2025 DEP Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: Market Position and Investment Value of DEP

DEAPCOIN (DEP) is an entertainment platform token that powers the PlayMining ecosystem, which enables users to earn cryptocurrency rewards while enjoying gaming and comic resources on the platform. Since its launch in 2020, DEP has established itself as a unique utility token in the entertainment and digital assets space. As of December 2025, DEP has a market capitalization of approximately $34.32 million USD, with a circulating supply of approximately 27.53 billion tokens, currently trading at around $0.001148 per token. This innovative "play-to-earn" asset is playing an increasingly important role in bridging entertainment content creation with blockchain-based digital asset ownership and trading.

This article will provide a comprehensive analysis of DEP's price trends and market dynamics, combining historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the 2025-2030 period.

I. DEP Price History Review and Market Status

DEP Historical Price Evolution Trajectory

- 2021: DEP reached its all-time high of $0.07894 on November 25, 2021, during the peak of the bull market cycle.

- 2023: DEP touched its all-time low of $0.00068582 on October 18, 2023, representing a significant correction from previous highs.

DEP Current Market Position

As of December 19, 2025, DEP is trading at $0.001148, with a market capitalization of approximately $34.32 million and a fully diluted valuation of $34.32 million. The token ranks 674th by market capitalization with a market dominance of 0.0010%. The circulating supply stands at 27.53 billion DEP tokens out of a maximum supply of 30 billion tokens, representing a circulation ratio of 91.75%.

24-Hour Price Movement: DEP experienced a marginal decline of -0.83% over the past 24 hours, with trading activity reaching $44,642.78 in volume. The 24-hour trading range moved between $0.0010454 and $0.001511.

Broader Price Trends: Over the past week, DEP showed modest gains of 0.8%, while the 30-day period demonstrated more substantial growth of 19.65%. However, the year-to-date performance reflects significant headwinds, with DEP declining 38.24% over the past 12 months.

Holder Distribution: The token maintains a holder base of 22,186 addresses, indicating moderate community participation in the ecosystem.

Click to view current DEP market price

DEP Market Sentiment Indicator

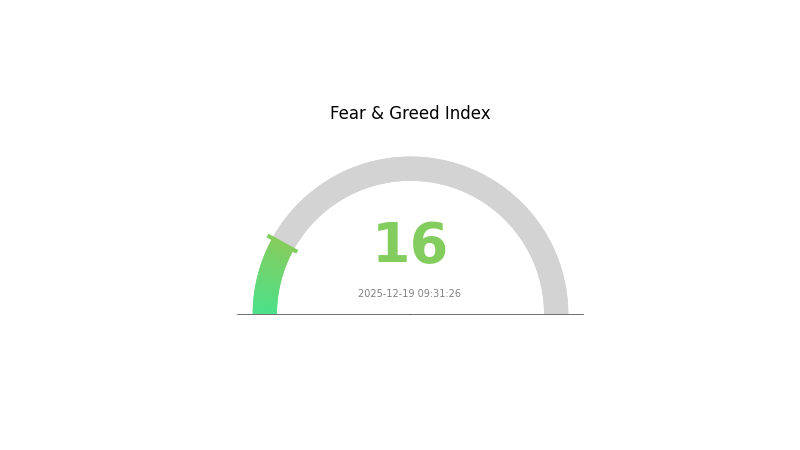

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This indicates significant market pessimism and heightened risk aversion among investors. Such extreme fear levels often present contrarian opportunities, as markets tend to overreact during panic phases. Investors should exercise caution while monitoring potential entry points. Consider diversifying your portfolio and maintaining a long-term investment perspective on Gate.com during this volatile period.

DEP Holding Distribution

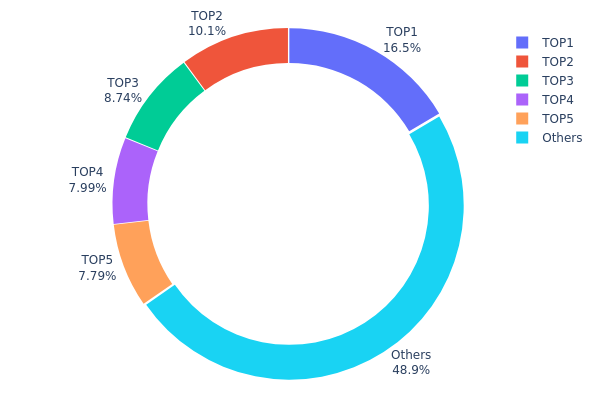

Address holding distribution represents the concentration of DEP tokens across blockchain addresses, serving as a critical indicator of market structure and decentralization levels. By analyzing the top holder positions and their percentage allocations, we can assess the degree of wealth concentration, liquidity dynamics, and potential systemic risks within the DEP ecosystem.

The current DEP holding distribution demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 51.08% of the total token supply, with the largest holder commanding 16.46%. This concentration level, while notable, remains within manageable parameters for mature blockchain projects. The presence of a diversified "Others" category representing 48.92% of holdings suggests a reasonably distributed base, indicating that the majority of tokens are fragmented across numerous smaller holders rather than controlled by a handful of entities. This distribution pattern reflects a relatively healthy ecosystem structure with both institutional and retail participation.

From a market structure perspective, the current holding distribution presents both opportunities and considerations. The significant concentration among top holders could potentially create liquidity dynamics that warrant monitoring, as coordinated movements by these entities could influence price discovery mechanisms. However, the substantial "Others" segment acts as a stabilizing factor, reducing the likelihood of extreme price manipulation scenarios. The decentralization profile suggests DEP maintains reasonable market resilience, with no single entity possessing overwhelming control that would compromise the network's integrity or price stability.

Click to view current DEP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf8ef...58445a | 4939800.05K | 16.46% |

| 2 | 0x2a45...926a1d | 3034653.49K | 10.11% |

| 3 | 0xed2a...176684 | 2621436.58K | 8.73% |

| 4 | 0xd242...7d5ebd | 2397538.05K | 7.99% |

| 5 | 0x0864...c75e6b | 2338222.00K | 7.79% |

| - | Others | 14668349.83K | 48.92% |

II. Core Factors Influencing DEP's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global central bank policy expectations will have a profound influence on DEP price. Changes in interest rates and monetary policy directly affect capital flows and market sentiment. The Federal Reserve's policy direction, particularly regarding interest rate adjustments, plays a critical role in determining cryptocurrency market dynamics and investor risk appetite.

-

Inflation Hedge Characteristics: In an inflationary environment, DEP's performance becomes a key focus for investors. As traditional fiat currencies face depreciation pressures, digital assets with inherent scarcity mechanisms gain increased appeal as potential stores of value and inflation hedges. DEP's ability to maintain purchasing power during periods of currency debasement enhances its attractiveness to investors seeking portfolio diversification.

III. DEP Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.00092-$0.00114

- Neutral Forecast: $0.00114 (average)

- Optimistic Forecast: $0.00121 (stable market conditions)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with moderate volatility and incremental adoption expansion

- Price Range Forecast:

- 2026: $0.00066-$0.00151

- 2027: $0.00098-$0.00173

- Key Catalysts: Ecosystem development progress, increased utility adoption, and market sentiment recovery

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00123-$0.00175 (sustained development momentum and steady market participation)

- Optimistic Scenario: $0.00155-$0.00219 (accelerated protocol adoption and positive macroeconomic conditions)

- Transformational Scenario: $0.00230+ (breakthrough utility integration, institutional adoption, and significant market expansion)

- December 19, 2030: DEP $0.00230 (projected long-term appreciation target)

The forecast trajectory indicates a cumulative 67% appreciation potential by 2030, reflecting gradual but consistent growth. Market participants should monitor ecosystem development milestones and monitor DEP trading pairs on Gate.com for portfolio management opportunities.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00121 | 0.00114 | 0.00092 | 0 |

| 2026 | 0.00151 | 0.00117 | 0.00066 | 2 |

| 2027 | 0.00173 | 0.00134 | 0.00098 | 17 |

| 2028 | 0.00175 | 0.00154 | 0.00123 | 34 |

| 2029 | 0.00219 | 0.00165 | 0.00142 | 43 |

| 2030 | 0.0023 | 0.00192 | 0.00155 | 67 |

DEAPCOIN (DEP) Professional Investment Analysis Report

IV. DEP Professional Investment Strategy and Risk Management

DEP Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Content creators, gaming enthusiasts, and believers in play-to-earn platforms

- Operational Recommendations:

- Accumulate DEP tokens during market downturns when price volatility presents buying opportunities

- Participate in the PlayMining platform ecosystem to earn additional DEP rewards through gaming and content consumption

- Hold tokens long-term to benefit from platform growth and user expansion across global markets

(2) Active Trading Strategy

-

Market Monitoring Focus:

- Track 24-hour volume trends (currently at 44,642.78 USDT) to identify liquidity patterns

- Monitor price action relative to key resistance levels (all-time high: $0.07894) and support levels (recent low: $0.001048)

-

Trading Considerations:

- Current 30-day positive momentum (+19.65%) suggests potential short-term strength

- One-year decline (-38.24%) indicates significant long-term bearish pressure requiring caution

- Limited 24-hour volume suggests careful position sizing to avoid slippage

DEP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.5% maximum portfolio allocation

- Active Investors: 2-4% maximum portfolio allocation

- Professional Investors: 4-6% maximum portfolio allocation with diversified entry strategies

(2) Risk Hedging Approaches

- Stablecoin Pairing: Maintain USDT or USDC reserves to execute tactical entries during price pullbacks

- Dollar-Cost Averaging: Execute regular purchases over time to reduce timing risk and average purchase costs across market cycles

(3) Secure Storage Solutions

- Self-Custody Option: Gate Web3 Wallet for direct token control with full private key management

- Exchange Custody: Maintain actively traded positions on Gate.com for immediate liquidity and trading access

- Security Considerations: Enable two-factor authentication on all accounts, use strong unique passwords, never share seed phrases, verify contract addresses before transactions (DEP Ethereum address: 0x1a3496c18d558bd9c6c8f609e1b129f67ab08163)

V. DEP Potential Risks and Challenges

DEP Market Risk

- Extreme Price Volatility: Token has experienced 98% drawdown from all-time high ($0.07894 to current $0.001148), indicating severe market risk and limited recovery confidence

- Low Trading Volume: Daily trading volume of only 44,642.78 USDT on a 31.6 million USDT market cap indicates illiquidity and potential difficulty exiting positions

- Market Cap Concentration: Fully diluted valuation ($34.3 million) relative to circulating supply concentration leaves token vulnerable to holder exits

DEP Regulatory Risk

- Geographic Constraints: PlayMining platform operations may face restrictions in certain jurisdictions with stricter play-to-earn regulations

- Gaming Platform Compliance: Entertainment and gaming platforms increasingly face regulatory scrutiny regarding reward mechanisms and user protections

DEP Technology Risk

- Private Blockchain Dependency: Digital Art Auction relies on proprietary ERC-721 blockchain requiring platform maintenance and security updates

- ERC-20 Standard Exposure: Token vulnerability to smart contract risks inherent to Ethereum network and potential protocol changes

- Platform Risk: PlayMining platform operational continuity directly impacts DEP token utility and user demand

VI. Conclusion and Action Recommendations

DEP Investment Value Assessment

DEAPCOIN operates as the utility token for the PlayMining entertainment platform, offering exposure to the play-to-earn and NFT gaming sectors. However, the token faces significant challenges including a 98% decline from historical peaks, minimal trading liquidity, and ongoing market skepticism reflected in negative year-over-year performance (-38.24%). The project's long-term viability depends on sustained platform user growth and broader adoption of crypto-enabled entertainment platforms. Current market pricing reflects reduced investor confidence relative to the 2021 bull market peak.

DEP Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of portfolio) using dollar-cost averaging on Gate.com to test platform mechanics before committing significant capital; prioritize education on play-to-earn risks

✅ Experienced Traders: Execute tactical accumulation during volatility spikes while maintaining strict stop-losses at psychological support levels; use technical analysis around the $0.001 threshold; avoid over-concentration given liquidity constraints

✅ Institutional Investors: Conduct thorough due diligence on PlayMining platform fundamentals, user growth metrics, and revenue generation before consideration; position sizing should reflect illiquidity constraints and potential regulatory developments

DEP Trading Participation Methods

- Exchange Trading: Trade on Gate.com with market and limit orders, utilizing the platform's trading interface for direct token exchange

- Platform Participation: Earn DEP rewards through active participation in PlayMining's gaming and content ecosystem

- Secondary Market Trading: Purchase digital assets within PlayMining to accumulate and trade DEP-denominated NFTs

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors must conduct independent research and risk assessment before participation. Consult qualified financial advisors regarding portfolio allocation decisions. Never invest capital exceeding your loss tolerance threshold.

FAQ

What is a dep coin?

DEP (Deapcoin) is a cryptocurrency integrated into the PlayMining platform that enables users to earn digital currency through gaming and mining activities. It serves as the primary reward token for platform participation.

Will dent reach 1 dollar?

Dent reaching $1 is highly unlikely. It would require approximately 468,000% growth from current levels. Current market predictions do not support this target being achieved in the foreseeable future.

What factors affect DEP price prediction?

DEP price prediction is influenced by market trends, trading volume, technical analysis patterns, investor sentiment, and overall cryptocurrency market conditions.

What is the current market cap and trading volume of DEP?

The current market cap of DEP is $31.89 million, with a 24-hour trading amount of $1.6 million as of December 19, 2025. DEP is trading at $0.00116 per token.

What are the risks associated with investing in DEP?

DEP investment risks include market volatility, liquidity risks, and potential overtrading. Price fluctuations can be significant, and token value depends on market demand and adoption rates. Investors should conduct thorough research before participating.

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 IMT Price Prediction: Bullish Trends and Market Factors Driving Potential Growth

2025 MBS Price Prediction: Analyzing Market Trends and Potential Impacts on Mortgage-Backed Securities

2025 PVU Price Prediction: Analyzing Market Trends and Growth Potential for Plant vs Undead Token

What is the PIXEL price prediction for 2030 based on current market trends?

2025 ZENT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Discover Your Wormhole Airdrop Eligibility Easily

Understanding Decentralized Lending: A Comprehensive Guide to DeFi Mechanics

Exploring Cyball: A Comprehensive Guide to Blockchain Gaming Tokens

Exploring the Advantages of Cryptocurrency Coin Burning Mechanisms

Exploring Cross the Ages: A New Era in Blockchain Gaming and Digital Ownership