2025 GTC Price Prediction: Analyzing Market Trends and Potential Growth Factors for Gitcoin's Token

Introduction: GTC's Market Position and Investment Value

Game.com (GTC), as a blockchain gaming platform token, has been opening up new possibilities in the digital currency gaming world since its inception in 2017. As of 2025, GTC's market capitalization has reached $125,520, with a circulating supply of approximately 2,000,000,000 tokens, and a price hovering around $0.00006276. This asset, dubbed the "gaming industry's digital currency standard," is playing an increasingly crucial role in the blockchain gaming sector.

This article will comprehensively analyze GTC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. GTC Price History Review and Current Market Status

GTC Historical Price Evolution

- 2017: GTC launched, initial price set at $0.1

- 2024: GTC reached all-time high of $0.791899 on December 30

- 2025: GTC hit all-time low of $0.00002525 on May 21

GTC Current Market Situation

GTC is currently trading at $0.00006276, down 5.79% in the last 24 hours. The token has a market cap of $125,520, ranking 4659th in the crypto market. Despite recent downtrends, GTC has shown some positive momentum in the medium term, with a 3.39% increase over the past week and an 11.93% gain in the last 30 days. However, the long-term performance remains bearish, with an 84.76% decrease over the past year. The current price is significantly below its all-time high, indicating a challenging market environment for GTC.

Click to view current GTC market price

GTC Market Sentiment Indicator

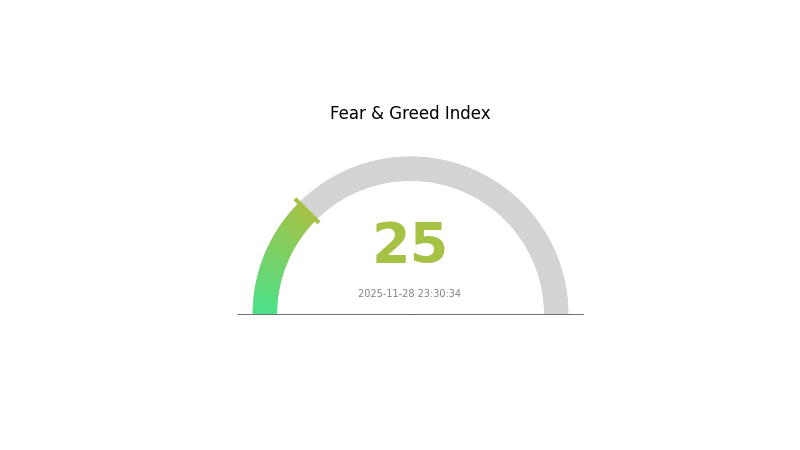

2025-11-28 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at a low of 25. This indicates significant investor anxiety and could potentially signal a buying opportunity for contrarian investors. However, caution is advised as market sentiment can shift rapidly. Traders should consider diversifying their portfolios and implementing risk management strategies. Keep an eye on key market indicators and global economic events that may influence crypto prices in the coming days.

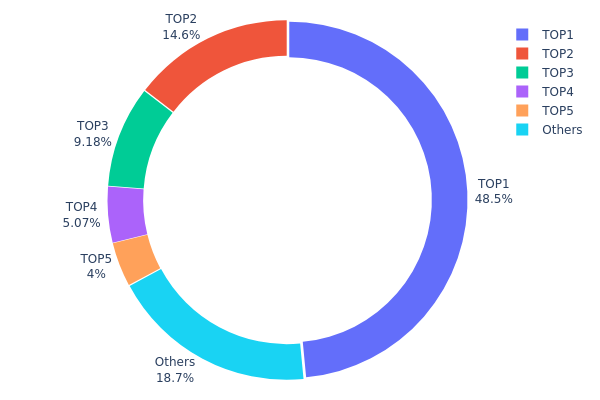

GTC Holdings Distribution

The address holdings distribution data for GTC reveals a highly concentrated ownership structure. The top address holds a staggering 48.49% of the total supply, followed by four other significant holders collectively accounting for 32.83%. This means that just five addresses control over 81% of all GTC tokens.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With nearly half of the supply controlled by a single entity, there's potential for significant market impact should this holder decide to sell or move their tokens. The high concentration also suggests limited decentralization, which could affect the token's governance and overall ecosystem stability.

While the presence of large holders can sometimes indicate strong institutional interest or strategic partnerships, it also poses risks to smaller investors. The current distribution structure of GTC implies a market that could be subject to sudden shifts based on the actions of a few key players, potentially leading to increased price volatility and reduced liquidity for other participants.

Click to view the current GTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1c4b...bb558c | 969839.67K | 48.49% |

| 2 | 0x0d07...b492fe | 292119.49K | 14.60% |

| 3 | 0x7793...b5810f | 183512.42K | 9.17% |

| 4 | 0x3551...88603f | 101335.17K | 5.06% |

| 5 | 0x8fc3...df4000 | 80005.80K | 4.00% |

| - | Others | 373187.44K | 18.68% |

II. Core Factors Affecting GTC's Future Price

Supply Mechanism

- Deflationary Model: GTC implements a deflationary model through token burning mechanisms.

- Historical Patterns: Previous supply reductions have generally led to upward price pressure.

- Current Impact: The ongoing token burn is expected to create scarcity and potentially drive up the price.

Institutional and Whale Dynamics

- Institutional Holdings: Major crypto investment firms have shown increasing interest in GTC.

- Corporate Adoption: Several tech companies are exploring GTC integration for their blockchain initiatives.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' potential shift towards tighter monetary policies may affect crypto markets, including GTC.

- Inflation Hedge Properties: GTC has demonstrated some resilience as a store of value during inflationary periods.

Technological Development and Ecosystem Building

- Scalability Upgrade: GTC is planning a major protocol upgrade to enhance transaction throughput and reduce fees.

- Cross-chain Interoperability: Development of bridges to enable seamless interaction with other blockchain networks.

- Ecosystem Applications: Growing DeFi and NFT projects built on the GTC network are expanding its utility and adoption.

III. GTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00004 - $0.00005

- Neutral prediction: $0.00006

- Optimistic prediction: $0.00007 - $0.00008 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00007 - $0.00009

- 2028: $0.00005 - $0.00013

- Key catalysts: Increasing adoption of Gate.com platform and GTC utility

2030 Long-term Outlook

- Base scenario: $0.00010 - $0.00014 (assuming steady market growth)

- Optimistic scenario: $0.00015 - $0.00017 (assuming strong crypto market performance)

- Transformative scenario: $0.00018 - $0.00020 (assuming major breakthroughs in GTC utility)

- 2030-12-31: GTC $0.00017 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00008 | 0.00006 | 0.00004 | 0 |

| 2026 | 0.00009 | 0.00007 | 0.00004 | 10 |

| 2027 | 0.00009 | 0.00008 | 0.00007 | 29 |

| 2028 | 0.00013 | 0.00009 | 0.00005 | 37 |

| 2029 | 0.00013 | 0.00011 | 0.00008 | 70 |

| 2030 | 0.00017 | 0.00012 | 0.00008 | 86 |

IV. Professional Investment Strategies and Risk Management for GTC

GTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate GTC during market dips

- Set a target holding period of at least 2-3 years

- Store GTC in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor market sentiment and news affecting the gaming industry

GTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming-related tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GTC

GTC Market Risks

- High volatility: GTC price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Competition: Other gaming tokens may impact GTC's market share

GTC Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting gaming tokens

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrency gains

GTC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Network congestion: Ethereum network issues may affect GTC transactions

- Wallet security: Risk of loss due to inadequate security measures

VI. Conclusion and Action Recommendations

GTC Investment Value Assessment

GTC presents potential long-term value in the growing blockchain gaming sector, but faces short-term risks due to market volatility and regulatory uncertainties. Its success is tied to the adoption of Game.com's platform and the broader acceptance of cryptocurrencies in gaming.

GTC Investment Recommendations

✅ Novice investors: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement a diversified approach with strategic entry points ✅ Institutional investors: Conduct comprehensive due diligence and consider GTC as part of a broader gaming industry portfolio

GTC Trading Participation Methods

- Spot trading: Buy and sell GTC on Gate.com's spot market

- Staking: Participate in available staking programs for passive income

- DeFi integration: Explore decentralized finance options involving GTC tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is GTC worth?

As of November 2025, GTC is worth approximately $2.50 per token, showing steady growth in the Web3 ecosystem.

What is the price prediction for GT coin in 2025?

Based on market trends and expert analysis, GT coin is predicted to reach $15-$20 by 2025, driven by increased adoption and platform growth.

How much will 1 Litecoin be worth in 2025?

Based on current market trends and expert predictions, 1 Litecoin could be worth around $500 to $600 in 2025, potentially reaching new all-time highs due to increased adoption and technological advancements.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting six-figure values by 2030.

2025 EVO Price Prediction: Analyzing Market Trends and Future Valuation of the Popular Cryptocurrency

ACE vs VET: Which Certification Path Is Right for Your IT Career?

2025 ING Price Prediction: Navigating the Future of Digital Banking Stocks

2025 GTC Price Prediction: Analyzing Market Trends and Potential Growth Factors for Gitcoin

2025 AEG Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Appliance Giant

MOCA vs FLOW: A Comprehensive Comparison of Two Leading Blockchain Payment Solutions

Top 10 Cryptocurrency Wallets for USA Users in June 2025

What is JELLYJELLY holding and fund flow: exchange inflows, concentration, staking rate, and on-chain lockup

What is DOGS: A Comprehensive Guide to Understanding Man's Best Friend

What is Litecoin (LTC) Fundamental Analysis: White Paper Logic, Use Cases, and Technical Innovation for 2025-2030?

What is MNDE: A Comprehensive Guide to Model-Neutral Data Exchange Framework