2025 GRASS Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: GRASS's Market Position and Investment Value

Grass (GRASS), as a network for sharing unused internet bandwidth, has achieved significant growth since its inception. As of 2025, GRASS's market capitalization has reached $136,562,356, with a circulating supply of approximately 313,360,158 tokens, and a price hovering around $0.4358. This asset, often referred to as the "internet bandwidth sharing token," is playing an increasingly crucial role in the field of decentralized internet resource utilization.

This article will comprehensively analyze GRASS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GRASS Price History Review and Current Market Status

GRASS Historical Price Evolution

- 2024: Project launch, price peaked at $3.9691 on November 8

- 2025: Market correction, price dropped to all-time low of $0.1698 on October 10

GRASS Current Market Situation

As of October 20, 2025, GRASS is trading at $0.4358, with a 24-hour trading volume of $732,922. The token has experienced a slight decline of 1.22% in the past 24 hours. GRASS currently ranks 349th in the cryptocurrency market with a market capitalization of $136,562,356.

The token's price has seen significant volatility in recent periods. Over the past week, GRASS has declined by 18.47%, and over the past month, it has dropped by 50.71%. This indicates a bearish trend in the short to medium term.

GRASS's current price is considerably lower than its all-time high of $3.9691, reached on November 8, 2024. However, it has shown some recovery from its all-time low of $0.1698, recorded on October 10, 2025.

The circulating supply of GRASS stands at 313,360,158 tokens, which represents 31.34% of the total supply of 1,000,000,000 GRASS tokens. The fully diluted market capitalization is $435,800,000.

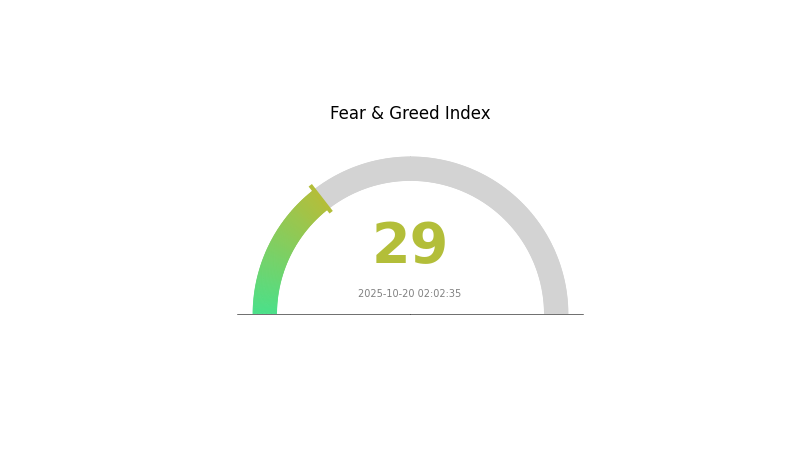

The overall cryptocurrency market sentiment, as indicated by the VIX index of 29, suggests a state of fear among investors, which may be influencing GRASS's price performance.

Click to view the current GRASS market price

GRASS Market Sentiment Indicator

2025-10-20 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently gripped by fear, with the Fear and Greed Index standing at 29. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Investors should conduct thorough research, diversify their portfolios, and consider using risk management tools available on platforms like Gate.com to navigate these uncertain times effectively.

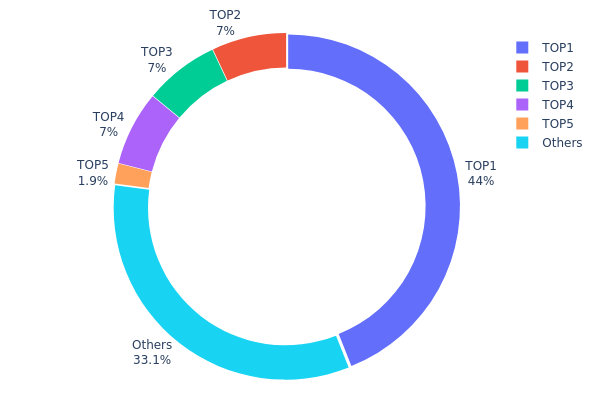

GRASS Holdings Distribution

The address holdings distribution chart for GRASS reveals a highly concentrated ownership structure. The top address holds a significant 44% of the total supply, while the next three largest holders each control 7%, collectively accounting for 65% of all GRASS tokens. This concentration is further emphasized by the fact that the top 5 addresses hold nearly 67% of the supply, leaving only about 33% distributed among other holders.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With a small number of addresses controlling the majority of tokens, there's an increased risk of large sell-offs or coordinated actions that could significantly impact GRASS's market price. This level of centralization also suggests a lower degree of decentralization within the GRASS ecosystem, potentially conflicting with blockchain principles of distributed ownership and control.

The current distribution structure indicates a relatively immature market for GRASS, with limited circulation among a broader base of users or investors. This could lead to higher volatility and lower liquidity in the short term, as large holders have the potential to sway market dynamics substantially.

Click to view the current GRASS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 31rYar...8tLGqQ | 440017.61K | 44.00% |

| 2 | CMLjq7...Cqe8iP | 70000.00K | 7.00% |

| 3 | 8XWdMc...5gMUiX | 70000.00K | 7.00% |

| 4 | iauGQj...Mzmxjt | 70000.00K | 7.00% |

| 5 | 2Exsx4...6zko9T | 19000.00K | 1.90% |

| - | Others | 330976.94K | 33.1% |

II. Key Factors Affecting GRASS's Future Price

Supply Mechanism

- Fixed Supply: GRASS has a fixed total supply, which can create scarcity and potentially drive up prices as demand increases.

- Historical Pattern: Limited supply has historically led to price increases in similar cryptocurrencies when demand rises.

- Current Impact: The fixed supply may contribute to price stability or appreciation if adoption and usage of GRASS continue to grow.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, GRASS may be viewed as a potential hedge against inflation, similar to other digital assets.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could increase interest in alternative assets like GRASS.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and projects within the GRASS ecosystem could enhance its utility and drive demand.

III. GRASS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.22 - $0.33

- Neutral prediction: $0.33 - $0.43

- Optimistic prediction: $0.43 - $0.61 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth and stabilization

- Price range forecast:

- 2026: $0.36 - $0.55

- 2027: $0.47 - $0.65

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.59 - $0.76 (assuming steady market growth)

- Optimistic scenario: $0.76 - $0.88 (assuming strong market performance)

- Transformative scenario: $0.88 - $1.09 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: GRASS $1.09 (potential peak under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.61109 | 0.4334 | 0.22103 | 0 |

| 2026 | 0.55358 | 0.52225 | 0.36557 | 19 |

| 2027 | 0.65626 | 0.53791 | 0.47874 | 23 |

| 2028 | 0.69859 | 0.59708 | 0.36422 | 37 |

| 2029 | 0.88106 | 0.64784 | 0.35631 | 48 |

| 2030 | 1.09316 | 0.76445 | 0.40516 | 75 |

IV. Professional Investment Strategies and Risk Management for GRASS

GRASS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate GRASS tokens during market dips

- Set price targets and regularly review portfolio

- Store tokens in secure wallets, preferably hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Grass network

- Set stop-loss orders to limit potential losses

GRASS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GRASS with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet option: Official Grass wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for GRASS

GRASS Market Risks

- High volatility: GRASS price may experience significant fluctuations

- Competition: Other bandwidth-sharing networks may emerge

- User adoption: Growth of the Grass network may slow down

GRASS Regulatory Risks

- Regulatory uncertainty: Potential changes in cryptocurrency regulations

- Cross-border operations: Varying legal status in different jurisdictions

- Data privacy concerns: Regulatory scrutiny on bandwidth sharing practices

GRASS Technical Risks

- Network security: Potential vulnerabilities in the Grass network

- Scalability issues: Challenges in handling increased user base

- Smart contract risks: Potential bugs or exploits in the token contract

VI. Conclusion and Action Recommendations

GRASS Investment Value Assessment

GRASS presents a unique value proposition in the bandwidth-sharing market, with potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties.

GRASS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the project ✅ Experienced investors: Consider a balanced approach with regular portfolio rebalancing ✅ Institutional investors: Conduct thorough due diligence and consider GRASS as part of a diversified crypto portfolio

GRASS Trading Participation Methods

- Spot trading: Buy and sell GRASS tokens on Gate.com

- Staking: Participate in staking programs if available

- Network participation: Consider sharing bandwidth through the Grass network to earn GRASS tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will grass tokens be worth?

GRASS tokens are projected to reach $0.15-$0.20 by late 2025, driven by increased adoption and ecosystem growth.

Is grass crypto good?

Yes, GRASS crypto shows potential. It's gaining traction in the Web3 ecosystem, with increasing adoption and a strong development team backing it.

Can GRT reach $10?

Yes, GRT could potentially reach $10 by 2025, given its strong fundamentals and growing adoption in the Web3 ecosystem. However, this would require significant market growth and continued development of The Graph protocol.

How much is the grass coin worth?

As of October 2025, the GRASS coin is valued at approximately $0.75, showing a steady increase from its previous price points.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

What is LANDSHARE: A Revolutionary Platform for Sustainable Agriculture and Community Land Access

What is SPEC: A Comprehensive Guide to Standard Performance Evaluation Corporation and Its Role in Computer Benchmarking

What is 1DOLLAR: A Comprehensive Guide to Understanding Its Value and Usage in the Digital Economy

Comprehensive Guide to Harmonic Patterns for Trading

Ultimate Guide to Dogelon Mars Trading