2025 CLND Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: Market Position and Investment Value of CLND

Colend (CLND), the premier decentralized lending protocol on Core Chain, represents a significant innovation in the Bitcoin DeFi ecosystem. Since its launch in November 2024, Colend has established itself as a key player in the BTCFi sector, which is transforming Bitcoin into a productive asset. As of January 5, 2026, CLND maintains a market capitalization of $63,599.99 with a circulating supply of 3,676,300 tokens, trading at $0.0173 per token. This protocol, powered by its unique ve(3,3) governance model, is reshaping how users engage with Bitcoin through lending and staking mechanisms while supporting long-term network security.

This article will provide a comprehensive analysis of CLND's price movements and market trajectory for 2026, incorporating historical performance data, market supply-demand dynamics, and ecosystem development factors. By examining recent price trends—including a 16.78% increase over the past seven days and a 9.35% gain over 24 hours—alongside broader market conditions, we aim to deliver professional price forecasts and actionable investment strategies for market participants interested in this emerging BTCFi protocol.

Colend (CLND) Market Analysis Report

I. CLND Price History Review and Current Market Status

CLND Historical Price Evolution

- November 2024: CLND reached its all-time high (ATH) of $0.33999 on November 30, 2024, marking the peak of the token's market performance.

- December 2024 to January 2025: The token experienced a significant decline, falling from its peak toward lower price levels, representing a substantial correction phase.

- December 2025: CLND reached its all-time low (ATL) of $0.01254 on December 3, 2025, marking the lowest point in the token's trading history. This represents a decline of approximately 96.31% from the all-time high.

CLND Current Market Position

As of January 5, 2026, CLND is trading at $0.0173, positioned at ranking #5,437 across the cryptocurrency market. The token demonstrates recent upward momentum with a 24-hour price increase of 9.35%, rising from a 24-hour low of $0.01481 to a high of $0.02029.

The current market cap stands at $63,599.99 with a fully diluted valuation of $1,730,000.00, representing a market dominance of 0.000052%. The circulating supply is 3,676,300 CLND tokens out of a total maximum supply of 100,000,000 tokens, with the circulating supply representing 3.6763% of total supply.

Trading activity shows a 24-hour volume of $12,667.57, with the token currently held by 4,875 addresses. Over the longer term, CLND has declined 91.05% over the past year, reflecting the significant price correction from its peak valuation.

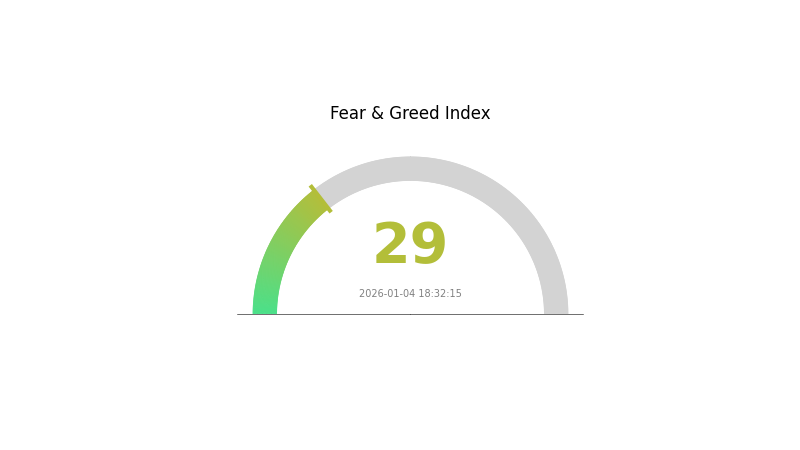

The current market sentiment registers as fearful, with a VIX reading of 29 as of January 4, 2026.

View current CLND market price

CLND Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing significant fear sentiment with the Fear and Greed Index reading at 29, indicating heightened market anxiety. This fear-driven environment typically reflects investor concerns about price volatility and market uncertainties. During such periods, risk-averse investors often adopt cautious strategies, while contrarian traders may view this as a potential buying opportunity. Market participants should remain vigilant, conduct thorough due diligence, and consider diversifying their portfolios. On Gate.com, you can monitor real-time market sentiment indicators to make more informed investment decisions.

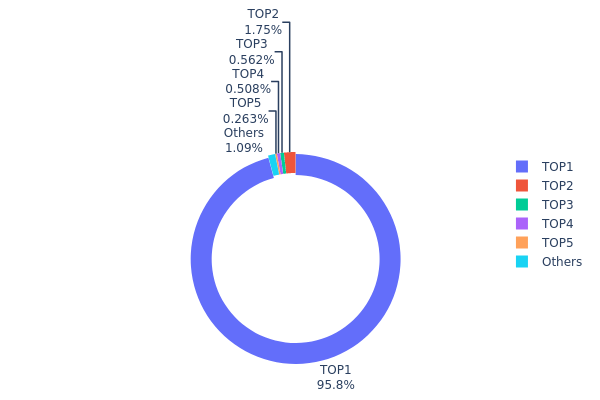

CLND Holdings Distribution

The address holding distribution represents the concentration of CLND tokens across blockchain addresses, providing critical insights into tokenomics structure and potential market dynamics. By analyzing the top holders and their respective percentages, we can assess the degree of decentralization and the vulnerability of the token to potential price manipulation or coordinated selling pressure.

The current CLND distribution exhibits severe concentration characteristics, with the top address commanding 95.82% of all circulating tokens. This extreme centralization presents a significant structural concern, as a single entity controls nearly the entire token supply. The remaining supply is fragmented across four other notable addresses holding between 0.26% and 1.75%, followed by dispersed smaller holders comprising 1.1% of the total supply. This distribution pattern indicates that decision-making power and price discovery mechanisms are heavily dependent on the actions of a single dominant stakeholder.

The highly concentrated holding structure creates substantial risks for market integrity and price stability. With over 95% of tokens controlled by one address, the potential for sudden liquidity events, large-scale liquidations, or coordinated exits could trigger significant price volatility. The minimal decentralization also suggests limited organic market participation, where price discovery occurs primarily through the intentions and actions of the principal holder rather than through competitive market forces. This concentration level is indicative of an early-stage or founder-controlled project, where token distribution has not yet achieved sufficient decentralization to establish robust market microstructure.

Access the latest CLND holdings data on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd34b...eec6ce | 95824.66K | 95.82% |

| 2 | 0xbff5...e9e9b8 | 1749.55K | 1.75% |

| 3 | 0x4b35...fff4b5 | 562.26K | 0.56% |

| 4 | 0x574b...671c82 | 507.75K | 0.51% |

| 5 | 0xf6a5...2cc22d | 263.20K | 0.26% |

| - | Others | 1092.57K | 1.1% |

Core Factors Influencing CLND's Future Price

Supply Mechanism

-

Staking Rewards: CLND implements a staking pool mechanism where users can stake their tokens in CLND staking pools to earn mining rewards. This supply mechanism affects the circulating supply dynamics and token availability in the market.

-

Current Impact: The staking reward system influences price movements through increased token distribution, which can create selling pressure as users realize rewards, while simultaneously incentivizing long-term holding through yield generation.

Market Demand and Trends

-

Market Sentiment: CLND's future price is primarily influenced by overall cryptocurrency market demand and trends. As the broader digital asset market fluctuates, investor sentiment directly impacts CLND's valuation.

-

Project Development: Ongoing development updates and project announcements play a significant role in determining price movements. New features, partnerships, or ecosystem expansions can drive renewed interest and price appreciation.

-

Regulatory Environment: Changes in cryptocurrency regulations can substantially impact CLND's value. Regulatory clarity or restrictions imposed by authorities can either bolster confidence or create downward pressure on the token's price.

Three、2026-2031 CLND Price Forecast

2026 Outlook

- Conservative Forecast: $0.01217 - $0.01816

- Base Case Forecast: $0.01816

- Optimistic Forecast: $0.02216 (requires sustained market recovery and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with incremental growth trajectory, potentially entering early expansion cycle by late 2028.

- Price Range Prediction:

- 2027: $0.01693 - $0.02842

- 2028: $0.01652 - $0.03109

- 2029: $0.01495 - $0.03821

- Key Catalysts: Protocol upgrades and feature releases, increased institutional adoption, growing ecosystem partnerships, and overall market sentiment improvement toward mid-tier altcoins.

2030-2031 Long-term Outlook

- Base Case: $0.02735 - $0.04514 (assumes steady adoption growth and stable macroeconomic conditions)

- Optimistic Case: $0.03295 - $0.04514 (assumes accelerated network utility and expanded market penetration)

- Transformative Case: $0.04514 - $0.04686 (assumes breakthrough adoption milestones and major ecosystem catalyst events)

Note: Price predictions are subject to market volatility and macroeconomic factors. For trading and investment decisions, please conduct thorough due diligence and consider consulting on Gate.com or other official market data sources.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.02216 | 0.01816 | 0.01217 | 4 |

| 2027 | 0.02842 | 0.02016 | 0.01693 | 16 |

| 2028 | 0.03109 | 0.02429 | 0.01652 | 40 |

| 2029 | 0.03821 | 0.02769 | 0.01495 | 60 |

| 2030 | 0.04514 | 0.03295 | 0.02735 | 90 |

| 2031 | 0.04686 | 0.03905 | 0.02655 | 125 |

Colend (CLND) Professional Investment Analysis Report

IV. CLND Professional Investment Strategy and Risk Management

CLND Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Bitcoin advocates and BTCFi believers with medium to long-term investment horizons; investors seeking exposure to Core Chain's growing ecosystem

-

Operational Recommendations:

- Accumulate CLND during market downturns, particularly when prices fall below the 24-hour low range, as this provides better entry points for long-term value accumulation

- Participate in the ve(3,3) governance model by staking CLND to gain influence over reward distribution and earn governance rewards

- Hold positions through market volatility cycles, considering the asset's historical perspective: currently trading at $0.0173 against an all-time high of $0.33999 (achieved on 2024-11-30), suggesting potential recovery phases in a maturing market

-

Storage Solution: Utilize Gate.com's secure wallet infrastructure or maintain custody through hardware solutions with proper key management practices. For frequent traders, Gate.com's exchange wallet provides convenient access with institutional-grade security measures.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- 24-hour volatility tracking: Monitor the 24-hour price range ($0.01481 - $0.02029) to identify support and resistance levels; utilize the current 9.35% 24-hour gain as a reference point for momentum analysis

- Multi-timeframe momentum analysis: Track the 1-hour (7.79%), 7-day (16.78%), and 30-day (3.53%) performance metrics to identify emerging trends and validate trading signals across different timeframes

-

Swing Trading Key Points:

- Execute buy positions near support levels established at the 24-hour low ($0.01481) and accumulate on dips below the 7-day moving average

- Set take-profit targets at 15-25% gains given the recent volatility patterns, with strict stop-loss orders positioned 8-12% below entry prices

CLND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum, positioning CLND as a speculative hedge rather than core holdings

- Active Investors: 3-8% portfolio allocation, allowing for meaningful exposure while maintaining diversification across multiple BTCFi and blockchain assets

- Professional Investors: 5-15% allocation within dedicated cryptocurrency portfolios, with systematic rebalancing strategies and derivative hedging tools

(2) Risk Hedging Solutions

- Portfolio diversification strategy: Combine CLND holdings with other established cryptocurrencies and blockchain infrastructure assets to reduce concentration risk; ensure BTCFi exposure represents no more than 15-20% of total crypto holdings

- Dollar-cost averaging approach: Execute periodic purchases at fixed intervals regardless of price movements, mitigating timing risk and reducing the impact of short-term volatility

(3) Secure Storage Solutions

- Hot wallet option: Gate.com's web and mobile wallet provides convenient access for active traders with enterprise-level security protocols and multi-signature verification

- Cold storage approach: For long-term holders, maintain significant CLND positions in hardware wallets with air-gapped security measures and multi-signature recovery protocols

- Critical Security Considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify official links before accessing wallet platforms; regularly audit transaction histories for unauthorized activity; consider graduated withdrawal strategies to minimize exposure during security audits

V. Potential Risks and Challenges for CLND

CLND Market Risks

- High volatility and price decline: The token has experienced a severe 91.05% decline over the past year, currently valued at $0.0173 against a historical high of $0.33999; this substantial drawdown reflects market skepticism and reduced investor confidence, creating risk of further depreciation

- Low liquidity and limited market depth: With only $12,667.57 in 24-hour trading volume and minimal circulation supply of 3,676,300 tokens against a 100-million total supply, the token exhibits thin order books that can result in significant price slippage during larger transactions

- Concentration and market cap concerns: Market capitalization of only $63,599.99 with 4,875 token holders indicates extreme concentration risk; large holders possess disproportionate influence over price movements and project direction

CLND Regulatory Risks

- BTCFi regulatory uncertainty: As the BTCFi sector develops, regulatory frameworks remain unclear across major jurisdictions; potential restrictions on Bitcoin derivative products or lending protocols could negatively impact Colend's operational capacity

- Compliance challenges on Core Chain: Regulatory status of Core Chain and its interactions with major jurisdictions remains evolving; changes in sidechain classification or security requirements could impose operational constraints

- Governance token classification: Regulatory authorities may reclassify CLND as a security rather than utility token, triggering compliance obligations and potentially restricting trading on certain platforms

CLND Technology Risks

- Core Chain dependency: Colend's entire operational framework relies on Core Chain's stability and security; any significant vulnerabilities, exploits, or network outages would directly impact protocol functionality

- Smart contract vulnerabilities: DeFi lending protocols face inherent smart contract risks; code vulnerabilities or unexpected edge cases could result in capital loss or protocol failures

- Market adoption risk: Sustained growth depends on achieving meaningful transaction volume and user adoption; failure to compete with established lending protocols could result in declining relevance and reduced tokenomics sustainability

VI. Conclusions and Action Recommendations

CLND Investment Value Assessment

Colend operates in the emerging BTCFi sector, which currently represents less than 1% of total cryptocurrency market capitalization, indicating substantial long-term growth potential. The protocol's distinctive ve(3,3) governance model provides users with meaningful influence over reward distribution, differentiating it from competitors. However, CLND's current valuation reflects market skepticism following a 91.05% yearly decline. The token's extreme concentration (4,875 holders), limited liquidity ($12,667.57 daily volume), and minimal market capitalization ($63,599.99) present significant volatility risks alongside corresponding opportunity for recovery. Investors must carefully evaluate whether BTCFi market expansion and Colend's competitive positioning justify exposure to these substantial short-term risks.

CLND Investment Recommendations

✅ Beginners: Start with minimal allocations (1-2% of crypto portfolio) through dollar-cost averaging on Gate.com; focus on understanding BTCFi fundamentals and governance mechanisms before increasing position sizes

✅ Experienced Investors: Consider 3-8% portfolio positions combined with comprehensive risk management strategies; actively monitor ve(3,3) governance opportunities and BTCFi market developments; maintain strict stop-loss discipline given historical volatility

✅ Institutional Investors: Evaluate CLND within dedicated BTCFi strategy allocations with thorough due diligence on protocol economics and Core Chain security; implement systematic rebalancing and hedging protocols; engage directly with Colend governance to assess project roadmap and competitive positioning

CLND Trading and Participation Methods

- Exchange trading: Execute spot trading on Gate.com with real-time price feeds, comprehensive charting tools, and institutional-grade execution infrastructure; utilize limit orders to manage entry and exit prices precisely

- Governance participation: Stake CLND through ve(3,3) mechanism to earn governance rewards and influence protocol parameter decisions; this approach transforms passive holdings into active protocol participation

- Core Chain ecosystem engagement: Participate in Colend's lending and borrowing functions as protocol usage matures; this provides yield generation opportunities beyond token price appreciation

Cryptocurrency investments carry extremely high risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and financial situation before making decisions. Consult professional financial advisors for personalized guidance. Never invest funds you cannot afford to lose.

FAQ

What is the historical price performance of CLND token?

CLND reached an all-time high of ¥1.70 on June 25, 2025, and an all-time low of ¥0.09169 on December 3, 2025. As of January 4, 2026, CLND trades between ¥0.09939 and ¥0.1067, representing significant volatility in its market cycle.

What are the main factors affecting CLND price?

CLND price is primarily influenced by market demand and trading volume, project development progress, ecosystem utility, regulatory environment, and overall cryptocurrency market sentiment. Token supply dynamics and investor confidence in the project's roadmap also play significant roles in price movements.

How to predict CLND price? What are the analysis methods?

To predict CLND price, use technical indicators like RSI, Moving Averages, and MACD to analyze trends. Monitor trading volume and market sentiment for comprehensive forecasting.

CLND代币的未来发展前景和价格潜力如何?

CLND代币通过私募融资筹集2900万美元,初始价格约0.088美元。凭借强劲市场需求和独特项目优势,价格潜力巨大,有望远超初始价格,前景看好。

What are the risks to pay attention to when investing in CLND tokens?

CLND token investments face market volatility risks, project development uncertainties, and regulatory changes. The project remains in early stages with evolving fundamentals. Investors should conduct thorough research before participating.

What are the advantages or disadvantages of CLND compared to similar tokens?

CLND offers decentralized lending and staking for Bitcoin holders with strong community support. Its niche focus in BTC DeFi provides competitive advantages, though regulatory uncertainties present challenges compared to established alternatives.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks