2025 DUSK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of DUSK

DUSK (DUSK) is a decentralized blockchain protocol that provides privacy and transparency solutions for payment, communication, and asset ownership transfer. Since its inception in 2019, it has introduced innovative consensus mechanisms including the Byzantine protocol (SBA) and secure tunnel switching (STS) technology. As of 2025, DUSK's market cap has reached approximately $20.29 million, with a circulating supply of 500 million tokens, currently trading at around $0.04058. This privacy-oriented blockchain asset is increasingly playing a critical role in enabling secure and transparent transactions across decentralized applications and on-chain governance systems.

This article will comprehensively analyze DUSK's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

DUSK Network (DUSK) Market Analysis Report

I. DUSK Price History Review and Market Status

DUSK Historical Price Evolution

- March 2020: Project early stage, recorded historical low at $0.01113274

- December 2021: Reached all-time high of $1.09, marking peak market valuation

- 2020-2025: Extended bear market cycle, price declined approximately 96.3% from ATH to current levels

DUSK Current Market Position

As of December 20, 2025, DUSK is trading at $0.04058 with a 24-hour trading volume of $16,185.44. The token has experienced significant volatility across multiple timeframes:

- 1-hour change: -0.91%

- 24-hour change: +4.3%

- 7-day change: -11.65%

- 30-day change: -42.61%

- 1-year change: -79.14%

The circulating supply stands at 500 million DUSK tokens out of a total supply of 500 million (50% circulation ratio), with a maximum supply cap of 1 billion tokens. The current market capitalization is approximately $20.29 million, ranking at position 865 by market cap. With 19,282 token holders and availability on 15 exchanges, DUSK maintains modest liquidity in the broader cryptocurrency market. The token's market dominance is 0.00063%, reflecting its relatively small position within the overall crypto ecosystem.

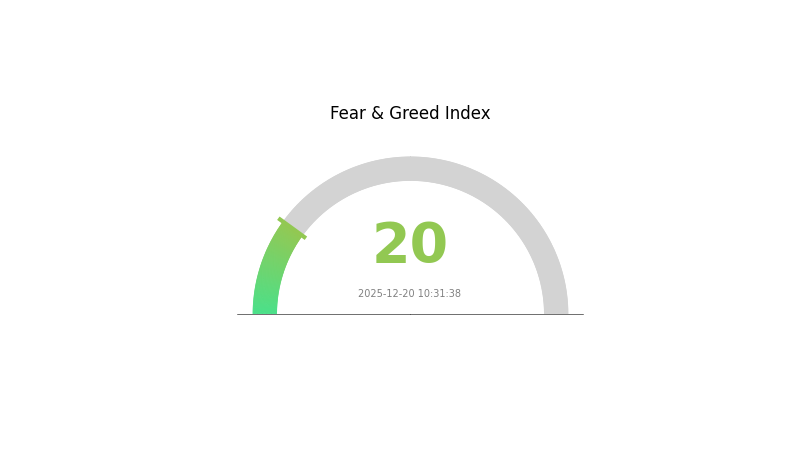

Current market sentiment shows extreme fear with a VIX reading of 20, indicating heightened market anxiety and risk aversion among investors.

Click to view current DUSK market price

DUSK Market Sentiment Indicator

2025-12-20 Fear & Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with the Fear & Greed Index dropping to 20. This indicates severe market pessimism and heightened investor anxiety. Such extreme fear levels often present contrarian buying opportunities for long-term investors, as panic-driven sell-offs may create attractive entry points. However, traders should exercise caution and conduct thorough analysis before making investment decisions. Monitor market developments closely and consider your risk tolerance when trading during periods of extreme fear.

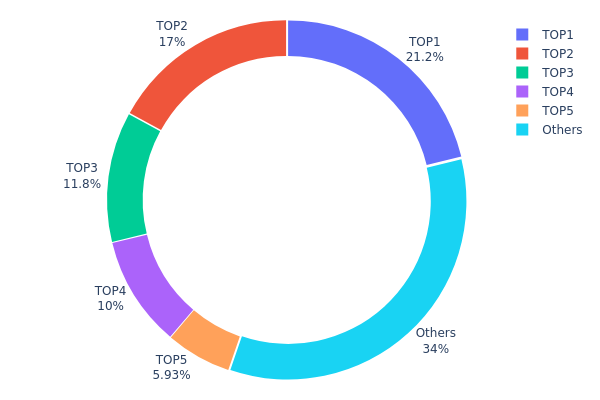

DUSK Holdings Distribution

The address holdings distribution chart illustrates the concentration of DUSK tokens across the top wallet addresses on the blockchain. By analyzing the proportion of tokens held by major addresses relative to total supply, this metric provides critical insights into the token's decentralization status and potential vulnerability to market manipulation.

DUSK exhibits a notable concentration pattern that warrants careful consideration. The top five addresses collectively control approximately 65.94% of the token supply, with the largest holder commanding 21.21% alone. The second and third largest addresses hold 17.03% and 11.77% respectively, indicating a significant wealth concentration among a limited number of entities. While the remaining addresses account for 34.06% of holdings, the substantial stake concentrated in the top tier presents a structural imbalance that could influence market dynamics. This distribution suggests that DUSK has not yet achieved optimal decentralization, with decision-making power potentially concentrated among a handful of stakeholders.

The current holdings distribution raises important considerations regarding market stability and price discovery mechanisms. The concentration of over two-thirds of supply in just five addresses creates conditions where coordinated actions—whether intentional or circumstantial—could materially impact price movements and trading liquidity. Smaller retailers and emerging holders must navigate a market structure where large token holders possess disproportionate influence. However, without additional context regarding whether these addresses represent project reserves, institutional holdings, or autonomous protocol contracts, the full implications of this concentration require further investigation into the nature and purpose of these major stakeholders.

Click to view current DUSK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8787...a1aa2d | 106066.96K | 21.21% |

| 2 | 0x36b8...f1084f | 85153.60K | 17.03% |

| 3 | 0xf977...41acec | 58861.28K | 11.77% |

| 4 | 0xe75d...24c339 | 50000.00K | 10.00% |

| 5 | 0xedc6...c487c9 | 29670.32K | 5.93% |

| - | Others | 170247.84K | 34.06% |

II. Core Factors Affecting DUSK's Future Price

Technology Development and Ecosystem Building

- Lightspeed Implementation: Successful launch and timely delivery of Lightspeed technology is expected to drive significant price appreciation over the next 6-18 months.

- Zedger Beta Release: The beta launch of Zedger represents a critical milestone that could enhance market confidence and token valuation.

- Hyperstaking Launch: The introduction of Hyperstaking functionality is anticipated to improve token utility and investor engagement, positively impacting price dynamics.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate fluctuations directly influence investment attractiveness for DUSK, with lower rates typically supporting higher valuations.

- Inflation Hedge Properties: DUSK demonstrates potential hedge characteristics in inflationary environments, positioning itself as a potential "digital asset" with store-of-value properties.

- Geopolitical Factors: International uncertainties may increase volatility and affect capital flows into alternative assets like DUSK.

Market Sentiment and Adoption Dynamics

- Market Awareness and Education: Currently, insufficient market recognition limits DUSK's price appreciation potential. Successful market education and promotional campaigns are essential to unlock growth opportunities.

- Positive News Impact: Favorable announcements regarding widespread DUSK adoption or major technological breakthroughs typically generate bullish sentiment, driving price increases.

- Investor Confidence: Market sentiment and investor confidence directly influence DUSK price movements, with positive narratives supporting upward trajectories while negative news—such as regulatory actions or security vulnerabilities—can trigger market panic and price declines.

Three、2025-2030 DUSK Price Forecast

2025 Outlook

- Conservative Forecast: $0.03795

- Neutral Forecast: $0.04037

- Optimistic Forecast: $0.06015

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady growth trajectory

- Price Range Forecast:

- 2026: $0.02764 - $0.06182

- 2027: $0.03923 - $0.07453

- 2028: $0.05288 - $0.07965

- Key Catalysts: Enhanced protocol adoption, improved market liquidity, strengthened ecosystem partnerships, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.04638 - $0.09711 (sustained ecosystem growth and moderate market expansion)

- Optimistic Case: $0.07885 - $0.1221 (accelerated adoption and network effect realization)

- Transformative Case: $0.1221+ (breakthrough in institutional adoption and significant technological innovations)

- Performance Milestones: DUSK demonstrates cumulative gains of 108% by 2030, indicating substantial value appreciation from current baseline levels

Market Analysis Note: The forecast data suggests a consistent upward trend across the forecast period, with projected gains ranging from baseline stability in 2025 to 108% cumulative appreciation by 2030. Traders and investors can monitor DUSK performance on Gate.com for real-time price tracking and portfolio management.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06015 | 0.04037 | 0.03795 | 0 |

| 2026 | 0.06182 | 0.05026 | 0.02764 | 23 |

| 2027 | 0.07453 | 0.05604 | 0.03923 | 38 |

| 2028 | 0.07965 | 0.06529 | 0.05288 | 60 |

| 2029 | 0.09711 | 0.07247 | 0.04638 | 78 |

| 2030 | 0.1221 | 0.08479 | 0.07885 | 108 |

DUSK Network Investment Strategy and Risk Management Report

IV. DUSK Professional Investment Strategy and Risk Management

DUSK Investment Methodology

(1) Long-term Holding Strategy

- Target Investor Profile: Privacy-focused investors, institutional players interested in blockchain infrastructure, long-term believers in privacy-preserving technologies

- Operation Recommendations:

- Accumulate during market downturns when DUSK trades below $0.05, capitalizing on the current bear market cycle

- Hold through consensus participation rewards, which provide a natural compounding mechanism as DUSK tokens are distributed to stakers

- Dollar-cost averaging (DCA) approach over 12-24 months to reduce timing risk, given DUSK's historical volatility (down 79.14% year-over-year)

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Support and Resistance Levels: Current price near $0.04058 represents a critical support zone, with historical resistance around $0.10-$0.15 levels

- Volatility Indicators: Monitor 24-hour and 7-day price volatility (currently 4.3% up in 24h, but -11.65% in 7 days) for swing trading opportunities

- Range Trading Key Points:

- Identify accumulation phases when price approaches the ATL of $0.01113274 relative to the established $0.04-$0.05 range

- Execute profit-taking positions near resistance levels, with moderate risk management given the project's market cap of $20.29 million

DUSK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation to DUSK, treating it as a speculative position given the small market cap and development stage

- Active Investors: 3-7% allocation, suitable for those with higher risk tolerance and conviction in privacy-oriented blockchain protocols

- Professional Investors: 5-15% allocation for institutional players conducting research on Byzantine consensus mechanisms and privacy infrastructure

(2) Risk Hedging Solutions

- Diversification Strategy: Balance DUSK holdings with established layer-1 and layer-2 blockchain assets to reduce single-project concentration risk

- Position Sizing: Implement strict position size limits based on the token's low liquidity ($16,185.44 in 24h volume) to ensure exit flexibility

(3) Secure Storage Solutions

- Hot Wallet Approach: For active trading, utilize Gate.com's integrated wallet services for convenient access to DUSK trading pairs while maintaining reasonable security standards

- Self-Custody Method: For long-term holders engaging in staking, consider transferring DUSK to Ethereum-compatible self-custody solutions that support the token's native smart contracts

- Security Considerations: Given DUSK's ERC-20 implementation on Ethereum, ensure protection against smart contract vulnerabilities, phishing attacks, and maintain backup recovery phrases in secure offline storage

V. DUSK Potential Risks and Challenges

DUSK Market Risk

- Low Liquidity Risk: With only $16,185.44 in 24-hour trading volume and a $20.29 million market cap, DUSK faces significant liquidity constraints that can lead to high slippage on larger trades

- Extreme Price Volatility: The token has experienced a 79.14% decline over the past year and traded as high as $1.09 (ATH in December 2021) to as low as $0.01113274 (ATL in March 2020), representing extreme volatility unsuitable for risk-averse investors

- Market Adoption Risk: As a privacy-focused protocol ranked #865 globally, DUSK faces challenges in competing with established privacy solutions and achieving meaningful user adoption

DUSK Regulatory Risk

- Privacy Technology Scrutiny: Governments worldwide are increasing regulatory pressure on privacy-enhancing technologies and anonymous transaction capabilities, which could impact DUSK's development roadmap and use cases

- Compliance Uncertainty: As privacy protocols face potential classification challenges in various jurisdictions, regulatory changes could affect DUSK's availability on compliant exchanges and institutional adoption pathways

- Cross-Border Restrictions: Certain jurisdictions may impose restrictions on privacy coins and tokens featuring anonymous transaction features, limiting DUSK's addressable market

DUSK Technical Risk

- Byzantine Protocol Implementation Risk: The protocol's novel Byzantine Fault Tolerant (SBA) consensus mechanism remains less battle-tested compared to established PoW or PoS mechanisms, potentially containing undiscovered vulnerabilities

- Secure Tunnel Switching (STS) Adoption Risk: The success of Dusk Network depends on practical deployment and adoption of its privacy-preserving mechanisms, which face technical implementation and user education challenges

- Smart Contract Vulnerability Risk: As an ERC-20 token on Ethereum, DUSK is exposed to Ethereum layer risks and any potential vulnerabilities in the token's smart contract code

VI. Conclusion and Action Recommendations

DUSK Investment Value Assessment

DUSK Network presents a specialized investment opportunity for those specifically focused on privacy-oriented blockchain infrastructure with Byzantine consensus innovations. However, the project exhibits significant challenges including extremely low market liquidity, severe price volatility (down 79% annually), and a small market capitalization indicating early-stage development. The technical innovation around privacy and consensus mechanisms holds long-term potential, but regulatory uncertainty around privacy technologies and competition from established privacy solutions create substantial headwinds. Investors should view DUSK as a high-risk, speculative position rather than a core holding.

DUSK Investment Recommendations

✅ Beginners: Limit DUSK exposure to 1-2% of portfolio as a learning opportunity in privacy blockchain technology; start with small, fixed amounts via Gate.com platform rather than attempting active trading strategies

✅ Experienced Investors: Consider 3-5% allocation for those with established positions in blockchain infrastructure; focus on long-term staking participation rather than short-term trading given liquidity constraints

✅ Institutional Investors: Conduct deep technical due diligence on Byzantine protocol implementation before considering 5-10% allocations; consider the project's development stage, team credibility, and regulatory trajectory before institutional commitment

DUSK Trading Participation Methods

- Exchange Trading: Access DUSK through Gate.com's spot trading market for ETH/DUSK pairs, with appropriate risk management given the limited trading volume

- On-chain staking: Participate in Dusk Network consensus by running nodes or delegating stakes to validators, earning block rewards denominated in newly issued DUSK tokens

- Liquidity Provision: Advanced users can provide liquidity to DUSK trading pairs on Ethereum-based protocols, earning fees while accepting impermanent loss risks given the token's volatility

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose. DUSK's regulatory status and technical implementation remain uncertain, making this a high-risk speculative asset suitable only for experienced investors with substantial risk capacity.

FAQ

Is dusk coin a good investment?

Dusk coin presents compelling investment potential with its innovative privacy-focused blockchain technology. Growing adoption and development activity suggest strong long-term prospects. Early-stage positioning offers significant upside opportunity for forward-thinking investors.

How much is dusk worth?

As of December 20, 2025, 1 Dusk (DUSK) is worth approximately $0.0399 USD. DUSK prices fluctuate constantly based on market conditions and trading volume. Check real-time data for the most current pricing information.

What is the max supply of dusk coins?

The maximum supply of DUSK coins is 500 million tokens. This represents the total amount of DUSK that will ever be created on the network.

2025 DCR Price Prediction: Decred's Potential Surge Amid Evolving Crypto Landscape

COOK vs FLOW: The Battle of Culinary Approaches in Modern Kitchen Innovation

How Do Crypto Holdings and Fund Flows Impact Market Trends?

How Does Cryptocurrency Holding and Fund Flow Impact Market Dynamics?

How Does LUNC's Holdings and Fund Flow Impact Its Price in 2025?

How Does FET's Circulating Supply of 2.37 Billion Impact Its Market Cap?

What is URANUS: A Comprehensive Guide to the Ice Giant of Our Solar System

What is BITBOARD: A Comprehensive Guide to Understanding Bitboard Representation in Chess Programming

Is the Quantum Computing Era Coming? Why Bitcoin May Need 5–10 Years to Transition to Post-Quantum Security

2025 DADDY Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 ATS Price Prediction: Expert Analysis and Market Outlook for the Coming Year