2025 DEGOD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: DEGOD's Market Position and Investment Value

DeGods (DEGOD) is a community coin for the internet community, built on the Solana blockchain. Since its launch in September 2024, DEGOD has emerged as a social asset reflecting the culture and values of its holders. As of December 2025, DEGOD maintains a market capitalization of approximately $3.71 million with a circulating supply of nearly 10 billion tokens, trading at around $0.0003714 per token.

This community-driven asset represents a unique segment in the digital asset landscape, fostering engagement and participation among its distributed holder base of over 29,600 accounts. DEGOD exemplifies the growing trend of culture-based tokenomics where community sentiment and social factors play instrumental roles in asset valuation.

This comprehensive analysis examines DEGOD's price dynamics across 2025-2030, integrating historical performance patterns, market sentiment, token supply mechanics, and broader macroeconomic conditions to deliver professional price forecasting and actionable investment guidance for market participants.

DEGOD Market Analysis Report

I. DEGOD Price History Review and Current Market Status

DEGOD Historical Price Movement Trajectory

Based on available data, DEGOD has experienced significant volatility since its launch:

- September 2024: Token launch at an initial price of $0.00672

- July 2025: Reached all-time high (ATH) of $0.08, representing approximately 1,090% appreciation from launch price

- December 2025: Declined to current levels, with the all-time low (ATL) of $0.0003035 recorded on December 1, 2025

The token's price trajectory reveals a sharp peak in mid-year 2025 followed by substantial correction, demonstrating significant market volatility characteristic of community-driven tokens.

DEGOD Current Market Status

Price and Market Capitalization:

- Current Price: $0.0003714

- 24-Hour Trading Volume: $12,079.23

- Total Market Capitalization: $3,714,000

- Fully Diluted Valuation (FDV): $3,714,000

- Market Dominance: 0.00011%

Price Performance Metrics:

- 1-Hour Change: -1.32%

- 24-Hour Change: -4.42%

- 7-Day Change: -4.74%

- 30-Day Change: -20.18%

- 1-Year Change: -89.59%

The token has experienced consistent downward pressure across all timeframes, with the most significant decline occurring over the 12-month period, reflecting a substantial 89.59% decrease from its initial launch price. The 24-hour trading volume remains relatively modest at approximately $12,000, indicating limited liquidity in current market conditions.

Token Supply:

- Circulating Supply: 9,999,999,922 DEGOD (99.99999922% of total supply)

- Total Supply: 10,000,000,000 DEGOD

- Maximum Supply: 10,000,000,000 DEGOD

- Active Holders: 29,638

Trading Range (24-Hour):

- High: $0.0003892

- Low: $0.0003647

The token's price movement within a narrow 24-hour range of approximately 0.67% reflects subdued trading activity and low volatility in the immediate term.

Visit DEGOD Market Price on Gate.com for real-time market data

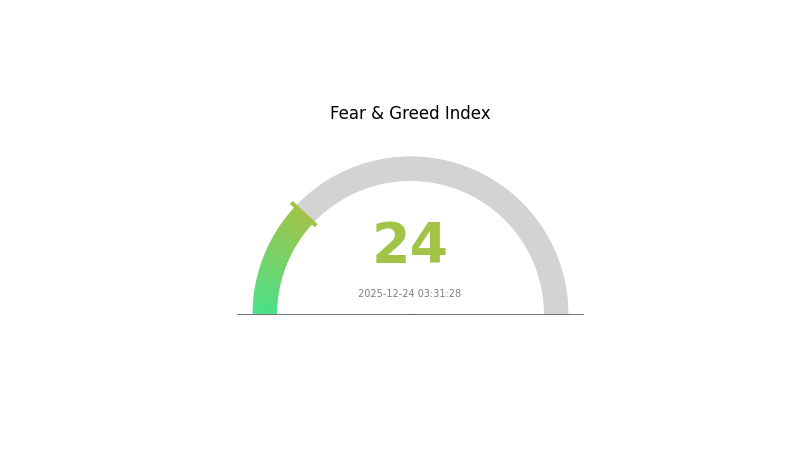

DEGOD Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 24. This indicates heightened anxiety among investors and significant market pessimism. During periods of extreme fear, opportunities often emerge for contrarian investors. However, caution is advised as volatility remains elevated. Market participants should conduct thorough research and implement proper risk management strategies. Consider dollar-cost averaging or waiting for clearer signals before making substantial investment decisions. Monitor key support levels and market developments closely on Gate.com to stay informed about potential turning points.

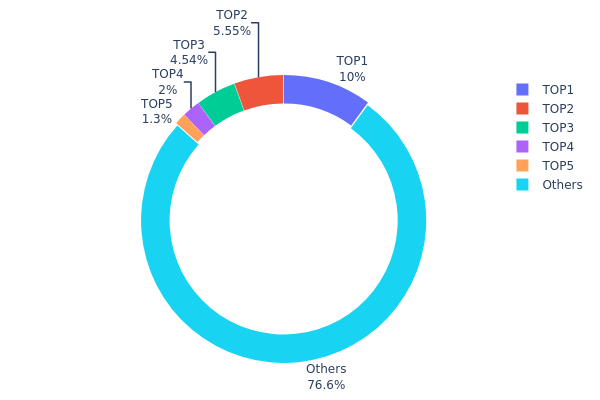

DEGOD Holdings Distribution

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing decentralization levels and potential market manipulation risks. This data reveals how DEGOD tokens are distributed among key stakeholders, with particular attention to whether wealth concentration exists among top holders.

The current holdings data demonstrates a moderate concentration pattern, with the top five addresses controlling approximately 23.4% of total DEGOD supply. The largest holder (3kdGNq...VsuVhS) commands 10.02% of the circulating supply, while the second and third holders account for 5.54% and 4.54% respectively. The remaining 76.6% of tokens are distributed across other addresses, indicating a relatively dispersed ownership structure. While the top holder's 10% position represents a significant stake, it falls short of the critical 15-20% threshold typically associated with severe concentration risk, suggesting the token maintains reasonable decentralization characteristics.

The distribution pattern suggests limited immediate manipulation risk, as no single entity commands an overwhelming majority of available tokens. The substantial presence of distributed holders (76.6%) provides natural market depth and reduces the likelihood of coordinated price movements by a small group of actors. However, continued monitoring remains warranted, particularly regarding potential coordination between the top five holders, which collectively represent nearly a quarter of total supply. The current structure reflects a relatively healthy market composition that balances institutional participation with broader community involvement.

Click to view current DEGOD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 3kdGNq...VsuVhS | 1002990.02K | 10.02% |

| 2 | CUpxVg...1wNvrG | 554960.90K | 5.54% |

| 3 | 5Q544f...pge4j1 | 454324.53K | 4.54% |

| 4 | 7HjM2k...Wb3pfn | 200000.00K | 2.00% |

| 5 | G95UUA...asauHk | 130047.67K | 1.30% |

| - | Others | 7657643.63K | 76.6% |

II. Core Factors Influencing DeGods' Future Price

Community Engagement and Market Sentiment

- Community Dynamics: DeGods' price is significantly influenced by community engagement levels. The strength of the holder community and their participation in ecosystem activities directly impacts demand and trading volume.

- Market Saturation Challenges: The NFT market faces substantial headwinds from saturation, with numerous new projects competing for attention. This consumer fatigue has created downward pressure on NFT valuations, including DeGods-related assets.

NFT Market Trends

- Market Performance: The broader NFT market has experienced a notable decline in sales volume and faces challenges from widespread market saturation. Many NFT projects launched during the boom cycle lack substantial use cases or long-term vision, leading to inevitable value deterioration.

- Project Execution Risk: DeGods' success depends heavily on the team's ability to execute on their roadmap and promises. Market analysis indicates that many NFT projects have failed to transition from simple collectibles to more substantive projects with integrated utilities or gaming elements. The gap between promised roadmaps and actual delivery remains a critical concern for investor confidence.

Solana Ecosystem Positioning

- Blockchain Infrastructure: As a leading NFT project on the Solana blockchain, DeGods benefits from Solana's positioning as the most complete alternative to Ethereum for NFT applications. Solana's low transaction fees and high throughput provide technical advantages for NFT trading and utility development.

- NFT Platform Integration: DeGods operates within an ecosystem supported by major NFT platforms. Magic Eden, Unisat, and other leading marketplaces provide trading infrastructure that supports Solana-based NFT projects, facilitating market accessibility and liquidity.

III. DEGOD Price Prediction for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00033 - $0.00037

- Neutral Forecast: $0.00037 (Average Price)

- Optimistic Forecast: $0.00047 (Peak Price)

Mid-term Perspective (2026-2028)

-

Market Phase Expectation: Gradual accumulation and recovery phase with increasing market participation and institutional interest building.

-

Price Range Predictions:

- 2026: $0.00033 - $0.00062 (13% upside potential)

- 2027: $0.00043 - $0.00077 (40% upside potential)

- 2028: $0.00049 - $0.00073 (73% upside potential)

-

Key Catalysts: Ecosystem development advancement, community engagement growth, strategic partnerships formation, and overall market sentiment recovery in the cryptocurrency sector.

Long-term Outlook (2029-2030)

-

Base Case Scenario: $0.00047 - $0.00068 (Assumes stable ecosystem development and moderate market adoption)

-

Optimistic Scenario: $0.00068 - $0.00073 (Assumes accelerated partnership ecosystem and increased utility adoption)

-

Transformative Scenario: $0.00073 - $0.00103 (Assumes breakthrough developments, mainstream recognition, and significant increase in blockchain adoption by 2030)

-

2030-12-31: DEGOD reaches $0.00103 at peak valuation (90% cumulative gain from 2025 baseline), representing strong long-term appreciation trajectory.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00047 | 0.00037 | 0.00033 | 0 |

| 2026 | 0.00062 | 0.00042 | 0.00033 | 13 |

| 2027 | 0.00077 | 0.00052 | 0.00043 | 40 |

| 2028 | 0.00073 | 0.00064 | 0.00049 | 73 |

| 2029 | 0.00073 | 0.00068 | 0.00047 | 84 |

| 2030 | 0.00103 | 0.00071 | 0.00047 | 90 |

DeGods (DEGOD) Professional Investment Strategy and Risk Management Report

I. Executive Summary

DeGods (DEGOD) is a community coin for "bros on the internet" built on the Solana blockchain. As of December 24, 2025, DEGOD is trading at $0.0003714 with a market capitalization of approximately $3.71 million. The token has experienced significant volatility, declining 89.59% over the past year from its all-time high of $0.08 reached on July 7, 2025. With 29,638 token holders and nearly complete circulation (99.99999922% of total supply), DEGOD represents a highly speculative community-driven asset.

II. Market Overview and Current Status

Token Metrics

- Current Price: $0.0003714

- 24-Hour Volume: $12,079.23

- Market Capitalization: $3,714,000.00

- Circulating Supply: 9,999,999,922 DEGOD

- Total Supply: 10,000,000,000 DEGOD

- Market Ranking: 1,721

Price Performance Analysis

- 24-Hour Change: -4.42%

- 7-Day Change: -4.74%

- 30-Day Change: -20.18%

- 1-Year Change: -89.59%

- All-Time High: $0.08 (July 7, 2025)

- All-Time Low: $0.0003035 (December 1, 2025)

- Current 24H Range: $0.0003647 - $0.0003892

The token shows sustained downward pressure with consistent losses across all measured timeframes, indicating a challenging market environment for DEGOD holders.

III. Project Fundamentals

Blockchain Infrastructure

- Blockchain: Solana

- Smart Contract Address: degod39zqQWzpG6h4b7SJLLTCFE6FeZnZD8BwHBFxaN

- Explorer Link: https://explorer.solana.com/account/degod39zqQWzpG6h4b7SJLLTCFE6FeZnZD8BwHBFxaN

Project Resources

- Official Website: https://degods.com/

- Social Media: @degodsnft (X/Twitter)

- Whitepaper: Available via project documentation

- Exchange Listings: Available on 2 exchanges including Gate.com

Community Metrics

- Active Token Holders: 29,638

- Market Sentiment: Bearish (Score: 1)

IV. DEGOD Professional Investment Strategy and Risk Management

DEGOD Investment Methodology

(1) Long-Term Hold Strategy

- Target Investors: Community believers with high risk tolerance, early adopters of Solana ecosystem projects, and investors with extended investment horizons

- Operational Recommendations:

- Dollar-cost averaging (DCA) into positions during market weakness to reduce average entry price

- Accumulating during periods of extreme market pessimism when sentiment reaches bottom

- Setting clear long-term targets and resisting short-term price volatility

- Storage Approach: Utilize Gate.com Web3 Wallet for secure storage with regular security audits and backup protocols

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to identify reversal opportunities

- Moving Averages (50/200 MA): Use for trend identification and support/resistance level confirmation

- Volume Analysis: Track unusual volume spikes that may indicate institutional accumulation or distribution

-

Wave Trading Considerations:

- Identify support levels near $0.00036 and resistance near $0.00039 for tactical entry/exit

- Monitor hourly momentum indicators given the token's high volatility

- Execute disciplined position sizing to manage downside risk exposure

DEGOD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% portfolio allocation maximum for speculative community tokens

- Aggressive Investors: 2-5% portfolio allocation to high-risk Solana ecosystem tokens

- Professional Investors: 3-8% allocation with structured hedging and rebalancing protocols

(2) Risk Hedging Solutions

- Portfolio Diversification: Allocate DEGOD investment alongside established Solana infrastructure tokens to reduce concentration risk

- Position Sizing Framework: Never exceed individual position size that would cause material portfolio drawdown in case of 80%+ price decline

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate.com Web3 Wallet provides institutional-grade security with multi-signature support and hardware wallet integration capabilities

- Self-Custody Approach: For significant holdings, implement hardware wallet backup with offline private key storage

- Security Critical Notes: Always enable two-factor authentication, maintain secure backup of seed phrases in geographically distributed locations, verify contract addresses against official sources before transfers, and never share private keys or seed phrases with any third parties

V. DEGOD Potential Risks and Challenges

DEGOD Market Risks

- Extreme Volatility: 89.59% annual decline demonstrates severe price instability; significant recovery would require 800%+ appreciation to reach previous highs

- Liquidity Constraints: 24-hour trading volume of only $12,079 represents minimal liquidity, creating substantial slippage risk for large transactions

- Community Dependency: As a community-driven token without apparent utility, value is entirely dependent on social sentiment and network effects, leaving it vulnerable to sentiment shifts

DEGOD Regulatory Risks

- Classification Uncertainty: Community tokens face potential regulatory reclassification as unregistered securities in various jurisdictions

- Exchange Compliance: Delisting risk increases if regulatory frameworks tighten around community-driven projects without clear tokenomics

- Jurisdictional Restrictions: Certain regions may restrict or prohibit community token trading, limiting access for international investors

DEGOD Technical Risks

- Solana Network Dependency: Token value is inherently tied to Solana blockchain security and operational continuity

- Smart Contract Vulnerabilities: Although established on Solana, potential security vulnerabilities in the token contract could affect holdings

- Network Congestion Impact: Solana network congestion during high-volume periods could impede trading execution and transaction finality

VI. Conclusions and Action Recommendations

DEGOD Investment Value Assessment

DeGods represents a high-risk, community-driven speculative asset with significant downside history and minimal fundamental support beyond social sentiment. The token's 89.59% annual decline and current bearish market sentiment suggest limited near-term recovery catalysts. Investors should approach DEGOD with extreme caution, recognizing that recovery to historical highs would require extraordinary circumstances and sustained community development efforts. The project's lack of disclosed utility beyond community identity creation limits institutional adoption potential. Value accumulation would primarily depend on renewed social media attention and successful expansion of the community.

DEGOD Investment Recommendations

✅ Newcomers: Consider only a minimal "portfolio test" allocation (0.25-0.5%) if participating in Solana ecosystem exploration; focus primarily on understanding Solana fundamentals before considering community tokens

✅ Experienced Investors: May consider 1-3% allocation for speculation with clear stop-losses at -30% from entry; utilize dollar-cost averaging during extreme weakness periods; pair holdings with profitable Solana positions to offset volatility

✅ Institutional Investors: DEGOD's liquidity profile ($12K daily volume) and market capitalization ($3.7M) suggest position size limitations; only suitable for ultra-small allocations as part of broader community token research initiatives

DEGOD Trading Participation Methods

- Direct Spot Trading: Purchase DEGOD on Gate.com with fiat or stablecoin deposits; implement limit orders rather than market orders due to low liquidity

- Portfolio Diversification: Combine DEGOD positions with established Solana infrastructure tokens (SOL) to create balanced exposure to the ecosystem

- Technical Trading: Utilize supported trading pairs to execute short-term trading strategies based on identified technical levels and momentum indicators

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. Professional financial consultation is strongly recommended. Never invest capital you cannot afford to lose completely.

FAQ

What is DEGOD and what is its use case?

DEGOD is a community-driven cryptocurrency launched by the DeGods team in 2022 for internet culture enthusiasts. Its primary use case is to foster a decentralized ecosystem for gaming on demand, enabling users to participate in a community-powered digital entertainment platform.

What is the current price of DEGOD and market cap?

The current market cap of DEGOD is $3.674 million as of December 24, 2025. The latest price of DEGOD is not currently available. For real-time pricing information, please check dedicated crypto data platforms.

Will DEGOD reach $1 in 2025?

DEGOD reaching $1 in 2025 depends on market momentum and adoption growth. While significant price appreciation is possible with strong community support and ecosystem development, the token would need substantial market cap expansion to achieve this target.

What factors could affect DEGOD price prediction?

Market sentiment, trading volume, cryptocurrency market trends, community engagement, and overall blockchain ecosystem developments significantly influence DEGOD price predictions.

How does DEGOD compare to other similar cryptocurrency projects?

DEGOD stands out through its unique digital art collection and strong community engagement on Solana. Unlike many competitors, DEGOD has strategic expansion plans to Ethereum, enhancing cross-chain accessibility and market reach compared to projects remaining on single blockchains.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?

Top Platforms for Learning and Earning in Cryptocurrency