2025 GIGGLE Price Prediction: Analyzing Market Trends and Future Growth Potential for the Emerging Cryptocurrency Token

Introduction: GIGGLE's Market Position and Investment Value

GIGGLE (GIGGLE) is a memecoin combining "charity + education" that leverages a fee-donation mechanism and the Giggle Academy narrative to build a brand of "doing good through memes." As of December 18, 2025, GIGGLE has achieved a market capitalization of $64,790,000 with a circulating supply of 1,000,000 tokens, maintaining a price point of $64.79. This innovative asset is playing an increasingly significant role in the intersection of community-driven finance and social impact initiatives.

This article will provide a comprehensive analysis of GIGGLE's price trajectory through 2030, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. GIGGLE Price History Review and Current Market Status

GIGGLE Historical Price Evolution Trajectory

- October 25, 2025: GIGGLE reached its all-time high of $288.92, marking the peak of its initial rally phase.

- November 4, 2025: GIGGLE hit its all-time low of $47.56, representing a significant correction from the peak.

- December 18, 2025: Current price stands at $64.79, recovering from the lows but still trading substantially below the all-time high.

GIGGLE Current Market Dynamics

GIGGLE is currently trading at $64.79 with a 24-hour trading volume of approximately $808,734.59. The token has experienced a -5.27% decline over the past 24 hours, with intraday movement ranging between $64.29 and $70.97. Over a broader perspective, the asset has declined -17.9% over the past 7 days and -50.51% over the past 30 days, reflecting the challenging market conditions that followed its peak in late October.

The token maintains a total market capitalization of $64.79 million with a fully diluted valuation matching this figure, given that all 1,000,000 tokens are currently in circulation. GIGGLE commands a market share of 0.0020% and is currently ranked 433 among all cryptocurrencies. The token is supported by 24,780 holders and is listed on 21 exchanges, with Gate.com providing a primary trading venue.

The current market sentiment reflects extreme fear, as indicated by the prevailing VIX conditions as of December 17, 2025. Notably, GIGGLE has generated exceptional long-term returns, with a year-to-date performance increase of 3,005,982.75%, demonstrating the asset's dramatic appreciation trajectory since its inception.

View the current GIGGLE market price

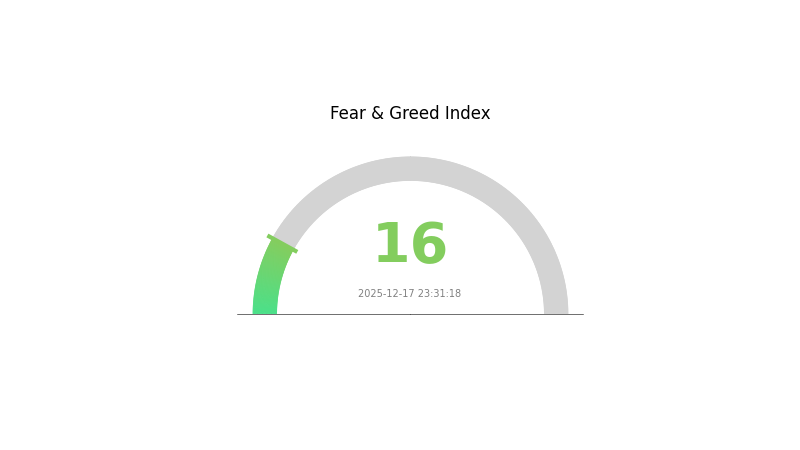

GIGGLE Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear conditions, with the index plummeting to 16. This severe sentiment indicates strong bearish pressure and widespread investor anxiety. Market participants are showing heightened risk aversion, leading to potential capitulation selling. Such extreme fear levels historically present contrarian opportunities for long-term investors. However, caution remains warranted as volatility persists. Monitor key support levels closely and consider portfolio positioning accordingly through Gate.com's comprehensive market analysis tools.

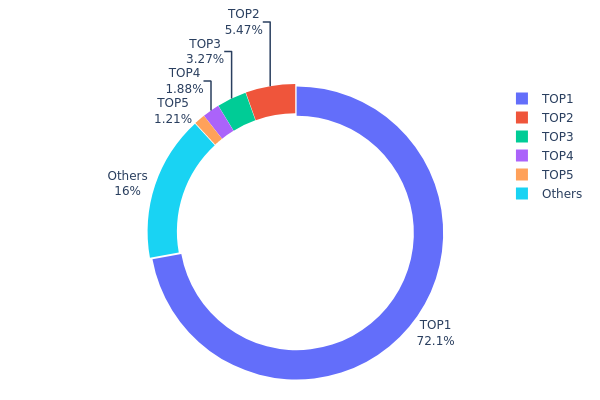

GIGGLE Holdings Distribution

Address holdings distribution refers to the allocation of token balances across blockchain addresses, serving as a critical metric for assessing the decentralization level and market structure of a cryptocurrency. This distribution pattern directly reflects the concentration of ownership and provides insights into potential market manipulation risks and price stability dynamics.

The current GIGGLE holdings distribution exhibits pronounced concentration characteristics. The top address commands 721.33K tokens, representing 72.13% of total supply—an exceptionally high concentration level that substantially exceeds healthy decentralization thresholds. The secondary tier of holders shows markedly reduced stakes, with the second-largest address holding only 5.47%, indicating a dramatic drop-off in ownership distribution. The top five addresses collectively control approximately 83.95% of circulating supply, while the remaining 16.05% is fragmented across other holders. This extreme concentration pattern suggests significant centralization risk within the token's holder structure.

This highly concentrated distribution architecture presents material implications for market microstructure and price dynamics. The dominant position of the lead address creates substantial vulnerability to coordinated selling pressure and potential market manipulation. Should concentrated holders elect to liquidate positions, the market would likely experience severe downward pressure given the limited absorption capacity from distributed retail holders. The skewed distribution also indicates reduced genuine market decentralization and raises concerns regarding the protocol's resilience to adverse actions by principal stakeholders. The significant gap between the largest holder and remaining addresses suggests an ecosystem where decision-making influence and price discovery mechanisms remain heavily weighted toward a narrow participant cohort, potentially limiting organic market development and validator diversification.

Click to view current GIGGLE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 721.33K | 72.13% |

| 2 | 0x0b71...f7c593 | 54.71K | 5.47% |

| 3 | 0x8894...e2d4e3 | 32.67K | 3.26% |

| 4 | 0x4368...26f042 | 18.82K | 1.88% |

| 5 | 0x0d07...b492fe | 12.12K | 1.21% |

| - | Others | 160.35K | 16.05% |

II. Core Factors Affecting GIGGLE's Future Price

Supply Mechanism

- Deflationary Model: GIGGLE token is expected to enter a deflationary mode in the future, driven by fee burning mechanisms and charitable initiatives, which could support long-term value proposition for the community.

Market Sentiment and Demand Dynamics

-

Weak Demand Pressure: According to chain analysis by Axel Adler, weak demand, persistent selling pressure, and deteriorating liquidity conditions support the view that bearish conditions will persist for several months ahead. The MVRV Z-Score model indicates continued downward pressure on prices.

-

Price Volatility: GIGGLE has experienced significant volatility, declining from its peak of $288 to $70, reflecting substantial investor sentiment shifts and market corrections on the BSC ecosystem.

-

Charitable Event Drivers: GIGGLE's price movements have been influenced by fee burning events from platform transactions and charitable initiatives, which generated market attention and contributed to market value fluctuations.

Macroeconomic Environment

- Monetary Policy Impact: The broader cryptocurrency market, including GIGGLE, operates within the context of central bank policies. Recent Federal Reserve decisions indicating rate cuts of up to 175 basis points cumulatively create a more accommodative environment that could support risk assets like cryptocurrencies, though the pace of future rate cuts remains uncertain.

III. 2025-2030 GIGGLE Price Forecast

2025 Outlook

- Conservative Forecast: $60.28 - $64.82

- Neutral Forecast: $64.82 - $71.30

- Bullish Forecast: $71.30 (baseline market stabilization)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with sustained growth momentum, transitioning from stability to moderate expansion as market participants accumulate positions.

- Price Range Predictions:

- 2026: $59.21 - $88.48 (5% upside potential)

- 2027: $43.05 - $111.14 (20% upside potential)

- 2028: $62.51 - $125.96 (46% upside potential)

- Key Catalysts: Ecosystem development maturation, institutional adoption acceleration, protocol upgrades and feature enhancements, positive macroeconomic sentiment toward digital assets.

2029-2030 Long-term Outlook

- Base Case Scenario: $81.65 - $150.05 (70% upside potential by 2029, assuming steady adoption and market cyclicality)

- Bullish Scenario: $130.19 - $188.78 (100% upside potential by 2030, assuming accelerated institutional integration and ecosystem expansion)

- Transformational Scenario: $188.78+ (breakthrough adoption milestones, mainstream financial integration, significant technological breakthroughs in underlying infrastructure)

- 2030-12-31: GIGGLE at $188.78 (all-time high achieved through sustained ecosystem growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 71.302 | 64.82 | 60.2826 | 0 |

| 2026 | 88.4793 | 68.061 | 59.21307 | 5 |

| 2027 | 111.14 | 78.27015 | 43.04858 | 20 |

| 2028 | 125.96 | 94.70688 | 62.50654 | 46 |

| 2029 | 150.05 | 110.33 | 81.6468 | 70 |

| 2030 | 188.78 | 130.19 | 72.90839 | 100 |

GIGGLE Investment Strategy and Risk Management Report

IV. GIGGLE Professional Investment Strategy and Risk Management

GIGGLE Investment Methodology

(1) Long-term Hold Strategy

- Suitable Investors: Retail investors with high risk tolerance and belief in the charity and education narrative of memecoins

- Operational Recommendations:

- Establish a fixed position within 2-5% of total portfolio allocation given the memecoin volatility

- Accumulate during price dips below $65, particularly during market-wide corrections

- Hold through market cycles to capture potential upside from the Giggle Academy education initiative and fee-donation mechanism adoption

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor the $64.29 (24H low) and $70.97 (24H high) price zones for entry and exit signals

- Moving Averages: Use 7-day and 30-day MA crossovers to identify trend reversals given the -17.9% 7-day decline

- Wave Trading Key Points:

- Execute buy orders at local support levels showing accumulation signals from the 24,780 token holders

- Take profit at psychological resistance levels; the -50.51% 30-day decline suggests potential for mean reversion rallies

- Monitor volume around 808,734.59 USDT daily trading volume as a liquidity indicator

GIGGLE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% portfolio allocation

- Active Investors: 1-3% portfolio allocation

- Aggressive Investors: 3-5% portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Limit GIGGLE exposure to memecoin allocation segment; balance with stablecoin reserves (USDT, USDC)

- Volatility Protection: Use stop-loss orders at -15% from entry price to manage downside risk given the -5.27% 24H decline

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for frequent trading with active position management

- Cold Storage Method: Transfer long-term holdings to non-custodial storage for enhanced security

- Security Considerations: Never share private keys; enable two-factor authentication on Gate.com account; verify contract address 0x20d6015660b3fe52e6690a889b5c51f69902ce0e on BSCScan before transactions

V. GIGGLE Potential Risks and Challenges

GIGGLE Market Risk

- Memecoin Volatility: GIGGLE exhibits extreme price swings (-50.51% over 30 days) with limited fundamental cash flows, making it highly speculative

- Liquidity Risk: Daily trading volume of $808,734.58 may be insufficient for large institutional orders, creating slippage risk

- Market Sentiment Dependency: As a memecoin, GIGGLE price is heavily influenced by social media trends and community sentiment rather than intrinsic value

GIGGLE Regulatory Risk

- Commodity Classification Uncertainty: Regulatory agencies may classify GIGGLE differently across jurisdictions, affecting trading and holding legality

- Charity Mechanism Scrutiny: The fee-donation mechanism could face regulatory challenges if not compliant with securities or charitable giving regulations

- Jurisdiction-Specific Restrictions: Certain countries may restrict memecoin trading or impose additional compliance requirements

GIGGLE Technical Risk

- Smart Contract Vulnerability: Any flaws in the BEP-20 token contract (0x20d6015660b3fe52e6690a889b5c51f69902ce0e) could lead to fund loss

- Exchange Delisting Risk: GIGGLE listed on 21 exchanges; delisting from major platforms could significantly impact liquidity and accessibility

- Network Congestion: BSC network issues could temporarily prevent transactions or cause price deviation across platforms

VI. Conclusion and Action Recommendations

GIGGLE Investment Value Assessment

GIGGLE combines memecoin speculative characteristics with a charity and education narrative through the Giggle Academy framework and fee-donation mechanism. While the all-time high of $288.92 (reached October 25, 2025) demonstrates strong community interest, the -50.51% 30-day decline and -5.27% 24H movement reflect significant volatility typical of emerging memecoins. With a market cap of $64.79 million and 1 million circulating supply, GIGGLE remains a high-risk, high-reward asset suitable only for risk-tolerant investors. The project's long-term viability depends on sustained community engagement, adoption of the education narrative, and effectiveness of the charity mechanism in differentiating itself from competing memecoins.

GIGGLE Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) through Gate.com; use limit orders at support levels ($64.29) to minimize slippage and emotional trading ✅ Experienced Investors: Implement active trading strategies using technical levels ($70.97 resistance, $64.29 support); allocate 2-3% to capture volatility while maintaining portfolio balance ✅ Institutional Investors: Conduct due diligence on the Giggle Academy initiative and fee-donation mechanism effectiveness; consider strategic positions only after evaluating governance transparency and fund utilization

GIGGLE Trading Participation Methods

- Gate.com Spot Trading: Direct purchase of GIGGLE tokens using BNB or stablecoins; best for position building at identified support levels

- Limit Order Strategy: Set buy orders at $65 and sell orders at $70-75 to capture intraday volatility without continuous monitoring

- DCA Approach: Dollar-cost average 0.2-0.5% portfolio allocation monthly to reduce timing risk and benefit from potential price recoveries

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. Consult professional financial advisors before investing. Never invest more than you can afford to lose.

FAQ

What is the future price prediction for giggle coin?

Based on market analysis, GIGGLE is projected to reach $17.3643 by 2028, representing a growth rate of 15.76%. This prediction reflects potential market expansion and adoption trends in the crypto space.

Can grt coin reach $10?

While GRT reaching $10 is unlikely in the near term given current market conditions and valuation, significant growth remains possible with strong ecosystem adoption and network expansion over the long term.

Is Giggle coin legit?

Giggle coin is associated with airdrop scams. It falsely claims to offer token distributions. Exercise caution and avoid participating in suspicious promotional activities claiming to be related to this project.

Will Dogelon Mars ever hit $1?

Dogelon Mars has potential to reach $1, but no guaranteed timeline. Success depends on increased adoption, market sentiment, and overall crypto growth. While unlikely in the near term, long-term possibilities exist if fundamental metrics improve significantly.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Exploring the Evolution and Advantages of DeFi 2.0

Understanding the Basics of Liquidity Mining

Understanding Segwit in Bitcoin: A Comprehensive Guide

Beginner's Guide to Purchasing Ethereum Classic (ETC) in India

Create Your Own Cryptocurrency Mining Network