2025 FARM Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: Market Position and Investment Value of FARM

Harvest (FARM) serves as the governance token of the Harvest protocol, a decentralized finance (DeFi) platform designed to automatically cultivate the highest yields from the latest DeFi protocols using advanced farming optimization techniques. Since its launch in September 2020, FARM has established itself as a key asset in the yield farming ecosystem. As of December 2025, FARM maintains a market capitalization of approximately $12.08 million, with a circulating supply of around 672,183 FARM tokens, trading at $17.50. This governance-focused digital asset plays an increasingly important role in DeFi yield optimization and protocol governance.

The present analysis will comprehensively examine FARM's price trajectory through 2025-2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasting and actionable investment strategies for navigating the evolving DeFi landscape.

I. FARM Price History Review and Current Market Status

FARM Historical Price Evolution

-

September 2020: FARM token launched with an initial price of $167.67, reaching an all-time high (ATH) of $628.46 on September 2, 2020, marking a significant early momentum in the project's market performance.

-

2020-2025: Extended bearish period, with the token experiencing substantial depreciation over five years, declining from its peak of $628.46 to current levels.

-

December 2025: Recent price action shows FARM trading near its all-time low (ATL) of $16.80, set on December 19, 2025, indicating sustained downward pressure in the current market cycle.

FARM Current Market Situation

As of December 21, 2025, FARM is trading at $17.50, reflecting recent market dynamics. The token demonstrates mixed short-term performance with a -0.22% change in the last hour and a -0.90% decline over the past 24 hours. Longer-term weakness is evident, with the token down -9% over seven days and -11.84% over the past month, while the year-to-date performance shows a significant -65.25% decline.

FARM's market capitalization stands at approximately $12.08 million in fully diluted valuation, with a circulating supply of 672,183.45 tokens out of a maximum supply of 690,420 tokens (97.36% circulated). The 24-hour trading volume is $16,270.14, with FARM available on 12 exchanges. The token maintains a market dominance of 0.00037%, indicating a relatively small position within the broader cryptocurrency ecosystem.

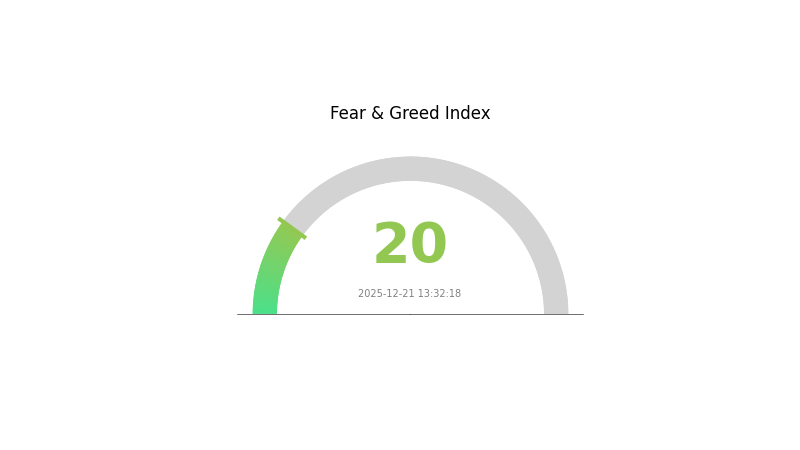

Market sentiment currently reflects "Extreme Fear" conditions with a VIX reading of 20, suggesting heightened volatility and risk aversion across digital asset markets.

Click to view current FARM market price

FARM Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates significant market pessimism and heightened investor anxiety. During such extreme fear periods, long-term investors often view the market as oversold, presenting potential buying opportunities for those with strong conviction. However, cautious risk management remains essential. Monitor market developments closely on Gate.com to make informed investment decisions aligned with your risk tolerance and investment strategy.

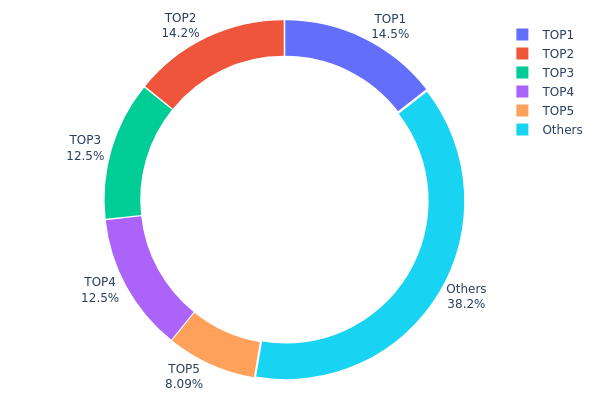

FARM Holdings Distribution

The address holdings distribution represents the concentration of FARM tokens across blockchain addresses, providing crucial insights into token ownership patterns and market structure. By analyzing the top holders and their respective percentages, we can assess the degree of centralization, identify potential risks of market manipulation, and evaluate the overall health of the token's decentralized ecosystem.

FARM's current holdings distribution reveals a moderate concentration pattern. The top five addresses collectively control approximately 61.8% of the circulating supply, with the largest holder maintaining 14.51% and the second-largest holding 14.17%. While this level of concentration is present, it is distributed across multiple addresses rather than dominated by a single entity, suggesting a relatively balanced structure among major stakeholders. The remaining 38.2% held by other addresses indicates that a substantial portion of tokens remains dispersed, which helps mitigate extreme centralization risks.

The distribution characteristics suggest several market implications. The concentration among top holders could potentially influence price movements during large transactions, though the absence of a single dominant stakeholder provides some resilience against unilateral market control. The relatively high percentage held by the top four addresses warrants monitoring, as coordinated actions among these entities could amplify volatility. However, the presence of numerous smaller holders distributed across the "Others" category contributes to improved market stability and reduces the likelihood of sudden, catastrophic price swings driven by individual whale activities. Overall, FARM demonstrates moderate decentralization with reasonable checks against excessive token concentration.

Click to view current FARM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x365a...335059 | 102.40K | 14.51% |

| 2 | 0xf977...41acec | 100.00K | 14.17% |

| 3 | 0xaab4...f96876 | 88.50K | 12.54% |

| 4 | 0x28c6...f21d60 | 88.14K | 12.49% |

| 5 | 0x8f5a...99436c | 57.08K | 8.09% |

| - | Others | 269.17K | 38.2% |

II. Core Factors Affecting FARM's Future Price

Supply Mechanism

-

Token Circulation and Distribution: The flow of FARM tokens significantly influences Harvest Finance's market position. The circulating supply and distribution mechanisms directly impact token scarcity and pricing dynamics in the DeFi ecosystem.

-

Current Impact: As of March 20, 2025, FARM was trading at $31.42 USD, reflecting the combined effects of market trends, investor sentiment, and token supply dynamics. The token's price performance remains closely tied to how supply changes interact with market demand.

DeFi Market Dynamics and Staking Activity

-

Staking and Governance Participation: FARM's price is substantially influenced by DeFi market dynamics and staking activities. The level of participation in staking and governance mechanisms directly affects investor sentiment and token demand.

-

Utility and Governance: FARM's practical utility within the Harvest Finance ecosystem and its governance participation rights contribute meaningfully to its valuation. Active engagement in protocol governance can enhance perceived value and attract long-term holders.

Investor Sentiment and Market Conditions

-

Market Sentiment Factors: Future FARM price movements are primarily driven by DeFi market sentiment, investor confidence, and broader cryptocurrency market trends. These psychological factors often override fundamental considerations in the short to medium term.

-

Risk Considerations: Investment risks require careful evaluation. The cryptocurrency market's volatility, regulatory uncertainties, and protocol-specific risks all warrant thorough assessment before investment decisions.

III. 2025-2030 FARM Price Forecast

2025 Outlook

- Conservative Forecast: $10.61 - $17.40

- Neutral Forecast: $17.40

- Bullish Forecast: $24.71 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Consolidation and recovery phase with gradual price stabilization following potential market corrections

- Price Range Forecast:

- 2026: $12.84 - $21.90

- 2027: $12.03 - $28.78

- Key Catalysts: Enhanced protocol functionality, DeFi ecosystem expansion, improved market liquidity through platforms like Gate.com, and growing user base adoption

2028-2030 Long-term Outlook

- Base Case Scenario: $22.36 - $36.93 (assumes steady protocol development and moderate market conditions)

- Bullish Scenario: $27.31 - $36.31 (contingent on successful ecosystem partnerships and mainstream DeFi adoption)

- Transformational Scenario: $26.93 - $38.04 (requires breakthrough innovation, significant capital inflows, and establishment of FARM as major DeFi infrastructure asset)

- December 21, 2030: FARM projected at $33.67 average price (representing 92% cumulative gain from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 24.708 | 17.4 | 10.614 | 0 |

| 2026 | 21.89616 | 21.054 | 12.84294 | 20 |

| 2027 | 28.77661 | 21.47508 | 12.02604 | 22 |

| 2028 | 36.93499 | 25.12584 | 22.362 | 43 |

| 2029 | 36.30559 | 31.03042 | 27.30677 | 77 |

| 2030 | 38.04484 | 33.668 | 26.9344 | 92 |

Harvest (FARM) Professional Investment Strategy and Risk Management Report

IV. FARM Professional Investment Strategy and Risk Management

FARM Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi yield farming enthusiasts and governance token collectors

- Operation Recommendations:

- Accumulate FARM during market downturns to average down entry costs, particularly given the -65.25% annual decline

- Participate in governance voting to exercise voting rights on FARM Treasury proposals

- Monitor yield optimization strategies implemented by Harvest protocol for protocol development opportunities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour trading range ($17.14-$17.90) to identify short-term support and resistance levels

- Volume Analysis: Track the 24-hour trading volume of $16,270.14 to identify breakout opportunities and liquidity conditions

- Wave Trading Key Points:

- Utilize recent historical lows ($16.80 reached on December 19, 2025) as potential support for swing trading entries

- Monitor resistance near all-time high ($628.46 from September 2, 2020) for long-term recovery potential, though noting substantial distance requires fundamental catalysts

FARM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Strategies

- Diversification Across DeFi Protocols: Allocate FARM holdings across multiple yield-generating DeFi platforms to reduce single-protocol risk exposure

- Stablecoin Reserves: Maintain 20-30% of intended FARM allocation in stablecoins to capitalize on volatility and unexpected buying opportunities

(3) Secure Storage Solutions

- Hot Wallet Solution: Use Gate.com Web3 Wallet for active trading and governance participation with frequent transactions

- Cold Storage Method: Transfer majority holdings to hardware wallets for long-term storage and enhanced security

- Security Best Practices: Enable two-factor authentication on all exchange accounts, use hardware wallet for governance voting, and maintain separate recovery phrases in secure locations

V. FARM Potential Risks and Challenges

FARM Market Risk

- Extreme Price Volatility: FARM has experienced a -65.25% decline over one year and -9% over seven days, indicating high volatility unsuitable for risk-averse investors

- Low Trading Liquidity: Daily volume of $16,270.14 on FARM suggests potential liquidity constraints for large position entries or exits

- Market Sentiment Pressure: Current negative market sentiment with -0.9% 24-hour decline and 0.00037% market dominance indicates limited market interest and potential for further downside pressure

FARM Regulatory Risk

- DeFi Regulatory Uncertainty: Ongoing regulatory scrutiny of DeFi protocols and yield farming mechanisms could impact Harvest protocol operations and FARM governance decisions

- Compliance Changes: Potential changes in cryptocurrency regulations across jurisdictions could affect FARM's trading accessibility and utility

- Protocol Restrictions: Regulatory authorities may impose restrictions on specific yield strategies employed by the Harvest protocol

FARM Technical Risk

- Smart Contract Vulnerabilities: DeFi protocols inherently face smart contract risks; vulnerabilities in Harvest's contracts could impact FARM token value and protocol viability

- Protocol Dependency: FARM's value is intrinsically linked to Harvest protocol performance; poor yield optimization results or protocol failures could severely diminish FARM utility

- Yield Sustainability: DeFi yield rates are cyclical and dependent on market conditions; declining yields across protocols could reduce Harvest protocol competitiveness and FARM demand

VI. Conclusion and Action Recommendations

FARM Investment Value Assessment

FARM represents a governance token for the Harvest automated yield farming protocol, offering protocol utility through Treasury voting rights and operational fee distribution (5% of harvest operations). However, the token faces significant headwinds: a -65.25% annual decline, minimal market capitalization of $12.08 million, and low trading volume. The substantial distance from all-time highs ($628.46) reflects the challenging DeFi market conditions and reduced investor appetite for yield farming tokens. While FARM holders benefit from protocol governance participation and fee revenue, the token's viability depends on Harvest protocol's ability to deliver competitive yields in a mature DeFi ecosystem. Current valuations present speculative opportunity for risk-tolerant investors, but fundamental protocol innovation or market recovery catalysts are necessary for sustained appreciation.

FARM Investment Recommendations

✅ Beginners: Start with minimal 1-2% portfolio allocation to understand DeFi governance mechanics and yield farming risks before increasing exposure; prioritize education on Harvest protocol mechanics through official documentation ✅ Experienced Investors: Consider 3-5% allocation for governance participation and protocol fee capture; employ dollar-cost averaging during volatility to optimize entry points and manage downside risk ✅ Institutional Investors: Evaluate FARM allocation within broader DeFi yield infrastructure strategy; conduct comprehensive due diligence on Harvest's competitive positioning versus rival yield optimization protocols and implement portfolio-level risk management

FARM Trading Participation Methods

- Gate.com Exchange Trading: Access FARM/USDT and FARM/ETH trading pairs directly through Gate.com's spot trading interface for immediate market exposure

- On-Chain Staking: Participate in Harvest protocol's staking mechanisms to earn protocol revenue distribution and governance participation simultaneously

- Governance Voting: Utilize FARM holdings to vote on Treasury proposals and protocol direction on Harvest's governance portal, creating ongoing engagement incentives beyond price appreciation

Cryptocurrency investing carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and consider professional financial consultation. Never invest funds you cannot afford to lose.

FAQ

How much is a 1 time FARM token?

A 1 time FARM token currently costs $0. The price reflects real-time market conditions and may fluctuate based on trading activity and market demand.

What is the harvest Finance prediction for 2025?

Harvest Finance (FARM) is predicted to reach approximately $64.79 in 2025 based on technical analysis indicators. This forecast reflects market trends and on-chain metrics through early 2025.

What factors influence FARM token price movements?

FARM token price is influenced by Total Value Locked (TVL) in Harvest Finance protocol, market demand and supply dynamics, overall crypto market sentiment, and DeFi ecosystem performance.

What is Harvest Finance and what does the FARM token do?

Harvest Finance is a DeFi yield farming platform. FARM is its native governance token enabling users to earn rewards, participate in platform decisions, and optimize yield farming strategies.

What are the risks associated with FARM token price predictions?

FARM price predictions involve high volatility and speculative uncertainty. Risks include sudden market fluctuations, limited liquidity, regulatory changes, and prediction inaccuracy. Market sentiment shifts can significantly impact token values unpredictably.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

FTT Explained

next crypto to hit $1 in 2025

2025 PUMP Price Prediction: Analyzing Market Trends and Growth Potential for Cryptocurrency Investors

What is BTR: A Comprehensive Guide to Beyond the Rack and Its Impact on Online Retail

What is CGN: A Comprehensive Guide to Conditional Generation Networks and Their Applications in Modern AI

What is VOOI: A Comprehensive Guide to Voice-Operated Operating Interface Technology

What is PUMPBTC: A Comprehensive Guide to the Bitcoin Pump Token and Its Market Impact

A Comprehensive Guide to Manta Network Token for Web3 Enthusiasts