2025 FLOCK Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: FLOCK's Market Position and Investment Value

FLOCK (FLOCK), a decentralized AI model training and validation network, has established itself as a significant player in the intersection of artificial intelligence and blockchain technology. Since its launch on December 31, 2024, FLOCK has demonstrated remarkable growth momentum. As of December 22, 2025, FLOCK's market capitalization has reached $88.26 million, with a circulating supply of approximately 103.8 million tokens trading at around $0.08826 per token. This innovative asset, which breaks down the walled gardens of model creation and development by making compute, data contribution, and training composable, is playing an increasingly critical role in democratizing AI development.

This article provides a comprehensive analysis of FLOCK's price trends and market dynamics for 2025-2030, integrating historical price patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

FLOCK Token Market Analysis Report

I. FLOCK Price History Review and Current Market Status

FLOCK Historical Price Evolution Trajectory

- December 31, 2024: Token reached its all-time high (ATH) of $3.00, marking a significant milestone since launch.

- December 2025: Price declined to $0.08826 as of December 22, 2025, representing a substantial correction from peak levels.

- April 7, 2025: Token touched its all-time low (ATL) of $0.03501, indicating extreme market pressure during this period.

FLOCK Current Market Performance

As of December 22, 2025, FLOCK is trading at $0.08826 with a market capitalization of $9,161,388 USD. The token is ranked #1218 by market cap with a circulating supply of 103,800,000 tokens out of a total supply of 1,000,000,000 tokens, representing a circulation ratio of 10.38%.

24-Hour Price Movement: FLOCK declined 3.11% over the past 24 hours, with trading range between $0.08668 (low) and $0.09209 (high). The 24-hour trading volume stands at $184,952.43 USD across 24 exchange listings.

Broader Price Trends:

- 1-hour performance: +0.42%

- 7-day performance: -12.59%

- 30-day performance: -37.84%

- 1-year performance: +1,106,575.39%

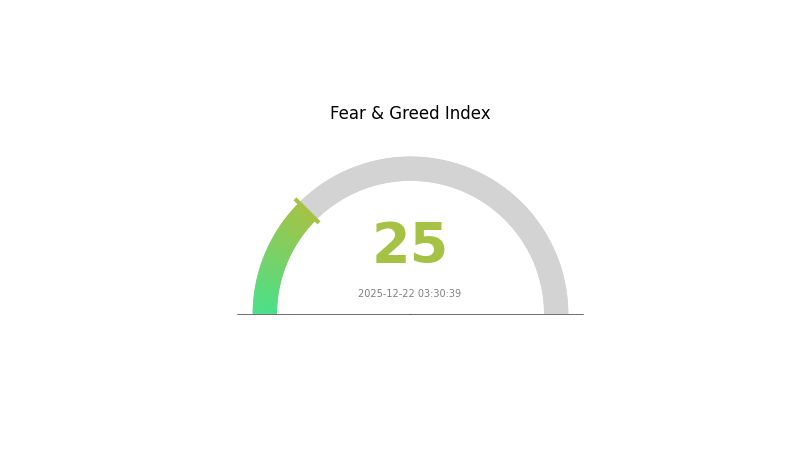

The token demonstrates significant volatility, with a fully diluted valuation (FDV) of $88,260,000 USD. Current market sentiment indicates extreme fear, with a VIX reading of 25 as of December 22, 2025.

Click to view current FLOCK market price

FLOCK Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates significant market pessimism and heightened investor anxiety. During extreme fear periods, risk-averse traders typically reduce positions, while contrarian investors may view it as a potential accumulation opportunity. Market volatility remains elevated, and investors should exercise caution and conduct thorough research before making trading decisions. Consider your risk tolerance and investment strategy carefully during such volatile market conditions.

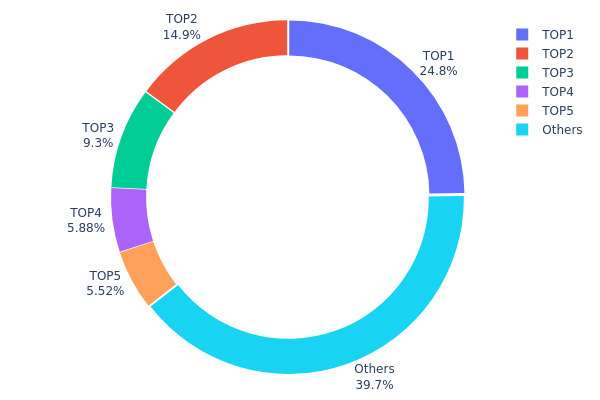

FLOCK Holdings Distribution

The address holdings distribution map reveals the concentration of token ownership across blockchain addresses, serving as a critical indicator of decentralization levels and potential market structural risks. By analyzing the top holders and their proportional stakes, we can assess the degree of wealth concentration and evaluate the robustness of the token's ecosystem.

FLOCK's current holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively hold 60.29% of all tokens, with the largest holder commanding 24.75% of total supply. While this concentration level warrants attention, it remains within ranges commonly observed in mature cryptocurrency projects. The distribution shows a relatively gradual decline from top holders to mid-tier participants, with the "Others" category representing 39.71% of supply, suggesting a diverse base of smaller stakeholders that provides some counterbalance to major holder influence.

The existing address concentration presents nuanced implications for market dynamics. The substantial holdings of top addresses could theoretically facilitate coordinated price movements or create vulnerability to large liquidation events during market volatility. However, the meaningful participation of dispersed smaller holders mitigates extreme centralization risks. This structure indicates FLOCK maintains a moderately decentralized on-chain architecture, balancing institutional or early investor concentration with broader community participation. The token's holder diversity suggests reasonable ecosystem resilience, though ongoing monitoring of top address activity remains prudent for assessing potential governance influence and market manipulation risks.

Click to view current FLOCK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe1fa...fc6123 | 64272.47K | 24.75% |

| 2 | 0xf35c...9de169 | 38571.94K | 14.85% |

| 3 | 0xbaed...e9439f | 24155.92K | 9.30% |

| 4 | 0x7e81...1e47bb | 15261.51K | 5.87% |

| 5 | 0x2bb8...2fbce0 | 14333.13K | 5.52% |

| - | Others | 103006.85K | 39.71% |

II. Core Factors Affecting FLOCK's Future Price

Supply Mechanism

-

Raw Material Price Volatility: Fluctuations in raw material prices and variations in component structures represent major constraints on market growth rates. These supply-side pressures directly impact production costs and market competitiveness.

-

Regulatory Approval Processes: Strict regulations related to commercialization approval procedures may significantly restrict market growth during the forecast period, affecting the availability and pricing of FLOCK products in key markets like the Middle East and Africa.

-

Current Impact: The interaction between raw material cost pressures and regulatory compliance requirements creates a constrained supply environment that could support price stability or appreciation if demand remains robust.

Market Dynamics

-

Supply and Demand Balance: Market price movements are fundamentally driven by the equilibrium between supply and demand. Investor sentiment and capital allocation strategies further influence fund flows and price discovery mechanisms.

-

Market Sentiment: Price fluctuations are not solely determined by technical factors but also reflect the psychological dynamics and probability assessments of market participants based on available information and trading strategies.

III. FLOCK Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.07514 - $0.0884

- Neutral Forecast: $0.0884

- Optimistic Forecast: $0.12288 (requires sustained market interest and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory as the project establishes market positioning.

- Price Range Predictions:

- 2026: $0.06972 - $0.1405

- 2027: $0.06892 - $0.15753

- Key Catalysts: Protocol upgrades, increased adoption rates, strategic partnerships, and improved market liquidity on platforms like Gate.com.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.10382 - $0.20764 by 2028 (assuming moderate ecosystem growth and consistent user adoption)

- Optimistic Scenario: $0.14787 - $0.25573 by 2029 (assuming accelerated development milestones and significant institutional interest)

- Transformational Scenario: $0.13321 - $0.23849 by 2030 (contingent on breakthrough technological advancements and mainstream adoption of underlying utility)

- 2030-12-31: FLOCK projected at $0.21485 average (base case scenario with cumulative 144% potential upside from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.12288 | 0.0884 | 0.07514 | 0 |

| 2026 | 0.1405 | 0.10564 | 0.06972 | 20 |

| 2027 | 0.15753 | 0.12307 | 0.06892 | 40 |

| 2028 | 0.20764 | 0.1403 | 0.10382 | 59 |

| 2029 | 0.25573 | 0.17397 | 0.14787 | 98 |

| 2030 | 0.23849 | 0.21485 | 0.13321 | 144 |

FLOCK Professional Investment Strategy and Risk Management Report

I. FLOCK Token Overview

Basic Information

- Token Name: Flock.io

- Token Symbol: FLOCK

- Current Price: $0.08826 (as of December 22, 2025)

- Market Capitalization: $9,161,388

- Fully Diluted Valuation: $88,260,000

- Circulating Supply: 103,800,000 FLOCK

- Total Supply: 1,000,000,000 FLOCK

- Market Ranking: #1218

- 24H Trading Volume: $184,952.43

Project Description

FLock.io is a decentralized AI model training and validation network. It breaks down the walled gardens of model creation and development from the few tech companies by making compute, data contribution, and training composable. The team consists of cutting-edge researchers, including several Computer Science PhDs from the University of Oxford. The project is backed by leading investors: DCG, Lightspeed Faction, Volt, Tagus, and OKX Ventures.

II. FLOCK Price Performance Analysis

Current Market Position

- 24H Price Change: -3.11%

- 7D Price Change: -12.59%

- 30D Price Change: -37.84%

- 1Y Price Change: +1,106,575.39%

- All-Time High: $3.00 (December 31, 2024)

- All-Time Low: $0.03501 (April 7, 2025)

- 24H High: $0.09209

- 24H Low: $0.08668

Price Trends

The token has experienced significant volatility since its launch at $0.05. While it achieved an all-time high of $3.00 within its first month, it has since corrected substantially, indicating typical post-launch volatility patterns in early-stage tokens. The 1,106,575.39% annual gain reflects its launch from a minimal price point, though current price levels are significantly below peak valuations.

III. FLOCK Technical Information

Blockchain Details

- Network: Base EVM

- Contract Address: 0x5ab3d4c385b400f3abb49e80de2faf6a88a7b691

- Explorer: BaseChain

- Token Holders: 56,022

Market Distribution

- Circulating Supply Ratio: 10.38%

- Market Dominance: 0.0027%

- Exchange Listings: 24 exchanges

- Available on: Gate.com

IV. FLOCK Professional Investment Strategy and Risk Management

FLOCK Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Technology-focused investors, AI infrastructure believers, and risk-tolerant participants seeking exposure to decentralized AI development

-

Operational Suggestions:

- Accumulate FLOCK during market corrections and periods of negative sentiment to build positions at lower valuations

- Dollar-cost average (DCA) entries over 6-12 months to mitigate timing risk and reduce average cost basis

- Set clear price targets based on project milestones and adoption metrics rather than technical levels alone

- Maintain position through development cycles and network expansion phases

-

Storage Solution:

- Use Gate.com's built-in wallet features for convenient management and staking opportunities

- For larger holdings, consider cold storage solutions with security priority

(2) Active Trading Strategy

-

Technical Analysis Tools:

- RSI (Relative Strength Index): Monitor overbought/oversold conditions; consider entries when RSI falls below 30 and exits when it exceeds 70 on 4-hour timeframes

- Moving Averages: Use 20-day, 50-day, and 200-day moving averages to identify trend direction and support/resistance levels

-

Swing Trading Key Points:

- Trade around resistance levels established at $0.10-$0.12 and support at $0.07-$0.08

- Execute position sizing with 2-5% risk per trade given the token's volatility profile

- Take profits incrementally at predefined resistance levels rather than holding through complete reversals

FLOCK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum, with strict stop-loss orders at -15% from entry

- Active Investors: 3-8% portfolio allocation, employing layered entry strategies and 10% trailing stops

- Professional Investors: 5-15% allocation with hedging strategies, leverage considerations, and dynamic rebalancing based on technical signals

(2) Risk Hedging Solutions

- Position Sizing Strategy: Never allocate more than 5% of total crypto portfolio to any single early-stage token; this prevents catastrophic losses while maintaining upside exposure

- Take-Profit Scaling: Implement systematic profit-taking at 50%, 100%, and 200% gains, progressively reducing position size as valuations increase

(3) Security Storage Solutions

- Exchange Wallet: Gate.com's platform wallet for active trading and frequent transactions

- Personal Custody: Transfer tokens to self-custody addresses for holdings exceeding 30 days, utilizing hardware security best practices

- Security Considerations: Never share private keys; enable two-factor authentication on all exchange accounts; verify contract addresses before any transfers; be cautious of phishing attempts targeting early token holders

V. FLOCK Potential Risks and Challenges

FLOCK Market Risks

- High Volatility Risk: The token has exhibited extreme price swings, with 37.84% decline over 30 days. This volatility can result in significant losses for poorly-timed entries or exits

- Liquidity Risk: With 24 exchange listings and $184,952 daily volume, liquidity may be insufficient during periods of market stress, potentially creating slippage on larger orders

- Early-stage Token Risk: Recent launch status means limited track record of performance through complete market cycles; projects of this nature have unpredictable adoption curves

FLOCK Regulatory Risks

- Regulatory Uncertainty: AI-focused tokens face evolving regulatory scrutiny as governments develop frameworks for AI governance and cryptocurrency integration

- Securities Classification Risk: Depending on jurisdiction, FLOCK's token characteristics could face reclassification as a security, imposing compliance requirements

- Geographic Restrictions: Some regions may restrict trading or holding of FLOCK based on local cryptocurrency regulations

FLOCK Technology Risks

- Competition Risk: The decentralized AI model training space is attracting significant venture capital and development; competitive projects could overtake FLock.io's technology leadership

- Smart Contract Risk: As a relatively new token on Base, any vulnerabilities in smart contracts could lead to financial loss or exploitation

- Adoption Risk: Success depends on achieving meaningful adoption from AI developers and model trainers; failure to gain traction could render the token valueless

VI. Conclusion and Action Recommendations

FLOCK Investment Value Assessment

FLock.io represents a speculative investment opportunity in the emerging decentralized AI infrastructure space. The project's strong backing from established venture capital firms (DCG, Lightspeed Faction, OKX Ventures) and experienced team of Oxford-educated researchers provide credibility. However, current valuation complexity—with significant drop from all-time highs and ongoing market challenges—requires careful risk assessment. The long-term value proposition depends on successful network adoption, meaningful transaction volumes, and the team's ability to execute on the protocol roadmap. Short-term price action reflects broader market sentiment toward early-stage tokens and should not solely drive investment decisions.

FLOCK Investment Recommendations

✅ For Beginners: Start with minimal allocation (1-2% of crypto portfolio) through dollar-cost averaging on Gate.com over 3-6 months. Use limit orders at predetermined price levels rather than market orders. Do not use leverage or borrowed funds. Prioritize understanding the project fundamentals before committing capital.

✅ For Experienced Investors: Consider 3-8% allocation with defined entry/exit strategy based on technical levels and project milestone. Employ trailing stops to protect profits and set take-profit targets at 100%, 200%, and 300% returns. Actively monitor development progress and community sentiment.

✅ For Institutional Investors: Conduct thorough due diligence on team execution capabilities, contract audit results, and competitive positioning. Consider 5-15% allocation as alternative asset exposure with hedge strategies. Establish relationships with project founders for transparency and insider development updates.

FLOCK Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase of FLOCK tokens at market or limit prices, suitable for long-term holders and conservative investors seeking simple entry methods

- Limit Orders: Set specific price targets and allow automatic execution when FLOCK reaches predetermined levels, enabling passive participation without constant monitoring

- Regular Accumulation: Implement automated weekly or monthly purchases via Gate.com's subscription features to achieve dollar-cost averaging benefits and reduce timing risk

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Consult with a professional financial advisor before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Could Flockerz reach $1?

Yes, Flockerz could potentially reach $1 by 2040 with sufficient adoption and platform utility. This long-term price target depends on increased token integration and community growth.

What factors could drive FLOCK price in the future?

FLOCK price could be driven by ecosystem adoption, technological breakthroughs in decentralized AI, increased transaction volume, and strategic funding rounds. Recent $3 million funding from DCG and Animoca Brands demonstrates institutional confidence and may accelerate growth potential.

What is the current market cap and circulating supply of FLOCK token?

The current market cap of FLOCK token is $22.327 million, with a circulating supply of 254 million tokens.

How does FLOCK compare to other similar cryptocurrency projects?

FLOCK features a reward-heavy distribution model encouraging community engagement, while competitors like FLOW use fixed supply caps for scarcity value. FLOCK's adoption rate, market cap, and technical ecosystem differ significantly, offering distinct investment dynamics and growth potential compared to similar projects.

Pi Coin Price Prediction 2025: Current Value and Market Analysis

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 QUBIC Price Prediction: Analyzing Market Trends and Growth Potential in the Emerging Cryptocurrency Sector

What is SIREN: Understanding the Advanced Neural Network Representation for Implicit Functions

2025 COOKIE Price Prediction: Market Analysis and Future Outlook for Digital Cookie Economy

2025 SIREN Price Prediction: Future Outlook, Market Analysis, and Key Factors Driving This Emerging Crypto Asset

Comprehensive Guide: How to Purchase Shiba Inu Tokens Securely

Top Web3 Wallets for Beginners in 2023

Introduction to Web3 Security: Best Practices for Novices

Exploring NFTs in the World of Web3

Comprehensive Web3 Guide to Tracking Ether Prices and Market Trends