2025 GALFAN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of GALFAN

Galatasaray Fan Token (GALFAN) is a fan engagement token designed to provide Galatasaray Club supporters with various membership benefits and voting rights within the club's ecosystem. Since its launch in 2021, GALFAN has established itself as a utility token on the Chiliz platform. As of December 22, 2025, GALFAN maintains a market capitalization of approximately $8.2 million with a circulating supply of 7,254,386 tokens, trading at around $1.1311 per token. This innovative asset represents the intersection of sports, community engagement, and blockchain technology, enabling fans to participate directly in club governance and access exclusive rewards.

This article will conduct a comprehensive analysis of GALFAN's price trends from 2025 to 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

Galatasaray Fan Token (GALFAN) Market Analysis Report

I. GALFAN Price History Review and Current Market Status

GALFAN Historical Price Evolution Trajectory

- May 2021: Token launch on Chiliz platform, reached all-time high of $33.63

- December 2025: Token reached all-time low of $1.075 on December 16, 2025

GALFAN Current Market Performance

Price and Market Capitalization:

- Current Price: $1.1311 (as of December 22, 2025)

- 24-Hour Price Range: $1.1252 - $1.1376

- Fully Diluted Valuation: $11,282,722.50

- Market Cap (Circulating): $8,205,436.00

- Market Dominance: 0.00034%

Supply Metrics:

- Circulating Supply: 7,254,386 GALFAN (72.54% of total)

- Total Supply: 9,975,000 GALFAN

- Maximum Supply: Unlimited

- Token Holders: 7,708

Trading Activity:

- 24-Hour Trading Volume: $14,728.97

- Market Ranking: #1282

- Listed on: 3 exchanges

Price Movement Analysis:

- 1-Hour Change: +0.09%

- 24-Hour Change: +0.34%

- 7-Day Change: -0.73%

- 30-Day Change: -1.14%

- 1-Year Change: -33.87%

The token has experienced significant depreciation from its historical high of $33.63 in May 2021, currently trading near its recent low. The 24-hour trading activity shows modest volume, reflecting the token's limited market liquidity. GALFAN is primarily used as a membership utility token for Galatasaray football club fans, enabling voting on club decisions and access to exclusive rewards through the Socios platform.

Click to view current GALFAN market price

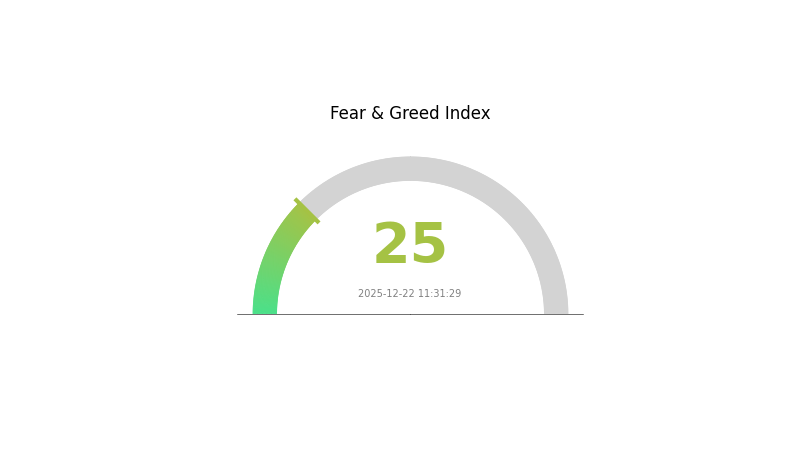

GALFAN Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This level indicates significant market pessimism and heightened risk aversion among investors. During such periods, volatility typically increases as traders reassess positions and market uncertainty remains elevated. Extreme fear often presents contrarian opportunities for long-term investors, as assets may be oversold. However, caution is advised when entering positions, as further downside pressure could occur. Monitor key support levels and market developments closely before making investment decisions on Gate.com or other platforms.

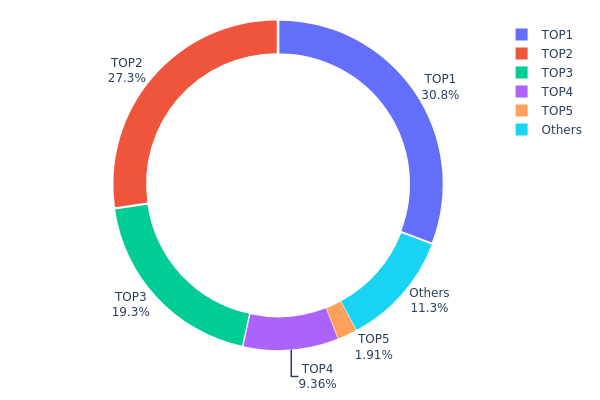

GALFAN Holding Distribution

Address holding distribution represents the concentration pattern of token ownership across blockchain addresses, serving as a critical indicator of market structure and potential manipulation risks. By analyzing the top holders and their respective stakes, we can assess the level of decentralization and identify whether token distribution aligns with sustainable market dynamics.

The current GALFAN holding distribution exhibits pronounced concentration characteristics. The top three addresses collectively control 77.42% of total supply, with the leading address alone commanding 30.83% of all tokens. This extreme concentration represents a significant structural risk, as decision-making power is heavily centralized among a limited number of stakeholders. When the top four addresses account for 86.78% of holdings, the token fails to demonstrate adequate decentralization—a hallmark of healthy market structures. The remaining 11.31% distributed among other addresses further underscores the concentration imbalance, suggesting that retail participation and organic adoption remain marginal components of the overall ecosystem.

Such concentrated holding structures pose material implications for market stability and price discovery mechanisms. Large position holders wielding 30%+ stakes possess considerable leverage to influence price movements, liquidity conditions, and market sentiment through coordinated or opportunistic actions. The distribution pattern suggests limited liquidity depth outside core holders, potentially resulting in heightened volatility and reduced market resilience during periods of selling pressure. Additionally, the absence of meaningful token distribution among dispersed addresses raises questions regarding the token's utility adoption and community engagement levels, indicating that GALFAN's current on-chain structure reflects early-stage concentration rather than mature, decentralized market participation.

Visit GALFAN Holding Distribution on Gate.com for real-time data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc368...816880 | 3075.16K | 30.83% |

| 2 | 0x6F45...41a33D | 2720.61K | 27.27% |

| 3 | 0x76eC...78Fbd3 | 1926.99K | 19.32% |

| 4 | 0xc80A...e92416 | 933.49K | 9.36% |

| 5 | 0x0213...F3cF97 | 190.30K | 1.91% |

| - | Others | 1128.44K | 11.31% |

Analysis of GALFAN Price Drivers

II. Core Factors Affecting GALFAN's Future Price

Supply Mechanism

-

Zinc Price Fluctuations: Zinc ingot price volatility significantly impacts GALFAN production costs and market pricing. In 2024, zinc prices demonstrated a oscillating upward trend, directly influencing the cost structure of galvanized coating products.

-

Current Impact: As raw material costs fluctuate, manufacturers must adjust their pricing strategies accordingly. The zinc market's continued volatility will remain a primary driver of GALFAN price movements in the near term.

Macroeconomic Environment

-

Raw Material Cost Pressures: Production costs are substantially influenced by zinc and steel material price fluctuations. These commodity price movements create supply chain challenges that ultimately affect end-product pricing and market competitiveness.

-

Market Demand Dynamics: GALFAN demand is driven by industrial applications requiring corrosion-resistant galvanized coatings. Market demand changes directly correlate with broader economic cycles and industrial production levels.

III. 2025-2030 GALFAN Price Forecast

2025 Outlook

- Conservative Forecast: $0.61 - $1.14

- Neutral Forecast: $1.13 (average expected price)

- Bullish Forecast: $1.51 (potential peak under favorable market conditions)

2026-2027 Mid-term Outlook

- Market Stage Expectations: Consolidation and gradual recovery phase with increasing institutional interest

- Price Range Predictions:

- 2026: $1.08 - $1.51 (16% potential upside)

- 2027: $0.99 - $1.53 (25% potential upside)

- Key Catalysts: Enhanced protocol adoption, ecosystem expansion, improved market sentiment, and potential regulatory clarity in major markets

2028-2030 Long-term Outlook

- Base Case Scenario: $1.35 - $1.85 (30% upside by 2028, assuming steady market conditions and gradual adoption)

- Optimistic Scenario: $1.66 - $2.06 (46% upside by 2029, assuming accelerated ecosystem growth and broader market recovery)

- Transformational Scenario: $2.72 (64% upside by 2030, under conditions of mainstream adoption, major partnership announcements, or significant technological breakthroughs)

Note: All price forecasts reflect analysis based on available market data as of December 22, 2025. Investors are advised to conduct independent research and consider using Gate.com for secure asset management and trading. Actual market performance may vary significantly from these projections due to market volatility and unforeseen circumstances.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.51433 | 1.1301 | 0.61025 | 0 |

| 2026 | 1.50733 | 1.32222 | 1.08422 | 16 |

| 2027 | 1.52795 | 1.41477 | 0.99034 | 25 |

| 2028 | 1.85392 | 1.47136 | 1.35365 | 30 |

| 2029 | 2.06167 | 1.66264 | 0.9477 | 46 |

| 2030 | 2.71875 | 1.86216 | 1.00556 | 64 |

Galatasaray Fan Token (GALFAN) Investment Analysis Report

IV. GALFAN Professional Investment Strategy and Risk Management

GALFAN Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investor Profile: Sports enthusiasts and Galatasaray supporters seeking long-term exposure to fan token ecosystem benefits; investors interested in sports blockchain tokenization trends.

-

Operational Recommendations:

- Accumulate GALFAN during market downturns to establish core positions, leveraging current market dynamics where the token has declined 33.87% over the past year.

- Participate in club governance votes and exclusive community benefits to maximize utility value beyond speculative trading.

- Dollar-cost averaging approach to mitigate volatility, given the token's price volatility from all-time high of $33.63 (May 2025) to recent lows near $1.075 (December 2025).

-

Storage Plan:

- Utilize Gate.com Web3 wallet for secure storage and easy access to trading and governance participation.

- Implement hardware-level security protocols for positions exceeding personal risk thresholds.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Price Action Analysis: Monitor 24-hour trading ranges ($1.1252 - $1.1376) and volume patterns to identify entry and exit points during intraday movements.

- Trend Following: Track 7-day and 30-day performance indicators (-0.73% and -1.14% respectively) to identify directional momentum shifts.

-

Swing Trading Key Points:

- Capitalize on short-term volatility within established support and resistance levels, noting the current 24-hour volume of $14,728.97.

- Set disciplined stop-loss orders at 5-8% below entry points to manage downside risk in this volatile asset class.

GALFAN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1% of total portfolio allocation, treating GALFAN as speculative exposure with limited capital at risk.

- Active Investors: 2% - 5% allocation, allowing for tactical positions while maintaining overall portfolio stability.

- Professional Investors: 5% - 10% allocation, with sophisticated hedging and derivatives strategies to optimize risk-adjusted returns.

(2) Risk Mitigation Strategies

- Position Sizing Protocol: Limit individual position size to predetermined percentage of total capital, ensuring no single investment threatens overall portfolio integrity.

- Diversification Across Sports Tokens: Balance GALFAN holdings with exposure to other established fan token projects to reduce concentration risk within the sports tokenization sector.

(3) Secure Storage Solution

- Hot Wallet Option: Gate.com Web3 wallet provides secure storage with convenient access for active trading and governance participation.

- Cold Storage Plan: Transfer significant holdings to secure offline storage for long-term preservation, reducing exposure to digital asset threats.

- Security Considerations: Utilize multi-signature authentication, enable two-factor authentication on all exchange and wallet accounts, never share private keys, and regularly verify wallet addresses before transactions.

V. GALFAN Potential Risks and Challenges

GALFAN Market Risk

- Extreme Volatility: Token has experienced 96.8% decline from all-time high ($33.63), indicating significant price instability and potential for further drawdowns during adverse market conditions.

- Low Trading Liquidity: With 24-hour volume of $14,728.97 and only 3 exchange listings, liquidity constraints may limit entry and exit flexibility for larger positions.

- Speculative Asset Nature: As an entertainment-focused token without fundamental cash flow generation, GALFAN remains primarily driven by community sentiment and speculation rather than intrinsic valuation metrics.

GALFAN Regulatory Risk

- Sports Betting Regulations: Potential regulatory scrutiny regarding fan tokens' classification as gambling-related instruments in certain jurisdictions, which could restrict distribution and trading.

- Securities Classification Uncertainty: Risk that regulatory authorities may reclassify fan tokens as unregistered securities, requiring compliance with traditional securities regulations.

- Geographic Restrictions: Varying regulatory frameworks across different countries may limit GALFAN's accessibility to certain investor populations, reducing global adoption potential.

GALFAN Technical Risk

- Blockchain Dependency: GALFAN operates on the CHZ2 chain, creating dependency on Chiliz blockchain infrastructure stability and security.

- Smart Contract Vulnerabilities: Potential technical flaws or exploits within tokenomic mechanisms could compromise token value or user security.

- Limited Technical Development: As a utility token rather than a technology platform, GALFAN lacks independent development roadmap, making it vulnerable to parent ecosystem changes.

VI. Conclusion and Action Recommendations

GALFAN Investment Value Assessment

Galatasaray Fan Token presents a niche investment opportunity within the sports tokenization ecosystem, offering governance participation and exclusive community benefits for Galatasaray supporters. However, the token's severe 96.8% decline from peak valuation, limited liquidity across only 3 exchanges, and speculative nature warrant careful consideration. The current price of $1.1311 represents value-catching opportunity for supporters seeking community participation, but investors should recognize this as a high-risk, entertainment-focused asset rather than a traditional investment vehicle. Long-term viability depends on sustained fan engagement, Chiliz ecosystem development, and mainstream adoption of sports tokenization.

GALFAN Investment Recommendations

✅ Beginners: Start with minimal position sizes (0.5-1% of portfolio) through Gate.com, treating GALFAN primarily as a community participation vehicle rather than speculative trade. Focus on understanding fan token utility before expanding exposure.

✅ Experienced Investors: Implement tactical swing trading strategies exploiting short-term volatility, while maintaining diversified exposure across multiple fan tokens to reduce concentration risk. Use dollar-cost averaging for core position building during depressed valuations.

✅ Institutional Investors: Evaluate GALFAN primarily for portfolio diversification and sports entertainment sector exposure rather than standalone investment merit. Consider derivatives strategies to hedge volatility while maintaining thematic exposure to fan tokenization trends.

GALFAN Participation Methods

- Direct Exchange Trading: Purchase GALFAN on Gate.com with market or limit orders, utilizing trading tools and real-time price data for optimal execution.

- Community Governance: Stake GALFAN tokens to participate in Galatasaray fan voting initiatives and access exclusive club-related benefits and merchandise discounts.

- Long-Term Holding: Store tokens in Gate.com Web3 wallet to accumulate governance rights and community recognition within the fan ecosystem.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions according to their risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

What is GALFAN token and what is its current use case?

GALFAN is a fan token for Galatasaray, a Turkish football club. It enables fan engagement through voting on club decisions and accessing exclusive content and benefits for token holders.

What factors could influence GALFAN price prediction for 2025?

GALFAN price in 2025 will be influenced by zinc and aluminum price fluctuations, raw material availability, supply chain conditions, and global economic trends. Market demand and production capacity also play critical roles in price movements.

Is GALFAN a good investment and what are the associated risks?

GALFAN presents strong investment potential with growing market demand and adoption. Key risks include market volatility,regulatory changes,and technological disruptions that could impact price performance.

How does GALFAN compare to other similar tokens in the market?

GALFAN distinguishes itself as a specialized fan token for Galatasaray enthusiasts, offering unique community governance features. While it has a smaller market cap and trade volume than major blockchain platforms, GALFAN provides dedicated utility for fan engagement and ecosystem participation, making it a niche but targeted investment within the fan token category.

What is the historical price performance of GALFAN token?

GALFAN reached an all-time high of $33.63 and an all-time low of $1.07. Currently trading at $1.14 with 24-hour trading volume of $10.53K as of December 2025.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

Discover the Upcoming $YZY Coin: Guide to Understanding and Purchasing

What is KARRAT: A Comprehensive Guide to the Revolutionary Autonomous Robot Platform

What is OCTA: A Comprehensive Guide to Optical Coherence Tomography Angiography in Modern Retinal Imaging

What is TITN: A Comprehensive Guide to Understanding This Revolutionary Technology Platform

What is ATM: A Comprehensive Guide to Automated Teller Machines and Their Role in Modern Banking