

CEEK ranks as the #1 virtual reality token and #7 metaverse token globally. It distinguishes itself through exclusive partnerships with top music artists and sports figures, offering unique virtual experiences that competitors cannot match.

Is ZTX (ZTX) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Metahero (HERO) a Good Investment?: Analyzing the Potential and Risks of this Metaverse Token in 2023

2025 HQ Price Prediction: Analyzing Market Trends and Factors Shaping the Future Value

2025 BAG Price Prediction: Analyzing Market Trends and Potential Growth Factors

OXT vs MANA: Comparing Two Cryptocurrencies in the Digital Asset Space

2025 ZTX Price Prediction: Analyzing Market Trends and Expert Forecasts for the Emerging Cryptocurrency

Is Kadena (KDA) a good investment?: A comprehensive analysis of potential returns, risks, and market outlook for 2024

Is Rarible (RARI) a good investment?: A Comprehensive Analysis of the NFT Marketplace Token's Potential and Risks in 2024

TIMECHRONO vs RUNE: A Comprehensive Comparison of Two Powerful Time Management and Blockchain Platforms

冷錢包交易是否需支付手續費?全面解析

How to Start Micro Trading with Just $1: A Guide for Beginners