2025 GOATED Price Prediction: Expert Analysis and Market Outlook for the Next Bull Run

Introduction: Market Position and Investment Value of GOATED

GOATED (GOAT), a Bitcoin-native ZK Rollup engineered to deliver sustainable native BTC yield, represents an innovative approach to Bitcoin layer-2 scaling. As of December 24, 2025, GOATED has established a market presence with a fully diluted valuation of approximately $40.73 million and a circulating supply of roughly 113.98 million tokens. The token is currently trading at $0.04073, reflecting its positioning within the emerging BTCFi infrastructure ecosystem.

GOAT Network distinguishes itself through proprietary technology including its production-ready zkMIPS virtual machine, the practical BitVM2 challenge model that dramatically reduces challenge periods from 14 days to less than 1 day, and Bitcoin's first decentralized sequencer network. The protocol's comprehensive BTCFi product suite—spanning yield generation (2%–30%+ APY), trading, and gaming—addresses authentic demand from BTC holders seeking transparent, risk-adjusted returns generated trustlessly from gas fees, MEV, and miner rewards.

This comprehensive analysis will examine GOATED's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development roadmap, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

GOAT Network (GOATED) Market Analysis Report

I. GOATED Price History Review and Current Market Status

GOATED Historical Price Evolution

- September 27, 2025: Project launch and initial trading phase, price reached all-time high of $0.22367

- September 27, 2025: All-time low established at $0.01251 on the same date as ATH, reflecting initial market volatility

- December 24, 2025: Significant downtrend from peak, price declined to $0.04073, representing a 81.78% decrease from all-time high

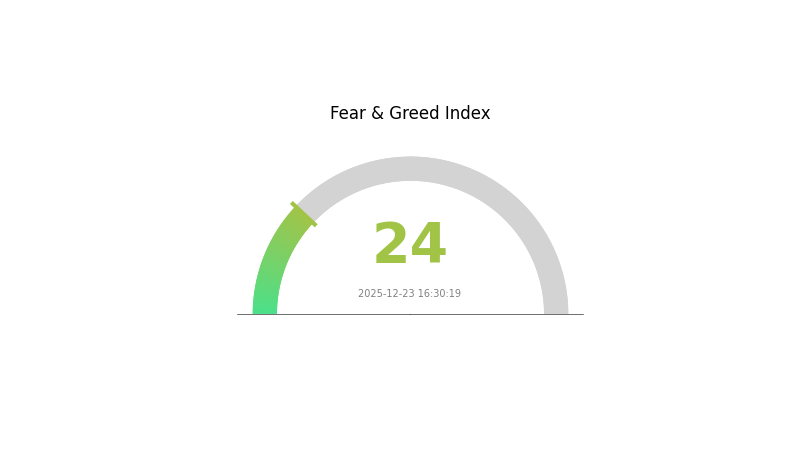

GOATED Current Market Sentiment

As of December 24, 2025, GOATED is trading at $0.04073 with a market capitalization of $40.73 million and a fully diluted valuation matching this figure. The 24-hour trading volume stands at $13,472.33, indicating moderate liquidity conditions.

Recent Price Performance:

- 1-hour change: -0.37%

- 24-hour change: -1%

- 7-day change: -15.45%

- 30-day change: -49.83%

- 1-year change: -60.13%

The token displays a bearish trend across all timeframes, with the most significant pressure occurring over the past 30 days. Current market sentiment indicates extreme fear, with a VIX reading of 24. Trading activity shows $0.0402–$0.04315 range within the latest 24-hour period.

The project maintains a market rank of 1,577 with a circulating supply of 113,984,977.534705 GOATED out of a total supply of 1 billion tokens. Token availability across 8 cryptocurrency exchanges provides multiple trading venues for participants.

Click to view current GOATED market price

GOATED Market Sentiment Index

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear as of December 23rd, with the Fear & Greed Index plummeting to 24. This reading signals significant market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often presents contrarian opportunities for strategic investors. Market downturns typically create oversold conditions, making it an ideal time to research quality projects and consider accumulating positions on Gate.com. However, proceed with caution and maintain disciplined risk management. Historical data shows that extreme fear often precedes market recoveries, rewarding patient investors who navigate volatility wisely.

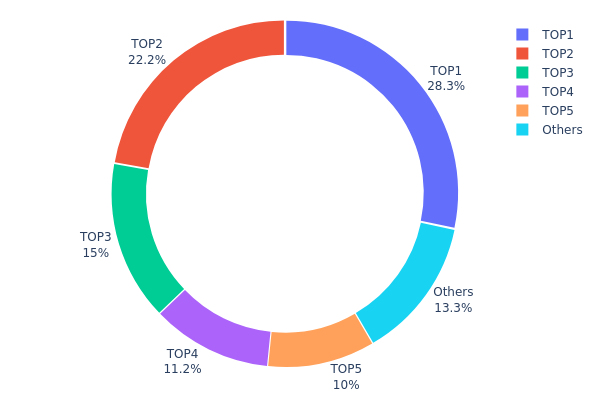

GOATED Holdings Distribution

The holdings distribution chart presents a snapshot of token concentration across blockchain addresses, revealing the allocation pattern of GOATED tokens among top holders. This metric serves as a critical indicator for assessing the decentralization level, market structure stability, and potential risks associated with token concentration.

Analysis of the current data reveals a pronounced concentration pattern in GOATED's holder landscape. The top five addresses collectively control 86.71% of the circulating supply, with the leading address (0x1372...7ecd0e) commanding 28.30% of total holdings. This concentration level indicates moderate to elevated centralization risk. The second-largest holder maintains 22.20% of the supply, while the remaining three addresses in the top five each hold between 10-15%. The distribution demonstrates a clear power-law structure where wealth accumulation is significantly skewed toward major stakeholders, leaving only 13.29% of tokens dispersed among remaining addresses.

The current address distribution structure presents meaningful implications for market dynamics and stability. With such substantial concentration among top holders, GOATED exhibits vulnerability to coordinated actions that could materially influence price movements and liquidity conditions. The top holder's 28.30% stake represents a potential single point of leverage that could trigger significant volatility during major holder transactions. However, the distribution among five independent addresses, rather than a single entity, provides some structural fragmentation that may mitigate extreme manipulation scenarios. The remaining 13.29% in other addresses suggests limited organic distribution among retail participants, which could constrain network effects and long-term decentralization growth.

Click to view current GOATED Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1372...7ecd0e | 2125.00K | 28.30% |

| 2 | 0xcd92...07a7e4 | 1666.99K | 22.20% |

| 3 | 0x0d07...b492fe | 1122.46K | 14.95% |

| 4 | 0xcffa...290703 | 844.64K | 11.24% |

| 5 | 0x9642...2f5d4e | 752.86K | 10.02% |

| - | Others | 995.94K | 13.29% |

II. Core Factors Affecting GOATED's Future Price

Supply Mechanism

-

Airdrop Distribution Model: GOATED tokens are distributed through an airdrop mechanism where allocation shares are directly linked to the impact and influence of quality content dissemination. Users who generate engaging content can qualify for a share of the 1% airdrop pool, with higher rankings receiving larger token allocations.

-

Current Impact: The content-driven airdrop model creates ongoing demand pressures as participants compete for airdrops based on content virality and influence, which may affect token circulation and market dynamics as distribution events occur.

Regulatory Uncertainty

-

Market Risks: Blockchain startup token investments inherently carry risks related to regulatory uncertainty and how token issuance may impact token pricing. The evolving regulatory landscape for cryptocurrencies could affect GOATED's market performance and adoption.

-

Potential Challenges: Questions remain regarding market liquidity sufficiency, sustained user retention, and whether GOATED can establish itself as a meaningful component of financial markets beyond short-term trends.

III. GOATED Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.02432 - $0.03243

- Neutral Forecast: $0.03243 - $0.04053

- Optimistic Forecast: $0.04053 - $0.05066 (requires sustained market sentiment and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with potential for incremental growth as market confidence strengthens

- Price Range Forecast:

- 2026: $0.03329 - $0.06064

- 2027: $0.04515 - $0.07649

- 2028: $0.03953 - $0.09073

- Key Catalysts: Expansion of ecosystem partnerships, increased institutional interest, regulatory clarity, and improvements in market infrastructure and liquidity

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04899 - $0.1151 (assumes steady market development and moderate adoption growth)

- Optimistic Scenario: $0.06557 - $0.1244 (assumes accelerated protocol development and significant community expansion)

- Transformational Scenario: $0.1244+ (requires breakthrough technological innovations, major exchange listings on platforms like Gate.com, and mainstream market integration)

- 2025-12-24: GOATED trading at baseline levels with moderate market volatility observed

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05066 | 0.04053 | 0.02432 | 0 |

| 2026 | 0.06064 | 0.0456 | 0.03329 | 11 |

| 2027 | 0.07649 | 0.05312 | 0.04515 | 30 |

| 2028 | 0.09073 | 0.06481 | 0.03953 | 59 |

| 2029 | 0.1151 | 0.07777 | 0.04899 | 90 |

| 2030 | 0.1244 | 0.09643 | 0.06557 | 136 |

GOAT Network (GOATED) Investment Strategy and Risk Management Report

IV. GOATED Professional Investment Strategy and Risk Management

GOATED Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: BTC holders seeking sustainable yield; investors with high risk tolerance for emerging Layer 2 infrastructure; institutions pursuing diversified blockchain exposure

- Operation Recommendations:

- Accumulate GOATED during market downturns when valuations are depressed, particularly given the -49.83% 30-day decline

- Hold positions for 12-24 months to capture potential infrastructure adoption gains as the zkMIPS technology matures and user base expands

- Reinvest yield generated from BTCFi products back into GOATED for compound growth

- Storage Solution: Utilize Gate.com Web3 Wallet for secure self-custody while maintaining flexibility to interact with GOAT Network's DeFi protocols

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current price of $0.04073 trades between 24-hour lows of $0.0402 and highs of $0.04315; monitor all-time high of $0.22367 as potential resistance target

- Volume Analysis: Monitor 24-hour trading volume of $13,472.33 relative to daily price movements to identify breakout opportunities and validate trend reversals

- Wave Trading Key Points:

- Execute buy orders during significant pullbacks (>10% daily declines) when technical indicators show oversold conditions

- Take profit targets at intermediate resistance levels, with initial exit at $0.06-0.08 range based on historical price action

GOATED Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum; focus on long-term holding only

- Aggressive Investors: 3-5% portfolio allocation; combine core positions with tactical trading around identified support/resistance

- Professional Investors: 5-8% portfolio allocation; implement hedging strategies and dynamic rebalancing based on on-chain metrics

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Deploy capital in equal installments monthly over 6-12 months to mitigate timing risk and reduce average entry price exposure

- Position Sizing: Limit individual trade sizes to 2-3% of total portfolio to prevent catastrophic drawdown scenarios during volatility spikes

(3) Secure Storage Solutions

- Hot Wallet: Gate.com Web3 Wallet recommended for frequent protocol interactions; enables seamless participation in GOAT Network's BTCFi ecosystem while maintaining non-custodial control

- Cold Storage Strategy: Transfer majority holdings (70-80%) to secure offline storage for extended holding periods; maintain only active trading amounts in web wallets

- Security Considerations: Enable multi-factor authentication on all exchange accounts; never share private keys or seed phrases; verify contract addresses independently before token interactions; monitor smart contract risks given the emerging nature of zkMIPS technology

V. GOATED Potential Risks and Challenges

GOATED Market Risk

- Extreme Volatility: GOATED has declined -60.13% over 1 year with -49.83% monthly loss, indicating severe price instability and significant drawdown potential for new entrants

- Low Liquidity: Trading volume of only $13,472.33 in 24 hours creates slippage risk for larger positions; exit liquidity may be constrained during market stress

- Early-Stage Project Risk: With market cap of only $40.73 million and fully diluted valuation suggesting limited institutional adoption, GOATED remains highly speculative with uncertain market-product fit

GOATED Regulatory Risk

- Regulatory Uncertainty: Bitcoin L2 protocols and yield-bearing mechanisms face evolving regulatory scrutiny; jurisdiction-specific securities classification could impact token utility and trading access

- Compliance Evolution: BitVM2 and decentralized sequencer models may trigger regulatory challenges regarding market manipulation, custody standards, or money transmission rules

- Geographic Restrictions: Potential delisting from major markets or regional trading restrictions could severely limit liquidity and investment accessibility

GOATED Technology Risk

- zkMIPS Production Readiness: While claimed as "fastest production-ready zkVM," the technology remains nascent; potential security vulnerabilities or performance degradation could undermine the entire value proposition

- Challenge Model Execution: The BitVM2 challenge mechanism reducing proving time from 14 days to <1 day is unproven at scale; implementation failures could delay withdrawals and compromise user trust

- Sequencer Decentralization Risk: The decentralized sequencer network is an emerging design; MEV extraction, validator consensus failures, or centralization drift could compromise the protocol's trustless claims

VI. Conclusion and Action Recommendations

GOATED Investment Value Assessment

GOATED Network presents a high-risk, high-reward opportunity centered on Bitcoin-native yield infrastructure. The project addresses genuine market demand from BTC holders seeking sustainable returns through technical innovations (zkMIPS, BitVM2, decentralized sequencers) and a comprehensive BTCFi suite. However, the extreme recent price decline (-60% annually, -49.83% monthly) reflects severe market skepticism regarding execution capability, regulatory viability, and competitive positioning.

The $40.73 million market cap and minimal trading volume indicate low institutional confidence and potential liquidity constraints. Success depends critically on:

- Successful production deployment of zkMIPS technology

- User adoption of the BTCFi product suite

- Regulatory clarity for yield-bearing Bitcoin protocols

- Market recovery sentiment for emerging Layer 2 solutions

Investment should be treated as early-stage venture participation, appropriate only for risk-tolerant portfolio allocations.

GOATED Investment Recommendations

✅ Beginners: Allocate maximum 1% to long-term GOAT positions; prioritize education on zkMIPS and BitVM2 mechanics; avoid leverage and daily trading; store securely in Gate.com Web3 Wallet

✅ Experienced Investors: Implement 2-4% core position with monthly DCA strategy; supplement with tactical trading around identified support levels ($0.02-0.03 range); actively monitor technical developments and team execution milestones

✅ Institutional Investors: Conduct thorough legal review of yield mechanics and regulatory exposure; establish 3-8% positions with rigorous risk controls; engage directly with team on protocol roadmap and security audits; implement sophisticated hedging against technology and regulatory risks

GOATED Trading Participation Methods

- Gate.com Trading: Direct spot trading pairs available; leverage Gate.com's institutional-grade trading infrastructure for GOATED purchases; utilize Gate.com's research and analysis tools for informed decision-making

- Strategic Accumulation: Execute disciplined DCA programs during extended downturns to optimize long-term entry points

- BTCFi Protocol Participation: Once comfortable with underlying technology, deposit GOATED into GOAT Network's earning, trading, and gaming products (2%-30%+ APY range) for active yield generation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. Consult qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Can goat coin reach $1?

GOAT has demonstrated strong momentum, reaching $0.85 at its peak. With sustained market interest and trading volume, reaching $1 is achievable in the near term, though market conditions remain a key factor in its trajectory.

What is the price prediction for goated token?

Based on current market analysis, GOAT token price is predicted to trade between $0.056880 and $0.055839 in the near term, with potential upside driven by growing trading volume and market adoption.

Is goat crypto a good investment?

GOAT shows strong potential as an AI-guided token with innovative tokenomics and growing community support. With bullish price predictions and increasing adoption, GOAT presents compelling opportunities for investors seeking exposure to emerging AI-driven crypto projects.

GOATED vs QNT: A Comprehensive Comparison of Two Leading Blockchain Infrastructure Tokens

Viction's Whitepaper Logic: Driving 75.6% Growth with Zero-Gas Innovations in 2025

GOAT Network (GOATED): Bitcoin ZK-Rollup With Native Yield

What is LA: The Ultimate Guide to Los Angeles' Culture and Attractions

What Makes GOAT Network GOATED

2025 MERL Price Prediction: Strategic Analysis and Market Outlook for Mitsubishi Electric Research Laboratories

P2P | End of Cash Zone Option in April 2025: What You Need to Know

Guide for Beginners: How to Easily Purchase Bitcoin (BTC)

Ethereum Surges Past 4,300 USDT Amidst Impressive Daily Growth

Security Issues Highlighted in Cryptocurrency Hardware Wallets After Multi-Million Dollar Theft

How to Use the Phantom Digital Wallet Effectively