2025 FHE Price Prediction: Expert Analysis and Market Outlook for Fully Homomorphic Encryption Tokens

Introduction: Market Position and Investment Value of FHE

Mind Network (FHE) represents a pioneering force in quantum-resistant Fully Homomorphic Encryption (FHE) infrastructure, establishing itself as a critical foundation for secure data and AI computation in the Web3 ecosystem. As of December 21, 2025, FHE maintains a market capitalization of $12.86 million with a circulating supply of 249 million tokens, trading at approximately $0.05165 per unit. This innovative asset has demonstrated remarkable growth momentum, with a 30-day surge of 132.08%, positioning it as an increasingly prominent player in the privacy-first blockchain infrastructure landscape.

This comprehensive analysis examines FHE's price trajectory through 2025-2030, integrating historical performance patterns, market demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for cryptocurrency investors.

Mind Network (FHE) Market Analysis Report

I. FHE Price History Review and Current Market Status

FHE Historical Price Evolution

Based on available data as of December 21, 2025:

- August 23, 2025: All-Time High (ATH) reached at $0.16569, marking the peak price since launch

- October 10, 2025: All-Time Low (ATL) recorded at $0.0131, representing the lowest price point in FHE's trading history

- December 21, 2025: Current trading period shows recovery phase with price stabilizing at $0.05165

FHE Current Market Status

As of December 21, 2025, FHE is trading at $0.05165, reflecting a 19.32% increase over the last 24 hours and a **22.38% gain over the past 7 days. Over the 30-day period, FHE has surged 132.079%, demonstrating strong recovery momentum from its October lows.

The token's current market capitalization stands at approximately $12.86 million, with a fully diluted valuation of $51.65 million. With 249 million tokens in circulation out of a total supply of 1 billion, FHE maintains a market dominance of 0.0015%. The token is currently ranked at position 1,059 across the broader cryptocurrency market.

Trading activity shows a 24-hour volume of $8.46 million, with the token ranging between a 24-hour low of $0.04326 and a 24-hour high of $0.05636. Short-term momentum remains positive, with FHE gaining 1.58% in the last hour alone.

The token is available on 18 exchanges, with notable presence on the Binance Smart Chain (BSC) network. The token has accumulated 103,007 holders, indicating growing adoption within the community.

View current FHE market price

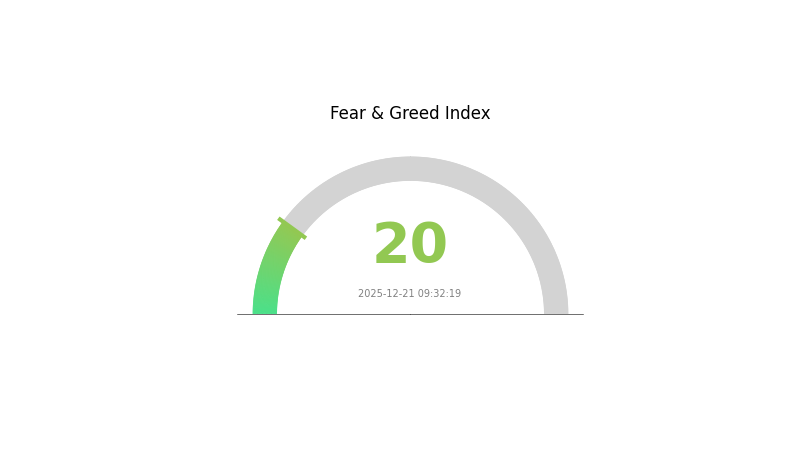

FHE Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This historically low reading suggests severe market pessimism and panic selling. During such periods, investors are heavily risk-averse, and asset prices may reach oversold levels. Experienced traders often view extreme fear as a potential buying opportunity, as contrarian strategies have proven effective at market bottoms. However, caution is advised, as the market may continue declining before stabilizing. Monitor key support levels and market fundamentals carefully before making investment decisions on Gate.com or other platforms.

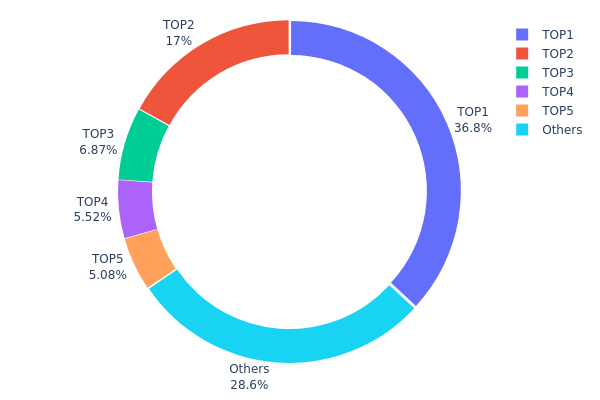

FHE Holdings Distribution

The address holdings distribution chart illustrates the concentration of FHE tokens across different wallet addresses on the blockchain. By analyzing the proportion of total token supply held by individual addresses, this metric provides critical insights into the decentralization level, potential market manipulation risks, and the stability of the token's on-chain structure. Understanding this distribution is essential for assessing the token's governance resilience and market dynamics.

FHE currently exhibits significant concentration concerns, with the top five addresses collectively controlling 71.33% of the total token supply. Most notably, the leading address (0x7501...b3dbf9) maintains an exceptionally dominant position, holding 36.84% of all FHE tokens in circulation. This level of concentration is substantial and raises questions about true decentralization. The second-largest holder (0x02b9...c8a838) accounts for an additional 17.04%, while the third through fifth positions hold between 5.07% and 6.86% respectively. The remaining 28.67% of tokens are distributed among other addresses, indicating that nearly three-quarters of the supply is concentrated in just five entities.

This pronounced concentration pattern presents notable implications for market structure and price stability. Such high levels of token concentration in a limited number of addresses creates potential vulnerability to significant price volatility, as these major holders possess substantial influence over supply dynamics and trading pressure. The dominance of a single address holding over one-third of the supply warrants close monitoring, as large token transfers or liquidation activities could materially impact market conditions. While the "Others" category demonstrates some level of distributed ownership, the overall holder structure suggests limited decentralization at present, potentially affecting the token's long-term governance autonomy and market resilience.

Click to view the current FHE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7501...b3dbf9 | 183000.00K | 36.84% |

| 2 | 0x02b9...c8a838 | 84631.95K | 17.04% |

| 3 | 0x1ab4...8f8f23 | 34111.04K | 6.86% |

| 4 | 0x0d07...b492fe | 27419.04K | 5.52% |

| 5 | 0x8782...eb07b3 | 25223.34K | 5.07% |

| - | Others | 142237.00K | 28.67% |

Core Factors Affecting FHE's Future Price Movement

Macroeconomic Environment

Monetary Policy Impact

-

Federal Reserve Interest Rate Policy: The U.S. Federal Reserve's monetary policy trajectory serves as a primary driver of FHE price movements. Market participants are closely monitoring whether the Fed will continue interest rate cuts or maintain current levels. According to CME FedWatch Tool data, traders are pricing in significant probability of rate reductions, which typically supports commodities and alternative assets.

-

Global Currency Dynamics: The U.S. dollar index movements have an inverse relationship with FHE pricing. A weaker dollar environment, driven by expectations of prolonged monetary easing and geopolitical factors, tends to support higher FHE valuations. The dollar has experienced significant depreciation against the backdrop of Trump administration trade policies.

Inflation Hedge Characteristics

-

Inflation Expectations and Purchasing Power Protection: FHE demonstrates characteristics as an inflation hedge asset. When real interest rates decline or inflation expectations rise, investors rotate capital into such stores of value. The core Personal Consumption Expenditures (PCE) index remains a key metric monitored by market participants for assessing future price pressures.

-

Fiat Currency Devaluation Concerns: Analysts note that markets are increasingly trading on the broader theme of "universal fiat currency depreciation relative to hard assets," signaling concerns about global debt sustainability and the need for alternative value preservation mechanisms.

Geopolitical Risk Factors

-

International Tensions and Safe-Haven Demand: Escalating geopolitical tensions drive investors toward safe-haven assets. Government stability concerns, international conflicts, and sanctions-related risks create sustained demand for alternative stores of value.

-

Central Bank Reserve Diversification: Central banks globally are increasingly accumulating hard assets as part of geopolitical hedging strategies. Approximately two-thirds of central banks invest in such assets for portfolio diversification, while roughly two-fifths cite geopolitical risk mitigation as a key objective.

Institutional and Major Holder Dynamics

Central Bank Accumulation

-

Systematic Official Reserve Purchases: Central banks have consistently purchased over 1,000 tons annually since 2022, with projections indicating continued acquisition momentum. This institutional-level demand represents a structural support floor for prices, accounting for approximately 23% of total annual demand during 2022-2025.

-

Emerging Market Central Bank Positioning: Economies subject to Western sanctions or sanctions risk have significantly increased their hard asset reserves, representing nearly half of the largest annual increases in official holdings since 1999.

Investment Fund Inflows

-

Exchange-Traded Product (ETF) Flows: ETF investments have become the most significant marginal demand source, with 2025 year-to-date inflows reaching 397 tons through June—the highest level since 2020. Deutsche Bank reports that ETF pricing influence has increased 50% over the past three years, establishing these instruments as core price discovery mechanisms.

-

Record Institutional Capital Allocation: Historical capital inflows into hard asset investment funds reached $176 billion over a four-week period, representing an all-time record. Current institutional allocation remains structurally undersized relative to historical benchmarks and wealth distribution targets.

Retail Investment Participation

- Diversification Patterns: Retail investors continue rotating allocations toward physical investment vehicles, with bullion demand increasing 10% while coins experienced 31% declines. Asian markets maintain robust demand expectations, supporting 2025 physical investment growth projections of approximately 2%.

III. FHE Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.04102 - $0.05193

- Base Case Forecast: $0.05193

- Optimistic Forecast: $0.05505 (requires sustained market interest and ecosystem development)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation as FHE technology gains institutional recognition and platform adoption expands.

- Price Range Predictions:

- 2026: $0.05028 - $0.06793

- 2027: $0.04432 - $0.06314

- Key Catalysts: Increased adoption of homomorphic encryption in enterprise solutions, technological breakthroughs reducing computational overhead, strategic partnerships with major platforms, regulatory clarity in privacy-focused technologies.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.05449 - $0.08855 (assumes moderate mainstream adoption and incremental technological improvements)

- Optimistic Scenario: $0.06983 - $0.10744 (assumes widespread enterprise integration and significant reduction in FHE computational costs)

- Transformative Scenario: $0.10744+ (assumes revolutionary breakthroughs in cryptographic efficiency, massive institutional inflows, and FHE becoming industry standard for privacy-critical applications)

- Growth Trajectory: FHE demonstrates a compound growth pattern with 45% upside potential by 2029 and 48% by 2030, reflecting increasing market maturation and utility expansion.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05505 | 0.05193 | 0.04102 | 0 |

| 2026 | 0.06793 | 0.05349 | 0.05028 | 3 |

| 2027 | 0.06314 | 0.06071 | 0.04432 | 17 |

| 2028 | 0.08855 | 0.06192 | 0.05449 | 19 |

| 2029 | 0.07825 | 0.07524 | 0.05492 | 45 |

| 2030 | 0.10744 | 0.07674 | 0.06983 | 48 |

Mind Network (FHE) Investment Strategy and Risk Management Report

IV. FHE Professional Investment Strategy and Risk Management

FHE Investment Methodology

(1) Long-term Holding Strategy

-

Target Investor Profile: Investors with 2+ year investment horizon seeking exposure to emerging encryption infrastructure and quantum-resistant technologies.

-

Operation Recommendations:

- Accumulate during market downturns when FHE trades below $0.04, aligning with the 30-day low of $0.04326

- Hold through technology development milestones and ecosystem partnerships announcements

- Reinvest any gains to compound exposure as the HTTPZ protocol gains adoption

-

Storage Solution: Store FHE tokens on Gate.com's secure wallet infrastructure for active trading, or utilize hardware security for long-term cold storage to protect against exchange-based risks.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- 24-hour momentum indicators: FHE's 19.32% 24H gain suggests strong short-term momentum; use RSI indicators to identify overbought conditions above 70

- 7-day trend analysis: With 22.38% weekly gains, traders should monitor the $0.05636 resistance level (24H high) for breakout opportunities

-

Wave Trading Key Points:

- Entry signals: Accumulate on dips to moving averages during the daily consolidation phase

- Exit signals: Take profits at resistance levels ($0.05636) or when RSI exceeds 70, indicating potential reversal

FHE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio allocation to FHE tokens, focusing on dollar-cost averaging over 12 months

- Aggressive Investors: 5-8% allocation with quarterly rebalancing based on technology milestones and market performance

- Institutional Investors: 8-12% allocation with structured hedging strategies and derivative instruments for downside protection

(2) Risk Hedging Solutions

- Volatility Hedging: Use Gate.com's futures trading features to open short positions equivalent to 30-50% of long holdings during periods of extreme price appreciation

- Portfolio Diversification: Balance FHE exposure with established cryptocurrencies and traditional assets to reduce concentration risk from early-stage projects

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate.com Web3 Wallet integration for active trading and daily operations with multi-signature authentication enabled

- Cold Storage Strategy: Transfer long-term holdings to hardware wallets or institutional custody solutions with strict access controls

- Security Precautions: Enable two-factor authentication (2FA) on all Gate.com accounts, never share private keys, and regularly audit wallet access logs

V. Potential FHE Risks and Challenges

FHE Market Risk

- Liquidity Risk: With 24H trading volume at $8.46M and market cap of $12.86M, FHE exhibits relatively thin liquidity. Large trades may experience significant slippage, impacting entry and exit execution

- Volatility Risk: FHE's 132% monthly gain reflects extreme price swings. The coin has traded from $0.0131 (ATL on October 10, 2025) to $0.16569 (ATH on August 23, 2025), creating substantial downside exposure

- Market Cap Risk: At $12.86M circulating market cap, FHE ranks #1059, indicating vulnerability to market sentiment shifts and potential pump-and-dump dynamics

FHE Regulatory Risk

- Encryption Regulation Uncertainty: As quantum-resistant and fully homomorphic encryption technologies gain prominence, regulatory bodies may impose restrictions on privacy-enhancing technologies, potentially limiting FHE's use cases and token utility

- Compliance Framework Gaps: The nascent nature of HTTPZ protocol means regulatory clarity remains undefined across jurisdictions, creating uncertainty for institutional adoption

- Cross-Border Legal Challenges: Different regions may regulate FHE tokens and encryption infrastructure differently, complicating global deployment of Mind Network's technology

FHE Technology Risk

- Protocol Maturity: HTTPZ remains an emerging protocol with limited real-world deployment data. Technical vulnerabilities or implementation flaws could undermine the security promises

- Quantum Computing Timeline Uncertainty: The practical threat of quantum computing breaking current cryptography remains theoretical. If quantum threats materialize faster or slower than expected, FHE's value proposition may shift significantly

- Integration Complexity: Widespread adoption requires seamless integration with existing Web3 and AI infrastructure. Technical barriers or poor integration experiences could slow adoption rates

VI. Conclusion and Action Recommendations

FHE Investment Value Assessment

Mind Network addresses a critical infrastructure gap in the Web3 and AI sectors by pioneering quantum-resistant, fully homomorphic encryption solutions. The HTTPZ protocol's zero-trust architecture positions FHE as a foundational asset for next-generation encrypted computing. However, the project remains early-stage with substantial execution risk. The 30-day gain of 132% suggests strong market enthusiasm, but this also reflects high volatility and potential speculative premium. Investors should evaluate FHE as a high-risk, high-reward opportunity requiring thorough technical due diligence and careful position sizing.

FHE Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) through dollar-cost averaging over 3-6 months on Gate.com. Use this period to understand the project's technology roadmap and ecosystem developments before increasing exposure.

✅ Experienced Investors: Allocate 3-5% with a two-tier strategy: hold 60% long-term as core exposure to encryption infrastructure trends, while trading 40% tactically around key support ($0.04326) and resistance ($0.05636) levels using technical indicators.

✅ Institutional Investors: Consider 5-10% allocations structured through derivative strategies on Gate.com, combining long spot positions with hedging instruments. Coordinate entries with major technology announcements or ecosystem partnerships to optimize execution.

FHE Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold FHE tokens directly through Gate.com's spot trading interface with real-time market data and deep liquidity pools

- Futures Trading Strategies: Use Gate.com's perpetual futures to establish leveraged long or short positions with customizable leverage ratios, ideal for experienced traders managing directional bets

- Dollar-Cost Averaging Plans: Set up recurring purchase orders on Gate.com to systematically accumulate FHE at regular intervals, reducing timing risk and smoothing entry costs

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is FHE (Fully Homomorphic Encryption) and why does it matter in crypto?

FHE enables computation on encrypted data without decryption, ensuring privacy on untrusted systems. In crypto, it's vital for secure transactions, confidential smart contracts, and zero-trust infrastructure, protecting user data while maintaining functionality.

What is the current price of FHE token and market cap?

As of December 21, 2025, FHE token is trading at $0 USD with a market capitalization of $0 USD. For the most current pricing and market data, please check major cryptocurrency tracking platforms for real-time updates.

Which projects are building FHE technology and what are their token prices?

Render Token (RNDR) and NEAR Protocol (NEAR) are leading FHE technology development. RNDR trades at approximately $5, while NEAR is priced around $2.50. Both projects advance privacy-preserving computation capabilities.

How much will FHE token be worth in 2025?

FHE token is projected to reach approximately $0.50-$1.50 by end of 2025, driven by growing adoption of privacy-preserving technologies and increasing market demand for FHE solutions in blockchain infrastructure.

What are the main use cases driving FHE adoption and price growth?

FHE enables secure data processing in cloud computing, healthcare, and finance while maintaining privacy compliance. Increasing demand for encrypted data computation and regulatory requirements drive adoption and price appreciation.

How does FHE compare to other privacy-focused cryptocurrencies?

FHE enables computations directly on encrypted data, offering stronger privacy guarantees than traditional privacy coins. Unlike obfuscation-based approaches, FHE provides verifiable privacy with advanced cryptographic capabilities, though it requires more computational resources.

What are the risks and challenges affecting FHE price prediction?

FHE price prediction faces risks including market manipulation, insider trading exploiting sensitive information, and regulatory compliance challenges. Market volatility, low trading volume, and inadequate data quality further complicate accurate predictions and market integrity.

Top Privacy Coins for Investment with High Growth Potential in 2025

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

Analysis of GT coin price and investment prospects in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Guide to Purchasing Tether (USDT) with INR in India

Can Shiba Inu's Price Hit 1 Rupee? Future Predictions for SHIB

Effortless NFT Minting Solutions for Solana and Beyond

Understanding Sand Coin (SAND): A Comprehensive Guide

What is VSC: A Comprehensive Guide to Visual Studio Code for Beginners and Developers