2025 DEGOPrice Prediction: Analyzing Key Factors and Market Trends for Long-Term Growth Potential

Introduction: DEGO's Market Position and Investment Value

Dego Finance (DEGO), as a cross-chain NFT+DeFi protocol and infrastructure, has made significant strides since its inception in 2020. As of 2025, DEGO's market capitalization has reached $23,534,700, with a circulating supply of approximately 21,000,000 tokens, and a price hovering around $1.1207. This asset, often referred to as an "NFT ecosystem enabler," is playing an increasingly crucial role in the fields of NFT creation, mining, auction, and trading.

This article will comprehensively analyze DEGO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. DEGO Price History Review and Current Market Status

DEGO Historical Price Evolution

- 2020: Project launched, price started at $1.19

- 2021: Reached all-time high of $33.41 on March 14

- 2022-2025: Experienced market cycles, price declined from highs to current levels

DEGO Current Market Situation

As of October 4, 2025, DEGO is trading at $1.1207. The token has seen a 1.57% increase in the last 24 hours, with a trading volume of $24,637.52. DEGO's market cap stands at $23,534,700, ranking it 1022nd in the cryptocurrency market. The token is currently 96.64% below its all-time high of $33.41, recorded on March 14, 2021. Over the past week, DEGO has experienced a significant decline of 18.91%, while its 30-day performance shows an 11.16% decrease. The yearly trend indicates a 32.49% drop in value.

Click to view the current DEGO market price

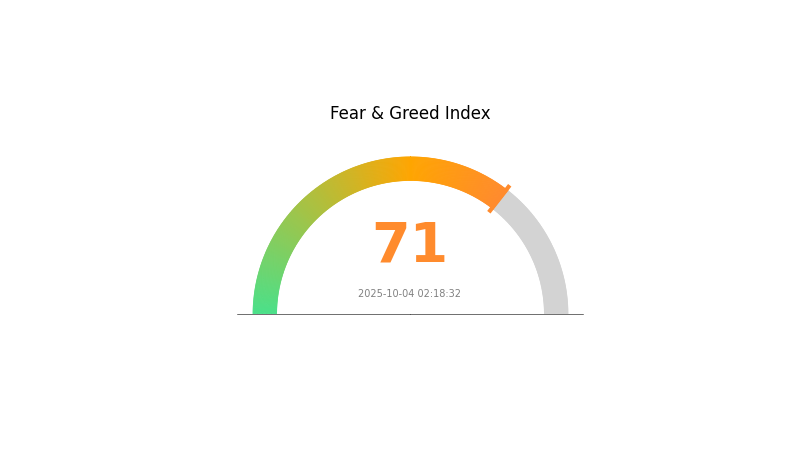

DEGO Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 71. This indicates high investor optimism and potentially overvalued assets. While the bullish sentiment may drive prices higher in the short term, it's essential to exercise caution. Experienced traders might consider taking profits or hedging positions. For those looking to enter the market, it may be wise to wait for a potential correction or to dollar-cost average. As always, conduct thorough research and manage risk carefully in this volatile market environment.

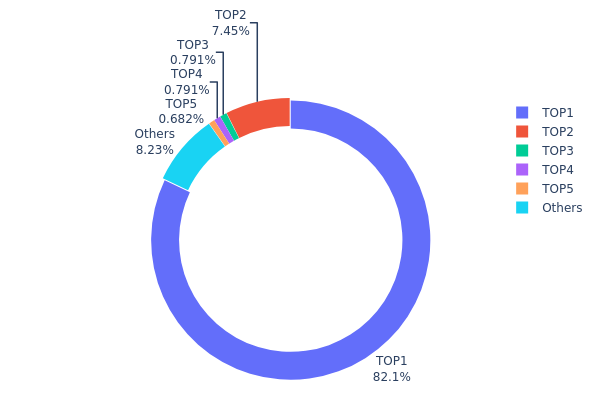

DEGO Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for DEGO tokens. The top address holds an overwhelming 82.05% of the total supply, equivalent to 12,307,080 DEGO tokens. This extreme concentration is further emphasized by the second-largest holder possessing 7.45% of the supply. Together, the top two addresses control 89.5% of all DEGO tokens, indicating a significant centralization of ownership.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With a single entity controlling over 80% of the supply, there is a risk of large-scale sell-offs or buying pressure that could dramatically impact DEGO's price. This centralization also suggests a low level of decentralization within the DEGO ecosystem, potentially compromising its resilience and governance structure.

The current holdings distribution reflects a market structure that is vulnerable to the actions of a few major players. While this concentration might provide short-term stability, it poses long-term risks to the token's broader adoption and market dynamics. Investors and stakeholders should be aware of these ownership patterns when assessing DEGO's market behavior and future prospects.

Click to view the current DEGO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 12307.08K | 82.05% |

| 2 | 0x0d07...b492fe | 1118.07K | 7.45% |

| 3 | 0xab66...2f3c78 | 118.65K | 0.79% |

| 4 | 0xa2aa...98edca | 118.60K | 0.79% |

| 5 | 0x43de...8398aa | 102.32K | 0.68% |

| - | Others | 1233.70K | 8.24% |

II. Key Factors Affecting DEGO's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions are likely to influence DEGO's price, as they affect overall market liquidity and investor risk appetite.

- Inflation Hedging Properties: DEGO's performance during inflationary periods may be closely watched by investors seeking potential hedges against currency devaluation.

- Geopolitical Factors: International tensions and global economic uncertainties can impact DEGO's price as investors may seek alternative assets during times of geopolitical stress.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development and adoption of decentralized applications (DApps) and projects within the DEGO ecosystem will be crucial for its long-term value proposition.

III. DEGO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.83 - $1.00

- Neutral prediction: $1.00 - $1.25

- Optimistic prediction: $1.25 - $1.60 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $1.06 - $1.49

- 2028: $0.92 - $1.85

- Key catalysts: Increased adoption and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $1.65 - $1.78 (assuming steady market growth)

- Optimistic scenario: $1.78 - $1.96 (with strong ecosystem development)

- Transformative scenario: Above $2.00 (with breakthrough innovations and mass adoption)

- 2030-12-31: DEGO $1.96 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.60518 | 1.1225 | 0.83065 | 0 |

| 2026 | 1.47294 | 1.36384 | 0.7092 | 21 |

| 2027 | 1.48931 | 1.41839 | 1.06379 | 26 |

| 2028 | 1.84639 | 1.45385 | 0.91593 | 29 |

| 2029 | 1.91414 | 1.65012 | 1.15508 | 47 |

| 2030 | 1.96034 | 1.78213 | 1.26531 | 59 |

IV. DEGO Professional Investment Strategies and Risk Management

DEGO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and NFT enthusiasts

- Operation suggestions:

- Accumulate DEGO tokens during market dips

- Participate in DEGO's NFT ecosystem to gain exposure

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor NFT market trends as they may impact DEGO's price

- Set stop-loss orders to manage downside risk

DEGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple NFT and DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Cold storage solution: Store long-term holdings offline

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for DEGO

DEGO Market Risks

- High volatility: NFT market fluctuations can impact DEGO's price

- Competition: Emerging NFT platforms may challenge DEGO's market position

- Liquidity risk: Limited trading volume may affect price stability

DEGO Regulatory Risks

- Uncertain regulations: Future NFT and DeFi regulations may impact DEGO

- Cross-chain compliance: Regulatory challenges across different blockchains

- Tax implications: Evolving tax laws for NFT transactions

DEGO Technical Risks

- Smart contract vulnerabilities: Potential security issues in DEGO's protocols

- Cross-chain interoperability challenges: Risk of failures in asset transfers

- Scalability concerns: Potential network congestion during high demand

VI. Conclusion and Action Recommendations

DEGO Investment Value Assessment

DEGO offers long-term potential in the growing NFT and DeFi sectors, but faces short-term risks from market volatility and regulatory uncertainties.

DEGO Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the NFT ecosystem

✅ Experienced investors: Consider a balanced approach, combining DEGO with other DeFi assets

✅ Institutional investors: Explore strategic partnerships within the DEGO ecosystem

DEGO Trading Participation Methods

- Spot trading: Purchase DEGO tokens on Gate.com

- NFT participation: Engage in DEGO's NFT creation and trading platform

- Staking: Explore DEGO Staking options for passive income

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Dego token?

The price prediction for Dego token is estimated to reach $1.49 by 2026, based on a projected 5% price change. Market conditions may affect this forecast.

Will DOGE hit $10?

It's highly improbable for DOGE to reach $10. Such a price would require an astronomical market cap, far exceeding current projections. While not impossible, it's extremely unlikely without major market shifts.

Why is Dego Finance falling?

Dego Finance is falling due to market volatility and bearish trends. The price has dropped significantly, influenced by overall crypto market conditions.

What is the all-time high for Dego Finance?

The all-time high for Dego Finance is $33.41, reached on November 14, 2021.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

SafeMoon Latest Updates and Price Analysis: What’s Happening with SafeMoon?

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential