2025 HLN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: HLN's Market Position and Investment Value

Ēnosys Global (HLN) is a research and software development center building a multichain Super-app for DeFi, interconnected via a central yield aggregator (APYCloud). Since its inception in 2023, the project has been pioneering research and development in blockchain technology, offering innovative products for seamless access to various applications across multiple chains. As of 2025, HLN has achieved a market capitalization of $4,192,203.99, with a circulating supply of approximately 65,853,031.56 tokens, currently trading at $0.06366. This innovative multichain DeFi solution is playing an increasingly key role in enabling seamless cross-chain yield aggregation and decentralized finance accessibility.

This article will comprehensively analyze HLN's price trends from 2025 through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. HLN Price History Review and Market Status

HLN Historical Price Movement Trajectory

- November 2023: Project launch phase, HLN reached its all-time high of $0.56 on November 14, 2023

- November 2024: Market correction period, HLN fell to its all-time low of $0.01861 on November 4, 2024

- December 2024 to Present: Recovery phase, price gradually stabilized in the $0.06 range

HLN Current Market Status

As of December 24, 2025, HLN is trading at $0.06366, reflecting a 24-hour decline of 2.74% and a 7-day decline of 4.29%. The token has experienced a 30-day downturn of 22.61%, yet demonstrates a remarkable annual gain of 82.19% since its launch.

The 24-hour trading volume stands at $13,072.12, with a market capitalization of approximately $4.19 million. The circulating supply is 65,853,031.56 HLN tokens out of a total supply of 150,000,000 tokens, representing a circulation ratio of 43.90%. The fully diluted valuation is assessed at $9.549 million, placing HLN at a market ranking of 1,641.

Current market sentiment indicators reflect extreme fear (VIX: 24), suggesting heightened volatility and risk aversion across the cryptocurrency market. The 1-hour price movement shows minimal change at -0.02%, while the 24-hour high reached $0.06687 and the low was $0.0635.

View current HLN market price

HLN Market Sentiment Index

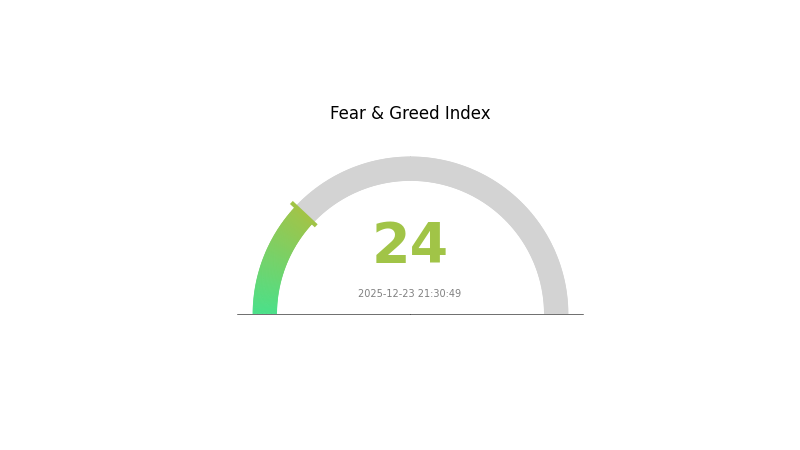

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates strong bearish sentiment among investors, characterized by significant selling pressure and risk aversion. During such periods of extreme fear, markets often experience heightened volatility and potential capitulation. However, historically, extreme fear levels have presented opportunities for contrarian investors. Monitor key support levels closely and consider portfolio adjustments based on your risk tolerance. On Gate.com, you can access real-time market data and sentiment indicators to make informed trading decisions.

HLN Holdings Distribution

The address holdings distribution chart is a fundamental on-chain analytical tool that visualizes the concentration of token ownership across wallet addresses within a blockchain network. This metric enables investors and analysts to assess the decentralization degree of a project, identify potential whale concentration risks, and evaluate the overall health of the token's holder structure. By categorizing addresses by their holding quantities and percentages, this distribution provides critical insights into market structure dynamics and potential price volatility drivers.

However, the data table provided is currently empty, containing no address holdings information for HLN. Without specific concentration metrics, we are unable to conduct a comprehensive assessment of the token's current holder distribution characteristics or evaluate whether excessive concentration exists within the network. To deliver a thorough analysis of HLN's address distribution patterns, their potential impact on market structure, and the degree of decentralization reflected in the on-chain ecosystem, complete holdings data would be necessary.

Investors and researchers interested in monitoring HLN's holder concentration and real-time distribution patterns are encouraged to access detailed on-chain analytics through professional cryptocurrency data platforms.

Click to view the current HLN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting HLN's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies, including interest rate and liquidity adjustments, will directly influence HLN price movements and investor sentiment. Changes in monetary conditions create significant implications for asset valuations across markets.

-

Inflation Hedge Characteristics: HLN's risk resilience during inflationary periods will serve as an important basis for investors seeking to preserve asset value. The asset's performance during high inflation environments is a key consideration for portfolio protection strategies.

Institutional and Major Holder Dynamics

-

Institutional Capital and ETF Flows: Core driving factors for HLN growth include institutional fund participation and ETF inflows, which contribute to market adoption and price appreciation potential.

-

Product Portfolio Expansion: Revenue growth can be driven by product portfolio diversification, market share expansion, pricing adjustments, or international market expansion. Investors should simultaneously monitor how these factors contribute to overall business development and market positioning.

III. HLN Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.04456 - $0.06365

- Neutral Forecast: $0.06365

- Bullish Forecast: $0.07702 (requires sustained market momentum and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual accumulation phase with incremental growth trajectory, characterized by steady price appreciation and increasing market participation.

- Price Range Forecasts:

- 2026: $0.03868 - $0.07666 (10% upside potential)

- 2027: $0.0441 - $0.10584 (15% upside potential)

- 2028: $0.06546 - $0.13271 (40% upside potential)

- Key Catalysts: Institutional adoption, ecosystem development, regulatory clarity, and sustained network growth

2029-2030 Long-term Outlook

- Base Case Scenario: $0.07672 - $0.1401 (assumes moderate market expansion and continued protocol upgrades)

- Bullish Scenario: $0.11119 - $0.14010 (assumes accelerated adoption and strong market demand)

- Transformative Scenario: $0.15328 (extreme positive conditions including major ecosystem breakthroughs and mainstream institutional integration with 97% upside potential)

- 2030-12-31: HLN reaches $0.15328 (near multi-year high under optimal conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07702 | 0.06365 | 0.04456 | 0 |

| 2026 | 0.07666 | 0.07033 | 0.03868 | 10 |

| 2027 | 0.10584 | 0.0735 | 0.0441 | 15 |

| 2028 | 0.13271 | 0.08967 | 0.06546 | 40 |

| 2029 | 0.1401 | 0.11119 | 0.07672 | 74 |

| 2030 | 0.15328 | 0.12564 | 0.07915 | 97 |

Enosys Global (HLN) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Enosys Global (HLN) is a research and software development center building a multichain DeFi super-app interconnected via a central yield aggregator (APYCloud). As of December 24, 2025, HLN trades at $0.06366 with a market capitalization of approximately $4.19 million and a fully diluted valuation of $9.55 million. The token has demonstrated significant volatility, ranging from historical highs of $0.56 to recent lows of $0.01861.

II. HLN Market Performance Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.06366 |

| 24-Hour Change | -2.74% |

| 7-Day Change | -4.29% |

| 30-Day Change | -22.61% |

| 1-Year Change | +82.19% |

| Market Cap | $4,192,203.99 |

| Fully Diluted Valuation | $9,549,000.00 |

| 24-Hour Volume | $13,072.12 |

| Circulating Supply | 65,853,031.56 HLN |

| Total Supply | 150,000,000 HLN |

| Circulating Ratio | 43.90% |

Price Movement Trends

HLN exhibits moderate trading volatility across multiple timeframes. The token reached its all-time high of $0.56 on November 14, 2023, and touched its recent low of $0.01861 on November 4, 2024. The year-to-date performance shows an 82.19% gain, indicating recovery from previous lows despite recent short-term weakness.

III. HLN Professional Investment Strategy and Risk Management

HLN Investment Methodology

(1) Long-Term Holding Strategy

Target Audience: DeFi yield aggregation enthusiasts, multichain protocol supporters, and long-term cryptocurrency investors with moderate-to-high risk tolerance.

Operational Guidelines:

- Position Building: Establish positions during price consolidation phases, particularly when HLN trades below $0.05 support levels, aligning purchases with the project's development milestones and APYCloud feature releases.

- Portfolio Allocation: Allocate HLN as a speculative DeFi play within a diversified cryptocurrency portfolio, targeting 2-5% of total crypto holdings for risk management purposes.

- Asset Storage: Maintain holdings on Gate.com for active trading access or transfer to secure custody solutions for extended holding periods.

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key levels at $0.05 (strong support), $0.06366 (current price), and $0.08-0.10 (resistance zones) to identify entry and exit opportunities.

- Volume Analysis: Track 24-hour trading volume fluctuations relative to the current average of $13,072; breakouts accompanied by increased volume may signal directional momentum.

Wave Trading Key Points:

- Volatility Capture: Execute buy orders during downward momentum (-2.74% to -4.29% daily declines) with predetermined stop-losses at 15% below entry points.

- Profit Realization: Target gains of 25-40% on short-term positions before taking profits, given the token's historical price volatility range.

IV. HLN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% allocation to HLN within overall cryptocurrency exposure; prioritize stablecoin and established altcoin positions.

- Active Investors: 2-5% allocation; execute tactical positions based on technical analysis and development announcements.

- Professional Investors: 5-10% allocation for specialized DeFi-focused portfolios; implement systematic hedging strategies and derivative overlays.

(2) Risk Hedging Solutions

- Volatility Management: Maintain stablecoin reserves (30-50% of position value) to capitalize on significant price declines for dollar-cost averaging purchases.

- Position Sizing: Apply strict position limits, never exceeding predetermined portfolio percentages; reduce exposure if HLN declines below $0.04 without corresponding development announcements.

(3) Secure Storage Solutions

- Exchange Custody: Maintain trading positions on Gate.com with active 2-factor authentication and withdrawal whitelist settings enabled for additional security.

- Self-Custody Approach: Transfer long-term holdings to compatible blockchain wallets on the Flare Network using the official contract address (0x140D8d3649Ec605CF69018C627fB44cCC76eC89f).

- Critical Security Considerations: Never share private keys, enable multi-signature approval for large transfers, regularly verify wallet addresses through official project channels (https://enosys.global), and maintain backup seed phrases in secure offline storage.

V. HLN Potential Risks and Challenges

HLN Market Risk

- Liquidity Risk: 24-hour trading volume of $13,072 indicates limited market liquidity; large buy or sell orders may experience significant price slippage, making this token unsuitable for institutional-scale trading without fragmented execution strategies.

- Price Volatility: Historical price range of $0.01861 to $0.56 demonstrates extreme volatility; investors face potential drawdowns exceeding 60% during bearish market cycles.

- Market Sentiment Risk: Current market emotion indicators and limited exchange presence (only 1 exchange listed) suggest concentrated trading activity vulnerable to rapid price reversals based on social media trends or project announcements.

HLN Regulatory Risk

- Emerging Regulatory Landscape: As a DeFi-focused token, HLN operates within evolving regulatory frameworks across multiple blockchains; changes in DeFi-specific regulations could impact token utility and value.

- Compliance Uncertainty: Multichain operations introduce jurisdictional complexity; regulatory actions against any supported blockchain could affect HLN functionality and investor access.

- Tokenomics Governance Risk: Yield aggregator protocols face potential regulatory scrutiny regarding token incentives and reward mechanisms; policy changes could restrict APYCloud functionality.

HLN Technical Risk

- Smart Contract Risk: Multichain super-app architecture introduces complexity in contract deployment and security; bugs or vulnerabilities in APYCloud smart contracts could result in fund losses.

- Chain Integration Risk: Seamless access to applications across multiple chains requires robust technical infrastructure; integration failures could compromise core functionality and user experience.

- Adoption Risk: Success depends on achieving critical mass of users and liquidity across supported chains; failure to gain traction could result in network effects stalling and value collapse.

VI. Conclusions and Action Recommendations

HLN Investment Value Assessment

Enosys Global presents a specialized investment opportunity within the DeFi yield aggregation sector. The project's multichain super-app architecture and APYCloud yield aggregator address a real market need for simplified cross-chain DeFi access. However, significant execution risks exist, including technical development timelines, market adoption challenges, and regulatory uncertainties. The current valuation ($9.55 million fully diluted) reflects early-stage positioning, offering potential upside for early adopters but substantial downside risk if adoption lags or competitive solutions emerge.

HLN Investment Recommendations

✅ Beginners: Initiate small exploratory positions (0.5-1% of crypto portfolio) on Gate.com; use limit orders near support levels ($0.05); conduct thorough research on APYCloud functionality before increasing exposure; consider starting with dollar-cost averaging strategies over 3-6 month periods to reduce timing risk.

✅ Experienced Investors: Build tactical positions (2-5% allocation) using technical analysis around identified support/resistance levels; maintain active monitoring of project development announcements and APYCloud release timelines; implement systematic profit-taking at 30-40% gains; reduce exposure if price closes below $0.04 without corresponding positive catalysts.

✅ Institutional Investors: Evaluate HLN as a specialized DeFi exposure within thematic portfolios; require detailed due diligence on smart contract audits, team credentials, and product roadmap timelines; execute positions using tranched entry strategies to minimize price impact; establish governance participation if token includes DAO mechanisms.

HLN Trading Participation Methods

- Spot Trading: Purchase and hold HLN directly on Gate.com using market or limit orders; suitable for all investor types with appropriate position sizing.

- Technical Trading: Execute short-term trading strategies (3-30 day holding periods) based on identified technical levels and volume patterns; leverage Gate.com's trading tools for technical analysis.

- DeFi Integration: Utilize HLN within APYCloud yield aggregation protocols once platform achieves sufficient liquidity and adoption; review protocol safety metrics and audit reports before depositing capital.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Strongly recommended to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the price target for HLN?

The price target for HLN ranges between $11.25 and $13.40, with an average forecasted upside of 23.68%. These targets reflect current market analysis as of December 2025.

Does Hyliion have a future?

Yes, Hyliion shows strong potential with forecasted earnings and revenue growth of 44% and 72.2% annually. Positive EPS growth and market innovation support its promising future outlook.

What is the price target for Hyliion in 2025?

Based on current analyst consensus, the price target for Hyliion in 2025 is approximately $5.00. Analysts project an EPS range of -$0.34 to -$0.32 for the year, reflecting the company's expected financial performance.

How volatile is HLN stock?

HLN stock exhibits low volatility at 2.05% with a beta coefficient of 0.28, indicating it moves less than the broader market. This makes it a relatively stable investment option.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

Cryptocurrency Exchanges: An In-Depth Guide to Leading Trading Platforms

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?