2025 GEAR Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: GEAR's Market Position and Investment Value

Gearbox (GEAR) is a universal leverage protocol that enables both passive liquidity providers to earn low-risk APY through single-asset liquidity provision and active traders, companies, and protocols to borrow these assets for leveraged trading or yield farming at up to 10x leverage. Since its launch in December 2022, GEAR has established itself as a key infrastructure component in the decentralized finance ecosystem. As of December 2025, GEAR's market capitalization stands at approximately $10.21 million, with a circulating supply of 10 billion tokens trading at around $0.001021 per token.

This article will provide a comprehensive analysis of GEAR's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants.

Gearbox (GEAR) Market Analysis Report

I. GEAR Price History Review and Current Market Status

GEAR Historical Price Evolution

Gearbox (GEAR) was launched on December 18, 2022, entering the market at the inception of the protocol. Since its launch, GEAR has experienced significant volatility:

-

December 2022 - April 2024: GEAR reached its all-time high of $0.03725561 on April 12, 2024, reflecting early investor enthusiasm and protocol adoption during the initial growth phase.

-

April 2024 - Present: Following the peak, GEAR has entered a prolonged downtrend, declining substantially over subsequent periods.

GEAR Current Market Situation

As of December 22, 2025, GEAR is trading at $0.0010207, representing a severe depreciation from its historical peak. Key market metrics reveal:

Price Performance:

- 24-hour change: +0.77%, with price ranging between $0.000989 and $0.0010884

- 1-hour change: -0.41%

- 7-day change: -15.98%

- 30-day change: -36.8%

- 1-year change: -92.43%

Market Capitalization and Supply:

- Market capitalization: $10,207,000 USD

- Circulating supply: 10,000,000,000 GEAR

- Total supply: 10,000,000,000 GEAR

- Market dominance: 0.00031%

Trading Activity:

- 24-hour trading volume: $25,495.23 USD

- Number of active holders: 10,938

- Listed on 7 exchanges globally

Market Sentiment: The current market emotion indicator registers extreme fear (VIX: 20), reflecting broader market pessimism on December 21, 2025.

Click to view current GEAR market price

GEAR Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the GEAR index at 20. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, panic selling often dominates, creating potential buying opportunities for long-term investors. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely and consider your risk tolerance when positioning your portfolio on Gate.com's trading platform.

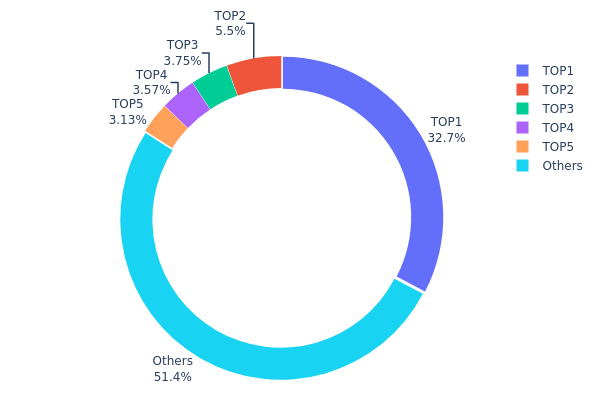

GEAR Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, revealing how GEAR tokens are allocated among the largest holders versus the broader holder base. This metric serves as a critical indicator of market structure, decentralization level, and potential vulnerability to price manipulation through concentrated selling or accumulation activity.

The current GEAR holdings data demonstrates moderate concentration characteristics. The top holder controls 32.66% of the total supply, while the top five addresses collectively account for 48.6% of all tokens in circulation. This level of concentration reflects a relatively centralized distribution pattern, though not to the degree of severe risk. The remaining 51.4% distributed across "Others" indicates a meaningful dispersal of tokens among smaller holders, suggesting some degree of decentralization at the lower end of the distribution spectrum.

From a market dynamics perspective, this holder composition presents both structural considerations and operational implications. The significant concentration in the top address warrants monitoring, as sudden liquidation or strategic accumulation by this holder could exert considerable downward or upward pressure on GEAR's price discovery mechanism. However, the non-trivial presence of smaller holders provides a degree of market resilience and limits the likelihood of unilateral price manipulation by a single entity. The current distribution suggests GEAR operates within a moderately decentralized framework, with governance and price stability moderately dependent on the cooperation and behavioral patterns of the top institutional or organizational holders.

Click to view current GEAR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7b06...ea73d1 | 3266256.20K | 32.66% |

| 2 | 0xe8d1...a17dae | 550000.00K | 5.50% |

| 3 | 0x91d4...c8debe | 375130.70K | 3.75% |

| 4 | 0x0e9b...95f1c2 | 357387.76K | 3.57% |

| 5 | 0x2fcb...459c33 | 312633.76K | 3.12% |

| - | Others | 5138591.58K | 51.4% |

II. Core Factors Influencing GEAR's Future Price

Supply Mechanism

- Market Demand: GEAR's future price is primarily driven by market demand and overall cryptocurrency industry trends.

- Historical Patterns: Past supply changes have already impacted GEAR's price, with market recognition and adoption rates playing significant roles.

- Current Impact: Supply and adoption velocity remain key factors influencing GEAR's valuation trajectory.

Technology Development and Ecosystem Construction

- Protocol Innovation: Technological advancements within the Gearbox DeFi protocol continue to drive ecosystem development and user adoption.

- Ecosystem Applications: The expansion of DeFi applications built on the Gearbox protocol strengthens the utility and demand for GEAR tokens.

Note: For the most comprehensive analysis of GEAR price predictions covering 2025-2030, market trends, technical indicators, and detailed investment strategies, visit Gate.com's cryptocurrency wiki section for in-depth DeFi protocol token analysis.

Three、2025-2030 GEAR Price Forecast

2025 Outlook

- Conservative Forecast: $0.00071 - $0.00102

- Neutral Forecast: $0.00102 (average price expectation)

- Optimistic Forecast: $0.00126 (requiring sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual consolidation phase with modest recovery trajectory, characterized by incremental growth and market stabilization.

- Price Range Predictions:

- 2026: $0.00073 - $0.00117

- 2027: $0.00072 - $0.00157

- Key Catalysts: Enhanced protocol functionality, increased institutional adoption, ecosystem expansion, and improvements in market liquidity on platforms like Gate.com.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00132 - $0.00184 (assuming steady market development and moderate adoption growth)

- Optimistic Scenario: $0.00189 - $0.00218 (assuming accelerated ecosystem integration and expanded use cases)

- Transformation Scenario: $0.00233 (under conditions of breakthrough technological advancement, significant mainstream adoption, and major partnership announcements)

- 2030-12-31: GEAR reaches $0.00233, representing 85% cumulative appreciation from 2025 baseline (maturation stage of multi-year development cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00126 | 0.00102 | 0.00071 | 0 |

| 2026 | 0.00117 | 0.00114 | 0.00073 | 11 |

| 2027 | 0.00157 | 0.00116 | 0.00072 | 13 |

| 2028 | 0.00184 | 0.00136 | 0.00132 | 33 |

| 2029 | 0.00218 | 0.0016 | 0.00106 | 56 |

| 2030 | 0.00233 | 0.00189 | 0.00146 | 85 |

Gearbox (GEAR) Professional Investment Strategy and Risk Management Report

IV. GEAR Professional Investment Strategy and Risk Management

GEAR Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: DeFi protocol enthusiasts, passive income seekers, and long-term believers in leveraged finance infrastructure

-

Operation Recommendations:

- Accumulate during market downturns when GEAR is trading near support levels, taking advantage of the -92.43% year-over-year decline to build positions at lower valuations

- Hold for 2-5 year periods to benefit from potential protocol adoption growth and ecosystem expansion

- Reinvest any governance rewards or protocol incentives to compound positions over time

-

Storage Solutions:

- Utilize Gate Web3 Wallet for convenient on-chain interaction with Gearbox protocol smart contracts

- Implement multi-signature verification for enhanced security of larger holdings

- Maintain regular backups of private keys in secure, offline locations

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor historical price levels at $0.03725561 (all-time high) and $0.00091266 (recent low) to identify potential breakout or breakdown zones

- Moving Averages: Apply 50-day and 200-day exponential moving averages to identify trend direction and momentum shifts

-

Swing Trading Key Points:

- Execute scaled buy orders during oversold conditions (tracking the 24-hour volume of $25,495.23 as baseline)

- Take partial profits during recovery rallies above daily resistance levels to lock in gains

- Manage position sizes carefully given the current low market cap of $10,207,000 and high volatility risk

GEAR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio allocation, treating GEAR as a speculative small-cap position

- Aggressive Investors: 2-5% of portfolio allocation, allowing for higher exposure to emerging DeFi infrastructure plays

- Professional Investors: 3-10% of portfolio allocation as part of a diversified DeFi protocol strategy, with hedging mechanisms in place

(2) Risk Hedging Solutions

- Position Sizing Hedging: Maintain strict position limits and use stop-loss orders at -15% to -20% below entry points to limit downside exposure

- Diversification Strategy: Balance GEAR holdings with exposure to more established DeFi protocols and blue-chip cryptocurrencies to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate Web3 Wallet provides convenient access for active traders while maintaining reasonable security standards for smaller positions

- Cold Storage Method: For significant holdings, consider using hardware security modules or secured offline storage to protect against exchange compromises

- Security Precautions: Never share private keys or recovery phrases; enable all available security features including two-factor authentication when using custodial services; regularly verify contract addresses before transactions

V. GEAR Potential Risks and Challenges

GEAR Market Risk

- Extreme Price Volatility: GEAR has experienced a -92.43% year-over-year decline and -36.8% monthly decline, indicating extreme price instability that could result in rapid capital loss for retail investors

- Low Liquidity and Market Depth: With only 24-hour volume of $25,495.23 and a market cap of $10,207,000, the token faces significant liquidity constraints that could impact entry and exit execution

- Concentration Risk: Only 10,938 token holders suggests a highly concentrated holder base, creating potential for manipulation or sudden sell-offs affecting price stability

GEAR Regulatory Risk

- DeFi Regulatory Uncertainty: Leverage protocols face evolving regulatory scrutiny globally, with potential restrictions on margin trading and leverage products that could impact protocol operations

- Securities Classification Risk: Regulatory agencies in certain jurisdictions may classify GEAR governance tokens as securities, creating compliance and legal challenges

- Jurisdiction-Specific Restrictions: Different countries have varying approaches to DeFi protocols, potentially limiting Gearbox accessibility and adoption in key markets

GEAR Technical Risk

- Smart Contract Vulnerability: As a leveraged protocol handling user assets, any undiscovered vulnerabilities in smart contracts could result in fund loss or exploitation

- Protocol Scalability Challenges: Operating on Ethereum mainnet may face congestion and high gas fees during peak usage periods, potentially limiting user adoption

- Liquidation Cascade Risk: During volatile market conditions, cascading liquidations of leveraged positions could trigger price spirals and systemic instability within the protocol

VI. Conclusion and Action Recommendations

GEAR Investment Value Assessment

Gearbox represents a specialized infrastructure play within the DeFi ecosystem, offering leveraged trading and yield generation mechanisms. However, the token faces significant headwinds including an extreme year-over-year price decline of -92.43%, very low market liquidity, and concentrated holder distribution. The protocol itself addresses a real market need for leverage in DeFi, but the token's valuation and market conditions suggest this is a high-risk, speculative position suitable only for investors with strong risk tolerance and conviction in DeFi infrastructure adoption.

GEAR Investment Recommendations

✅ Beginners: Start with micro-positions (0.1-0.5% of portfolio) through Gate.com if interested in DeFi exposure; prioritize education on leveraged protocol mechanics and risks before increasing allocation

✅ Experienced Investors: Consider tactical accumulation during major market downturns as a small-cap alternative play; implement strict position sizing and stop-loss disciplines; monitor protocol developments and governance decisions

✅ Institutional Investors: Evaluate Gearbox as part of broader DeFi infrastructure thesis with dedicated allocation; conduct comprehensive smart contract audits and operational due diligence; structure positions with appropriate hedging mechanisms

GEAR Trading Participation Methods

- Direct Token Purchase: Access GEAR trading pairs through Gate.com, which supports the token across multiple trading pairs with competitive liquidity conditions for the available volume

- Protocol Interaction: Engage directly with Gearbox protocol smart contracts via Gate Web3 Wallet to provide liquidity or utilize leverage for trading strategies, earning protocol incentives

- Dollar-Cost Averaging: Execute systematic purchases over extended time periods to reduce timing risk and benefit from potential long-term adoption growth

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose entirely.

FAQ

What price could GEAR token reach in the future?

Based on technical analysis, GEAR is predicted to reach $0.00289 by January 14, 2026, with potential highs of $0.018177. Long-term growth depends on platform adoption and market conditions.

What is the GEAR coin price prediction for 2025?

Based on current market trends and predictive analysis, GEAR is projected to trade around $0.005872 in 2025. This forecast may adjust based on market dynamics and development progress of the Gearbox protocol.

What factors influence GEAR token price?

GEAR token price is influenced by supply mechanisms, market demand, trading volume, and geopolitical events. Strong community adoption and ecosystem development also drive price movements.

What are the advantages of GEAR token compared to other DeFi tokens?

GEAR token offers faster transaction speeds, enhanced security, and lower operational costs compared to other DeFi tokens. Its innovative architecture simplifies complex functionality, providing superior efficiency and user experience in the DeFi ecosystem.

Is GEAR worth investing in now?

GEAR is worth considering as an investment option. Based on current market analysis, GEAR is projected to reach $0.005877 by December 23, 2025. The token shows potential for growth with increasing trading volume and community engagement in the ecosystem.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

FTT Explained

next crypto to hit $1 in 2025

2025 PUMP Price Prediction: Analyzing Market Trends and Growth Potential for Cryptocurrency Investors

Is Bitlayer (BTR) a good investment?: A Comprehensive Analysis of Performance, Technology, and Market Potential

Exploring Secure Web3 Wallet Solutions

Exploring Jambo: Features and Benefits of a Leading Crypto Platform

Ultimate Guide to Web3 Gaming in the Pixelverse

Earn Crypto by Playing Popular Games on Telegram