2025 HEI Price Prediction: Analyzing Market Trends and Potential Growth Factors for HEI Token

Introduction: HEI's Market Position and Investment Value

Heima (HEI), as a cutting-edge Layer 1 blockchain designed for multi-chain and cross-chain interoperability, has made significant strides since its inception. As of 2025, HEI's market capitalization has reached $14,760,644, with a circulating supply of approximately 67,616,329 tokens, and a price hovering around $0.2183. This asset, known for its "advanced security modules and exchange chain abstraction support," is playing an increasingly crucial role in enabling seamless blockchain interoperability.

This article will provide a comprehensive analysis of HEI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. HEI Price History Review and Current Market Status

HEI Historical Price Evolution Trajectory

- 2025 February: HEI reached its all-time high of $1.25, marking a significant milestone in its price history.

- 2025 October: The token experienced its lowest point, dropping to $0.04755675, indicating a substantial market correction.

- 2025 November: HEI shows signs of recovery, with the current price at $0.2183, reflecting a 358.82% increase from its all-time low.

HEI Current Market Situation

As of November 20, 2025, HEI is trading at $0.2183, with a 24-hour trading volume of $38,677.81. The token has shown a slight positive momentum in the short term, with a 0.46% increase in the last 24 hours and a 0.18% gain in the past hour. However, the longer-term trend appears bearish, with declines of 2.67% over the past week, 8.97% in the last 30 days, and a significant 69.33% drop over the past year.

HEI's market capitalization currently stands at $14,760,644.62, ranking it at 1046th in the overall cryptocurrency market. The token has a circulating supply of 67,616,329 HEI, which represents 72.82% of its total supply of 92,859,274 tokens. The fully diluted valuation of HEI is $20,271,179.51, indicating potential for growth if the entire supply enters circulation.

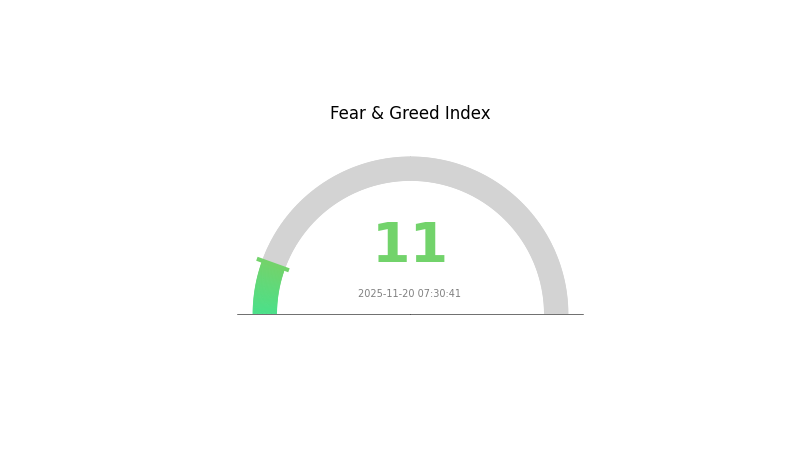

The market sentiment for cryptocurrencies in general is currently characterized as "Extreme Fear" with a VIX index of 11, suggesting a cautious approach from investors in the broader crypto market.

Click to view the current HEI market price

HEI Market Sentiment Indicator

2025-11-20 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the Fear and Greed Index plummeting to a mere 11. This alarmingly low figure suggests that investors are overwhelmingly pessimistic about the market's prospects. Such extreme fear often precedes significant market movements, potentially signaling a buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly in the volatile world of cryptocurrencies.

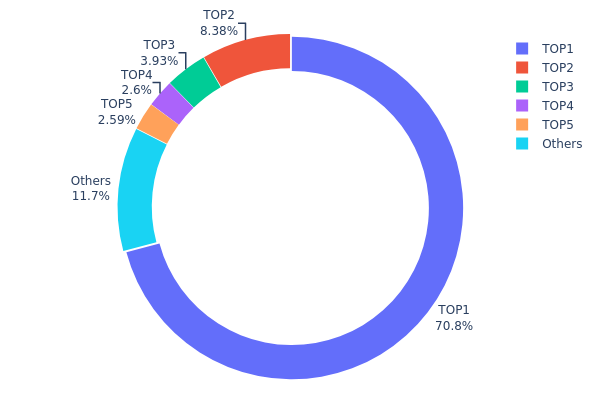

HEI Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for HEI tokens. The top address holds a staggering 70.84% of the total supply, with 40,944,560 HEI tokens. This level of concentration raises significant concerns about centralization and potential market manipulation risks.

The top five addresses collectively control 88.3% of the total HEI supply, leaving only 11.7% distributed among all other holders. Such a skewed distribution could lead to increased price volatility and susceptibility to large-scale sell-offs or accumulation events. The dominance of a single address holding over 70% of the supply may also indicate a lack of widespread adoption or limited circulation in the broader market.

This concentration of HEI tokens in few hands suggests a low level of decentralization and potential vulnerabilities in the token's ecosystem. It could impact market liquidity and price discovery mechanisms, as large holders may have disproportionate influence over trading volumes and price movements. Investors should be aware of these structural characteristics when considering HEI's market dynamics and long-term stability.

Click to view the current HEI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 40944.56K | 70.84% |

| 2 | 0x5fc8...7b4c11 | 4841.11K | 8.37% |

| 3 | 0x465d...00cf36 | 2269.84K | 3.92% |

| 4 | 0x4368...26f042 | 1500.00K | 2.59% |

| 5 | 0x6a55...1aa3d2 | 1495.81K | 2.58% |

| - | Others | 6745.44K | 11.7% |

II. Key Factors Affecting HEI's Future Price

Supply Mechanism

- Gradual Release: HEI tokens are released gradually over time according to a predetermined schedule.

- Historical Pattern: Past supply increases have generally led to short-term price pressure but long-term value appreciation as the ecosystem grows.

- Current Impact: The ongoing token release is expected to maintain a steady supply, potentially stabilizing the price in the medium term.

Institutional and Whale Dynamics

- Institutional Holdings: Several major cryptocurrency investment firms have added HEI to their portfolios, indicating growing institutional interest.

- Corporate Adoption: A number of tech companies have begun exploring HEI integration for various blockchain-based solutions.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing quantitative tightening may reduce overall liquidity in financial markets, potentially affecting cryptocurrency investments including HEI.

- Inflation Hedging Properties: HEI has shown some correlation with traditional inflation hedges, making it attractive during periods of high inflation.

Technical Development and Ecosystem Building

- Scalability Upgrade: An upcoming network upgrade aims to increase transaction throughput and reduce fees, potentially driving more adoption.

- Cross-chain Interoperability: Development of cross-chain bridges to enhance HEI's connectivity with other blockchain ecosystems.

- Ecosystem Applications: Several decentralized finance (DeFi) projects and non-fungible token (NFT) platforms are being built on the HEI network, expanding its utility and user base.

III. HEI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.20918 - $0.21790

- Neutral prediction: $0.21790 - $0.22553

- Optimistic prediction: $0.22553 - $0.23315 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.14912 - $0.27992

- 2028: $0.15975 - $0.39532

- Key catalysts: Increasing adoption and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.33304 - $0.33804 (assuming steady market growth)

- Optimistic scenario: $0.34303 - $0.48678 (assuming favorable market conditions)

- Transformative scenario: Above $0.48678 (extreme positive market developments)

- 2030-12-31: HEI $0.33804 (potential for significant appreciation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.23315 | 0.2179 | 0.20918 | 0 |

| 2026 | 0.29769 | 0.22553 | 0.18493 | 3 |

| 2027 | 0.27992 | 0.26161 | 0.14912 | 19 |

| 2028 | 0.39532 | 0.27077 | 0.15975 | 24 |

| 2029 | 0.34303 | 0.33304 | 0.20982 | 52 |

| 2030 | 0.48678 | 0.33804 | 0.1893 | 54 |

IV. HEI Professional Investment Strategy and Risk Management

HEI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational suggestions:

- Accumulate HEI during market dips

- Set a target holding period of 2-3 years

- Store HEI in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs for trend identification

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Use stop-loss orders to manage risk

HEI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: 10-15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HEI

HEI Market Risks

- High volatility: Cryptocurrency markets are known for rapid price fluctuations

- Competition: Other Layer 1 blockchains may outperform HEI

- Market sentiment: Negative news can significantly impact price

HEI Regulatory Risks

- Regulatory uncertainty: Changing regulations may affect HEI's operations

- Cross-border compliance: Varying regulations across jurisdictions

- Taxation: Evolving tax laws may impact investor returns

HEI Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues as network usage grows

- Interoperability issues: Compatibility problems with other blockchains

VI. Conclusion and Action Recommendations

HEI Investment Value Assessment

HEI presents a promising long-term value proposition as a Layer 1 blockchain focusing on interoperability. However, short-term risks include market volatility and regulatory uncertainties.

HEI Investment Recommendations

✅ Newcomers: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider HEI as part of a diversified crypto portfolio

HEI Trading Participation Methods

- Spot trading: Buy and sell HEI on Gate.com

- Staking: Participate in staking programs if available

- DeFi: Explore decentralized finance options on the Heima Network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for the Heima coin in 2025?

Based on current market trends and expert analysis, the Heima coin is predicted to reach $0.15 to $0.20 by the end of 2025, showing potential for significant growth.

What is the Hei stock price forecast?

Based on current market trends and expert analysis, the Hei stock price is projected to reach $0.15 by the end of 2026, with potential for further growth in subsequent years.

Will Hamster Kombat reach $1?

Based on current market trends and the project's potential, it's possible for Hamster Kombat to reach $1 in the future. However, this depends on various factors like market conditions and project development.

How high will helium hnt go?

Helium (HNT) could potentially reach $50-$75 by 2025, driven by increased IoT adoption and network expansion.

2025 CORE Price Prediction: Analyzing Potential Growth Factors and Market Trends in the Cryptocurrency Ecosystem

2025 CKB Price Prediction: Bullish Outlook as Adoption and Development Accelerate

2025 SUI价格预测:区块链新贵的未来发展与投资价值分析

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

ICP Crypto: Why Internet Computer Could Surge to $30 AUD

What is URANUS: A Comprehensive Guide to the Ice Giant of Our Solar System

What is BITBOARD: A Comprehensive Guide to Understanding Bitboard Representation in Chess Programming

Is the Quantum Computing Era Coming? Why Bitcoin May Need 5–10 Years to Transition to Post-Quantum Security

2025 DADDY Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 ATS Price Prediction: Expert Analysis and Market Outlook for the Coming Year