2025 HOLDSTATION Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Holdstation's Market Position and Investment Value

Holdstation (HOLDSTATION) is an innovative smart contract wallet platform built on zkSync Era, designed for seamless trading and asset management. Since its launch in November 2024, the project has established itself as a leading perpetual DEX on zkSync, integrating account abstraction with wallet, DeFutures, and zkStarter launchpad functionalities. As of December 23, 2025, HOLDSTATION's market capitalization stands at approximately $5.79 million, with a circulating supply of 7.90 million tokens out of a total supply of 30 million. The current price is trading at $0.733, reflecting the market's dynamic valuation of this emerging DeFi infrastructure asset.

This asset represents what the community recognizes as a "product-community fit" platform, playing an increasingly important role in enabling intuitive DeFi experiences across multiple blockchain ecosystems including zkSync, Berachain, and Worldchain. Holdstation's unique value proposition lies in its support for high-leverage futures trading (up to 500x), token swaps across Layer 2 and EVM chains, and advanced security features such as Paymaster functionality, batch transactions, spending limits, and social recovery mechanisms.

This article will comprehensively analyze Holdstation's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development progress, and macroeconomic factors to provide investors with professional price forecasting and actionable investment strategies.

HOLDSTATION Market Analysis Report

I. HOLDSTATION Price History Review and Current Market Status

HOLDSTATION Historical Price Evolution

-

December 2024: HOLDSTATION reached its all-time high of $16.445 on December 27, 2024, marking a significant peak in the asset's trading history.

-

December 2024 - Present: Following the all-time high, the token experienced a substantial decline, with the price deteriorating significantly over the subsequent weeks.

-

March 2025: HOLDSTATION reached its all-time low of $0.647 on March 9, 2025, representing a dramatic 96% decline from the all-time high, reflecting extreme market corrections.

HOLDSTATION Current Market Dynamics

As of December 23, 2025, HOLDSTATION is trading at $0.733, demonstrating marginal losses across multiple timeframes:

- 1-Hour Performance: -0.94%, indicating slight bearish pressure in the immediate term

- 24-Hour Performance: -2.75%, showing continued downward momentum over the past day

- 7-Day Performance: -10.07%, reflecting a more pronounced weekly decline

- 30-Day Performance: -16.33%, demonstrating sustained bearish sentiment throughout the month

- Year-to-Date Performance: -61.14%, indicating severe long-term depreciation from the launch price of $1.00

Market Capitalization & Token Metrics:

- Current Market Cap: $5,793,412.10

- Fully Diluted Valuation (FDV): $21,990,000.00

- Circulating Supply: 7,903,700 HOLDSTATION (26.35% of total supply)

- Total Supply: 30,000,000 HOLDSTATION

- 24-Hour Trading Volume: $68,584.19

- Market Dominance: 0.00069%

- Active Holders: 526

Technical Range (24-Hour):

- Intraday High: $0.7583

- Intraday Low: $0.7222

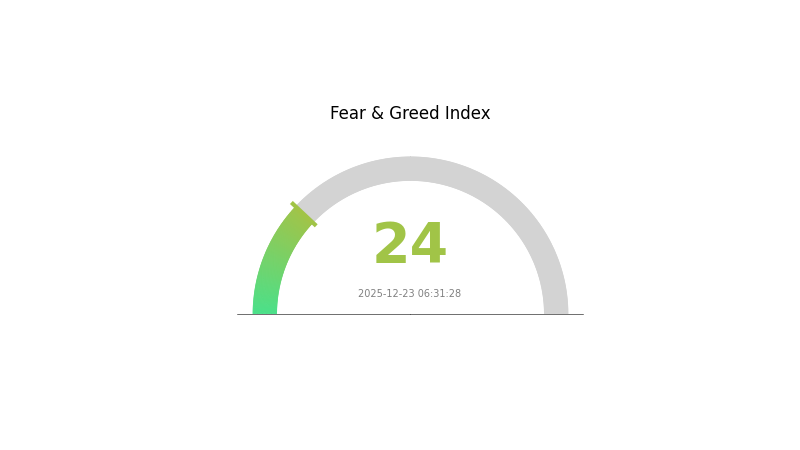

The token currently maintains a $0.733 price point with the market experiencing extreme fear conditions (VIX: 24 - Extreme Fear), suggesting heightened market volatility and risk aversion sentiment.

Visit HOLDSTATION Market Price on Gate.com for real-time trading data and updates.

HOLDSTATION Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 24. This significantly low level indicates widespread panic and pessimism among investors. During such periods, market volatility typically increases as uncertainty dominates sentiment. Risk-averse investors may consider defensive strategies, while contrarian traders might view this as a potential accumulation opportunity. Monitor key support levels and market catalysts closely. Historical data shows extreme fear often precedes market rebounds, but always conduct thorough due diligence before making investment decisions on Gate.com or other platforms.

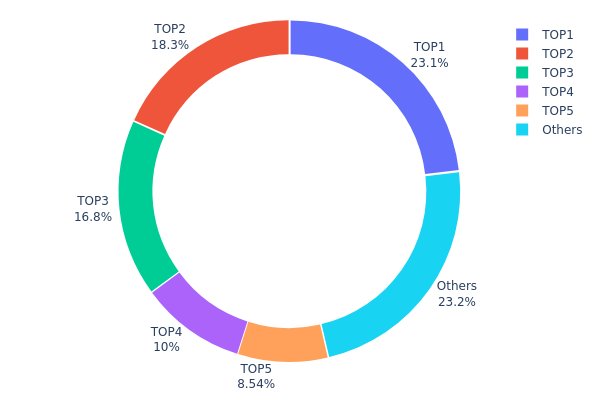

HOLDSTATION Holdings Distribution

An address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical indicator of token decentralization, market structure stability, and potential manipulation risks. By analyzing the top holders and their respective ownership percentages, investors and analysts can assess the degree of wealth concentration and evaluate the resilience of the token's ecosystem against large-scale sell-offs or coordinated trading activities.

The current HOLDSTATION holdings distribution exhibits notable concentration characteristics. The top five addresses collectively control 76.74% of the total supply, with the leading address alone commanding 23.13% of all tokens. This distribution pattern suggests a moderately centralized structure, where a limited number of entities wield significant influence over token dynamics. However, the presence of a diversified "Others" category representing 23.26% of holdings provides some degree of distribution balance, indicating that approximately one-quarter of the supply remains dispersed among numerous smaller holders, which partially mitigates extreme centralization risks.

This holdings concentration level carries meaningful implications for market structure and price stability. While the top holders' substantial positions could theoretically enable coordinated market movements or significant price pressure during liquidation events, the existence of a meaningful retail holder base reduces the likelihood of extreme volatility stemming from single entities. The current distribution suggests a market structure with moderate centralization—higher than ideal for fully decentralized protocols, yet not severely concentrated enough to pose immediate systemic risks. This balance reflects a typical token ecosystem in development phases, where early investors and project participants maintain substantial positions alongside growing community participation.

View current HOLDSTATION Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xffa8...44cd54 | 948.36K | 23.13% |

| 2 | 0x9123...11b22f | 749.00K | 18.27% |

| 3 | 0x0d07...b492fe | 689.12K | 16.81% |

| 4 | 0xca2b...49838c | 410.11K | 10.00% |

| 5 | 0x2a4f...498eeb | 350.00K | 8.53% |

| - | Others | 952.05K | 23.26% |

II. Core Factors Influencing HOLDSTATION's Future Price

Technology Development and Ecosystem Building

-

Dynamic Pricing Feed Mechanism (DPF): HoldStation DeFutures implements a Dynamic Pricing Feed mechanism that integrates multiple data sources to ensure price transparency and fairness, reducing deviations caused by market volatility.

-

Flexible Market Maker (FMM): Combined with the Dynamic Pricing Feed mechanism, the Flexible Market Maker mechanism enhances the platform's operational efficiency and market liquidity.

-

DeFi Sector Advancement: HOLDSTATION's future price is influenced by technological advancements in the broader DeFi sector, including improvements to underlying blockchain infrastructure and smart contract capabilities that enable more efficient and secure decentralized finance operations.

Market Sentiment and Adoption

-

Investor Confidence: Investor confidence and market sentiment play crucial roles in determining HOLDSTATION's price trajectory. Positive news regarding widespread adoption or major technological breakthroughs typically triggers optimistic market sentiment and price appreciation.

-

Adoption Rate Growth: The platform is positioned to enter a growth phase with continuous improvement in adoption rates, which serves as a primary driver for future price appreciation.

III. HOLDSTATION Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.52-$0.73

- Neutral prediction: $0.73

- Bullish prediction: $1.09 (requiring sustained market demand and positive ecosystem development)

2026-2027 Medium-term Outlook

- Expected market phase: Recovery and consolidation with gradual upward momentum

- Price range predictions:

- 2026: $0.87-$1.30 (24% projected increase)

- 2027: $0.67-$1.51 (51% projected increase)

- Key catalysts: Platform adoption acceleration, ecosystem expansion, strategic partnerships, and institutional interest in the protocol

2028-2030 Long-term Outlook

- Base case scenario: $1.12-$1.94 by 2028 (78% projected increase)

- Bullish scenario: $1.46-$2.38 by 2029 (121% projected increase, assuming mainstream adoption and favorable regulatory environment)

- Transformative scenario: $1.64-$2.22+ by 2030 (173% projected increase, contingent on breakthrough technological innovation and market-wide expansion)

- Key milestone: The 2028-2030 period represents a potential inflection point where cumulative ecosystem growth and market maturation could drive significant value appreciation, with average price trajectory trending toward $1.30-$2.00 range

Note: These projections are based on historical data analysis and market models. Actual performance may differ significantly based on regulatory changes, market conditions, and technological developments.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.09187 | 0.7328 | 0.52029 | 0 |

| 2026 | 1.30464 | 0.91234 | 0.86672 | 24 |

| 2027 | 1.50754 | 1.10849 | 0.66509 | 51 |

| 2028 | 1.93586 | 1.30802 | 1.12489 | 78 |

| 2029 | 2.38425 | 1.62194 | 1.45975 | 121 |

| 2030 | 2.22344 | 2.0031 | 1.64254 | 173 |

Holdstation Professional Investment Strategy and Risk Management Report

IV. Holdstation Professional Investment Strategy and Risk Management

Holdstation Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi enthusiasts, zkSync ecosystem participants, futures traders seeking exposure to Account Abstraction technology

- Operational Suggestions:

- Accumulate HOLDSTATION tokens during market downturns, particularly leveraging the current -61.14% year-to-date decline as a potential value opportunity

- Dollar-cost averaging (DCA) over 6-12 months to reduce timing risk and benefit from volatility

- Hold through protocol upgrades and ecosystem expansions on Berachain and Worldchain to capture network growth premiums

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor $0.647 (ATL) as key support and $16.445 (ATH) as resistance, with intermediate levels at $1.00 and $2.00

- Volume Analysis: Trade volume of $68,584.19 (24h) indicates moderate liquidity; monitor for volume spikes preceding directional moves

- Wave Trading Key Points:

- Execute buy positions during oversold conditions (current 24h decline of -2.75% presents tactical entry opportunities)

- Set profit targets at 15-25% gains given the token's volatility profile, with stop losses at 8-10% below entry

Holdstation Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% portfolio allocation maximum

- Active Investors: 5-8% portfolio allocation

- Professional Investors: 10-15% allocation as part of diversified DeFi/L2 strategy

(2) Risk Hedging Solutions

- Delta Hedging: Utilize Holdstation's native 500x leveraged futures to short against long spot positions during high volatility periods

- Stablecoin Reserves: Maintain 40-50% of allocated capital in USDC/USDT to capitalize on sharp pullbacks in HOLDSTATION pricing

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for frequent dApp interactions and DeFi protocol engagement on zkSync Era

- Cold Storage Solution: For long-term holdings exceeding 12 months, transfer tokens to non-custodial hardware-verified addresses on BSC blockchain

- Security Considerations: Enable social recovery mechanisms native to Holdstation's Account Abstraction infrastructure; never share private keys; verify contract address (0xff583dc5ddc7c0bb3625fff39a587a2000e78888 on BSC) before token transfers

V. Holdstation Potential Risks and Challenges

Holdstation Market Risk

- Liquidity Risk: With only 4 exchange listings and $68,584 daily volume, HOLDSTATION exhibits limited market depth; large trades may experience significant slippage

- Volatility Risk: Historical performance shows -61.14% YTD decline and extreme ATH-to-current price deterioration (from $16.445 to $0.733), indicating acute market sentiment fragility

- Market Cap Concentration: $21.99M market cap with only 7.9M circulating tokens (26.35% of 30M total supply) creates potential dilution risk upon further token unlock events

Holdstation Regulatory Risk

- DeFi Regulatory Uncertainty: Jurisdiction-specific restrictions on leveraged trading products may impact Holdstation's 500x futures offering across different markets

- L2 Chain Regulatory Status: zkSync Era and Berachain regulatory classifications remain ambiguous in major jurisdictions, creating operational uncertainty

- Derivatives Licensing: Account Abstraction wallets offering native futures trading may face regulatory scrutiny from financial authorities regarding derivatives product offerings

Holdstation Technology Risk

- Smart Contract Vulnerability: Account Abstraction implementation on zkSync involves complex cross-chain interactions; potential smart contract exploits could compromise user funds

- L2 Scalability Dependency: Platform viability depends on sustained transaction throughput and network security of underlying zkSync and Berachain protocols

- Integration Risk: Multi-chain expansion (Berachain, Worldchain) increases surface area for technical failures and liquidity fragmentation across chains

VI. Conclusions and Action Recommendations

Holdstation Investment Value Assessment

Holdstation represents a speculative opportunity within the Account Abstraction and DeFi futures trading sectors. The platform's innovative integration of Account Abstraction with leveraged trading on zkSync Era provides genuine technical differentiation. However, the 61.14% year-to-date decline, moderate liquidity profile, and early-stage adoption metrics suggest investors should approach this asset with elevated risk discipline. The project shows legitimate technical merit through its multi-chain expansion roadmap, but market adoption remains nascent relative to established DeFi protocols.

Holdstation Investment Recommendations

✅ Beginners: Limited allocation (1-2%) as educational exposure to Account Abstraction technology; focus on understanding Holdstation's wallet infrastructure before active trading

✅ Experienced Investors: Moderate allocation (5-8%) with systematic DCA accumulation during pronounced downturns; engage with DeFi interactions via Gate.com's interface to evaluate product-market fit

✅ Institutional Investors: Consider 3-5% tactical allocation within broader L2/DeFi exposure, conditional upon technical security audits and improved liquidity metrics across centralized venues

Holdstation Trading Participation Methods

- Gate.com Spot Trading: Direct HOLDSTATION/USDT and HOLDSTATION/USDC pairs for entry/exit execution with institutional-grade order routing

- Leverage Trading on Holdstation: Utilize the platform's native 500x futures for directional positions on risk capital only; implement strict position sizing (maximum 2% account risk per trade)

- Liquidity Provision: Contribute to Holdstation DEX liquidity pools on zkSync Era for yield opportunities, understanding impermanent loss risks given current volatility regime

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult professional financial advisors. Never invest capital you cannot afford to lose entirely.

FAQ

What is HOLDSTATION and what is its use case?

HOLDSTATION (HOLD) is a decentralized exchange platform powered by AI trading tools. It enables cross-chain transactions and simplifies DeFi participation, allowing users to trade cryptocurrencies efficiently across multiple blockchain networks.

What factors could influence HOLDSTATION's price in the future?

HOLDSTATION's price is influenced by supply and demand dynamics, protocol updates, block reward changes, market sentiment, and broader cryptocurrency trends. Real-world adoption and transaction volume growth also impact its valuation.

Is HOLDSTATION a good investment and what are the risks involved?

HOLDSTATION offers potential returns but carries significant volatility risks. As an emerging crypto asset, price fluctuations are substantial. Conduct thorough research on tokenomics, team credibility, and market conditions before investing. Only allocate capital you can afford to lose, as cryptocurrency markets remain highly speculative and unpredictable.

How does HOLDSTATION compare to other similar cryptocurrency projects?

HOLDSTATION stands out with superior user-friendly trading interface and lower fees compared to similar projects. It offers better liquidity, faster transaction speeds, and stronger community support. HOLDSTATION's innovative features and transparent governance model position it ahead of competitors in the current market landscape.

What is the current market cap and trading volume of HOLDSTATION?

The current market cap of HOLDSTATION is $6.5 million, with a circulating supply of 7.9 million tokens. Its 24-hour trading amount is $98,260, reflecting active market participation.

Is Holdstation (HOLDSTATION) a Good Investment?: Analyzing the Potential Returns and Risks in the Current Crypto Market

2025 ZF Price Prediction: Analyzing Market Trends and Potential Growth Factors for ZF Shares

2025 NAVX Price Prediction: Navigating the Future of Decentralized Finance

What is AEVO: A Comprehensive Guide to the Decentralized Options Trading Platform

2025 NETT Price Prediction: Exploring the Potential for Exponential Growth in the Decentralized Finance Market

2025 NOM Price Prediction: Expert Analysis and Market Outlook for Nomad Token in the Coming Year

Bitcoin Price Forecast: Prospects Beyond 2025

Understanding Web 3.0: The Next Phase of Decentralized Internet Evolution

2024 Meme Coin Price Prediction: STARS Skyrockets with New Listings

Presale Success: Crypto All-Stars Raises $4 Million with Promising Tokenomics

Understanding Centralized Cryptocurrency Exchanges: A Comprehensive Guide