2025 ELA Price Prediction: Expert Analysis and Market Forecast for Elastos Network

Introduction: ELA's Market Position and Investment Value

Elastos (ELA) serves as a next-generation Web 3.0 platform dedicated to building a decentralized intelligent World Wide Web (SmartWeb) based on blockchain technology. Since its inception in 2018, Elastos has established itself as a foundational infrastructure for distributed applications with a focus on user privacy protection and data security. As of 2025, ELA's market capitalization has reached approximately $31.62 million, with a circulating supply of around 23.04 million tokens, maintaining a price point near $1.21.

This innovative blockchain platform, which combines main-side chain architecture, multi-layer consensus mechanisms, and smart contract consensus computing, is increasingly playing a pivotal role in enabling data asset monetization and decentralized services including identity management, communication, storage, and computing infrastructure.

This article will provide a comprehensive analysis of ELA's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

Elastos (ELA) Market Analysis Report

I. ELA Price History Review and Current Market Status

ELA Historical Price Evolution Trajectory

-

February 2018: Elastos reached its all-time high (ATH) of $89.14, marking the peak of initial market enthusiasm following the project's launch in January 2018 at an initial price of $15.152.

-

2018-2023 Period: A prolonged bear market phase where ELA experienced significant depreciation, reflecting broader cryptocurrency market cycles and shifting investor sentiment.

-

January 2023: ELA touched its all-time low (ATL) of $0.793867 on January 8, 2023, representing a substantial decline from historical peaks and indicating a prolonged accumulation phase.

-

2023-2025 Period: Gradual recovery phase with ELA stabilizing and beginning to rebuild value from multi-year lows.

ELA Current Market Status

As of December 20, 2025, Elastos (ELA) is trading at $1.2084, reflecting a modest recovery trajectory from its historical lows. The token demonstrates the following characteristics:

Price Performance Metrics:

- 24-hour change: +2.13% (price increase of $0.0252)

- 7-day change: +1.84%

- 30-day change: +1.16%

- 1-year change: -48.33% (year-to-date decline)

- 24-hour trading range: $1.1704 - $1.216

Market Capitalization Data:

- Current market cap: $27,840,447.23

- Fully diluted valuation (FDV): $31,622,995.41

- Market cap to FDV ratio: 81.64%

- 24-hour trading volume: $19,552.21

Supply Metrics:

- Circulating supply: 23,039,099 ELA (81.64% of total supply)

- Total supply: 26,169,311 ELA

- Maximum supply: 28,219,999 ELA

- Number of token holders: 2,555

Market Position:

- Global ranking: #730 by market capitalization

- Market dominance: 0.00099%

- Trading on 8 exchanges

- Market sentiment: Extreme Fear (VIX: 16)

ELA maintains active blockchain infrastructure with accessible explorer tools and continues to operate across multiple blockchain networks, including Ethereum mainnet integration through token contracts.

Click to view current ELA market price

ELA Market Sentiment Index

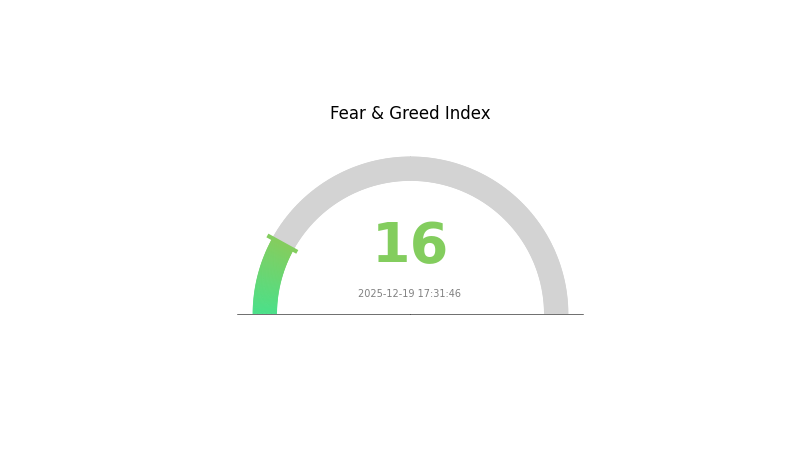

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The ELA market is currently experiencing extreme fear, with the Fear and Greed Index standing at just 16 points. This indicates severe market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases, and asset prices may face downward pressure. However, extreme fear often signals potential buying opportunities for contrarian investors with long-term perspectives. Traders should exercise caution, manage risk carefully, and avoid panic-driven decisions. Consider dollar-cost averaging strategies or waiting for stabilization signals before entering positions. Monitor market fundamentals closely on Gate.com for informed trading decisions.

ELA Holdings Distribution

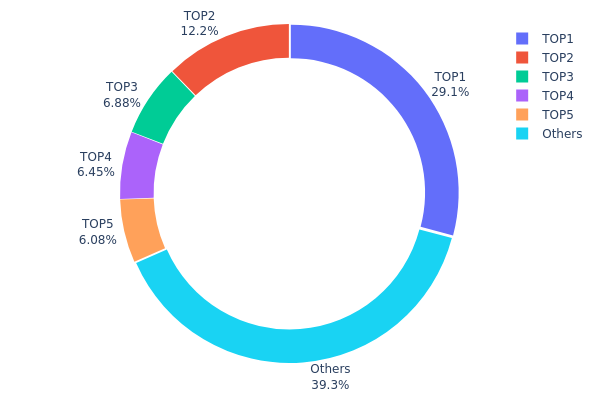

The address holdings distribution chart illustrates the concentration of ELA tokens across blockchain addresses, revealing the ownership structure and decentralization characteristics of the network. By analyzing the distribution of token quantities among top holders and other participants, this metric provides critical insights into market dynamics, potential risks of value concentration, and the overall health of the ecosystem's decentralization.

Current analysis of ELA's holdings distribution reveals moderate concentration concerns. The top five addresses collectively hold approximately 60.72% of the total token supply, with the largest address commanding 29.11% alone. This concentration level indicates a potential vulnerability, as these major holders possess substantial influence over market sentiment and price direction. However, the remaining 39.28% distributed among other addresses demonstrates that a significant portion of ELA tokens remains outside the top five holders, suggesting some degree of decentralization has been maintained within the broader holder base.

The distribution pattern reflects several market implications. The dominant position of the first address, holding nearly 30% of circulating supply, could amplify price volatility during periods of significant transactions or rebalancing activities. While such concentration is not uncommon in cryptocurrency projects, particularly during early development phases, it warrants monitoring to assess whether token distribution becomes more decentralized over time. The presence of a substantial "Others" segment suggests that retail participation and institutional diversification exist in the ELA ecosystem, which could help mitigate potential manipulation risks from individual whale actors.

View current ELA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2291...77d4ea | 1585.38K | 29.11% |

| 2 | 0x1870...dda12e | 665.00K | 12.21% |

| 3 | 0xe646...d2d0e9 | 374.34K | 6.87% |

| 4 | 0xe587...f4cde3 | 351.21K | 6.45% |

| 5 | 0xa9d1...1d3e43 | 331.24K | 6.08% |

| - | Others | 2137.34K | 39.28% |

II. Core Factors Affecting ELA's Future Price

Technology Development and Ecosystem Building

-

Decentralized Identity and Storage Solutions: Elastos (ELA) is leveraging decentralized identity and storage mechanisms to reshape the internet ecosystem. The platform aims to provide innovative solutions for a decentralized internet era, with technological advancement serving as a fundamental driver of ecosystem expansion.

-

Ecosystem Growth: The expansion of the ELA ecosystem is expected to support significant price appreciation. As more applications and use cases are developed within the Elastos platform, increased adoption and market demand could substantially influence future price movements.

-

Regulatory Challenges and Technical Risks: Price volatility and regulatory uncertainties present challenges to sustained growth. Policy changes in different jurisdictions may create headwinds, while technical implementation risks require ongoing development attention to ensure robust platform operations.

Market Demand and Investor Sentiment

-

Market Demand: Future ELA price movements are primarily influenced by technological progress, ecosystem development, and overall market demand. Strong adoption of the platform's solutions within the decentralized internet space could drive positive price dynamics.

-

Investor Confidence: Market competition and investor sentiment play critical roles in determining ELA's price trajectory. The platform's ability to differentiate itself and maintain competitive advantages will be essential for attracting and retaining investor interest.

III. ELA Price Prediction for 2025-2030

2025 Outlook

- Conservative Forecast: $1.11-$1.21

- Neutral Forecast: $1.21-$1.38

- Optimistic Forecast: $1.54-$1.70 (contingent on positive market sentiment and ecosystem expansion)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual appreciation driven by technological development and market recovery

- Price Range Predictions:

- 2026: $1.11-$2.02 (20% potential upside)

- 2027: $1.08-$2.19 (43% potential upside)

- Key Catalysts: Enhanced blockchain adoption, ecosystem partnerships, network utility expansion, and positive macroeconomic conditions

2028-2030 Long-term Outlook

- Base Case Scenario: $1.81-$2.65 (62% growth potential, assuming steady ecosystem development and moderate market expansion)

- Optimistic Scenario: $2.31-$2.63 (91% growth potential, assuming accelerated institutional adoption and technological breakthroughs)

- Transformational Scenario: $2.21-$3.34 (104% growth potential, contingent on major mainstream adoption, successful Layer 2 scaling solutions, and sustained bull market conditions)

- December 20, 2025: ELA trading at $1.21 average (baseline market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.70384 | 1.2084 | 1.11173 | 0 |

| 2026 | 2.02401 | 1.45612 | 1.10665 | 20 |

| 2027 | 2.19248 | 1.74007 | 1.07884 | 43 |

| 2028 | 2.65447 | 1.96627 | 1.80897 | 62 |

| 2029 | 2.63382 | 2.31037 | 1.31691 | 91 |

| 2030 | 3.33733 | 2.4721 | 2.20017 | 104 |

Elastos (ELA) Professional Investment Strategy and Risk Management Report

IV. ELA Professional Investment Strategy and Risk Management

ELA Investment Methodology

(1) Long-term Holding Strategy

- Suitable For: Institutional investors and long-term believers in Web 3.0 infrastructure development

- Operational Recommendations:

- Accumulate ELA during market corrections, focusing on the project's technological roadmap and ecosystem expansion milestones

- Monitor the development of Elastos' SmartWeb platform and decentralized services adoption metrics

- Maintain positions through market cycles, viewing volatility as accumulation opportunities given the project's foundational Web 3.0 positioning

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Utilize historical price points (ATH: $89.14, ATL: $0.793867) to identify key breakout and breakdown zones

- Volume Analysis: Monitor 24-hour trading volume trends ($19,552.21) relative to historical averages to confirm trend strength

- Wave Trading Key Points:

- Execute buy signals during positive momentum periods (recent 24H gain of +2.13%)

- Apply trailing stop losses to capture upside while protecting against downside volatility

ELA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Aggressive Investors: 3-7% portfolio allocation

- Professional Investors: 5-15% portfolio allocation

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-50% of allocated capital in stablecoins to capitalize on market dips

- Diversification Strategy: Balance ELA holdings with other Web 3.0 infrastructure tokens to reduce concentration risk

(3) Secure Storage Solutions

- Hardware Wallet Method: Utilize professional-grade hardware solutions for holdings exceeding $10,000 USD

- Hot wallet Method: For active trading amounts, use Gate Web3 Wallet on Gate.com with multi-signature authentication enabled

- Security Considerations: Enable two-factor authentication, regularly audit wallet access logs, never share private keys, and maintain offline backup records of recovery phrases

V. ELA Potential Risks and Challenges

ELA Market Risk

- Liquidity Concentration: With only 8 exchange listings and relatively limited trading volume, ELA faces potential slippage during large position entries or exits

- Price Volatility: The token has experienced significant drawdowns (-48.33% over one year), reflecting high volatility exposure

- Market Cap Dependency: Current market cap of $27.84 million positions ELA as a micro-cap asset vulnerable to rapid price swings

ELA Regulatory Risk

- Evolving Compliance Environment: Regulatory changes in major jurisdictions could impact token classification and exchange listing availability

- Jurisdictional Uncertainty: Smart contract platforms face ongoing regulatory scrutiny regarding their operational structure and governance

- Securities Classification Risk: Depending on regulatory developments, ELA could face reclassification affecting trading and holding legality in certain regions

ELA Technology Risk

- Competition from Established Platforms: Elastos competes against well-funded Web 3.0 platforms with larger development teams and institutional backing

- Ecosystem Adoption Challenges: Success depends on achieving meaningful adoption of the SmartWeb platform and decentralized services

- Technical Execution Risk: The platform's multi-layer consensus and sidechain architecture adds complexity that could pose implementation and scalability challenges

VI. Conclusion and Action Recommendations

ELA Investment Value Assessment

Elastos presents a technically ambitious Web 3.0 infrastructure project with a focus on decentralized identity, communications, storage, and computing services. The project's core value proposition centers on enabling data asset monetization through blockchain technology. However, current market positioning reflects limited adoption, with a micro-cap status and declining year-over-year performance. The token's long-term viability depends on successful ecosystem expansion and real-world adoption of its SmartWeb platform services.

ELA Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through Gate.com, using dollar-cost averaging to build exposure while learning the project's technological developments

✅ Experienced Investors: Implement a structured accumulation strategy during volatility, utilizing technical support levels and ecosystem milestones as entry triggers

✅ Institutional Investors: Conduct detailed due diligence on Elastos' development team and technology partners before considering meaningful allocations; monitor ecosystem partnerships and sidechain adoption metrics

ELA Trading Participation Methods

- Spot Trading on Gate.com: Buy and hold ELA directly through the platform's spot market with competitive fees

- Margin Trading: For experienced traders, utilize Gate.com's margin features to amplify positions during identified technical breakout patterns

- Portfolio Integration: Include ELA as a diversified holding within a broader Web 3.0 infrastructure allocation strategy

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Elastos crypto a good investment?

Elastos (ELA) offers unique privacy and decentralized identity solutions with strong fundamentals. Its innovative technology and growing ecosystem position it as a promising long-term investment opportunity in the blockchain space.

What is the price of ELA?

As of December 19, 2025, ELA is trading at $13.48, up from the previous close of $11.70. The price reflects current market conditions and recent trading activity.

How does Elastos compare to ethereum?

Elastos is a smaller blockchain platform compared to Ethereum. While both are blockchain platforms, Ethereum has a larger ecosystem, higher market cap, and more widespread adoption. Elastos focuses on decentralized internet infrastructure with unique strengths in that specific domain.

2025 XCNPrice Prediction: Will XCN Token Reach New Heights in the Post-Halving Bull Market?

2025 XCNPrice Prediction: Analyzing Market Trends and Potential Growth Factors for XCN in a Changing Crypto Landscape

2025 BICO Price Prediction: Analyzing Market Trends and Expert Forecasts for the Future of Biconomy

2025 RIF Price Prediction: Analyzing Trends and Factors Shaping the Future of RIF Token

2025 XCN Price Prediction: Analyzing Market Trends and Potential Growth Factors for XCN Tokens

2025 ELF Price Prediction: Analyzing Market Trends and Potential Growth Factors for aelf Cryptocurrency

The Future of Fiat Currencies: Understanding Their Value Decline

Exploring the Cheems Meme Coin: What Makes It Unique?

Dropee Question of the Day for 20 december 2025

Guide to Obtaining DeFi Loans: A Deep Dive into Crypto Decentralized Lending

Spur Protocol Daily Quiz Answer Today 20 december 2025