2025 HIGH Price Prediction: Expert Analysis and Market Outlook for Digital Assets in the Coming Year

Introduction: Market Position and Investment Value of HIGH

Highstreet (HIGH) serves as the native utility and governance token of the Highstreet metaverse ecosystem, an open-world MMORPG platform that seamlessly integrates shopping, gaming, NFTs, and both traditional and cryptocurrency brands. Since its launch in October 2021, HIGH has established itself as a critical asset within a decentralized metaverse environment. As of December 2025, HIGH maintains a market capitalization of approximately $20.73 million with a circulating supply of 77.59 million tokens out of a maximum supply of 100 million, trading at around $0.2073 per token.

Within the Highstreet ecosystem, HIGH serves multiple essential functions: enabling in-game access across different regions, facilitating purchases of special items and virtual real estate on the Highstreet Marketplace, and empowering token holders with governance rights through on-chain proposal creation and voting mechanisms weighted by staked token amounts. This multifaceted utility framework positions HIGH as a fundamental component driving ecosystem participation and long-term value capture.

This article provides a comprehensive analysis of HIGH's price trajectory and market dynamics, examining historical price movements, current market sentiment, ecosystem development, and relevant macroeconomic factors. By synthesizing these elements, this analysis offers professional price forecasting and practical investment guidance for market participants seeking to understand HIGH's positioning within the broader metaverse and gaming token landscape through 2030 and beyond.

Highstreet (HIGH) Market Analysis Report

I. HIGH Price History Review and Current Market Status

HIGH Historical Price Evolution Trajectory

- December 2021: Highstreet reached its all-time high (ATH) of $38.42 on December 17, 2021, representing the peak of market enthusiasm during the initial launch phase.

- 2022-2024: Extended bear market period, with significant price depreciation from the ATH level.

- December 2025: Recent decline reached an all-time low (ATL) of $0.189441 on December 19, 2025, marking a 99.51% decline from the historical peak.

HIGH Current Market Position

As of December 21, 2025, HIGH is trading at $0.2073, representing a 1.22% gain over the past 24 hours. The token shows modest short-term momentum with a 1-hour price change of 0.24%. However, medium to long-term performance remains significantly negative, with a 7-day decline of 12.68%, 30-day decrease of 11.94%, and a devastating 1-year performance of -85.64%.

Key Market Metrics:

- 24h Trading Range: $0.2035 - $0.2088

- 24h Trading Volume: $17,243.01

- Market Capitalization: $16,084,721.73

- Fully Diluted Valuation (FDV): $20,730,000.00

- Circulating Supply: 77,591,518.25 HIGH (77.59% of total supply)

- Total Supply: 100,000,000 HIGH

- Market Dominance: 0.00064%

- Active Holders: 5,599

- Listed On: 26 exchanges

HIGH maintains a market rank of 947 among all cryptocurrencies, with a market cap to FDV ratio of 77.59%, indicating that the majority of the token supply is already in circulation.

Click to view current HIGH market price

HIGH Market Sentiment Indicator

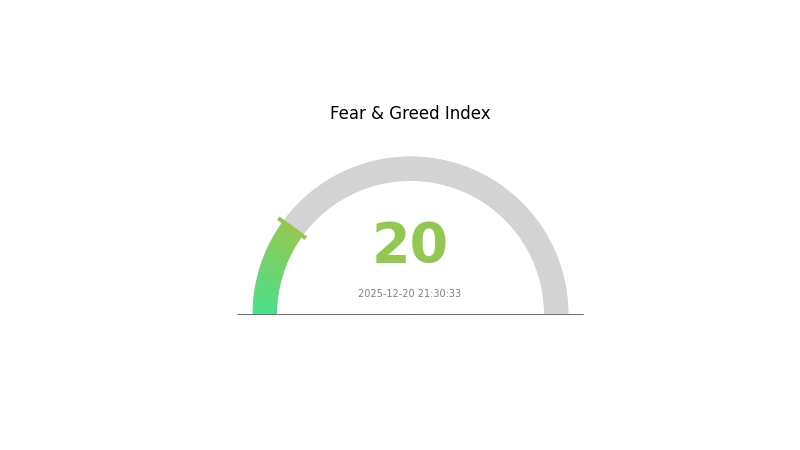

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 20. This significant downturn indicates widespread investor panic and pessimistic market sentiment. During periods of extreme fear, asset prices often reach capitulation levels, creating potential opportunities for contrarian investors. However, traders should exercise caution and conduct thorough research before making investment decisions. Market volatility remains elevated, and risk management is crucial. Monitor key support levels and consider dollar-cost averaging strategies to navigate this turbulent period effectively.

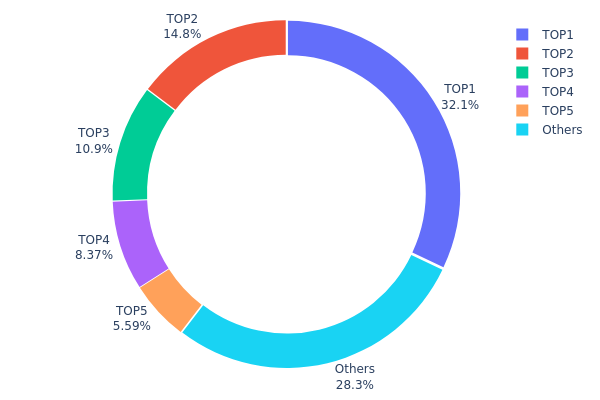

HIGH Holdings Distribution

The address holdings distribution represents the concentration of HIGH tokens across blockchain addresses, serving as a critical metric for assessing decentralization levels and potential market manipulation risks. By analyzing the percentage of tokens held by top addresses versus the broader holder base, this metric provides insight into the structural health and vulnerability of the token's on-chain ecosystem.

HIGH exhibits significant concentration risk in its current holder structure. The top five addresses collectively control 71.66% of total circulating supply, with the largest holder commanding 32.07% independently. This concentration is particularly pronounced in the top address, which alone holds nearly one-third of all tokens, substantially exceeding typical decentralization benchmarks. The second and third-largest holders further contribute 14.75% and 10.90% respectively, creating a steep distribution curve where power is heavily consolidated among a small number of entities.

This elevated concentration level introduces considerable market structure concerns. The substantial holdings by top addresses create asymmetric risk exposure, as coordinated movements or large liquidations from these positions could trigger significant price volatility or potential market manipulation. The remaining 28.34% distributed among "Others" suggests a fragmented secondary holder base, which further amplifies the dominance of top holders. While the dispersed nature of smaller holdings provides some resilience, the overall structure reflects a centralization pattern that undermines the decentralized ethos typically associated with blockchain assets, indicating ongoing dependence on whale holders and institutional positions rather than organic community distribution.

Click to view current HIGH holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2796...b8ceb6 | 32078.58K | 32.07% |

| 2 | 0xe455...5ec8fa | 14757.27K | 14.75% |

| 3 | 0xf977...41acec | 10901.93K | 10.90% |

| 4 | 0x93b2...651b69 | 8368.73K | 8.36% |

| 5 | 0xd16e...cb0bda | 5587.09K | 5.58% |

| - | Others | 28306.40K | 28.34% |

II. Core Factors Influencing HIGH's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve has conducted three consecutive rate cuts, lowering the interest rate range to 3.50%-3.75%. Market expectations for future rate movements remain uncertain, with the timing of additional cuts dependent on labor market performance and inflation trends. These monetary policy shifts directly influence liquidity and investment flows into alternative assets, including cryptocurrencies.

-

Inflation Hedging Properties: Cryptocurrencies serve as potential inflation hedges, particularly in environments where traditional currencies face depreciation pressures. As core CPI and overall inflation metrics fluctuate around 3%, investors may seek diversification into digital assets to protect purchasing power.

-

Geopolitical Factors: Global trade tensions, including tariff policies and geopolitical instability, create market uncertainty. These factors increase demand for alternative assets and may redirect capital flows toward decentralized financial solutions, potentially benefiting blockchain-based projects like HIGH.

Market Supply and Demand Dynamics

-

Supply-Demand Mechanics: The interaction between cryptocurrency supply expansion and investor demand forms the foundation of price movements. Market sentiment and capital flows play critical roles, with psychological factors driving significant price volatility during periods of extreme fear or greed.

-

Market Sentiment Indicators: Sustained periods of extreme market fear, as reflected in sentiment indices, can create contrarian opportunities while extending bear phases. Investor psychology and behavioral patterns significantly influence SHORT-term price discovery mechanisms.

III. 2025-2030 Price Forecast Analysis

2025-2026 Outlook

- Conservative Forecast: $0.11396 - $0.20720

- Base Case Forecast: $0.20720 - $0.29008

- Optimistic Forecast: $0.29008 - $0.30334 (requires positive market sentiment and increased adoption)

Mid-Term Period (2027-2028) Outlook

-

Market Stage Expectation: Consolidation and gradual recovery phase with increasing institutional interest and ecosystem development

-

Price Range Forecast:

- 2027: $0.17663 - $0.31463

- 2028: $0.19786 - $0.38095

-

Key Catalysts: Regulatory clarity, technological improvements, institutional adoption, and macroeconomic recovery

Long-Term Outlook (2029-2030)

-

Base Case Scenario: $0.26374 - $0.44633 (assuming steady ecosystem growth and moderate market expansion)

-

Optimistic Scenario: $0.33813 - $0.58442 (assuming accelerated adoption and favorable regulatory environment)

-

Transformative Scenario: $0.39223 - $0.58442 (extreme positive conditions including breakthrough partnerships and mainstream adoption)

-

2025-12-21: Current baseline established at $0.2072 average price (market foundation for long-term projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.29008 | 0.2072 | 0.11396 | 0 |

| 2026 | 0.30334 | 0.24864 | 0.12929 | 19 |

| 2027 | 0.31463 | 0.27599 | 0.17663 | 33 |

| 2028 | 0.38095 | 0.29531 | 0.19786 | 42 |

| 2029 | 0.44633 | 0.33813 | 0.26374 | 63 |

| 2030 | 0.58442 | 0.39223 | 0.20396 | 89 |

Highstreet (HIGH) Professional Investment Analysis Report

IV. HIGH Professional Investment Strategy and Risk Management

HIGH Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Metaverse gaming enthusiasts, NFT collectors, and long-term crypto believers committed to play-to-earn ecosystems

-

Operational Recommendations:

- Accumulate HIGH tokens during market downturns to build a core position, leveraging the current price of $0.2073 which represents a significant discount from the all-time high of $38.42

- Participate in governance voting to engage with the Highstreet ecosystem and earn rewards proportional to staked tokens

- Hold corresponding NFTs (Forever Fomo Duck Squad) to unlock exclusive club access, enhanced staking multipliers, and airdrop eligibility

-

Storage Solution:

- Use Gate Web3 Wallet for secure custody with convenient access to in-game asset management and trading on Highstreet Marketplace

- Maintain private key security and enable multi-layer authentication protocols

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Price momentum indicators: Monitor the 24-hour change (+1.22%) and 7-day trend (-12.68%) to identify support and resistance levels

- Volume analysis: Track the 24-hour trading volume of $17,243 relative to market cap ($20.73M) to assess liquidity conditions

-

Swing Trading Considerations:

- Identify rebound opportunities from recent low points ($0.189441 as of December 19, 2025) with defined entry and exit targets

- Monitor weekly price patterns given the significant year-to-date decline (-85.64%), which may indicate accumulation phases or exhaustion signals

- Execute trades exclusively on Gate.com with market liquidity considerations

HIGH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio, focusing exclusively on long-term staking and governance participation

- Active Investors: 3-8% of total crypto portfolio, combining core holdings with tactical trading positions and NFT acquisition

- Professional Investors: 8-15% of total crypto portfolio with sophisticated hedging strategies and derivatives positions

(2) Risk Hedging Solutions

- Diversification Strategy: Balance HIGH token exposure with stable metaverse assets and established gaming tokens to mitigate concentration risk

- Position Scaling: Implement dollar-cost averaging over 3-6 months rather than lump-sum purchases to reduce timing risk and average entry costs

(3) Secure Storage Solution

- Self-Custody Wallet: Gate Web3 Wallet provides institutional-grade security with seamless integration for gaming transactions and governance voting

- Exchange Custody: Gate.com's regulated platform offers insurance protections for holdings intended for active trading

- Security Considerations: Never share private keys, enable withdrawal whitelist features, and verify contract addresses before any NFT or token transactions to prevent smart contract exploitation

V. HIGH Potential Risks and Challenges

HIGH Market Risk

- Severe Price Volatility: The token has experienced an 85.64% decline over the past year, reflecting extreme market risk and indicating potential structural challenges in user adoption or game development

- Low Trading Volume: Daily volume of $17,243 against a $20.73M market cap suggests insufficient liquidity for large position exits, creating significant slippage risk

- Declining Market Sentiment: The project has dropped from ranking position historically to rank 947, suggesting diminished market confidence and reduced institutional interest

HIGH Regulatory Risk

- Evolving Gaming Regulations: Jurisdictions are increasingly scrutinizing play-to-earn mechanics, NFT integration, and token rewards, potentially restricting Highstreet's operations in key markets

- Securities Classification: Depending on governance mechanisms and reward structures, HIGH tokens could face reclassification as securities in certain regions, impacting trading and custody options

- Cross-Border Compliance: Operating in multiple jurisdictions with traditional and cryptocurrency brands creates complex regulatory exposure

HIGH Technology Risk

- Development Delays: The project was in private alpha stage as of the reference data, with mobile version deployment occurring in Q1 2022—extended development timelines increase competitive obsolescence risk

- Gaming Competition: The metaverse gaming landscape features well-funded competitors with larger player bases, superior graphics, and established brand integrations

- Smart Contract Vulnerabilities: As an Ethereum-based token, security audits and potential contract exploits present technical risk vectors requiring continuous monitoring

VI. Conclusion and Action Recommendations

HIGH Investment Value Assessment

Highstreet represents a speculative opportunity in the metaverse gaming sector with significant technical execution risks and regulatory uncertainties. The token's 85.64% year-over-year decline reflects market skepticism regarding play-to-earn sustainability and user retention models. While the project's VR/PC/mobile multi-platform strategy and NFT integration present differentiation potential, the current market cap of $20.73M and minimal trading liquidity suggest limited institutional validation. Investment viability depends critically on successful game launch execution, meaningful user acquisition, and sustainable token economics that balance utility with speculative demand.

HIGH Investment Recommendations

✅ Beginners: Allocate 1-2% of crypto holdings through Gate.com only after studying Highstreet's game mechanics and roadmap; prioritize learning governance participation over active trading

✅ Experienced Investors: Consider 3-5% portfolio allocation with emphasis on NFT acquisition to unlock exclusive benefits; implement systematic dollar-cost averaging during market weakness rather than concentrated positions

✅ Institutional Investors: Conduct deep technical due diligence on development progress, player metrics, and game economics before any position establishment; monitor regulatory developments in gaming and NFT jurisdictions

HIGH Trading Participation Methods

- Spot Trading: Execute buy/sell transactions directly on Gate.com with market orders for liquid entry and exit, prioritizing risk management over execution timing

- Staking Participation: Lock HIGH tokens for governance rewards on the Highstreet platform while holding NFTs to maximize earning multipliers and participate in ecosystem development

- NFT Integration: Acquire Forever Fomo Duck Squad NFTs through Highstreet Marketplace to unlock exclusive clubs, enhance staking returns, and gain early access to ecosystem features

Cryptocurrency investment carries extreme risk of total capital loss. This report does not constitute investment advice. Investors must conduct independent research and consult qualified financial advisors before making any investment decisions. Never invest funds you cannot afford to lose completely. The information provided reflects market conditions as of December 21, 2025, and may become outdated rapidly.

FAQ

Why did Highstreet crypto drop?

Highstreet crypto dropped due to profit-taking by investors, technical chart breakdowns, and broader market risk aversion affecting the sector.

What is the price prediction for HIGH token in 2024/2025?

Based on current analysis, HIGH token is projected to reach approximately $0.25 in 2025. Price predictions for 2024 lack sufficient data at this time. Market conditions and project developments will significantly influence actual price performance.

What factors influence HIGH coin price movements?

HIGH coin price movements are driven by supply and demand dynamics, market sentiment, regulatory developments, and trading volume. Lower trading volumes typically result in higher volatility, while broader market trends and investor interest also significantly impact price fluctuations.

Is HIGH a good investment based on current market analysis?

HIGH demonstrates strong fundamentals with growing trading volume and positive market sentiment. Technical analysis suggests bullish momentum, making it an attractive entry point for investors seeking exposure to the token's potential upside.

GMRT vs SAND: Comparing Two Leading Blockchain Solutions for Decentralized Data Storage

How Will PENGU Price Volatility Impact Pudgy World's Success in 2030?

2025 APE Price Prediction: Analyzing Market Trends, Ecosystem Growth and Investment Potential in the ApeCoin Ecosystem

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

2025 WAXPPrice Prediction: Market Trends and Future Outlook for the WAX Ecosystem

2025 ENJ Price Prediction: Analyzing Blockchain Gaming Token's Potential Growth and Market Drivers

How to Set Price Alerts for Cryptocurrency on Mobile and Desktop

ONG price prediction analysis: Is Ontology Gas undervalued after token burning?

Introduction to Spark Token and Flare Network for Beginners

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

Can You Mine Bitcoin on Your Smartphone?