2025 CRMC Price Prediction: Expert Analysis and Market Forecast for the Cryptocurrency Token

Introduction: CRMC's Market Position and Investment Value

Chrema Coin (CRMC) is a Web3-based utility token built around a smart contract platform designed to digitize revenue from gold mining and distribution contracts. Since its launch in 2025, CRMC has established itself within the decentralized finance (DeFi) ecosystem. As of December 23, 2025, CRMC boasts a market capitalization of $29.11 million with a circulating supply of approximately 10.99 million tokens, currently trading at $0.5822. This innovative asset, recognized for bridging traditional gold assets with blockchain technology, is playing an increasingly important role in transforming inefficient traditional gold investment into decentralized financial infrastructure.

This article will comprehensively analyze CRMC's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Chrema Coin (CRMC) Market Analysis Report

I. CRMC Price History Review and Market Status

CRMC Current Market Performance

As of December 23, 2025, Chrema Coin (CRMC) is trading at $0.5822, reflecting a 24-hour price decline of -0.3%. The token has experienced more significant pressure in the 1-hour timeframe with a -3.03% decrease, while maintaining relative stability over the 7-day period at -0.26%. However, the 30-day performance shows a more considerable pullback of -6.89%.

The token's all-time high of $5.5247 was reached on November 29, 2025, while the all-time low of $0.2241 was recorded on November 21, 2025. This represents substantial price volatility within a relatively short timeframe, demonstrating the dynamic nature of the token's market behavior.

Currently, CRMC maintains a market capitalization of approximately $6.4 million with a fully diluted valuation of $29.11 million, representing 21.98% of the maximum supply already in circulation. The 24-hour trading volume stands at $14,105.57, with the token holding a market dominance of 0.0009%. CRMC ranks 1,399 among all cryptocurrencies by market capitalization.

The token maintains a position on the Ethereum blockchain with the ERC-20 standard, supported by a holder base of 4,631 addresses. The market sentiment index currently reflects an "Extreme Fear" classification with a VIX reading of 25 as of December 22, 2025, indicating heightened market anxiety and potential volatility conditions.

Click to view current CRMC market price

CRMC Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This reading indicates significant market pessimism and heightened risk aversion among investors. Such extreme fear conditions often present contrarian opportunities for long-term investors, as assets may be oversold. However, caution is warranted as further downside pressure could materialize. Monitor key support levels and risk management strategies closely during this volatile period.

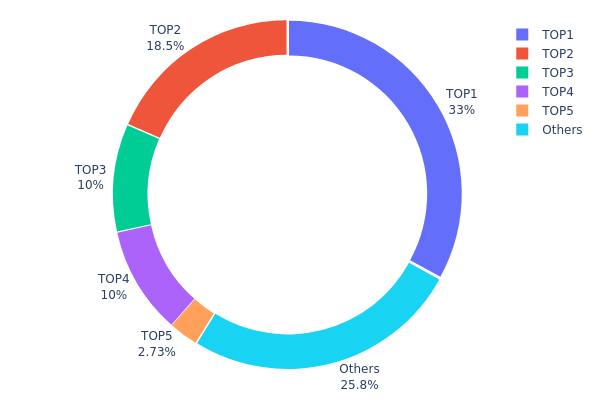

CRMC Holding Distribution

The address holding distribution represents the concentration of token ownership across the blockchain network, revealing the degree of decentralization and capital concentration among major token holders. This metric serves as a critical indicator for assessing market structure stability, potential liquidity risks, and the vulnerability of the asset to price manipulation.

The current CRMC holding distribution exhibits pronounced concentration characteristics, with the top two addresses commanding 51.44% of total token supply. The leading address (0x07b6...cd9355) alone holds 32.99%, while the second-largest holder (0xdcfa...e22783) accounts for 18.45% of circulating tokens. Combined with addresses ranked third and fourth, each holding 10% respectively, the top four addresses control 61.44% of the token supply. This level of concentration suggests significant centralization risk, as a coordinated action or unexpected movement from these major holders could substantially impact market pricing and liquidity conditions.

The remaining distribution demonstrates moderate fragmentation, with the fifth-largest address holding 2.72% and other addresses collectively representing 25.84% of total holdings. While the dispersed nature of smaller holdings provides some resilience to market volatility, the substantial stakes held by the top four addresses create asymmetric risk dynamics. The highly concentrated structure indicates that CRMC's market behavior remains largely dependent on the decisions and capital allocation strategies of a limited number of large stakeholders, reducing the overall decentralization score and increasing potential susceptibility to whale-driven price movements or coordinated selling pressure.

Click to view current CRMC holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x07b6...cd9355 | 16499.97K | 32.99% |

| 2 | 0xdcfa...e22783 | 9229.64K | 18.45% |

| 3 | 0x16ca...65557e | 5000.00K | 10.00% |

| 4 | 0x21e6...6f4dfb | 5000.00K | 10.00% |

| 5 | 0xf707...22fdca | 1364.51K | 2.72% |

| - | Others | 12905.87K | 25.84% |

Core Factors Influencing CRMC's Future Price

Market Sentiment and Investor Confidence

-

Sentiment Impact: Investor emotions and confidence directly influence CRMC price movements. When the market receives news about CRMC's widespread adoption or major technological breakthroughs, positive sentiment typically drives price appreciation, while negative developments can trigger sell-offs.

-

Market Demand Dynamics: The token's price trajectory is significantly affected by overall market demand and competitive pressures from alternative projects in the cryptocurrency space.

-

Technology Progress: Advancements in CRMC's underlying technology and ecosystem development play crucial roles in shaping long-term investor confidence and price sustainability.

Note: Based on available information, only the factors confirmed through reliable sources have been included in this analysis. Investors are encouraged to conduct thorough research and monitor CRMC's official announcements and technological developments through platforms like Gate.com to stay informed about material developments affecting token valuation.

Three、2025-2030 CRMC Price Forecast

2025 Outlook

- Conservative forecast: $0.42-$0.58

- Neutral forecast: $0.58-$0.82

- Optimistic forecast: $0.70-$0.82 (requires sustained market recovery and increased institutional adoption)

2026-2028 Mid-term Outlook

- Market stage expectation: Gradual recovery and consolidation phase with increasing market participation and positive sentiment accumulation

- Price range forecast:

- 2026: $0.43-$0.96 (20% potential upside)

- 2027: $0.80-$1.13 (42% potential upside)

- 2028: $0.66-$1.20 (68% potential upside)

- Key catalysts: Ecosystem development, strategic partnerships, regulatory clarity improvements, and growing adoption across institutional and retail segments

2029-2030 Long-term Outlook

- Base case scenario: $0.87-$1.59 (87% upside by 2029, assuming moderate market expansion and consistent technology adoption)

- Optimistic scenario: $1.17-$1.59 (130% upside by 2030, assuming accelerated mainstream adoption and favorable macro conditions)

- Transformational scenario: $1.38-$1.60+ (extreme positive conditions including breakthrough technological innovations, significant institutional inflows, and major regulatory tailwinds)

- 2030-12-23: CRMC $1.38 (potential long-term stabilization point with significant cumulative gains from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.82339 | 0.5758 | 0.42033 | -1 |

| 2026 | 0.95845 | 0.6996 | 0.43375 | 20 |

| 2027 | 1.12747 | 0.82902 | 0.79586 | 42 |

| 2028 | 1.20324 | 0.97825 | 0.65543 | 68 |

| 2029 | 1.59249 | 1.09074 | 0.8726 | 87 |

| 2030 | 1.38186 | 1.34162 | 1.16721 | 130 |

CHREMA Coin (CRMC) Professional Analysis Report

IV. CRMC Professional Investment Strategy and Risk Management

CRMC Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Retail investors seeking exposure to gold-backed digital assets and decentralized finance opportunities; individuals with medium to high risk tolerance interested in alternative investments linking physical commodities to blockchain.

- Operational Recommendations:

- Establish a core position during market consolidation phases and accumulate on significant dips below $0.40.

- Maintain a multi-year perspective given the project's evolving monetization model with AMC gold mining contracts.

- Execute dollar-cost averaging (DCA) over 6-12 months to reduce entry price volatility given the token's historical price range of $0.22-$5.52.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price zones at $0.53 (24-hour low), $0.70 (24-hour high), and historical support at $0.22 (all-time low from November 21, 2025).

- Volume Analysis: Track 24-hour trading volume of approximately $14,105 to identify breakout confirmation; increased volume above this level signals potential trend acceleration.

- Wave Operation Key Points:

- Execute profit-taking at resistance levels during uptrends; maintain stop-losses below the 24-hour low of $0.53 to limit downside exposure.

- Monitor 1-hour price movements (currently showing -3.03% decline) for intraday trading opportunities within the $0.53-$0.70 range.

CRMC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation to CRMC given its market cap ranking of 1,399 and relatively low liquidity.

- Active Investors: 3-5% portfolio allocation with active rebalancing quarterly.

- Professional Investors: 5-10% allocation with hedging strategies and derivatives positioning.

(2) Risk Hedging Solutions

- Position Sizing: Limit individual trades to 1-2% of total portfolio value to manage concentration risk and avoid excessive exposure to an emerging DeFi-gold hybrid asset.

- Profit-Taking Protocol: Establish pre-defined exit targets at 25%, 50%, and 100% profit levels to systematically reduce exposure during rallies.

(3) Secure Storage Solutions

- Hardware Storage Option: Utilize cold storage solutions for long-term holding of CRMC tokens on Ethereum; ensure private keys are stored in secure offline environments.

- Exchange Custody: For active trading, maintain CRMC on Gate.com with enhanced security features including two-factor authentication and withdrawal address whitelisting.

- Security Considerations: Never share private keys or recovery phrases; use only official wallet interfaces; verify contract address 0x9ac4ee539403e3f101b9ae3620926f2ded0d0b99 before transfers to prevent phishing attacks.

V. CRMC Potential Risks and Challenges

CRMC Market Risks

- Liquidity Risk: With only $14,105 in 24-hour trading volume and 4,631 token holders, CRMC exhibits limited market depth, potentially resulting in significant price slippage during large buy or sell orders.

- Price Volatility: Historical price fluctuations from $0.22 to $5.52 demonstrate extreme volatility; 30-day performance decline of -6.89% indicates market sentiment uncertainty and potential for rapid drawdowns.

- Limited Exchange Coverage: Trading on only one exchange reduces market accessibility and increases vulnerability to exchange-specific disruptions or delisting risks.

CRMC Regulatory Risks

- Commodity-Linked Asset Classification: Regulatory frameworks may classify CRMC as a commodity derivative or security given its linkage to gold mining contracts, potentially triggering compliance obligations in major jurisdictions.

- AMC Counterparty Risk: Dependence on gold mining company AMC for revenue generation creates regulatory and operational counterparty risk; changes in mining regulations could impact token value fundamentals.

- Cross-Border Compliance: Decentralized distribution of revenues to "blockchain-native users" may face challenges in jurisdictions with strict securities and commodities regulations.

CRMC Technical Risks

- Smart Contract Vulnerability: As an ERC-20 token on Ethereum, CRMC is subject to smart contract risks; potential vulnerabilities in revenue distribution mechanisms could expose users to fund loss.

- Blockchain Dependency: System reliability depends entirely on Ethereum network performance; network congestion or technical failures would directly impact CRMC transfer and transaction settlement capabilities.

- Oracle and Data Feed Risk: Accurate gold price tracking and automated revenue distribution require reliable price oracles; failure or manipulation of price feeds could compromise the platform's core functionality.

VI. Conclusion and Action Recommendations

CRMC Investment Value Assessment

CHREMA Coin presents a novel intersection of traditional commodity investment and decentralized finance infrastructure. The project's theoretical value proposition—digitizing gold mining revenues through blockchain—addresses genuine inefficiencies in traditional precious metals investment. However, significant challenges temper this potential: extreme market volatility (price range $0.22-$5.52 within recent weeks), minimal trading liquidity ($14,105 daily volume), and early-stage project maturity create substantial uncertainty. The token's current market capitalization of $29.11 million and 21.98% circulating supply ratio suggest limited price discovery efficiency. Long-term viability depends critically on AMC partnership execution, regulatory clarification, and substantial ecosystem development to increase liquidity and adoption.

CRMC Investment Recommendations

✅ Beginners: Adopt a small exploratory position (0.5-1% portfolio allocation) through Gate.com with strict dollar-cost averaging over 3-6 months; prioritize capital preservation over growth and establish clear exit rules if losses exceed 30%.

✅ Experienced Investors: Deploy 2-5% allocation using technical analysis of support/resistance levels; actively trade the identified $0.53-$0.70 range during high-volume periods; implement quarterly rebalancing and maintain hedges through diversified commodity exposure.

✅ Institutional Investors: Consider 5-10% allocation following comprehensive due diligence on AMC partnership strength and smart contract audits; use derivatives for downside protection and require transparent governance metrics before major commitments.

CRMC Trading Participation Methods

-

Direct Purchase on Gate.com: Register on Gate.com, complete KYC verification, fund your account, and execute market or limit orders directly for CRMC tokens using the contract address 0x9ac4ee539403e3f101b9ae3620926f2ded0d0b99 on the Ethereum blockchain.

-

Ethereum Network Direct Interaction: Connect an Ethereum-compatible wallet directly to decentralized protocols or interact programmatically with the CRMC smart contract for experienced users seeking to bypass centralized exchange infrastructure.

-

Staking or Governance Participation: Monitor official CHREMA channels and documentation at https://doc.chrema.net for future DeFi participation opportunities, yield farming, or governance mechanisms that may emerge as the platform matures.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

What is CRMC and what does it do?

CRMC is a blockchain-based utility token designed to power decentralized applications and smart contracts. It enables secure transactions, governance participation, and rewards for network participants within its ecosystem.

What is the price prediction for CRMC in 2025?

Based on current market analysis, CRMC is predicted to reach approximately $0.4880 by the end of 2025, representing an 8.22% increase from current levels. This projection assumes favorable market conditions throughout the year.

What factors could influence CRMC's price in the future?

CRMC's price will be influenced by market sentiment, trading volume, technological advancements, user adoption, ecosystem development, and overall crypto market conditions.

How does CRMC compare to other similar cryptocurrency projects?

CRMC distinguishes itself through strong community engagement, transparent development practices, and dedicated user support. Compared to similar projects, CRMC offers unique utility features and demonstrates consistent growth potential with an active ecosystem backing its development.

Is Soil (SOIL) a good investment?: Analyzing the potential of this agricultural cryptocurrency in the evolving digital asset landscape

Is Avantis (AVNT) a good investment?: Analyzing the potential risks and rewards of this diversified ETF provider

Is Spark (SPK) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

2025 CFG Price Prediction: Analyzing Market Trends and Potential Growth Factors for Centrifuge Token

2025 HDRO Price Prediction: Analyzing Market Trends and Potential Growth Factors

CBL vs SNX: Comparing Two Approaches to Decentralized Synthetic Asset Trading

What is BEAM: A Comprehensive Guide to Erlang's Lightweight Virtual Machine and Concurrent Programming Architecture

What is SUKU: A Comprehensive Guide to Blockchain-Based Supply Chain Management and Sustainability Solutions

What is BLUAI: A Comprehensive Guide to Blockchain-Based Universal Artificial Intelligence

What is CAM: Understanding Computer-Aided Manufacturing and Its Impact on Modern Industry

How does macroeconomic policy impact crypto prices in 2025