2025 FAIR3 Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of FAIR3

FAIR3 (Fair and Free) is a decentralized, community-governed movement for technical fairness dedicated to making "fairness" a tangible reality across technology, society, and opportunity. Launched in December 2025, the project has quickly established itself as a distinctive player in the Web3 ecosystem through its community-centric governance model and strategic partnerships with leading blockchain platforms including BNB Chain and Unicornverse.

As of December 22, 2025, FAIR3 has achieved a market capitalization of approximately $7.92 million with a circulating supply of 935.81 million tokens, currently trading at $0.00846. The token maintains a strong community foundation with over 27,200 token holders actively participating in the project's governance through the CTO (Community Token Owners) model. This emerging asset, characterized by its commitment to on-chain transparency and long-termism, is increasingly serving a pivotal role in the decentralized governance and community-driven innovation landscape.

This article will provide a comprehensive analysis of FAIR3's price movements and market dynamics, examining historical trends, community engagement metrics, ecosystem development, and broader market conditions to deliver professional price insights and practical investment guidance for the period through 2030. We will explore the token's positioning on Gate.com and other trading venues, while evaluating the sustainability of its community-governed tokenomics model.

I. FAIR3 Price History Review and Current Market Status

FAIR3 Historical Price Movement Trajectory

FAIR3 was published on December 10, 2024, marking the beginning of its market journey. The token reached its all-time high (ATH) of $0.038 on September 8, 2025, representing a significant milestone in its early trading history. Subsequently, the token also recorded its all-time low (ATL) of $0.003 on the same date, September 8, 2025, indicating notable price volatility during this period.

FAIR3 Current Market Dynamics

As of December 22, 2025, FAIR3 is trading at $0.00846 with a market capitalization of approximately $7.92 million. The token demonstrates mixed short-term performance with a 24-hour price change of -0.56%, while showing more resilience over the 30-day period with a +4.97% gain. However, the year-to-date performance reflects significant downside pressure, with the token trading 71.18% below its peak valuation.

The 24-hour trading volume stands at $19,644.46, reflecting moderate liquidity in the market. FAIR3 maintains a circulating supply of 935,814,213 tokens, with the fully diluted market cap aligned at $7.92 million (100% circulating ratio), indicating that all tokens are currently in circulation.

The token holds a market dominance of 0.00024% within the broader cryptocurrency ecosystem and ranks #1,300 by market capitalization. With 27,200 token holders, FAIR3 maintains a relatively distributed holder base. The token is available for trading on 4 exchanges, with Gate.com being a primary platform for FAIR3 trading activity.

Current market sentiment reflects extreme fear conditions, as indicated by elevated volatility indicators in the broader market environment on December 22, 2025.

Click to view current FAIR3 market price

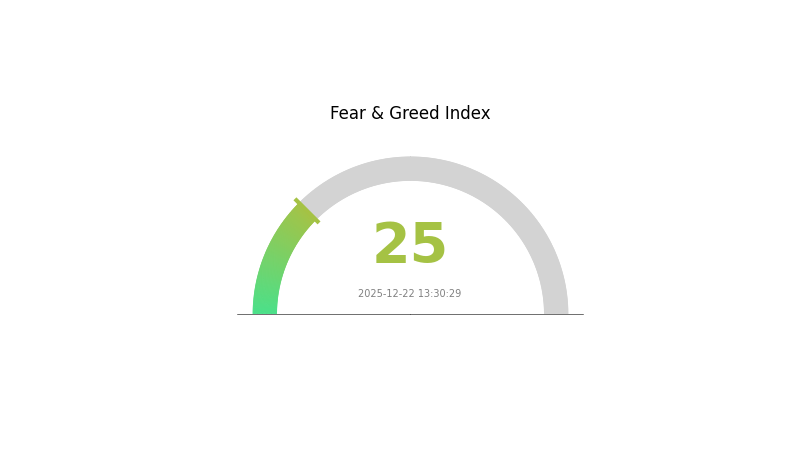

FAIR3 Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This reading indicates severe market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often signals potential capitulation in the market. Risk-averse investors may consider this volatility cautiously, as extreme fear can sometimes precede market rebounds. Monitor key support levels closely and ensure proper risk management. Stay informed through Gate.com's real-time market data and sentiment analysis tools to make informed trading decisions during this uncertain period.

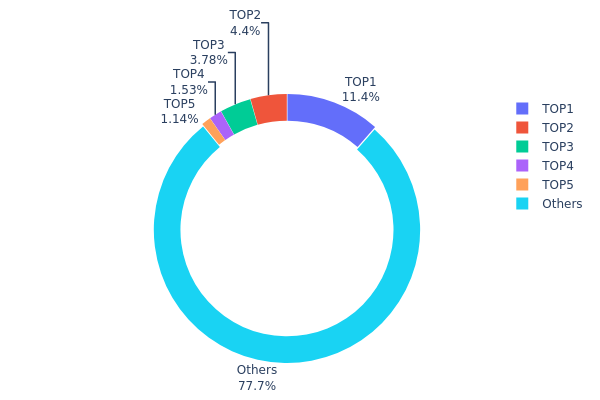

FAIR3 Holdings Distribution

The address holdings distribution chart illustrates the concentration of FAIR3 tokens across the network by displaying the top wallet addresses and their respective token quantities as a percentage of total circulating supply. This metric serves as a critical indicator for assessing the decentralization level and potential concentration risks within the token ecosystem.

Current data reveals a moderate concentration pattern in FAIR3's holder structure. The top address holds 11.42% of total tokens, while the top five addresses collectively control approximately 22.25% of the supply. This concentration level suggests a relatively balanced distribution compared to highly centralized tokens, though the presence of a single address holding over 11% warrants monitoring. The remaining 77.75% of tokens distributed across other addresses indicates substantial decentralization, with no single entity maintaining dominant control over the asset.

The existing holder distribution reflects a stable on-chain structure with limited acute manipulation risks. The concentration of approximately one-fifth of the supply among the top five addresses is typical for mature token projects and does not indicate excessive centralization. However, coordinated actions by the top five holders could theoretically influence market dynamics during periods of low liquidity. The substantial proportion held by dispersed addresses demonstrates healthy community participation and reduces the likelihood of price manipulation through concentrated selling or buying pressure, thereby supporting market resilience and price stability across different market cycles.

Click to view current FAIR3 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 106942.39K | 11.42% |

| 2 | 0x1b49...be1852 | 41139.24K | 4.39% |

| 3 | 0x7012...667dde | 35354.31K | 3.77% |

| 4 | 0x8201...61011c | 14332.73K | 1.53% |

| 5 | 0xdbf7...3e9483 | 10689.04K | 1.14% |

| - | Others | 727356.50K | 77.75% |

II. Core Factors Affecting FAIR3 Future Price

Macroeconomic Environment

-

Monetary Policy Impact: FAIR3 price predictions are commonly influenced by macroeconomic events such as interest rate adjustments. Changes in central bank policies affect investor risk appetite and overall demand for cryptocurrencies like FAIR3.

-

Geopolitical Factors: Geopolitical tensions impact FAIR3's price trajectory by altering market sentiment. For example, economic recessions may suppress FAIR3 demand, leading to price declines. Monitoring global events is essential for investors to understand potential price movements.

Market Sentiment and Trend Factors

-

Investor Sentiment: FAIR3 price fluctuations are significantly driven by market sentiment. Investor confidence, risk appetite, and overall market psychology directly influence trading activity and price direction.

-

Cryptocurrency Market Trends: FAIR3's price movements are closely correlated with broader cryptocurrency market trends. Technical analysis, market sentiment, project fundamentals, and overall market conditions all contribute to price prediction, though such predictions contain significant uncertainty.

-

Regulatory Environment: Policy monitoring and regulatory dynamics play important roles in shaping FAIR3's price outlook. Changes in cryptocurrency regulations can substantially impact investor confidence and market dynamics.

III. 2025-2030 FAIR3 Price Forecast

2025 Outlook

- Conservative Forecast: $0.00778 - $0.00846

- Base Case Forecast: $0.00846

- Optimistic Forecast: $0.00939 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectations: Consolidation and gradual accumulation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.00589 - $0.01151

- 2027: $0.0094 - $0.01288

- 2028: $0.00681 - $0.01189

- Key Catalysts: Protocol upgrades, increased institutional adoption, expansion of use cases within the ecosystem, and broader market sentiment recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01055 - $0.01606 (assumes continued protocol development and steady adoption growth)

- Optimistic Scenario: $0.01292 - $0.01750 (assumes accelerated ecosystem expansion and increased market integration)

- Transformative Scenario: $0.01750+ (assumes breakthrough innovations, significant partnerships, or major market-wide bullish catalysts)

- 2025-12-22: FAIR3 displaying foundational strength with expected 64% appreciation potential by 2030 end (based on long-term cumulative growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00939 | 0.00846 | 0.00778 | 0 |

| 2026 | 0.01151 | 0.00893 | 0.00589 | 5 |

| 2027 | 0.01288 | 0.01022 | 0.0094 | 20 |

| 2028 | 0.01189 | 0.01155 | 0.00681 | 36 |

| 2029 | 0.01606 | 0.01172 | 0.01055 | 38 |

| 2030 | 0.0175 | 0.01389 | 0.01292 | 64 |

FAIR3 Professional Investment Strategy and Risk Management Report

IV. FAIR3 Professional Investment Strategy and Risk Management

FAIR3 Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community-aligned participants who believe in decentralized fairness principles and are willing to support the project's long-term vision

- Operational Recommendations:

- Participate in governance processes as a Community Token Owner (CTO) to influence project direction while holding tokens

- Accumulate FAIR3 tokens during market downturns to dollar-cost average your entry position over time

- Store tokens securely and maintain positions through market volatility cycles, targeting 2-3 year holding horizons

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price levels at 0.003 (all-time low) and 0.038 (all-time high) to determine entry and exit points

- Moving Averages: Use 20-day and 50-day moving averages to identify trend direction and potential reversal points

- Wave Trading Key Points:

- Monitor 24-hour and 7-day price changes (-0.56% and -1.06% respectively as of December 22, 2025) for short-term momentum signals

- Execute trades during high volatility periods when 24-hour trading volume exceeds average levels

FAIR3 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total portfolio allocation maximum, emphasizing capital preservation

- Active Investors: 5-8% of total portfolio allocation, allowing for moderate growth exposure

- Professional Investors: 10-15% of total portfolio allocation, with structured diversification across multiple positions

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-40% of allocated capital in stablecoins to enable opportunistic purchases during market corrections

- Position Sizing: Limit single trade size to no more than 2-3% of total hedging budget to manage downside exposure

(3) Secure Storage Solutions

- Self-Custody Options: Use Gate.com Web3 Wallet for secure, non-custodial storage with direct control over private keys and seed phrases

- Custody Approach: For institutional participants, consider secure hardware storage with multi-signature authorization protocols

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication on all exchange accounts, verify contract addresses before transactions, and maintain regular security audits of stored assets

V. FAIR3 Potential Risks and Challenges

FAIR3 Market Risks

- Price Volatility: FAIR3 has experienced extreme price fluctuations, declining 71.18% over one year while showing 4.97% gains over 30 days, indicating high market volatility and unpredictable price movements

- Limited Liquidity: With only 4 exchange listings and 24-hour trading volume of approximately 19,644 units, liquidity remains relatively low, potentially resulting in significant slippage during large trades

- Early-Stage Project Risk: As a relatively new community-governed initiative, FAIR3 faces uncertainty regarding product-market fit, user adoption rates, and long-term sustainability

FAIR3 Regulatory Risks

- Decentralized Governance Regulatory Uncertainty: Community Token Owner (CTO) governance structures may face evolving regulatory scrutiny as authorities worldwide develop clearer frameworks for decentralized autonomous organizations (DAOs)

- Jurisdictional Compliance: As the project expands globally through airdrops and hackathons, it may encounter varying regulatory requirements across different jurisdictions

- Token Classification Ambiguity: Regulatory agencies may reclassify FAIR3 tokens or governance mechanisms, potentially impacting trading, holding, or transfer capabilities

FAIR3 Technical Risks

- Smart Contract Vulnerability: The BEP20 token contract on BSC (Binance Smart Chain) could contain undiscovered security vulnerabilities or exploitable code patterns despite community review

- Network Dependency: FAIR3's reliance on the Binance Smart Chain infrastructure exposes the project to potential network congestion, fees, or chain-level security incidents

- Governance Implementation Risk: Executing complex governance decisions transparently on-chain while maintaining system integrity and preventing malicious voting patterns presents ongoing technical challenges

VI. Conclusions and Action Recommendations

FAIR3 Investment Value Assessment

FAIR3 represents an experimental approach to decentralized community governance and technical fairness principles. The project's emphasis on on-chain transparency, long-termism, and authentic incentives differentiates it within the ecosystem. However, significant challenges remain: extreme price volatility (ranging from 0.003 to 0.038 historically), limited exchange liquidity, and the inherent risks associated with early-stage decentralized governance models. The project's strategic backing from BNB Chain and Unicornverse provides credibility, but execution risk remains substantial. Current market conditions (down 0.56% in 24 hours, up 4.97% in 30 days) suggest continued uncertainty about fundamental value discovery.

FAIR3 Investment Recommendations

✅ Beginners: Start with minimal allocations (1-2% of crypto portfolio maximum), focus on understanding the community governance model before increasing exposure, and prioritize security through Gate.com Web3 Wallet.

✅ Experienced Investors: Implement dollar-cost averaging strategies during price dips, actively participate in governance processes to understand project direction, and maintain strict position sizing discipline aligned with overall portfolio risk management.

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, evaluate governance framework effectiveness, and structure positions with appropriate custodial solutions and multi-signature security protocols.

FAIR3 Trading Participation Methods

- Gate.com Platform Trading: Execute spot trades directly through Gate.com's trading interface for immediate market participation with competitive spreads

- Community Airdrops: Participate in airdrop mechanisms distributed by the FAIR3 project to accumulate tokens while engaging with community initiatives

- Governance Participation: Become an active Community Token Owner by holding FAIR3 tokens and voting on governance proposals, combining investment participation with project decision-making

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with professional financial advisors before investing. Never invest funds you cannot afford to lose completely.

FAQ

What is FAIR3 and what is its current use case?

FAIR3 is a meme token built on BNB Chain that leverages NFTs to document real-world injustices and social issues. Its primary use case focuses on decentralized documentation and transparency of social problems through blockchain technology.

What are the price predictions for FAIR3 in 2024 and 2025?

FAIR3 is projected to reach $0.008268 by December 2025, with further growth expected to $0.008408 by April 2026. These predictions are based on current market trend analysis and technical indicators.

What factors could affect FAIR3 token price in the future?

FAIR3 token price could be influenced by regulatory changes, enterprise and government adoption rates, market sentiment, trading volume, and macroeconomic conditions affecting the broader cryptocurrency sector.

Does FAIR3 have a strong development team and roadmap?

Yes, FAIR3 is led by experienced blockchain developers and AI experts with a clear development roadmap. The team is actively advancing the project with strong technical capabilities and vision for digital content innovation.

What is FAIR3: A Comprehensive Guide to the Fourth Pillar of Open Science Data Management

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

IKA: Sui’s Parallel MPC Network Star Launches on Gate.com Launchpad

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 APE Price Prediction: Analyzing Market Trends, Ecosystem Growth and Investment Potential in the ApeCoin Ecosystem

2025 CRVPrice Prediction: Analyzing Market Trends, Adoption Metrics, and Key Factors Driving Curve DAO Token Valuation

Is Investing in MATIC (Polygon) a Smart Choice for Beginners? Pros, Cons, and Considerations

Understanding Blockchain Network Congestion

What is GUN: A Comprehensive Guide to Understanding Firearms, Their History, and Global Regulations

Understanding the Concept of Bridges in Blockchain

What is BTR: A Comprehensive Guide to Beyond the Rack and Its Impact on Online Retail