2025 DYM Price Prediction: Expert Analysis and Market Forecast for Dymension Token

Introduction: DYM's Market Position and Investment Value

Dymension (DYM) is an L1 blockchain built for modular RollApps, representing a significant innovation in the modular blockchain ecosystem. Since its launch in January 2024, DYM has established itself as a key infrastructure project in the decentralized application space. As of December 2025, DYM boasts a market capitalization of approximately $29.4 million, with a circulating supply of around 428.3 million tokens trading at $0.06865 per unit. Currently ranked 700th by market cap, this innovative protocol is playing an increasingly important role in enabling scalable and efficient modular blockchain architectures.

This comprehensive analysis will examine DYM's price trajectory and market performance through 2025, integrating historical price patterns, market supply-demand dynamics, ecosystem development milestones, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies. By evaluating both technical indicators and fundamental developments, this guide aims to equip stakeholders with the insights necessary to make informed decisions regarding DYM's investment potential in the evolving cryptocurrency landscape.

Dymension (DYM) Market Analysis Report

I. DYM Price History Review and Current Market Status

DYM Historical Price Movement

Dymension (DYM) has experienced significant volatility since its launch in January 2025. The token reached its all-time high of $8.7379 on February 14, 2024, representing a peak valuation period for the project. Subsequently, the asset entered a prolonged downtrend, declining substantially throughout 2024 and into 2025. The all-time low of $0.0234 was recorded on October 10, 2025, marking approximately a 99.7% decrease from its historical peak. This dramatic price compression reflects the challenging market conditions faced by the broader cryptocurrency sector during this period.

DYM Current Market Dynamics

As of December 19, 2025, DYM is trading at $0.06865, demonstrating a modest recovery trajectory from its recent lows. The token has appreciated 1.35% over the past 24 hours, with intraday trading range between $0.06482 and $0.07106. Short-term momentum appears slightly positive, with a 0.54% gain recorded in the last hour. However, medium to long-term performance remains subdued, with the asset declining 12.36% over the past seven days and 11.02% over the past month. The one-year performance is particularly bearish, reflecting an 95.84% depreciation from year-ago levels.

The market capitalization stands at approximately $29.41 million based on circulating supply, while the fully diluted valuation reaches $68.65 million. The circulating supply comprises 428.35 million DYM tokens from a total supply of 1 billion tokens, indicating a circulation ratio of 42.83%. Daily trading volume reaches $100,269.88, demonstrating relatively modest liquidity in current market conditions. DYM maintains a market ranking of 700 and a dominance metric of 0.0021%, reflecting its positioning as a mid-cap cryptocurrency asset.

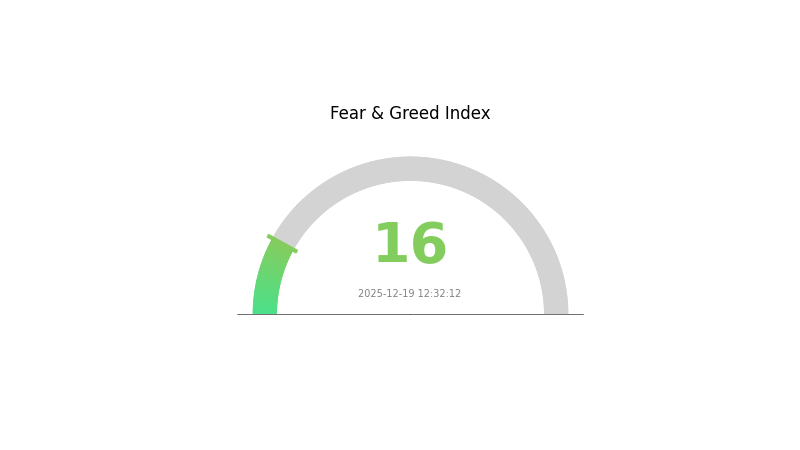

Current market sentiment indicators show "Extreme Fear" (Volatility Index: 16), suggesting heightened risk aversion across the broader cryptocurrency ecosystem, which may be constraining capital allocation to mid-tier projects like Dymension.

Visit DYM Market Price on Gate.com for real-time data

DYM Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 16. This indicates severe market pessimism and heightened investor anxiety. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic selling may create favorable entry points. However, caution is warranted as further downside risks remain. Monitor market developments closely on Gate.com to track sentiment shifts and make informed trading decisions during this volatile period.

DYM Holdings Distribution

The address holdings distribution chart represents the concentration of DYM tokens across different wallet addresses on the blockchain, serving as a critical metric for assessing tokenomics health and market structure. This analysis examines the top holders and their proportional ownership to evaluate the degree of decentralization and potential systemic risks within the DYM ecosystem.

Unfortunately, the provided data table appears to be empty, containing no specific address holdings information or concentration metrics. Without concrete data on the distribution of DYM tokens across addresses, a comprehensive assessment of holder concentration, wealth disparity, and decentralization indicators cannot be accurately performed at this time. To conduct a thorough analysis of DYM's address distribution characteristics, complete holdings data including specific wallet addresses, their respective token quantities, and percentage allocations would be required.

When such data becomes available, the analysis would typically evaluate whether token distribution exhibits excessive concentration among a small number of addresses—a condition that could increase vulnerability to market manipulation, sudden liquidity events, or governance imbalances. The resulting assessment would provide insights into the blockchain's decentralization maturity and the stability of its on-chain structure, ultimately informing conclusions about DYM's market resilience and long-term sustainability.

Click to view current DYM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing DYM's Future Price

Supply Mechanism

- Total Supply Cap: DYM has a total supply of 1,000,000,000 tokens, with no maximum supply limit established, which directly impacts price and investment value.

- Historical Patterns: Historical experience demonstrates that supply fluctuations have driven cryptocurrency price volatility in the past.

- Current Impact: User growth and the proliferation of RollApps are jointly driving price appreciation. Scarcity serves as the primary factor supporting long-term investment value.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policy changes may determine market direction and overall cryptocurrency market sentiment.

Technology Development and Ecosystem Building

- RollApps Growth: The expansion of RollApps within the Dymension ecosystem represents a key technological advancement supporting broader user adoption and ecosystem development.

III. DYM Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.03517 - $0.05724

- Base Case Forecast: $0.06897

- Optimistic Forecast: $0.07932 (requiring sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing institutional interest and protocol maturation driving steady appreciation.

- Price Range Predictions:

- 2026: $0.05190 - $0.08452 (8% upside potential)

- 2027: $0.04522 - $0.11265 (15% upside potential)

- Key Catalysts: Protocol upgrades, ecosystem expansion, increased DeFi adoption, and strengthening network fundamentals supporting long-term value proposition.

2028-2030 Long-term Outlook

- Base Scenario: $0.04896 - $0.11135 by 2028 (39% growth potential, assuming moderate adoption and stable market conditions)

- Optimistic Scenario: $0.09019 - $0.14203 by 2029 (51% upside with accelerated ecosystem growth and mainstream DeFi integration)

- Bullish Scenario: $0.07003 - $0.15848 by 2030 (78% growth potential under favorable macroeconomic conditions, widespread protocol adoption, and significant institutional participation)

Through 2030, DYM demonstrates substantial long-term appreciation potential as the project matures and captures increasing market share within its segment. Success hinges on continuous innovation, community engagement, and effective execution of strategic milestones.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07932 | 0.06897 | 0.03517 | 0 |

| 2026 | 0.08452 | 0.07414 | 0.0519 | 8 |

| 2027 | 0.11265 | 0.07933 | 0.04522 | 15 |

| 2028 | 0.11135 | 0.09599 | 0.04896 | 39 |

| 2029 | 0.14203 | 0.10367 | 0.09019 | 51 |

| 2030 | 0.15848 | 0.12285 | 0.07003 | 78 |

Dymension (DYM) Professional Investment Strategy and Risk Management Report

IV. DYM Professional Investment Strategy and Risk Management

DYM Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Believers in modular blockchain architecture and L1 infrastructure development; investors with high risk tolerance seeking exposure to RollApps ecosystem growth

-

Operation Recommendations:

- Accumulate during market downturns, particularly when prices remain significantly below all-time highs; current 95.84% decline from ATH presents potential entry opportunities for long-term believers

- Dollar-cost averaging (DCA) approach to mitigate volatility risk; consider monthly or quarterly allocations rather than lump-sum entries

- Maintain positions through protocol updates and ecosystem development milestones; monitor Dymension's rollout of new RollApps and network improvements

-

Storage Solutions:

- For significant holdings, utilize self-custody solutions to maintain control over private keys and ensure security against exchange risks

- Implement multi-signature wallet protocols for institutional-scale holdings to distribute custody and approval requirements across multiple signatories

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.06482 - $0.07106) as immediate support and resistance; track historical price action relative to ATH ($8.7379) and recent ATL ($0.0234)

- Volume Analysis: Current 24-hour volume of approximately $100,269 indicates relatively modest liquidity; track volume spikes during price movements to identify trend confirmation or reversal signals

-

Swing Trading Entry Points:

- Capitalize on the -12.36% 7-day decline and -11.02% 30-day decline patterns; positions entered during weakness with targets around previous resistance levels

- Monitor 1-hour price movements (+0.54%) for scalping opportunities; execute stop-loss orders below the 24-hour low to manage downside risk effectively

DYM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation; focus on buy-and-hold strategy with extended time horizon

- Active Investors: 3-5% of total portfolio allocation; implement position sizing relative to overall cryptocurrency exposure

- Professional Investors: 5-10% of total portfolio allocation; may include derivatives and structured positions for yield enhancement

(2) Risk Hedging Solutions

- Diversification Strategy: Balance DYM holdings with other Layer 1 and modular blockchain tokens to reduce concentration risk

- Position Sizing: Never allocate more than 5-10% of trading capital to any single position; maintain strict risk-per-trade limits at 1-2% of account equity

(3) Secure Storage Solutions

- Hardware-Grade Security: Utilize institutional-grade custody solutions for large holdings; consider multi-signature arrangements with trusted security partners

- Self-Custody Options: For experienced users, implement proper key management practices including seed phrase storage in secure offline locations

- Security Considerations: Never share private keys or recovery phrases; use reputable blockchain explorers for address verification; enable two-factor authentication on all trading accounts at Gate.com

V. DYM Potential Risks and Challenges

DYM Market Risk

- Extreme Volatility: DYM has experienced a 95.84% decline from all-time high, demonstrating severe price instability; such volatility creates significant risk of further losses and makes position management challenging

- Liquidity Constraints: Current 24-hour trading volume of $100,269 across 27 exchanges represents relatively modest liquidity; large trades could face substantial slippage and price impact

- Market Sentiment Deterioration: Consistent negative price action across multiple timeframes (7-day: -12.36%, 30-day: -11.02%, 1-year: -95.84%) indicates sustained selling pressure and weakening market confidence

DYM Regulatory Risk

- Jurisdictional Uncertainty: Rapidly evolving cryptocurrency regulations across different territories create uncertainty regarding DYM's legal status and operational compliance requirements

- Classification Risk: Regulatory agencies may reclassify DYM or modular blockchain tokens, potentially affecting trading, custody, and investment eligibility across different jurisdictions

- Compliance Requirements: Infrastructure projects may face increasing regulatory scrutiny; changes in requirements could impact network operations and token utility

DYM Technical Risk

- Ecosystem Adoption Uncertainty: As an L1 blockchain for modular RollApps, DYM's success depends on significant developer and user adoption; failure to attract projects could undermine fundamental value proposition

- Smart Contract Vulnerabilities: Any critical bugs or security exploits in the protocol could result in fund loss, network disruption, and severe token devaluation

- Competing Solutions: Other modular blockchain platforms and Layer 2 solutions present ongoing competitive threats; failure to maintain technological leadership could result in market share erosion

VI. Conclusion and Action Recommendations

DYM Investment Value Assessment

Dymension represents a specialized investment in modular blockchain infrastructure with a distinct positioning around RollApps technology. However, the token faces significant headwinds: a 95.84% decline from all-time highs, sustained negative price momentum, modest trading liquidity of approximately $100,269 daily, and execution risk associated with ecosystem adoption. While the modular blockchain narrative remains compelling long-term, current conditions reflect market skepticism regarding near-term growth prospects. Investors should approach DYM carefully, focusing on technical merit rather than short-term price recovery expectations. The risk-reward profile appears challenging for conservative investors but may offer speculative opportunities for experienced traders with high risk tolerance and extended investment horizons.

DYM Investment Recommendations

✅ Beginners: Avoid direct DYM investment in favor of more established Layer 1 projects; if interested in modular blockchain exposure, consider positions sized at 1% of portfolio maximum with clear understanding of total loss potential

✅ Experienced Investors: Consider small speculative positions (2-5% allocation) only if you maintain conviction in modular RollApps technology and can tolerate significant additional downside; employ strict stop-loss discipline and position sizing protocols

✅ Institutional Investors: Evaluate DYM alongside broader modular blockchain infrastructure strategy; implement comprehensive due diligence on network metrics, developer activity, and competitive positioning before committing capital; use Gate.com for institutional trading execution with proper compliance frameworks

DYM Trading Participation Methods

- Gate.com Spot Trading: Purchase DYM directly using multiple fiat and cryptocurrency pairs; utilize limit orders to optimize entry prices during volatile trading conditions

- Dollar-Cost Averaging Program: Establish automated recurring purchases through Gate.com to systematically build positions over extended timeframes while reducing timing risk

- Advanced Orders: Implement stop-loss and take-profit orders to automate risk management; use conditional orders to execute trades based on predefined technical levels

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must conduct independent analysis and consult with qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely. Regulatory environments continue evolving; market conditions and risk factors may change significantly.

FAQ

What is the price prediction for DYM crypto in 2030?

Based on market analysis, DYM price prediction for 2030 ranges from $0.06797 to $0.1359, depending on market conditions and adoption growth.

What are the risks of using Dymension?

Key risks include high token inflation which may pressure DYM price, slower adoption compared to competitors like Conduit and EigenLayer, and potential market position weakening. Technical risks involve rollapp security and network reliability. Market volatility and regulatory uncertainty also pose considerations for users.

What is the all time high for DYMension coin?

The all-time high for DYMension coin is $4.97, reached in February. This represents the peak price ever recorded for DYM in its trading history.

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

2025 SAGA Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Blockchain Ecosystem

Is Kaspa (KAS) a good investment?: Analyzing the potential of this high-throughput blockchain project

FOXY vs APT: Comparing Modern Threat Detection Systems in Enterprise Security Environments

Ethereum 2024 Price Predictions

Ethereum Shanghai Update: Implications for Staking

Claim Your Layer Zero Airdrop: A Step-by-Step Guide

A Beginner’s Guide to Cryptocurrency Launchpads

Understanding the Mechanics of Decentralized Crypto Lending