2025 FHE Price Prediction: Expert Analysis and Market Forecast for Fully Homomorphic Encryption Tokens

Introduction: Market Position and Investment Value of FHE

Mind Network (FHE) serves as a pioneer in quantum-resistant Fully Homomorphic Encryption (FHE) infrastructure, driving a fully encrypted internet through secure data and AI computation. As a foundational technology asset in the Web3 and AI ecosystem, Mind Network has established itself as a key player in encrypted data processing and trusted AI standards. As of December 2025, Mind Network's market capitalization has reached approximately $44.67 million, with a circulating supply of 249 million tokens and a current price hovering around $0.04467.

This innovative asset, recognized as a "next-generation privacy and encryption infrastructure," is playing an increasingly critical role in enabling zero-trust internet protocols and on-chain data security. Through its development of HTTPZ — a Zero Trust Internet Protocol — in collaboration with industry leaders, Mind Network is setting new standards for how data and computational privacy will be managed in decentralized ecosystems.

This article will comprehensively analyze Mind Network's price trajectory from 2025 through 2030, integrating historical price patterns, market supply-and-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Mind Network (FHE) Market Analysis Report

I. FHE Price History Review and Current Market Status

FHE Historical Price Trajectory

Mind Network's FHE token has experienced significant volatility since its launch on December 14, 2024. The token reached its all-time high (ATH) of $0.16569 on August 23, 2025, representing a notable peak in market valuation. Subsequently, the token experienced a substantial correction, reaching its all-time low (ATL) of $0.0131 on October 10, 2025. This marked a significant drawdown from the peak, reflecting market sentiment shifts and price discovery dynamics in the early stages of the project's trading lifecycle.

FHE Current Market Situation

As of December 22, 2025, FHE is trading at $0.04467, displaying a market capitalization of approximately $11.12 million with a fully diluted valuation (FDV) of $44.67 million. The token maintains a circulating supply of 249 million FHE out of a total supply of 1 billion tokens, indicating 100% circulation ratio.

24-Hour Performance: FHE declined 7.27% in the last 24 hours, trading within a range of $0.04057 (low) to $0.05636 (high). Trading volume over the past 24 hours reached approximately $5.35 million, reflecting moderate liquidity with 19 exchange listings. The token is currently held by 103,007 token holders.

Short-Term Price Movements:

- 1-hour change: +1.26%

- 7-day change: -45.35%

- 30-day change: +101.27%

- 1-year annualized change: -8.95%

The token demonstrates considerable volatility, with the 30-day gain of 101.27% contrasting sharply with the 7-day decline of 45.35%, indicating heightened price fluctuations and market uncertainty in recent trading periods.

Visit Gate.com to view current FHE market price

FHE Market Sentiment Index

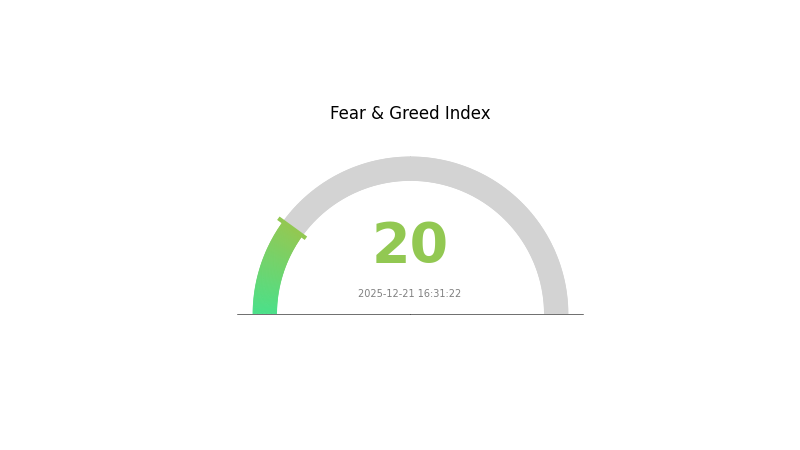

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 20. This indicates widespread panic and negative sentiment among investors. Such extreme fear levels typically present contrarian opportunities for long-term investors, as markets often experience significant reversals from these levels. However, caution is advised as further downside pressure may still occur. Monitor key support levels closely and consider dollar-cost averaging strategies. Risk management remains paramount during periods of intense market uncertainty. Stay informed through Gate.com's real-time market data and analysis tools.

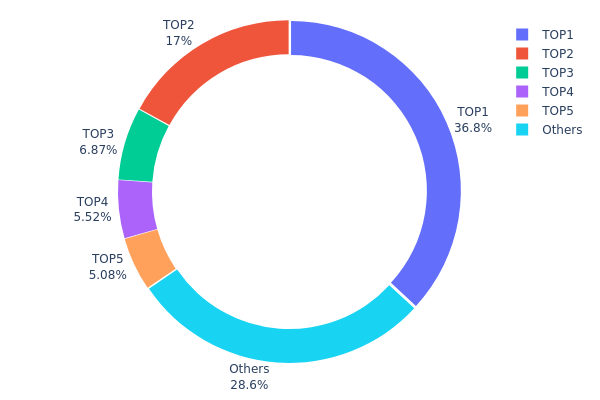

FHE Holdings Distribution

The address holdings distribution map illustrates the concentration of FHE tokens across different wallet addresses on the blockchain. This metric reveals the degree of decentralization and potential market concentration risk by tracking how token supply is distributed among top holders versus the broader holder base.

The current distribution data demonstrates a pronounced concentration pattern within the FHE ecosystem. The top five addresses control approximately 71.33% of the total token supply, with the largest single address (0x7501...b3dbf9) commanding 36.84% of all holdings. This concentration level indicates significant centralization, as nearly two-thirds of circulating tokens are held by a small group of addresses. The second-largest holder maintains a 17.04% position, while the remaining top three addresses each hold between 5% and 7%. This tiered structure suggests the presence of major institutional stakeholders or founding entity allocations rather than a naturally distributed community-driven holder base.

The concentration of over one-third of the token supply in a single address presents notable implications for market dynamics and governance. Such extreme concentration can amplify price volatility, as large-scale liquidation or accumulation decisions by these principal holders could significantly impact market conditions. Additionally, the distribution raises considerations regarding decentralization governance, as decision-making power would be disproportionately weighted toward top holders in protocol governance scenarios. The remaining 28.67% distributed among other addresses suggests a fragmented secondary holder base, which may limit organic market support and increase susceptibility to price movements driven by principal holders' actions. This distribution pattern reflects characteristics commonly observed in early-stage or recently launched tokens, where founding allocations and early-stage investors retain substantial positions.

Click to view current FHE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7501...b3dbf9 | 183000.00K | 36.84% |

| 2 | 0x02b9...c8a838 | 84631.95K | 17.04% |

| 3 | 0x1ab4...8f8f23 | 34111.04K | 6.86% |

| 4 | 0x0d07...b492fe | 27419.04K | 5.52% |

| 5 | 0x8782...eb07b3 | 25223.34K | 5.07% |

| - | Others | 142237.00K | 28.67% |

II. Core Factors Influencing FHE's Future Price

Supply Mechanism

- Fixed Supply: FHE has a capped total supply, which increases scarcity and contributes to long-term price growth.

- Historical Pattern: Limited supply has historically supported price appreciation for similar cryptocurrency assets.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate adjustments and monetary policy changes affect asset attractiveness.

- Inflation Hedge Properties: FHE has the potential to serve as "digital gold" in inflationary environments, offering safe-haven characteristics.

- Geopolitical Factors: International uncertainties may increase demand for privacy-focused cryptocurrencies like FHE.

III. 2025-2030 FHE Price Forecast

2025 Outlook

- Conservative Forecast: $0.03095 - $0.04422

- Neutral Forecast: $0.04422

- Bearish Forecast: $0.06191 (requires market stabilization and sustained institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Recovery and consolidation phase with gradual appreciation as fundamental developments mature

- Price Range Forecasts:

- 2026: $0.04139 - $0.07058 (18% potential upside)

- 2027: $0.05564 - $0.07851 (38% cumulative growth)

- 2028: $0.05543 - $0.07578 (57% cumulative growth)

- Key Catalysts: Expansion of FHE protocol adoption, ecosystem infrastructure development, increasing enterprise integration, and growing recognition of privacy-preserving computation solutions

2029-2030 Long-term Outlook

- Base Case: $0.05911 - $0.10508 (63% appreciation by 2029)

- Optimistic Case: $0.07389 - $0.1184 (99% potential upside by 2030)

- Transformational Case: $0.1184+ (contingent on breakthrough applications in enterprise blockchain solutions, regulatory clarity favoring privacy technologies, and substantial mainstream adoption of FHE-based platforms)

Note: These forecasts represent analytical projections based on current market data and should not be considered investment advice. Investors are encouraged to conduct thorough due diligence and consider storing assets securely through established platforms such as Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06191 | 0.04422 | 0.03095 | -1 |

| 2026 | 0.07058 | 0.05306 | 0.04139 | 18 |

| 2027 | 0.07851 | 0.06182 | 0.05564 | 38 |

| 2028 | 0.07578 | 0.07017 | 0.05543 | 57 |

| 2029 | 0.10508 | 0.07297 | 0.05911 | 63 |

| 2030 | 0.1184 | 0.08903 | 0.07389 | 99 |

Mind Network (FHE) Professional Investment Strategy and Risk Management Report

IV. FHE Professional Investment Strategy and Risk Management

FHE Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Risk-tolerant investors with 2-5 year investment horizons who believe in the long-term potential of quantum-resistant encryption infrastructure and Web3 ecosystem development.

-

Operational Recommendations:

- Accumulate during market corrections when FHE price dips below key support levels, particularly following bearish 7-day and 30-day trends.

- Establish a dollar-cost averaging (DCA) approach by investing fixed amounts at regular intervals to reduce timing risk and volatility impact.

- Utilize Gate.com's staking or reward programs if available to generate passive returns on your FHE holdings while maintaining exposure to the asset.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- RSI (Relative Strength Index): Monitor overbought conditions above 70 and oversold conditions below 30 to identify potential entry and exit points. Current market volatility suggests RSI analysis is particularly valuable given the -7.27% 24-hour decline.

- Moving Average Crossovers: Track 50-day and 200-day moving averages to identify trend reversals. The recent -45.35% 7-day decline suggests potential mean reversion opportunities when averages stabilize.

-

Range Trading Key Points:

- Identify resistance at recent highs ($0.05636 in 24-hour range) and support at lows ($0.04057 in 24-hour range) to execute buy-low, sell-high strategies within established ranges.

- Monitor volume patterns against the 24-hour trading volume of $5.35M to confirm breakout validity before committing additional capital to positions.

FHE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% portfolio allocation to FHE and related quantum-resistant encryption projects, treating this as an experimental growth position rather than core holdings.

- Active Investors: 5-8% allocation, potentially including leveraged positions or options strategies to amplify exposure while maintaining strict stop-loss discipline.

- Institutional Investors: 3-5% allocation with a focus on strategic positioning within broader Web3 and AI infrastructure themes, potentially negotiating OTC trading through Gate.com's institutional services.

(2) Risk Hedging Strategies

- Volatility Hedging: Implement trailing stop-loss orders set at 15-20% below entry price to protect against catastrophic losses during sharp market downturns, particularly important given the current -45.35% 7-day performance.

- Portfolio Diversification: Combine FHE holdings with other encryption infrastructure projects and complementary AI-related tokens to reduce single-asset concentration risk and balance the portfolio's overall risk profile.

(3) Secure Storage Solutions

- Hot Wallet Approach: Use Gate.com's native trading platform for active trading positions and frequent transactions, leveraging its security infrastructure and exchange insurance protections for amounts you're actively managing.

- Cold Storage Method: Transfer long-term holdings to hardware wallets or offline storage solutions to eliminate exchange counterparty risk for portions of your portfolio intended for multi-year holding periods.

- Security Considerations: Enable two-factor authentication on all exchange accounts, use unique and complex passwords, never share private keys or seed phrases, and periodically audit wallet balances to detect unauthorized access. When transferring between wallets, always conduct test transactions with small amounts first.

V. FHE Potential Risks and Challenges

FHE Market Risks

- High Volatility Exposure: FHE has experienced extreme price swings, declining 45.35% over seven days while gaining 101.27% over 30 days, indicating acute sensitivity to market sentiment shifts and the speculative nature of emerging encryption infrastructure projects.

- Liquidity Concentration: With 24-hour trading volume of $5.35M against a $44.67M market capitalization, large position entries or exits could significantly impact price discovery, creating slippage risks for institutional investors.

- Market Adoption Uncertainty: The commercial viability of fully homomorphic encryption infrastructure remains unproven at scale, creating binary outcomes where widespread adoption could dramatically increase valuations while continued technical or adoption barriers could erode investor confidence.

FHE Regulatory Risks

- Encryption Regulation Evolution: Different jurisdictions may impose varying restrictions on quantum-resistant or advanced encryption technologies, potentially affecting the project's ability to operate globally and creating compliance uncertainties for token holders.

- Classification Ambiguity: Regulatory agencies have not yet established clear frameworks for FHE infrastructure tokens, creating the possibility of sudden reclassification that could impact trading, custody, or utility options available to investors.

- Sanctions and Restrictions: As encryption technology faces potential regulatory scrutiny due to national security concerns, governmental actions could restrict access to services, trading pairs, or protocol functionality.

FHE Technical Risks

- Scalability Limitations: Fully homomorphic encryption requires significant computational resources, and the protocol's real-world scalability and transaction throughput remain unproven at enterprise scale, risking adoption delays.

- Implementation Complexity: The technical complexity of FHE infrastructure creates meaningful risks around smart contract vulnerabilities, security audits, and the potential for costly exploits that could severely damage ecosystem credibility.

- Competition from Alternative Solutions: Other privacy and encryption approaches, including zero-knowledge proofs and differential privacy mechanisms, may prove more practical or efficient, potentially limiting Mind Network's competitive differentiation and market share capture.

VI. Conclusion and Action Recommendations

FHE Investment Value Assessment

Mind Network represents an early-stage infrastructure bet on quantum-resistant encryption and the broader theme of privacy-preserving computation in Web3 and AI ecosystems. The technology thesis is compelling given increasing regulatory focus on data privacy and future quantum computing threats, but current valuations reflect significant speculative premium. The extreme volatility (±45% swings within weeks) suggests the market is still discovering appropriate price levels. Long-term value creation depends on the project achieving meaningful commercial adoption of its HTTPZ protocol and successfully navigating technical implementation challenges. The current market capitalization of $44.67M remains relatively modest for an infrastructure protocol, suggesting meaningful upside potential for successful execution, though the -7.27% 24-hour decline and -8.95% annual performance indicate current market sentiment remains cautious.

FHE Investment Recommendations

✅ Beginners: Start with small, fixed-amount purchases through Gate.com's spot trading using dollar-cost averaging over 3-6 months to build familiarity with FHE without exposing yourself to timing risk. Focus on understanding the underlying technology before making larger commitments.

✅ Experienced Investors: Execute range-trading strategies within identified support ($0.04057) and resistance ($0.05636) levels, using technical indicators to identify entry points during oversold conditions, while maintaining strict 15-20% trailing stop-losses to manage downside risk.

✅ Institutional Investors: Consider OTC trading through Gate.com's institutional services for substantial position building, negotiate custody arrangements, and treat this as a long-term infrastructure allocation component (3-5% of Web3 infrastructure allocations) rather than a speculative trading vehicle.

FHE Trading Participation Methods

- Spot Trading on Gate.com: Purchase FHE tokens directly at current market rates ($0.04467 as of December 22, 2025) for immediate ownership and the most straightforward entry method for most investors.

- Dollar-Cost Averaging Program: Set up recurring purchases through Gate.com's automatic investment features to acquire FHE systematically regardless of price fluctuations, reducing the impact of market timing errors.

- Technical Analysis-Based Entries: Use Gate.com's charting tools to identify support levels and oversold RSI conditions before executing accumulation trades, taking advantage of the current -45.35% 7-day weakness if you believe in the project's long-term potential.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with a professional financial advisor before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

What is the current price of FHE token?

FHE token is currently trading at 0.02665 USD, down 1.56% in the last 24 hours. The token's price fluctuates based on market conditions and trading volume.

What is the FHE price prediction for 2025?

FHE price is predicted to reach approximately $10,000 in 2025 based on current market trends and technological developments. Specific figures may vary with market conditions.

What are the practical applications and value support for FHE as a crypto asset?

FHE enables secure computations on encrypted data without decryption, supporting privacy-preserving applications in healthcare, finance, and blockchain. Its value lies in enabling secure transactions and data processing across untrusted networks in Web3 ecosystems.

What are the advantages of FHE compared to other privacy-focused cryptocurrencies?

FHE enables computation on encrypted data without decryption, providing superior privacy protection. It offers lower transaction fees than many privacy coins and ensures data remains inaccessible before decryption. FHE's cost-efficiency and advanced cryptographic technology make it a standout solution for privacy and economic benefits.

What are the main factors affecting FHE price?

FHE price is primarily influenced by market supply and demand, adoption growth in privacy computing, technology development progress, macroeconomic conditions, and investor sentiment. Increased demand and limited supply typically drive prices higher, while regulatory developments and market cycles also play significant roles.

How does FHE's technology roadmap impact its price?

FHE's technological advancement drives price growth by enabling broader adoption in privacy-preserving applications. Roadmap milestones like improved efficiency and scalability attract institutional investment, potentially pushing valuations significantly higher through 2030 as real-world use cases expand.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

Analysis of GT coin price and investment prospects in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

Understanding the PEPE Project ($PEPE): A Guide to This Innovative Cryptocurrency

Convert USDT to INR Effortlessly | Live Exchange Rates

Syscoin Price Outlook: Can SYS Recover from Oversold Levels?

Blum (BLUM): Key Features and Role in the Cryptocurrency Ecosystem

How to Set Price Alerts for Cryptocurrency on Mobile and Desktop