2025 CGN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of CGN

Cygnus (CGN) is the industry's first Instagram App Layer, merging on-chain and off-chain assets to empower the creator economy. As of December 23, 2025, CGN has achieved a market capitalization of $31.3 million with a circulating supply of 2.3 billion tokens, currently trading at $0.00313. This innovative asset, dubbed the "creator economy enabler," is playing an increasingly vital role in bridging billions of users into Web3 through its Cygnus LVS infrastructure.

This article will conduct a comprehensive analysis of CGN's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies.

I. CGN Price History Review and Market Status

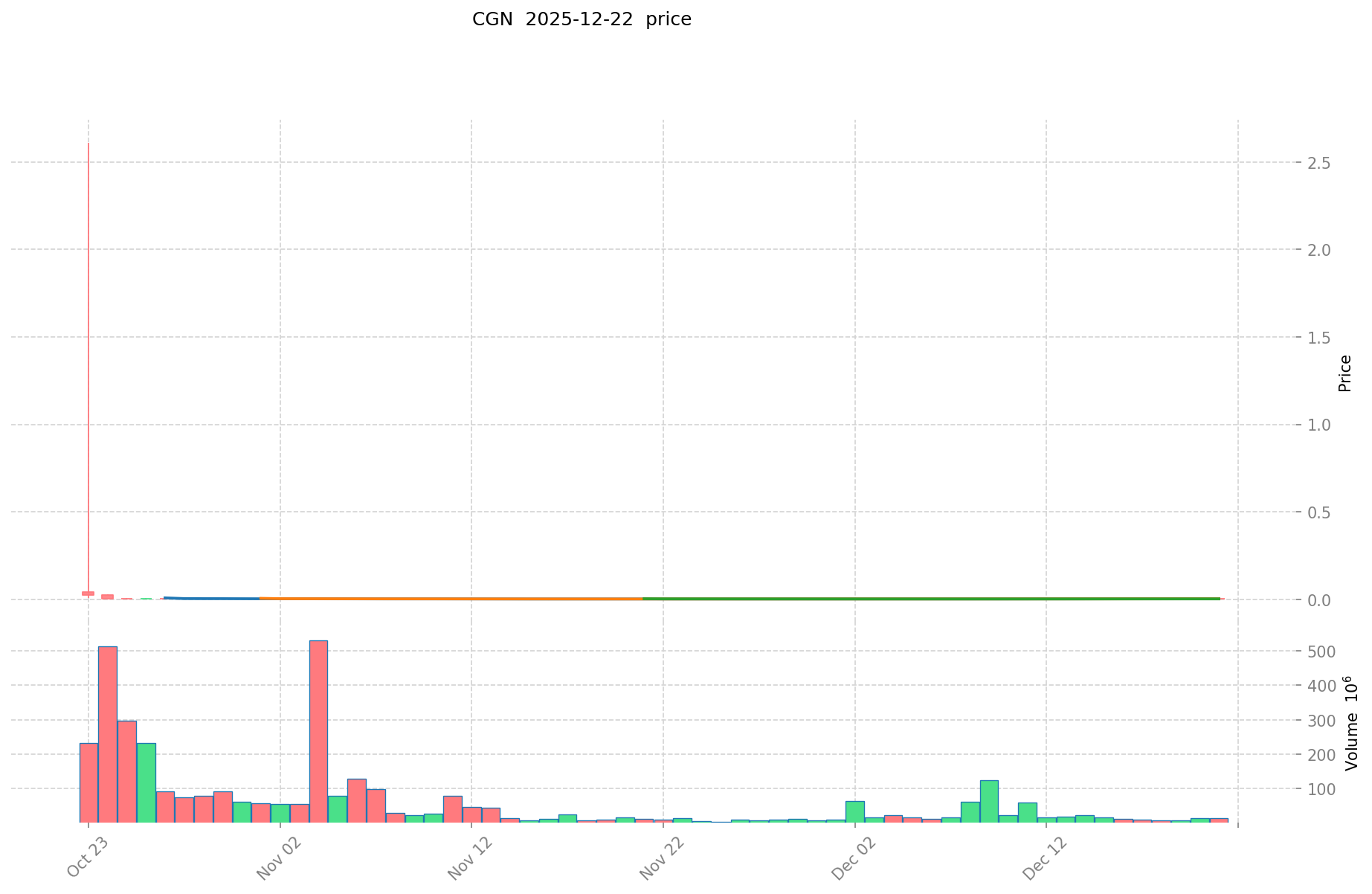

CGN Historical Price Movement Trajectory

- October 23, 2025: CGN reached its all-time high of $2.6106, marking a significant peak in the token's trading history.

- November 13, 2025: CGN hit its all-time low of $0.001549, representing a sharp decline from previous highs.

- December 23, 2025: CGN is currently trading at $0.00313, reflecting continued volatility in recent weeks.

CGN Current Market Situation

As of December 23, 2025, CGN is trading at $0.00313 with a 24-hour trading volume of approximately $49,876.89. The token has experienced a marginal decline of -0.12% over the past 24 hours, while showing a modest positive performance of 0.77% over the 7-day period. Over the 30-day timeframe, CGN has demonstrated significant growth of 57.99%, indicating recent bullish momentum despite long-term challenges. However, the year-to-date performance reveals a severe decline of -99.84%, suggesting substantial losses for investors who entered at higher price levels.

The fully diluted valuation of CGN stands at $31.3 million, with a circulating supply of 2.3 billion tokens representing 23% of the total supply of 10 billion tokens. The token maintains a market dominance of 0.00096% and is ranked 1344 among cryptocurrencies. CGN currently has 84,654 token holders and is listed on 1 exchange. The 24-hour price range shows a high of $0.00316 and a low of $0.003098.

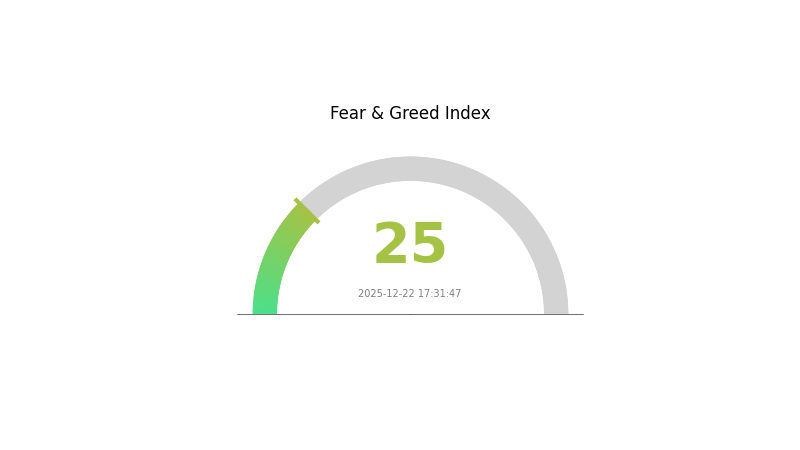

Market sentiment indicates extreme fear with a VIX reading of 25 as of December 22, 2025, suggesting heightened market uncertainty and risk aversion among investors.

Click to view current CGN market price

CGN Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 25. This sentiment reflects significant market anxiety and pessimism among investors. During periods of extreme fear, historically savvy traders often view it as a potential buying opportunity, as assets may be undervalued due to panic selling. However, exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely on Gate.com to stay informed about price movements and emerging opportunities in this volatile environment.

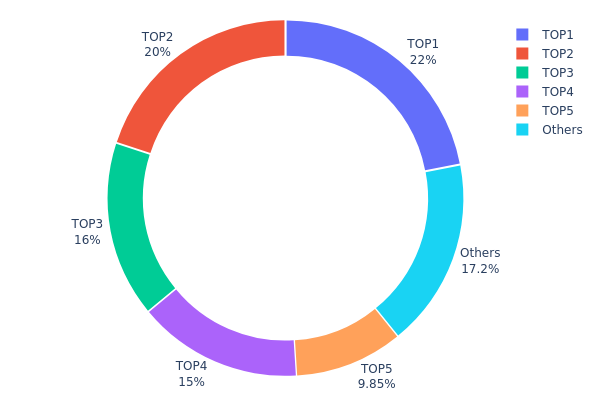

CGN Holdings Distribution

The address holdings distribution chart illustrates the concentration of CGN tokens across blockchain addresses, revealing the degree of ownership centralization within the ecosystem. This metric serves as a critical indicator of market structure, liquidity dynamics, and potential vulnerability to coordinated price movements. By analyzing the top holders and their proportional stakes, investors and analysts can assess the token's decentralization status and the stability of its on-chain architecture.

CGN exhibits moderate concentration characteristics, with the top five addresses collectively controlling 82.84% of the total token supply. The largest holder maintains a 22.00% position, while the second-largest holds 20.00%, indicating a relatively balanced distribution among the most significant stakeholders compared to extreme concentration scenarios. However, the combined influence of the top four addresses—accounting for 72.99% of circulating tokens—suggests that decision-making power remains concentrated within a limited number of entities. This distribution pattern presents both structural considerations and market implications that warrant careful monitoring.

The current holdings configuration indicates a market structure where price stability may be subject to the actions of major stakeholders. While the remaining 17.16% held across dispersed addresses demonstrates some degree of retail participation and decentralized ownership, the substantial holdings concentrated among the top five addresses suggests that coordinated or unilateral actions by these parties could materially influence market dynamics. This concentration level, while not representing an extreme risk scenario, underscores the importance of tracking large holder behavior and market sentiment to assess potential volatility catalysts and assess the overall resilience of the token's market infrastructure.

Click to view current CGN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2de5...fc9680 | 2200000.00K | 22.00% |

| 2 | 0x31ad...3e2de5 | 2000000.00K | 20.00% |

| 3 | 0x9997...ba6e72 | 1600000.00K | 16.00% |

| 4 | 0xd4e9...247b55 | 1500000.00K | 14.99% |

| 5 | 0x48bb...66be0d | 985000.00K | 9.85% |

| - | Others | 1715000.00K | 17.16% |

II. Core Factors Influencing CGN's Future Price

Supply Mechanism

-

Nuclear Fuel Market Price Fluctuations: Future fluctuations in nuclear fuel market prices may adversely impact the company's procurement costs, thereby affecting operational performance and profitability of nuclear power generation business.

-

Historical Impact: Nuclear fuel price volatility has historically demonstrated correlation with overall nuclear power operational margins, affecting gross profit rates in the nuclear energy generation sector.

-

Current Impact: As uranium prices have shown volatility (ranging from USD 63.45 to USD 84.00 per pound in recent periods), procurement cost pressures continue to pose risks to CGN's operational margins.

Government Policy Framework

-

Clean Energy Development Policy: China's commitment to carbon neutrality by 2060 and peak carbon emissions by 2030 positions nuclear energy as a critical component of the national energy strategy, providing long-term policy support for nuclear power expansion.

-

Strategic Industry Status: Nuclear power is designated as a key focus area in the 14th Five-Year Plan (2021-2025), receiving government backing for technological advancement and facility expansion, which supports sustained demand for CGN's services.

Technology Development and Ecosystem

-

Third-Generation Nuclear Technology "Hualong One": CGN's independently developed Hualong One (ACPR1000+) represents advanced safety features including non-passive cooling systems and dual containment structures, positioning the company competitively in international markets after receiving EUR and GDA certifications.

-

Domestic Nuclear Control System Leadership: Localized nuclear-grade instrumentation and control systems have achieved 100% coverage in new Chinese nuclear power stations, with domestic systems capturing 70% market share, eliminating dependence on foreign suppliers like Siemens and Mitsubishi.

-

Safety Performance Excellence: CGN's nuclear operations achieve safety metrics placing approximately 80% of its reactor indicators within the global top 10% among all nuclear power facilities, enhancing operational reliability and investor confidence.

III. 2025-2030 CGN Price Forecast

2025 Outlook

- Conservative Forecast: $0.00301-$0.00313

- Neutral Forecast: $0.00313

- Bullish Forecast: $0.00351 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with increasing volatility

- Price Range Forecast:

- 2026: $0.00173-$0.00405

- 2027: $0.00221-$0.00542

- 2028: $0.00328-$0.00478

- Key Catalysts: Enhanced token utility adoption, strategic partnership announcements, broader market recovery, and increased institutional interest in emerging digital assets

2029-2030 Long-term Outlook

- Base Case: $0.00364-$0.00485 (assumes steady ecosystem expansion and moderate market growth)

- Bullish Case: $0.00466-$0.00619 (contingent on mainstream adoption acceleration and positive regulatory environment)

- Transformational Case: $0.00619+ (requires breakthrough technological innovations, major enterprise integrations, and significant market expansion beyond current projections)

Note: Price forecasts are based on historical data analysis and market trend projections. Actual market performance may vary significantly based on macroeconomic conditions, regulatory developments, and technological advancements. Investors should conduct thorough research on Gate.com and other authorized platforms before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00351 | 0.00313 | 0.00301 | 0 |

| 2026 | 0.00405 | 0.00332 | 0.00173 | 6 |

| 2027 | 0.00542 | 0.00369 | 0.00221 | 17 |

| 2028 | 0.00478 | 0.00455 | 0.00328 | 45 |

| 2029 | 0.00485 | 0.00466 | 0.00364 | 49 |

| 2030 | 0.00619 | 0.00476 | 0.00252 | 52 |

Cygnus (CGN) Professional Investment Strategy and Risk Management Report

I. Project Overview

Basic Information

Cygnus is the industry's first Instagram App Layer, merging on-chain and off-chain assets to power the creator economy. Built with Cygnus LVS, the project aims to onboard the next billion users onto Web3.

Token Details:

- Token Symbol: CGN

- Blockchain: BASE (BEP-20)

- Contract Address: 0x2e6c4bd1c947e195645d2b920b827498cfaa6766

- Current Price: $0.00313 (as of December 23, 2025)

- Market Cap: $7,199,000

- Fully Diluted Valuation: $31,300,000

- Circulating Supply: 2,300,000,000 CGN

- Total Supply: 10,000,000,000 CGN

- Circulating Ratio: 23%

- Market Rank: #1344

- Total Holders: 84,654

Price Performance

Recent Price Action:

- 1H Change: -0.22%

- 24H Change: -0.12%

- 7D Change: +0.77%

- 30D Change: +57.99%

- 1Y Change: -99.84%

Historical Price Levels:

- All-Time High (ATH): $2.6106 (October 23, 2025)

- All-Time Low (ATL): $0.001549 (November 13, 2025)

- 24H High: $0.00316

- 24H Low: $0.003098

II. CGN Professional Investment Strategy and Risk Management

CGN Investment Methodology

(1) Long-term Holding Strategy

-

Suitable Investors: Creator economy enthusiasts, Web3 believers seeking exposure to social infrastructure, and investors with extended investment horizons (12+ months)

-

Operational Recommendations:

- Dollar-cost averaging (DCA) approach: Allocate fixed amounts at regular intervals to reduce average entry cost and volatility impact

- Regular portfolio rebalancing: Review positions quarterly and rebalance according to your target allocation percentages

- Compound strategy: Consider reinvesting any rewards or additional gains back into CGN positions to maximize long-term growth

-

Storage Solution: Utilize Gate Web3 Wallet for secure, non-custodial storage with easy access to Web3 applications and DeFi protocols

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the recent ATH of $2.6106 and ATL of $0.001549 to identify key reversal zones

- Volume Analysis: Observe 24H trading volume of $49,876.89 to gauge market participation and validate breakout strength

-

Swing Trading Key Points:

- Entry Signals: Look for price consolidation above the 7D moving average, combined with increasing trading volume

- Exit Strategy: Set profit targets at 20-30% gains and stop-loss orders at 10-15% below entry to protect capital

CGN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-8% of total portfolio allocation

- Professional Investors: 5-15% of total portfolio allocation

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 20-30% of intended investment capital in stablecoins to capitalize on sudden price dips without missing opportunities

- Diversification Strategy: Combine CGN exposure with other Web3 infrastructure projects to reduce single-asset risk and improve portfolio resilience

(3) Secure Storage Solution

- Recommended Custody: Gate Web3 Wallet - provides self-custody capabilities with user-friendly interface, multi-chain support, and direct integration with trading on Gate.com

- Hardware Security Option: For larger holdings, consider air-gapped storage solutions with regular security audits

- Security Precautions: Enable two-factor authentication (2FA) on all accounts, use hardware-backed wallets for amounts exceeding $10,000, maintain encrypted backups of private keys in multiple secure locations, and never share seed phrases or private keys

III. CGN Potential Risks and Challenges

CGN Market Risks

-

Extreme Volatility: CGN has experienced a 99.84% decline over the past year, indicating severe price instability and heightened risk of capital loss for buy-and-hold investors during downturns

-

Liquidity Constraints: With 24-hour trading volume of only $49,876.89 relative to a $7.2 million market cap, the token exhibits limited liquidity that could result in slippage during large transactions

-

Market Sentiment Sensitivity: As an early-stage project token, CGN is highly susceptible to sentiment shifts, influenza from prominent voices, and changes in Web3 adoption trends

CGN Regulatory Risks

-

Evolving Regulatory Framework: Creator economy platforms may face regulatory scrutiny regarding asset classification, content moderation liability, and securities compliance depending on jurisdictions of operation

-

Compliance Uncertainty: Varying regulations across countries could impact the project's ability to operate globally and expand user adoption, particularly regarding on-chain asset integration

-

Policy Changes: Future government actions toward decentralized applications and Web3 platforms could materially affect project viability and token utility

CGN Technology Risks

-

Smart Contract Vulnerability: As a token operating on the BASE blockchain, CGN faces risks from potential smart contract vulnerabilities or exploits that could affect token functionality or holder security

-

Platform Dependence: The project's success depends heavily on adoption of its Instagram App Layer infrastructure; technical failures or poor user experience could severely impact adoption rates

-

Scalability Challenges: The ability to handle "next billion users" requires robust scaling solutions; any technical limitations in the underlying infrastructure could hinder mass adoption

IV. Conclusion and Action Recommendations

CGN Investment Value Assessment

Cygnus represents an early-stage experiment in bridging social media and Web3 through creator economy infrastructure. While the project's vision addresses significant market opportunities in the creator economy space, the token currently exhibits characteristics typical of highly speculative, pre-maturity projects: extreme volatility, limited liquidity, and significant price drawdowns. The 57.99% 30-day recovery partially offset the devastating 99.84% annual decline, but this volatility pattern demands cautious portfolio positioning and strict risk management disciplines.

CGN Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio), use dollar-cost averaging over 3-6 months to establish positions gradually, and focus on understanding the creator economy narrative before increasing exposure

✅ Experienced Investors: Deploy 3-8% allocations with defined entry/exit strategies based on technical levels, maintain hedging positions in stablecoins, and consider swing trading opportunities during high-volume periods

✅ Institutional Investors: Conduct deep-dive technical due diligence on the Cygnus LVS infrastructure, evaluate team credentials and development progress, structure positions with appropriate risk management frameworks, and potentially negotiate OTC pricing for larger allocations

CGN Trading Participation Methods

- On Gate.com: Trade CGN directly through Gate.com's spot trading platform with competitive fees, advanced charting tools, and integrated wallets for seamless execution

- DCA Programs: Utilize Gate.com's automated investment features to establish disciplined, recurring purchase schedules that reduce timing risk

- Staking and Rewards: Monitor for any yield-generating opportunities or incentive programs that Gate.com may offer for CGN holders

Cryptocurrency investing carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is CGN and what is its current price?

CGN (Cygnus) is a cryptocurrency token currently priced at $0.003113, with a 24-hour trading volume of $2,847,199. The token has experienced minor price fluctuations, reflecting market dynamics in the crypto space.

Can CGN reach $1 in the next few years?

Yes, CGN has the potential to reach $1. With strong fundamentals and favorable market conditions, this target is achievable within the next few years. However, timing and market dynamics will play crucial roles in determining when this milestone is reached.

What factors could affect CGN price prediction for 2025?

Whale activity, market sentiment, and overall cryptocurrency market performance significantly influence CGN price prediction for 2025. Large holders can trigger substantial price movements. Regulatory developments, adoption rates, and macroeconomic conditions also play crucial roles in price trajectory.

What is the total supply and market cap of CGN token?

CGN has a total supply of 2,299,821,922 tokens with a current market cap of $6,986,859, trading at approximately $0.0030 per token.

Greater Fool Theory Explained: Buying for the Next Buyer, Not Value

2025 BOXPrice Prediction: Analyzing Market Trends and Future Valuation of BOX Token in the Crypto Ecosystem

2025 ZTX Price Prediction: Bullish Outlook as Adoption and Technology Advancements Drive Growth

2025 RSS3 Price Prediction: Navigating the Future of Decentralized Social Networks and Their Token Values

2025 SQR Price Prediction: Analyzing Market Trends and Expert Forecasts for Potential Growth

2025 APRS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Latest Updates and Insights on PI Network Exchange Listing

Community Backlash Over Token Locking Policies

Earn Cryptocurrencies with Ease: A Guide to Bitcoin Mining on Mobile Devices

What is NAKA: A Comprehensive Guide to Understanding the Emerging Cryptocurrency and Blockchain Platform

What is PLAYSOLANA: A Comprehensive Guide to the Revolutionary Gaming Platform on Solana Blockchain