2025 GLMR Price Prediction: Expert Analysis and Market Forecast for Moonbeam Network Token

Introduction: Market Position and Investment Value of GLMR

Moonbeam Network (GLMR) serves as an EVM-compatible blockchain operating as a parachain on the Polkadot network, enabling Ethereum-based applications to be deployed while providing developers with Solidity smart contract deployment, Web3-compatible APIs, oracle data, and cross-chain bridge functionality. Since its inception in December 2021, GLMR has established itself as a functional and governance token within the Polkadot ecosystem. As of December 2025, GLMR maintains a market capitalization of approximately $25.09 million with a circulating supply of approximately 1.03 billion tokens, currently trading at around $0.02425 per token. This multi-functional asset—recognized for its role in transaction fees, network staking, governance participation, and liquidity mining incentives—continues to play an increasingly significant role in the cross-chain interoperability landscape.

This article will comprehensively analyze GLMR's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies grounded in current market data and network fundamentals.

Moonbeam Network (GLMR) Market Analysis Report

I. GLMR Price History Review and Current Market Status

GLMR Historical Price Evolution Timeline

-

January 2022: Moonbeam achieved its all-time high of $19.50 on January 11, 2022, representing the peak of market enthusiasm following the project's successful acquisition of a parachain slot on Polkadot in December 2021.

-

2022-2024: Extended bear market period, with GLMR experiencing significant depreciation as the broader cryptocurrency market contracted and developer activity matured on the platform.

-

December 2025: GLMR reached its all-time low of $0.02279482 on December 19, 2025, representing a decline of approximately 90.62% from its initial launch price of $0.25, and a 99.88% decrease from its historical peak.

GLMR Current Market Conditions

As of December 20, 2025, GLMR is trading at $0.02425, with a 24-hour trading volume of $131,980.58. The token has demonstrated modest positive momentum, gaining 4.65% over the past 24 hours. However, longer-term sentiment remains bearish, with the token declining 16% over the past 7 days and 17.06% over the past 30 days.

The circulating supply stands at 1,034,736,550 GLMR out of a total supply of 1,207,851,242 GLMR, representing a circulation ratio of approximately 85.67%. The current market capitalization is $25,092,361.34, with a fully diluted valuation of $29,290,392.62. GLMR maintains a market rank of 773 across all digital assets, with a market dominance of 0.00091%. The token is actively trading on 27 exchanges and has accumulated 1,800,433 unique token holders.

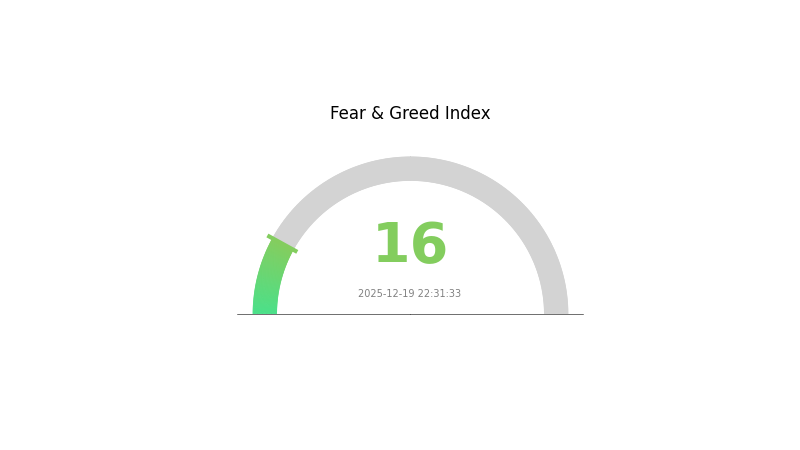

Market sentiment remains severely depressed, with the current Fear & Greed Index reading "Extreme Fear" at a level of 16, indicating heightened risk aversion in the broader market.

Click to view current GLMR market price

Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index registering at 16. This sentiment reading suggests investors are highly pessimistic about near-term market prospects. During periods of extreme fear, opportunities often emerge for contrarian investors. Market volatility tends to peak when sentiment reaches such depths. It's crucial to conduct thorough research and risk assessment before making investment decisions. On Gate.com, you can monitor real-time market sentiment indicators to better understand current market conditions and adjust your trading strategy accordingly.

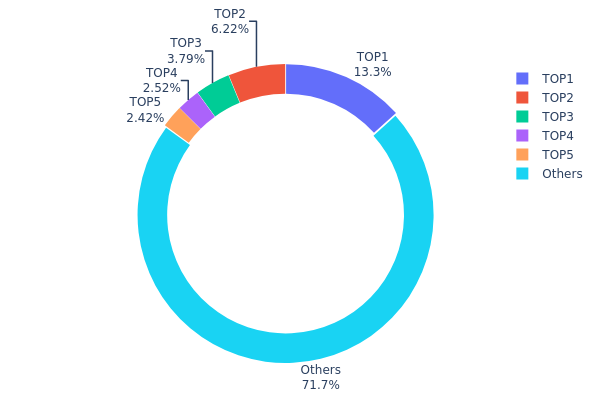

GLMR Holdings Distribution

The address holdings distribution chart illustrates the concentration of GLMR tokens across different wallet addresses, serving as a critical indicator of token decentralization and market structure. By analyzing the top holders and their respective ownership percentages, investors can assess the degree of wealth concentration and potential risks associated with large holders' market influence.

Current GLMR holdings data reveals a moderate concentration pattern. The top five addresses collectively hold approximately 28.26% of all tokens, with the largest holder (0xf977...41acec) commanding 13.31% of the total supply. This level of concentration suggests that while significant holdings are present among major addresses, the asset maintains a relatively distributed structure compared to highly centralized tokens. The remaining 71.74% distributed among other addresses indicates a reasonably dispersed token base, which is generally favorable for market health and reduces systemic risks associated with extreme concentration.

The current distribution pattern suggests limited risk of major price manipulation through coordinated action by top holders. However, the presence of a single address holding over 13% warrants monitoring, as this entity maintains sufficient capital to potentially influence short-term price movements during periods of low trading volume. The overall holdings structure demonstrates that GLMR maintains adequate decentralization while preserving the influence necessary for ecosystem development and governance stability.

Click to view current GLMR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 160818.15K | 13.31% |

| 2 | 0xf391...ce28ce | 75123.59K | 6.22% |

| 3 | 0x8ebb...6c4c34 | 45823.83K | 3.79% |

| 4 | 0xa557...a556f9 | 30435.20K | 2.52% |

| 5 | 0x44fd...9d3219 | 29268.38K | 2.42% |

| - | Others | 866245.38K | 71.74% |

II. Core Factors Influencing GLMR's Future Price

Supply Mechanism

-

Block Reward Halving: Moonbeam's price dynamics are driven by supply and demand factors, with block reward halvings serving as a key supply-side mechanism that impacts token scarcity and investor expectations.

-

Historical Patterns: Historical evidence suggests that supply-side events such as block reward reductions have influenced GLMR price movements, establishing supply adjustments as a material factor in price discovery.

-

Current Impact: Upcoming protocol updates and supply adjustments are expected to continue influencing GLMR valuation as the network matures.

Institutional and Major Holder Dynamics

-

Enterprise Adoption: GLMR's price trajectory is influenced by the adoption of Moonbeam's cross-chain capabilities by enterprises and developers integrating the platform into their ecosystems.

-

Regulatory Environment: Real-world events, including regulatory developments and government adoption of blockchain technologies, have demonstrated the ability to materially impact GLMR pricing.

Technology Development and Ecosystem Building

-

Hard Forks and Protocol Updates: Hard forks and protocol updates represent significant technological developments that can influence market sentiment and GLMR price movements by enhancing network functionality and security.

-

Cross-Chain Interoperability: The adoption and implementation of Moonbeam's cross-chain capabilities serve as a key driver of ecosystem growth and platform utility, directly affecting investor confidence and price expectations.

-

Ecosystem Growth: The overall expansion of the Moonbeam ecosystem, including developer adoption and decentralized application proliferation, supports long-term price appreciation potential through increased platform utility and demand.

Three: 2025-2030 GLMR Price Forecast

2025 Outlook

- Conservative Forecast: $0.01314 - $0.02555

- Neutral Forecast: $0.02433

- Bullish Forecast: $0.02555 (requires sustained ecosystem development and market recovery)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental growth driven by protocol improvements and increasing adoption

- Price Range Forecast:

- 2026: $0.02220 - $0.03666

- 2027: $0.02341 - $0.03819

- 2028: $0.02484 - $0.03691

- Key Catalysts: Enhanced DeFi ecosystem integration, parachain optimization, institutional adoption initiatives, and broader market sentiment improvement

2029-2030 Long-term Outlook

- Base Case: $0.02642 - $0.04498 (assumes moderate ecosystem expansion and steady market conditions)

- Bullish Case: $0.0357 - $0.04498 (assumes accelerated adoption of Moonbeam's smart contract capabilities and significant developer growth)

- Transformational Case: $0.04034 - $0.04357 (assumes breakthrough interoperability solutions, major enterprise partnerships, and market capitalization expansion)

- 2025-12-20: GLMR remains in accumulation phase with 0% YoY change projected for current year

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02555 | 0.02433 | 0.01314 | 0 |

| 2026 | 0.03666 | 0.02494 | 0.0222 | 2 |

| 2027 | 0.03819 | 0.0308 | 0.02341 | 27 |

| 2028 | 0.03691 | 0.03449 | 0.02484 | 42 |

| 2029 | 0.04498 | 0.0357 | 0.02642 | 47 |

| 2030 | 0.04357 | 0.04034 | 0.02743 | 66 |

Moonbeam Network (GLMR) Professional Investment Analysis Report

I. Executive Summary

Moonbeam Network (GLMR) is an EVM-compatible blockchain operating as a parachain on the Polkadot network. As of December 20, 2025, GLMR is trading at $0.02425, representing a significant decline of 90.62% over the past year from its all-time high of $19.50 on January 11, 2022. With a market capitalization of approximately $25.09 million and a 24-hour trading volume of $131,980.58, GLMR ranks 773rd in market capitalization among digital assets.

II. Project Overview

Moonbeam Network Foundation

Moonbeam is an EVM-compatible blockchain that enables Ethereum-based applications to be deployed directly on the Polkadot ecosystem. The network operates as a parachain on Polkadot, providing developers with critical infrastructure including Solidity smart contract deployment, Web3-compatible APIs, oracle data integration, and Ethereum network bridges.

GLMR Token Utility

GLMR functions as both a utility and governance token with multiple use cases:

- Transaction Fees: Users can pay transaction fees and execute smart contracts using GLMR.

- Staking: Users can stake GLMR to become validators or participate as delegators, earning network rewards through consensus participation.

- Governance: GLMR token holders can nominate council members and participate in network-wide voting decisions.

- Liquidity Mining: Holders can provide liquidity to decentralized applications on the Moonbeam blockchain and earn transaction fee distributions.

Network Architecture

Polkadot Integration: Moonbeam represents the Polkadot ecosystem version of Moonriver (MOVR) from the Kusama testnet, demonstrating the project's commitment to cross-chain communication and operational interoperability.

Parachain Slot Acquisition: Moonbeam successfully won its parachain slot through the second slot auction via community crowdfunding, beginning December 17, 2021, for an initial 96-week period. The project raised approximately 36 million DOT tokens from approximately 200,000 contributors to secure this critical infrastructure position.

III. Market Performance Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.02425 |

| 24-Hour Change | +4.65% |

| 7-Day Change | -16.00% |

| 30-Day Change | -17.06% |

| Year-to-Date Change | -90.62% |

| 24-Hour High | $0.02443 |

| 24-Hour Low | $0.02271 |

| All-Time High | $19.50 (Jan 11, 2022) |

| All-Time Low | $0.02279482 (Dec 19, 2025) |

Supply Metrics

| Metric | Value |

|---|---|

| Circulating Supply | 1,034,736,550 GLMR |

| Total Supply | 1,207,851,242 GLMR |

| Maximum Supply | Unlimited |

| Circulation Ratio | 85.67% |

| Market Cap | $25,092,361.34 |

| Fully Diluted Valuation | $29,290,392.62 |

| Market Cap/FDV Ratio | 85.67% |

Network Adoption

- Total Token Holders: 1,800,433

- Trading Pairs Available: 27 exchanges

- Market Dominance: 0.00091%

IV. GLMR Professional Investment Strategy and Risk Management

GLMR Investment Methodology

(1) Long-Term Holding Strategy

-

Suitable For: Investors with strong conviction in Polkadot's cross-chain vision and Moonbeam's role in the ecosystem, particularly those comfortable with extended holding periods through volatility cycles.

-

Operational Recommendations:

- Establish a dollar-cost averaging (DCA) strategy to accumulate positions at varying price levels, mitigating timing risk during the current market downturn.

- Build positions during periods of network development milestones, parachain slot renewal negotiations, or ecosystem expansion announcements.

- Maintain a minimum 12-24 month holding horizon to capture potential network adoption and governance participation rewards.

-

Storage Solution: Utilize staking mechanisms within the Moonbeam ecosystem to earn passive rewards while maintaining network participation and governance rights. Alternatively, secure storage through institutional-grade custody solutions for larger positions.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the $0.022-$0.024 support zone established in recent trading, with resistance at $0.026-$0.030 levels. These price bands have defined recent volatility patterns.

- Volume Analysis: Track 24-hour volume against 90-day averages to identify potential breakout signals. Current volumes near $132,000 represent moderate liquidity conditions.

-

Wave Operation Key Points:

- Capitalize on the 24-hour positive momentum (+4.65%) against longer-term weakness to execute scalp trades within identified support/resistance bands.

- Recognize that the 7-day and 30-day declines (-16% and -17.06% respectively) suggest potential oversold conditions, creating intermediate trading opportunities.

- Monitor Polkadot network events and Moonbeam governance proposals as catalysts for short-term price movements.

GLMR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation. GLMR should represent a small speculative position given its high volatility and 90.62% year-over-year decline.

- Active Investors: 3-8% of portfolio allocation. Appropriate for investors with Polkadot ecosystem conviction and risk tolerance for high-volatility blockchain assets.

- Professional Investors: 8-15% of portfolio allocation within risk-adjusted diversification frameworks, potentially using GLMR as part of broader Polkadot ecosystem exposure strategies.

(2) Risk Hedging Strategies

- Staking Rewards Hedging: Lock a portion of holdings in network staking to generate stable reward streams, reducing net exposure to price volatility while maintaining governance participation.

- Parachain Slot Renewal Risk Management: Monitor upcoming parachain slot renewal cycles (subsequent renewal windows occur periodically). Hedge exposure before slot renewals through position sizing adjustments, as slot acquisition failures could materially impact network viability.

(3) Secure Storage Solutions

-

Hot Wallet Operations: For active trading and regular transactions, utilize Gate.com's Web3 wallet solution, which provides secure, user-controlled asset management with institutional-grade security protocols and seamless integration with the Moonbeam network.

-

Cold Storage Strategy: For long-term holdings exceeding 12 months, consider hardware-based security solutions with regular address verification and multi-signature confirmation protocols to eliminate exchange counterparty risk.

-

Security Considerations: Never store private keys on internet-connected devices. Enable all available security features including two-factor authentication on exchange accounts. Verify all wallet addresses independently before executing transfers. Exercise extreme caution with smart contract interactions, as Moonbeam's EVM compatibility means exposure to smart contract vulnerabilities is inherent.

V. GLMR Potential Risks and Challenges

GLMR Market Risks

-

Extreme Price Volatility: GLMR has declined 90.62% year-over-year, demonstrating severe price instability. The token reached an all-time low of $0.02279482 on December 19, 2025, just days before current analysis, indicating potential continued downside pressure and illiquidity during market stress events.

-

Liquidity Constraints: With $131,980.58 in 24-hour trading volume against a $25.09 million market capitalization, significant order execution challenges exist. Large position acquisitions or liquidations could face substantial slippage, making price discovery difficult during volatile trading sessions.

-

Market Sentiment Deterioration: The 16% decline over seven days and 17.06% decline over 30 days suggest negative momentum. Social sentiment indicators and developer activity metrics should be monitored for signs of ecosystem disengagement or user migration to competing Polkadot parachains.

GLMR Regulatory Risks

-

Parachain Slot Renewal Uncertainty: Moonbeam's continued operation depends on successfully renewing parachain slots on the Polkadot network through competitive auctions. Regulatory changes affecting Polkadot governance or slot allocation mechanisms could jeopardize Moonbeam's network positioning and economic viability.

-

Cryptocurrency Regulatory Frameworks: Evolving global regulatory environments targeting staking mechanisms, smart contract operations, and blockchain networks could restrict GLMR utility, particularly in jurisdictions implementing comprehensive digital asset regulation.

-

Cross-Chain Bridge Regulation: Moonbeam's Ethereum network bridge functionality faces potential regulatory scrutiny, particularly regarding cross-chain asset transfer compliance and anti-money laundering obligations that could necessitate operational restrictions or functionality limitations.

GLMR Technical Risks

-

Polkadot Ecosystem Dependency: Moonbeam's operational viability is entirely dependent on Polkadot's network stability and security. Technical failures, consensus mechanism vulnerabilities, or governance deadlock within Polkadot could directly compromise Moonbeam's functionality and economic value proposition.

-

EVM Compatibility Limitations: While EVM compatibility enables Ethereum application porting, technical limitations in replicating all Ethereum functionality could create developer friction and limit ecosystem expansion. Layer-2 scaling solutions and alternative blockchain platforms with superior performance characteristics pose ongoing competitive threats.

-

Smart Contract Security Vulnerabilities: Moonbeam's functionality relies on third-party smart contract deployments. Exploitation of smart contract vulnerabilities, particularly within decentralized finance protocols built on Moonbeam, could trigger cascading system failures and loss of user confidence, accelerating network abandonment.

VI. Conclusion and Action Recommendations

GLMR Investment Value Assessment

Moonbeam Network represents a specialized blockchain infrastructure play within the Polkadot ecosystem, offering EVM compatibility and cross-chain interoperability benefits. However, the project faces significant headwinds: a 90.62% year-over-year price decline, extremely tight liquidity conditions, and fundamental questions regarding Polkadot's competitive positioning in an increasingly crowded multi-chain landscape. GLMR's long-term value proposition remains contingent on Moonbeam's successful ecosystem development, parachain slot renewals, and sustained developer adoption. Current pricing reflects substantial pessimism, potentially creating accumulation opportunities for risk-tolerant investors with strong Polkadot ecosystem conviction. Short-term price stability remains unlikely, and significant additional downside cannot be excluded if ecosystem degradation continues.

GLMR Investment Recommendations

✅ Beginners: Avoid direct GLMR exposure. Instead, gain Polkadot ecosystem exposure through larger-cap, more established assets with superior liquidity and demonstrated track records. If interested in Moonbeam specifically, limit exposure to 1-2% of portfolio as a purely speculative position and maintain multi-year holding expectations.

✅ Experienced Investors: Consider selective accumulation during pronounced weakness using dollar-cost averaging strategies over extended periods. Position sizing should reflect 3-5% of portfolio allocations at maximum. Implement strict stop-loss discipline at 25-30% below entry points. Monitor ecosystem development metrics, developer activity levels, and parachain performance indicators as leading indicators for potential recovery.

✅ Institutional Investors: Evaluate GLMR as part of comprehensive Polkadot ecosystem positioning strategies, weighing Moonbeam's interoperability benefits against concentrated parachain risk. Consider risk-weighted allocations of 5-10% within digital asset portfolios. Implement sophisticated hedging strategies using Polkadot correlation analysis and cross-chain liquidity monitoring. Engage directly with Moonbeam governance to influence developmental priorities and ecosystem expansion decisions.

GLMR Trading Participation Methods

-

Gate.com Exchange Trading: Execute spot market purchases, sales, and margin trading of GLMR with institutional-grade security, competitive fee structures, and access to 27 distinct trading pairs. Gate.com provides 24/7 market access and advanced order types including stop-loss and limit orders essential for risk management.

-

Staking and Yield Generation: Participate in network staking protocols to earn passive income streams denominated in GLMR, reducing net exposure to price fluctuations while maintaining governance participation rights and network validation support.

-

Ecosystem Protocol Participation: Engage with decentralized applications built on Moonbeam to generate yield through liquidity provision, yield farming, and governance token acquisition, creating multi-dimensional return exposure beyond simple price speculation.

Cryptocurrency investment carries extreme risk. This analysis does not constitute investment advice. Investors must make independent decisions aligned with personal risk tolerance and financial circumstances. Strongly recommend consulting qualified financial advisors before committing capital. Never invest funds you cannot afford to lose completely. Historical performance does not guarantee future results. Market conditions change rapidly and can result in substantial capital losses.

FAQ

Does Moonbeam have a future?

Yes, Moonbeam has a promising future. As a leading Polkadot parachain enabling Ethereum compatibility, it continues expanding its ecosystem and developer adoption. Market forecasts suggest positive growth potential for GLMR, with increasing institutional interest and technological advancements driving long-term value.

Is Moonbeam crypto a good investment?

Yes, Moonbeam's robust fundamentals and practical use cases make it a compelling long-term investment. With strong developer ecosystem and Polkadot interoperability, GLMR shows significant growth potential in the Web3 space.

What will Beam be worth in 2030?

Based on market analysis, Beam (BEAM) is projected to trade between $0.25 and $0.35 in 2030, with an average price around $0.30. However, cryptocurrency prices are highly volatile and influenced by numerous factors including market conditions, adoption rates, and regulatory developments.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

What Is EVAA Cryptocurrency Compliance Risk and How Will SEC Regulations Impact 80% of Crypto by 2030?

CATI vs CHZ: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Digital Economy

How to Analyze On-Chain Data: Active Addresses, Transaction Volume, and Whale Movements in Crypto Markets

Understanding the Core Factors Influencing Cryptocurrency Value

What Do Futures Open Interest, Funding Rates, and Liquidation Data Reveal About Crypto Derivatives Market Signals?