2025 CLORE Price Prediction: Expert Analysis and Market Forecast for Distributed Cloud Computing Token

Introduction: CLORE's Market Position and Investment Value

Clore.ai (CLORE) serves as an innovative GPU computing power marketplace that enables users to share and lease computational resources for AI training, rendering, and mining tasks. Since its launch in November 2022, the project has established itself as a community-driven platform offering accessible high-performance computing solutions. As of December 2025, CLORE maintains a market capitalization of approximately $4.33 million, with a circulating supply of around 625.47 million tokens, currently trading at $0.006878. This asset is increasingly playing a vital role in democratizing access to advanced computational resources through its secure managed services and incentive mechanisms like Clore Mining.

This article will comprehensively analyze CLORE's price trajectory and market dynamics, integrating historical performance data, supply-demand factors, ecosystem development, and macroeconomic conditions to provide investors with professional price insights and practical investment strategies for the period ahead.

CLORE Price History Review and Market Status

I. CLORE Price History Review and Current Market Situation

CLORE Historical Price Evolution Trajectory

Based on available data, CLORE has experienced significant price volatility since its launch:

- November 10, 2023: All-time low of $0.0046 was recorded during this period

- March 17, 2024: All-time high of $0.45 was achieved, representing a peak valuation period for the token

- December 24, 2025: Current trading period shows price consolidation with adjusted market positioning

CLORE Current Market Status

As of December 24, 2025, CLORE is trading at $0.006878, reflecting substantial depreciation from its historical peak of $0.45 recorded on March 17, 2024. This represents an approximate decline of 91.89% over the past year, indicating a significant bearish trend in the token's valuation.

Market Capitalization and Liquidity Metrics:

- Current Market Cap: $4,301,995.04

- Fully Diluted Valuation: $4,326,178.95

- 24-Hour Trading Volume: $49,229.05

- Circulating Supply: 625,471,800.30 CLORE (48.11% of max supply)

- Total Supply: 628,987,925.37 CLORE

- Maximum Supply: 1,300,000,000 CLORE

Short-Term Price Performance:

- 1-Hour Change: -0.27%

- 24-Hour Change: +0.99%

- 7-Day Change: -0.38%

- 30-Day Change: +4.27%

The token's 24-hour trading activity shows mild positive momentum of +0.99%, with the price range between $0.0067 and $0.007267 during the day. However, the broader trend remains pressured, with negative performance over weekly and yearly timeframes.

Market Sentiment:

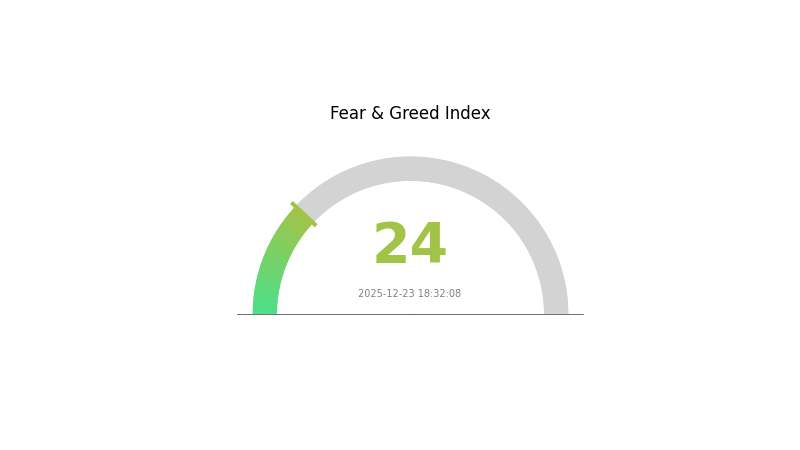

Current market sentiment reflects extreme fear conditions (VIX: 24, rated as "Extreme Fear"), which may be contributing to broader cryptocurrency market weakness affecting CLORE's price action.

Click to view current CLORE market price

CLORE Market Sentiment Index

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index plummeting to 24. This indicates severe market pessimism and heightened risk aversion among investors. During such periods, volatility typically increases as panic selling dominates trading activities. However, extreme fear often presents contrarian opportunities for long-term investors seeking attractive entry points. Monitor key support levels carefully and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment and make informed trading decisions based on comprehensive market data.

CLORE Holdings Distribution

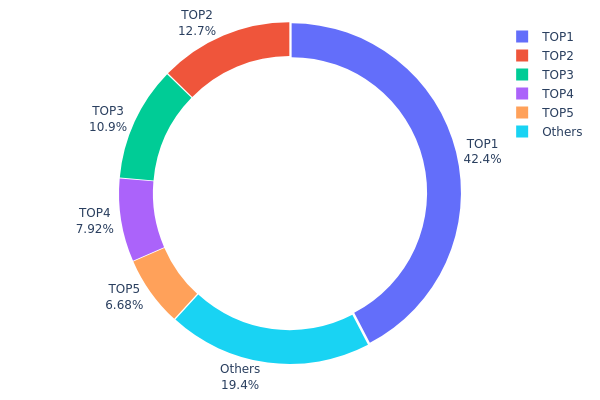

The address holding distribution represents the concentration of CLORE tokens across distinct wallet addresses on the blockchain, serving as a critical metric for assessing network decentralization and potential concentration risks. This distribution snapshot reveals the proportional allocation of total token supply among the top holders and the remaining address base, providing insight into whether token ownership is distributed across a diverse ecosystem or concentrated among a limited number of entities.

Current data demonstrates significant concentration within CLORE's holder base. The top five addresses control 80.52% of the total token supply, with the leading address alone commanding 42.35% of all circulating tokens. This level of dominance by a single entity raises substantive concerns regarding centralization. The second and third largest holders maintain positions of 12.71% and 10.88% respectively, further reinforcing the concentration narrative. Only 19.48% of tokens remain distributed among all other addresses, indicating a highly fragmented long-tail distribution that collectively represents minority stakeholder interests.

Such pronounced concentration creates identifiable market structure vulnerabilities. The substantial holdings by top-tier addresses generate potential for significant price volatility should these entities execute large transactions, whether through strategic positioning or forced liquidation events. The concentration ratio suggests limited market resilience to large sell pressures and indicates that price discovery mechanisms may be materially influenced by the investment decisions of a narrow holder cohort. This distribution pattern reflects a relatively immature decentralization profile, with governance and market dynamics substantially influenced by concentrated token ownership rather than distributed stakeholder consensus.

View current CLORE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7e12...9c775a | 550629.77K | 42.35% |

| 2 | 0x1ffb...2d49c7 | 165292.27K | 12.71% |

| 3 | 0xc4c9...68cbb0 | 141490.64K | 10.88% |

| 4 | 0x0d07...b492fe | 102942.40K | 7.91% |

| 5 | 0xd903...90d14f | 86816.25K | 6.67% |

| - | Others | 252828.66K | 19.48% |

Core Factors Influencing CLORE's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global monetary conditions play a significant role in CLORE's price trajectory. According to IMF projections, global inflation is expected to decline from 6.8% in 2023 to 4.5% in 2025, with central banks adjusting policy rates accordingly. These macroeconomic shifts, including changes in interest rates and monetary policy stance, directly influence investor sentiment and capital allocation toward cryptocurrencies like CLORE.

-

Market Sentiment Dynamics: Market sentiment serves as a critical driver of CLORE price movements. Investor confidence and emotion, driven by news, social media discussions, and overall market trends, can significantly amplify or dampen price volatility. During periods of optimistic sentiment and "greed," bullish predictions may be reinforced, while negative news or fear can lead to bearish outlooks. Market sentiment analysis, combined with on-chain indicators, remains a key tool for predicting CLORE price movements in both the near and medium term.

-

Regulatory Environment: Regulatory changes, including ETF approvals and government policy developments, constitute important factors affecting CLORE's valuation. Changes in regulatory frameworks across different jurisdictions can either facilitate or restrict institutional adoption and trading activity.

-

Supply and Demand Dynamics: The fundamental interplay between supply and demand in the market directly impacts CLORE's price discovery process. Shifts in these dynamics, influenced by trading volume, investor interest, and market structure, contribute to price volatility and long-term trends.

Institutional Adoption and Market Structure

- Institutional Adoption: Increased institutional adoption rates represent a key catalyst for CLORE's future price appreciation. As more institutional investors enter the market and recognize the value proposition of CLORE and the broader cryptocurrency ecosystem, demand and price support may strengthen. Continued institutional demand, similar to ETF-related inflows seen in other crypto assets, could significantly impact CLORE's medium to long-term price trajectory.

III. 2025-2030 CLORE Price Forecast

2025 Outlook

- Conservative Forecast: $0.00365 - $0.00688

- Base Case Forecast: $0.00688

- Optimistic Forecast: $0.00853 (requiring sustained ecosystem development and increased adoption)

2026-2028 Medium-term Perspective

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.00408 - $0.0104 (12% upside potential)

- 2027: $0.0077 - $0.01014 (31% cumulative growth)

- 2028: $0.00806 - $0.01161 (39% cumulative growth)

- Key Catalysts: Platform expansion, strategic partnerships, technological upgrades, and improved market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00594 - $0.0123 (54% growth by 2029, with stabilization expected)

- Optimistic Scenario: $0.0123 - $0.01230 (54% appreciation achieved through mainstream institutional adoption)

- Transformational Scenario: $0.01661 (66% growth by 2030 under conditions of breakthrough technological innovations, significant market cap expansion, and robust community engagement)

- December 24, 2025: CLORE remains in early price discovery phase (baseline reference point for trajectory analysis)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00853 | 0.00688 | 0.00365 | 0 |

| 2026 | 0.0104 | 0.00771 | 0.00408 | 12 |

| 2027 | 0.01014 | 0.00906 | 0.0077 | 31 |

| 2028 | 0.01161 | 0.0096 | 0.00806 | 39 |

| 2029 | 0.0123 | 0.01061 | 0.00594 | 54 |

| 2030 | 0.01661 | 0.01146 | 0.00664 | 66 |

Clore.ai (CLORE) Professional Investment Strategy and Risk Management Report

IV. CLORE Professional Investment Strategy and Risk Management

CLORE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in emerging GPU computing infrastructure projects with a long-term outlook

- Operational suggestions:

- Accumulate CLORE tokens during price dips below the 30-day moving average, targeting positions that align with your risk tolerance

- Hold through market cycles to benefit from potential growth in the GPU sharing and AI computation marketplace

- Reinvest any rewards from community incentive programs like Clore Mining to compound returns

(2) Active Trading Strategy

- Price Action Monitoring:

- Track 24-hour price movements: Current 24h change of 0.99% indicates moderate volatility; use this as a baseline for entry/exit signals

- Monitor 7-day and 30-day trends: The -0.38% 7D change contrasted with 4.27% 30D positive change suggests ongoing consolidation

- Wave Trading Key Points:

- Identify resistance levels near the historical high of $0.45 and support near recent lows around $0.0067

- Execute position sizing based on volatility: Current daily trading volume of $49,229 suggests limited liquidity; use smaller position sizes to avoid slippage

CLORE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio allocation

- Aggressive investors: 3-8% of portfolio allocation

- Professional investors: 5-15% of portfolio allocation with structured hedging strategies

(2) Risk Hedging Solutions

- Volatility management: Implement stop-loss orders at 15-20% below entry points given the token's historical volatility (down 91.89% over one year)

- Portfolio diversification: Balance CLORE positions with established layer-1 cryptocurrencies to mitigate concentration risk

(3) Secure Storage Solutions

- Hardware wallet option: For amounts exceeding $1,000, utilize hardware wallets for cold storage to eliminate smart contract risks

- Exchange custody: For active traders, maintain working capital on Gate.com with two-factor authentication and withdrawal whitelisting enabled

- Security considerations: Never share private keys; verify contract addresses through official channels (https://clore.ai) before transactions; be cautious of phishing attempts given the project's smaller market cap

V. CLORE Potential Risks and Challenges

CLORE Market Risk

- Extreme historical volatility: The token has declined 91.89% over the past year from historical highs, indicating severe price instability and potential for further downside

- Limited liquidity: With only 5 exchanges listing CLORE and 24-hour volume of $49,229, the token faces liquidity constraints that can amplify price movements during larger trades

- Market sentiment deterioration: The token's 214 unique holders and small market cap of $4.3 million suggest concentrated ownership and vulnerability to whale movements

CLORE Regulatory Risk

- Evolving regulatory frameworks: GPU rental and AI computation services may face regulatory scrutiny as governments clarify classification and taxation of distributed computing rewards

- Compliance uncertainty: Different jurisdictions may treat mining rewards and rental income differently, creating tax and legal compliance challenges for users

- Securities classification risk: Depending on token utility classification, regulatory bodies could impose restrictions on token trading or distribution

CLORE Technology Risk

- Smart contract vulnerabilities: The Ethereum-based token contract (0xe60201989b8628f43dc0605f585a72bcf1f1e977) carries inherent risks of undiscovered bugs or exploits

- GPU network reliability: The success of the platform depends on maintaining consistent availability and performance of distributed GPU resources

- Market adoption challenges: Competition from established cloud computing providers and infrastructure protocols may limit the growth of the GPU sharing marketplace

VI. Conclusion and Action Recommendations

CLORE Investment Value Assessment

Clore.ai represents an emerging infrastructure play targeting the GPU computing marketplace with community-driven incentives. However, the project faces significant challenges: an 91.89% one-year decline, limited liquidity with only $49K daily volume, and a small market cap of $4.3 million indicate high volatility and speculative risk. The innovative GPU-sharing concept has merit, but execution risks, competitive pressures, and regulatory uncertainty present substantial headwinds. Investors should view this as a high-risk, speculative opportunity rather than a core holding.

CLORE Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) on Gate.com; use this as an educational allocation to understand emerging infrastructure projects; prioritize understanding the platform fundamentals before expanding exposure

✅ Experienced investors: Consider position-building strategies during multi-month downtrends; maintain strict risk management with 15-20% stop-losses; use technical analysis to identify oversold conditions as potential accumulation points

✅ Institutional investors: Conduct thorough due diligence on GPU supply chain integration and competitive positioning; structure positions with clear exit criteria tied to adoption milestones; consider the concentrated holder base when planning position sizes

CLORE Trading Participation Methods

- Purchase on Gate.com: Access CLORE token trading through Gate.com's spot market; ensure proper account security and withdrawal whitelist configuration

- Direct swap participation: Use token swap features for position entry/exit during high volatility periods to minimize slippage impact

- Yield farming alternatives: Explore community incentive programs like Clore Mining directly through official channels to accumulate tokens while maintaining portfolio stability

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors must assess their individual risk tolerance and financial situation before making decisions. Strongly recommended to consult with professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the clore coin worth?

CLORE is currently trading at $0.006946, with a 24-hour price increase of 0.65%. The daily trading volume stands at $2,195,406, reflecting active market participation and liquidity.

What is CLORE token and what does it do?

CLORE token is the foundation of the CLORE.AI system, providing stability and income to platform members. It powers the ecosystem's operations and reward mechanisms, serving as the core utility token for the platform.

What factors influence CLORE price prediction?

CLORE price prediction is influenced by regulatory environment, investor sentiment, market dynamics, trading volume, and overall cryptocurrency market trends. These elements directly impact its future value trajectory.

Is CLORE a good investment for the future?

Yes, CLORE shows strong investment potential with price predictions reaching $0.01008 by 2026. Growing adoption in decentralized computing and strong community support indicate promising long-term prospects for early investors.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

What is Web3 Marketing: Everything You Need to Know

Satoshi Nakamoto Bitcoin Founder Technology and Mystery

A Complete Guide to the 1inch Swap

Free Money for App Registration: Crypto Platform Welcome Bonuses

How to Choose a Crypto Wallet: Options Overview and Test