2025 CUDIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: CUDIS Market Position and Investment Value

CUDIS (CUDIS) is a pioneering longevity protocol designed to make health tracking, personalization, and rewards accessible to everyone. Aiming to extend health-span to 140 years, CUDIS integrates the CUDIS Ring, an AI-powered Longevity Hub, and a blockchain-driven Super App to give users full ownership of their health data and economic incentives for optimizing their biological health. As of December 2025, CUDIS has achieved a market capitalization of $8,021,475, with circulating supply of 247,500,000 tokens and a current price hovering around $0.03241. This innovative asset is establishing itself as a key player in the emerging intersection of health technology and blockchain-based incentive systems.

This article will provide a comprehensive analysis of CUDIS price trends from 2025 through 2030, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

CUDIS Price History Review and Market Analysis

I. CUDIS Price History Review and Market Status

CUDIS Historical Price Movement Trajectory

CUDIS reached its all-time high (ATH) of $0.31204 on November 4, 2025, representing a significant milestone in the token's price discovery phase. Subsequently, the token experienced a substantial correction, reaching its all-time low (ATL) of $0.02352 on December 1, 2025. This represents a sharp decline of approximately 92.48% from the peak, reflecting significant volatility in the token's valuation over a compressed timeframe.

CUDIS Current Market Status

As of December 22, 2025, CUDIS is trading at $0.03241, demonstrating recovery momentum from its recent lows. The token has appreciated 37.77% from its ATL established just three weeks prior. Over the past 24 hours, CUDIS has gained 18.28%, with intraday trading ranging between $0.02755 (24H low) and $0.03294 (24H high).

Key Market Metrics:

- Market Capitalization: $8,021,475 USD

- Fully Diluted Valuation (FDV): $32,410,000 USD

- Market Cap to FDV Ratio: 24.75%

- 24-Hour Trading Volume: $35,113.37 USD

- Circulating Supply: 247,500,000 CUDIS (24.75% of total supply)

- Total Supply: 1,000,000,000 CUDIS

- Holders: 18,976 addresses

- Market Dominance: 0.00099%

Price Performance Across Multiple Timeframes:

- 1-Hour Change: +8.01%

- 24-Hour Change: +18.28%

- 7-Day Change: +24.27%

- 30-Day Change: +11.79%

- 1-Year Change: -71.71%

The token is listed on 15 exchanges globally and maintains BEP-20 compatibility across multiple blockchains, including Binance Smart Chain (BSC) and Solana (SOL).

Click to view current CUDIS market price

CUDIS Market Sentiment Index

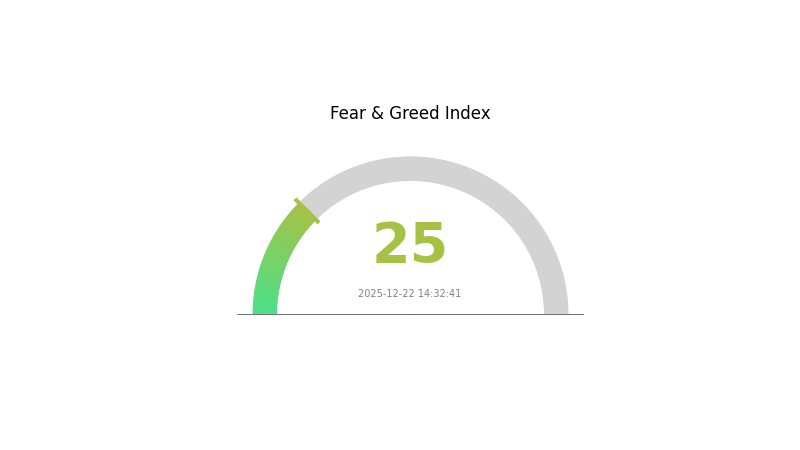

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the CUDIS index hitting 25. This indicates widespread investor anxiety and pessimism across the market. Such extreme readings often present contrarian opportunities, as excessive fear can signal potential bottom formations. However, investors should remain cautious and conduct thorough due diligence before making trading decisions. Consider dollar-cost averaging strategies rather than lump-sum investments during high-fear periods. Monitor market developments closely on Gate.com for real-time insights and trading opportunities.

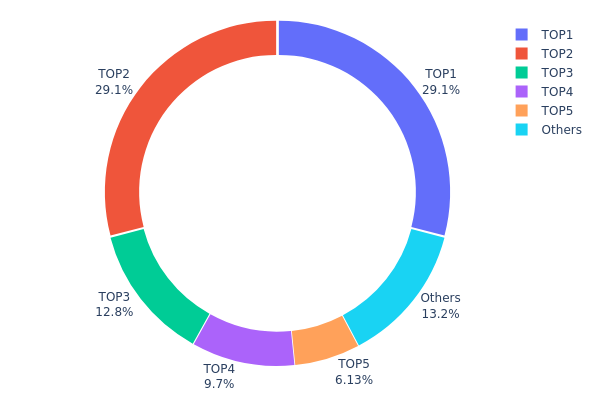

CUDIS Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the top wallet addresses on the blockchain. This metric provides critical insight into the decentralization structure of CUDIS, revealing the degree to which token supply is concentrated among major holders and indicating potential market dynamics and governance risks.

Current analysis of CUDIS holdings demonstrates a notable concentration pattern. The top two addresses collectively control 58.20% of the total supply, each holding precisely 150,000.00K tokens (29.10% each). This dual dominance is followed by a third-largest holder maintaining 12.80% of the circulating supply. The top five addresses account for approximately 86.83% of all tokens, with the remaining 13.17% distributed across numerous other addresses. Such distribution reveals a moderately centralized token structure, where decision-making power and market influence are concentrated in a limited number of accounts.

This concentration level presents meaningful implications for market stability and decentralization metrics. While not extreme, the current holdings distribution indicates that CUDIS maintains a concentrated governance structure susceptible to coordinated action by major stakeholders. The substantial holdings by the top two addresses suggest potential institutional ownership or treasury reserves, which could stabilize token economics but may also introduce risks related to sudden large-scale liquidations or governance interventions. For investors and participants, this distribution underscores the importance of monitoring major address movements and understanding the intended roles of these principal holders in CUDIS's long-term development strategy.

Click to view current CUDIS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x29b4...75dcd3 | 150000.00K | 29.10% |

| 2 | 0x98e1...55080a | 150000.00K | 29.10% |

| 3 | 0x7fad...4d8cce | 66000.00K | 12.80% |

| 4 | 0x9540...7714ad | 50000.00K | 9.70% |

| 5 | 0xf89d...5eaa40 | 31619.26K | 6.13% |

| - | Others | 67793.00K | 13.17% |

Core Factors Influencing CUDIS Future Price

Supply Mechanism

-

Token Distribution Model: CUDIS has a total token supply of 1 billion tokens, with 24.75% circulating at Token Generation Event (TGE). A total of 25% of tokens are allocated to the community to incentivize user participation across multiple seasons, with the first season distributing 5% of total supply. The first season airdrop claiming opened on June 5 at 20:00 Beijing time, distributing a total of 50 million CUDIS tokens to over 60,000 active community users.

-

Current Impact: This community-focused distribution model creates long-term user engagement incentives. The staged token release through seasonal distributions helps manage token velocity and maintain ecosystem participation over extended periods.

Institutional and Major Holders Activity

-

Enterprise Adoption: CUDIS is a DePIN (Decentralized Physical Infrastructure) project offering smart ring hardware priced at USD 349 per unit. The project benefits from Asia's manufacturing and supply chain infrastructure, with hardware produced through established partnerships in Shenzhen and Dongguan.

-

Government Policy: Trump administration policies supporting AI and energy sectors indirectly benefit the DePIN ecosystem. These policy tailwinds reduce the need for extensive investor education regarding the sector's fundamental importance, attracting institutional interest to the broader DePIN narrative.

Macroeconomic Environment

-

Monetary Policy Impact: Current U.S. Treasury yields are approaching 4.6%, nearing historical highs around 5%. In such a high-yield environment, large inflows of speculative capital into cryptocurrency markets face headwinds, with meaningful shifts requiring substantive changes in monetary policy.

-

Market Dynamics: The cryptocurrency market is currently experiencing seasonal patterns rather than sustained bull market conditions. Capital flows are showing rotational dynamics across different sectors and narratives rather than concentrated flows into emerging asset classes.

Technology Development and Ecosystem Building

-

Hardware Integration: CUDIS smart rings represent a tangible physical infrastructure component within the DePIN ecosystem. The project's success depends on maintaining dual-flywheel economics combining hardware sales revenue with token incentive models. System stability is critical, as reliance solely on token incentives without sustainable hardware revenue could lead to potential collapse scenarios.

-

Ecosystem Positioning: CUDIS operates within the broader DePIN sector, which has established itself as a mainstream discussion topic in Western markets. The sector demonstrates long-term development potential compared to short-lived speculative trends. The project benefits from supply chain efficiencies leveraging Asian manufacturing advantages, enabling direct scale production of hardware units.

III. 2025-2030 CUDIS Price Forecast

2025 Outlook

- Conservative Forecast: $0.0222 - $0.03217

- Neutral Forecast: $0.03217

- Optimistic Forecast: $0.04439 (requires sustained market momentum and positive sentiment)

2026-2028 Mid-Term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery and accumulation patterns as the market establishes support levels and builds foundation for longer-term growth.

- Price Range Forecast:

- 2026: $0.0268 - $0.03943

- 2027: $0.03031 - $0.05012

- 2028: $0.03292 - $0.04627

- Key Catalysts: Institutional adoption, regulatory clarity, ecosystem development, and increased trading volume on platforms like Gate.com; technical breakouts above resistance levels; positive macroeconomic conditions supporting alternative assets.

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.04181 - $0.05037 (assumes steady adoption and moderate market expansion)

- Optimistic Scenario: $0.05440 - $0.05536 (assumes breakthrough in mainstream adoption and significant ecosystem growth)

- Transformative Scenario: $0.05536+ (extreme favorable conditions including major institutional inflows, regulatory approval, and technological breakthroughs)

- 2030-12-22: CUDIS may reach $0.0544 (60% appreciation from current levels indicating strong medium-to-long-term bullish trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04439 | 0.03217 | 0.0222 | 2 |

| 2026 | 0.03943 | 0.03828 | 0.0268 | 22 |

| 2027 | 0.05012 | 0.03886 | 0.03031 | 24 |

| 2028 | 0.04627 | 0.04449 | 0.03292 | 42 |

| 2029 | 0.05536 | 0.04538 | 0.02632 | 45 |

| 2030 | 0.0544 | 0.05037 | 0.04181 | 60 |

CUDIS Investment Strategy and Risk Management Report

IV. CUDIS Professional Investment Strategy and Risk Management

CUDIS Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Health-conscious individuals interested in longevity technology, long-term believers in the Web3 health ecosystem, and risk-tolerant investors with extended investment horizons

- Operational Recommendations:

- Accumulate CUDIS tokens during market corrections, targeting positions built over 6-12 months

- Participate in the CUDIS ecosystem through the CUDIS Ring and Longevity Hub to generate additional token rewards

- Maintain holdings through market volatility cycles, as the protocol's value proposition strengthens with ecosystem adoption

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price zones at $0.02755 (24H low) and $0.03294 (24H high) for entry and exit points

- Moving Averages: Use 7-day and 30-day trend indicators to identify momentum shifts in the $0.025-$0.035 trading range

- Wave Trading Key Points:

- Monitor 24-hour price volatility (currently showing +18.28% change) as entry opportunities for short-term positions

- Use the all-time high ($0.31204 on November 4, 2025) as a resistance target for position-taking decisions

CUDIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional Investors: 7-15% of portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance CUDIS holdings with established cryptocurrency positions and traditional assets

- Position Sizing: Use dollar-cost averaging to reduce timing risk when entering positions

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 wallet for active trading and frequent transaction needs

- Cold Storage Method: Transfer long-term holdings to secure self-custody solutions, maintaining private key security offline

- Security Precautions: Enable multi-factor authentication, regularly backup private keys, and never share seed phrases with third parties

V. CUDIS Potential Risks and Challenges

CUDIS Market Risks

- High Volatility Exposure: CUDIS has experienced a -71.71% decline over the past year, indicating significant price volatility and speculative trading pressures

- Liquidity Constraints: With a 24-hour trading volume of $35,113.37 and market cap of $8.02 million, the token faces potential liquidity challenges during large position exits

- Market Sentiment Dependency: The project's valuation is heavily influenced by sentiment around longevity tech adoption and the Web3 health ecosystem narrative

CUDIS Regulatory Risks

- Health and Wellness Claims: As CUDIS positions itself in the longevity and health sectors, it may face regulatory scrutiny regarding health-related promises and data privacy compliance

- Cryptocurrency Regulatory Evolution: Changes in global crypto regulations could impact the token's trading availability and blockchain infrastructure compliance

- Cross-Border Health Data Regulations: Operating internationally with health data requires compliance with GDPR, HIPAA, and other regional privacy frameworks

CUDIS Technical Risks

- Multi-Chain Dependency: CUDIS operates on both BSC and Solana networks, creating technical complexity and potential chain-specific vulnerabilities

- Smart Contract Security: As a protocol integrating Ring devices, AI hubs, and blockchain infrastructure, unforeseen smart contract bugs or exploits could impact token value

- Integration Complexity: The intricate coordination between hardware (CUDIS Ring), AI systems (Longevity Hub), and blockchain components introduces operational risks

VI. Conclusion and Action Recommendations

CUDIS Investment Value Assessment

CUDIS represents a novel intersection between health technology and blockchain incentives, targeting the growing longevity market with a vision to extend health-span to 140 years. The project's integrated ecosystem combining wearable technology, AI-powered insights, and economic incentives addresses a genuine market need. However, the significant year-long decline (-71.71%) and current illiquidity present substantial challenges. The token's success depends on widespread ecosystem adoption, regulatory approval for health data handling, and sustained technology development. Investors should view CUDIS as a speculative, early-stage bet on longevity tech rather than a stable investment vehicle.

CUDIS Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) through Gate.com's trading platform to understand the ecosystem, focusing on long-term holds rather than active trading

✅ Experienced Investors: Consider 3-5% allocations using dollar-cost averaging strategies, supplemented by technical analysis on the 24-hour and 7-day price movements

✅ Institutional Investors: Conduct deep due diligence on the team, technology stack, and regulatory compliance before considering positions, potentially engaging directly with the project for partnership opportunities

CUDIS Trading Participation Methods

- Direct Purchase: Trade CUDIS on Gate.com using BTC, ETH, or stablecoins for direct token acquisition

- Ecosystem Participation: Earn tokens through CUDIS Ring usage and Longevity Hub engagement, creating additional value beyond trading

- Strategic Accumulation: Build positions gradually during market weakness, particularly after high-volatility sell-offs

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make careful decisions based on personal risk tolerance and are advised to consult professional financial advisors. Never invest more capital than you can afford to lose.

FAQ

How much is a Cudis token worth today?

As of today, a Cudis token is worth $0.0272. The token has experienced a slight decrease over the last 24 hours but shows a positive trend over the past week.

How much is Cudis?

As of December 22, 2025, Cudis is priced at $0.028672 per unit with a market cap of $7.10 million USD and 24-hour trading volume of $6.33 million USD.

What factors influence Cudis token price movements?

Cudis token price is primarily driven by supply and demand dynamics, market sentiment, trading volume, protocol updates, block reward halvings, hard forks, and broader cryptocurrency market trends.

What is the price prediction for Cudis in the next 12 months?

Based on current market analysis, Cudis is projected to experience volatility over the next 12 months. Short-term forecasts suggest a potential decrease of approximately 24.88% in the near term, with the price expected around $0.02215 by early 2026. Long-term performance will depend on market adoption and ecosystem developments.

Is Shieldeum (SDM) a good investment?: Analyzing the potential risks and rewards of this emerging cryptocurrency

Is Gather (GAT) a good investment?: Analyzing the Potential and Risks of the Virtual World Token

Is Deeper Network (DPR) a good investment?: Analyzing the potential and risks of this decentralized VPN project

2025 STORJ Price Prediction: Expert Analysis and Market Forecast for Decentralized Storage Token

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

2025 VLR Price Prediction: Expert Analysis and Market Forecast for Valour Inc.'s Digital Asset Performance

2025 COMMON Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Crypto Market Insights: Glory Token Price Trends and Analysis

Navigating Blockchain: Top Security Audit Tools for Safe Transactions

Is THORWallet (TITN) a good investment?: A comprehensive analysis of features, tokenomics, and market potential