2025 HOLDSTATION Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Holdstation's Market Position and Investment Value

Holdstation (HOLDSTATION) is an innovative Smart Contract Wallet for Futures Trading built on zkSync Era, serving as a "product-fitted community" platform for seamless trading and asset management. Since its launch in November 2024, Holdstation has established itself as one of the first wallets to adopt native Account Abstraction on zkSync. As of December 2025, Holdstation's market cap has reached approximately $5.82 million, with a circulating supply of around 7.9 million tokens and a current price hovering near $0.74. This pioneering platform, recognized for its "Account Abstraction-powered DeFi experience," is playing an increasingly important role in the decentralized finance ecosystem across multiple blockchain networks including zkSync, Berachain, and Worldchain.

The platform enables users to engage with dApps, exchange tokens across Layer 2 and EVM chains, and trade leveraged futures up to 500x with enhanced security features such as Paymaster, Batch Transactions, Spending Limit, and Social Recovery. Additionally, through its A(i)gentFi initiative, users can collectively own and deploy revenue-generating AI agents.

This article will comprehensively analyze Holdstation's price trends from 2025 to 2030, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

HOLDSTATION Price Analysis Report

I. HOLDSTATION Price History Review and Market Status

HOLDSTATION Historical Price Trajectory

-

December 2024: HOLDSTATION reached its all-time high of $16.445 on December 27, 2024, marking a significant peak in the token's market performance during the post-launch period.

-

2025: The token experienced substantial depreciation throughout the year, declining from its peak levels to reach an all-time low of $0.647 on March 9, 2025, representing an approximate 96% decrease from the all-time high.

-

Current Period: From March 2025 to December 2025, HOLDSTATION has recovered partially, trading at $0.7367 as of December 23, 2025, demonstrating slight stabilization from the earlier lows while remaining significantly below historical peaks.

HOLDSTATION Current Market Position

Price Metrics and Performance:

- Current price: $0.7367 USD

- 24-hour price change: -2.85%

- 7-day price change: -11.05%

- 30-day price change: -16.0099%

- 1-year price change: -60.81%

- 24-hour trading range: $0.7222 - $0.7606

Market Capitalization and Supply:

- Current market capitalization: $5,822,655.79

- Fully diluted valuation: $22,101,000.00

- Circulating supply: 7,903,700 HOLDSTATION (26.35% of total supply)

- Total supply: 30,000,000 HOLDSTATION

- Market dominance: 0.00069%

Trading Activity:

- 24-hour trading volume: $61,666.31

- Token holders: 526

- Listed on 4 exchanges

- Market capitalization to fully diluted valuation ratio: 26.35%

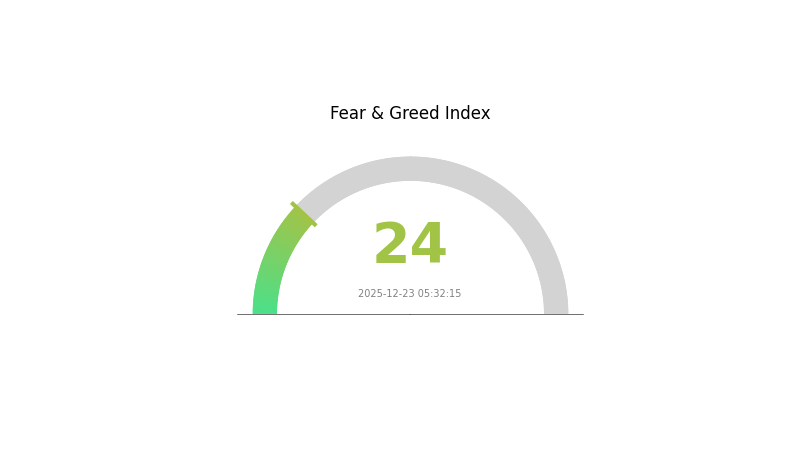

Market Sentiment: Current market sentiment reflects extreme fear (VIX: 24), indicating heightened risk aversion in the broader cryptocurrency market as of December 23, 2025.

Click to view current HOLDSTATION market price

HOLDSTATION Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting 24 points. This indicates investors are highly risk-averse, reflecting significant uncertainty and bearish sentiment across the market. During such periods, traditional defensive strategies become crucial. Seasoned traders often view extreme fear as potential buying opportunities, while newcomers should exercise caution and avoid panic selling. Monitor market developments closely on Gate.com and consider dollar-cost averaging if you maintain a long-term investment outlook. Remember, emotional volatility is inherent to crypto markets.

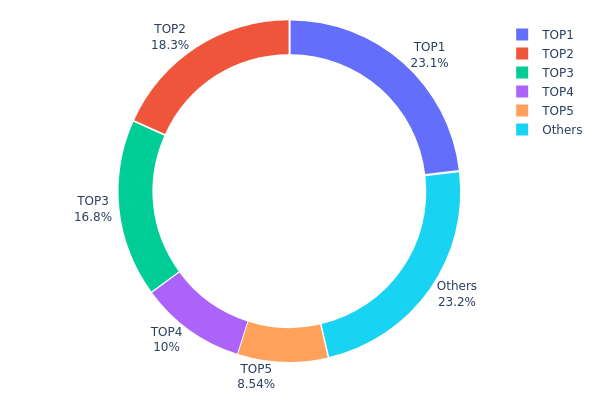

HOLDSTATION Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, providing critical insight into market structure and potential governance risks. By analyzing the top holders and their respective percentages of total supply, investors and analysts can assess the degree of decentralization, identify potential whale influence, and evaluate vulnerability to coordinated price movements or market manipulation.

The HOLDSTATION token exhibits significant concentration risk, with the top five addresses collectively controlling 76.74% of the total supply. The largest holder commands 23.13% of tokens, while the second and third holders account for 18.27% and 16.81% respectively. This distribution pattern reveals a relatively high degree of centralization, as fewer than five entities control three-quarters of the circulating supply. The concentration becomes more pronounced when noting that the top four addresses alone represent 68.21% of holdings, indicating potential governance asymmetry and elevated systemic risk.

The remaining 23.26% of tokens distributed among other addresses demonstrates limited decentralization at the tail end of the distribution curve. This structure suggests that while some token dispersion exists beyond the major holders, the overall architecture remains vulnerable to coordinated actions by principal stakeholders. The prevalence of substantial single-address holdings raises questions regarding market stability and price discovery mechanisms, as concentrated ownership can facilitate large-scale exits or create artificial scarcity scenarios that disproportionately impact smaller market participants.

Click to view current HOLDSTATION holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xffa8...44cd54 | 948.36K | 23.13% |

| 2 | 0x9123...11b22f | 749.00K | 18.27% |

| 3 | 0x0d07...b492fe | 689.12K | 16.81% |

| 4 | 0xca2b...49838c | 410.11K | 10.00% |

| 5 | 0x2a4f...498eeb | 350.00K | 8.53% |

| - | Others | 952.05K | 23.26% |

Core Factors Influencing HOLDSTATION's Future Price

Technology Development and Ecosystem Building

-

Dynamic Price Feed Mechanism (DPF): HoldStation DeFutures employs a dynamic price feed mechanism that integrates multiple data sources to ensure price transparency and fairness, reducing deviations caused by market volatility.

-

Flexible Market Making (FMM): The platform utilizes flexible market making mechanisms to enhance liquidity and trading efficiency within its ecosystem.

Market Sentiment and News Dynamics

-

Investor Confidence: Investor sentiment and confidence directly impact HOLD/USD price fluctuations. Market psychology plays a crucial role in determining short-term price movements.

-

Positive News and Developments: Positive announcements regarding widespread adoption of HOLD or major technological breakthroughs significantly boost market sentiment. Conversely, regulatory crackdowns, security vulnerabilities, or other negative news can trigger market panic and price declines.

Regulatory Environment

- Policy Monitoring Impact: Regulatory monitoring and potential policy changes represent significant factors that can substantially alter HOLD's price trajectory. Regulatory clarity or restrictions can create both upside and downside pressure on the token's valuation.

Three、2025-2030 HOLDSTATION Price Forecast

2025 Outlook

- Conservative Prediction: $0.37 - $0.55

- Neutral Prediction: $0.55 - $0.73

- Optimistic Prediction: $0.73 - $0.83 (requires sustained market sentiment and ecosystem development)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation and gradual recovery phase with increasing institutional adoption

- Price Range Predictions:

- 2026: $0.41 - $0.95

- 2027: $0.67 - $1.21

- Key Catalysts: Platform ecosystem expansion, strategic partnerships, improved market liquidity on major exchanges like Gate.com, and increased utility adoption

2028-2030 Long-term Outlook

- Base Case: $0.70 - $1.07 (2028) progressing to $0.81 - $1.51 (2030), assuming stable regulatory environment and moderate adoption growth

- Optimistic Case: $1.07 - $1.39 (2029) with sustained bull market momentum and significant institutional inflows

- Transformation Case: $1.51+ (2030), contingent on breakthrough technological innovations, mainstream adoption, and transformative market conditions

Key Observation: HOLDSTATION demonstrates a projected cumulative appreciation of approximately 65% through 2030, with increasing price volatility and upside potential in mid-to-long term periods, though downside protection remains important for risk management.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.82931 | 0.7339 | 0.37429 | 0 |

| 2026 | 0.94574 | 0.7816 | 0.40643 | 6 |

| 2027 | 1.20914 | 0.86367 | 0.66503 | 17 |

| 2028 | 1.0675 | 1.03641 | 0.70476 | 40 |

| 2029 | 1.38858 | 1.05195 | 0.67325 | 42 |

| 2030 | 1.51313 | 1.22026 | 0.80537 | 65 |

Holdstation (HOLDSTATION) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Holdstation is an innovative Smart Contract Wallet for Futures Trading built on zkSync Era. As of December 23, 2025, the token trades at $0.7367 with a market capitalization of approximately $5.82 million and a fully diluted valuation of $22.1 million. The token has experienced significant volatility, declining 60.81% over the past year from its all-time high of $16.445 reached on December 27, 2024.

II. Current Market Status of Holdstation

Market Overview

| Metric | Value |

|---|---|

| Current Price | $0.7367 |

| Market Cap | $5,822,655.79 |

| Fully Diluted Valuation | $22,101,000.00 |

| Circulating Supply | 7,903,700 HOLDSTATION |

| Total Supply | 30,000,000 HOLDSTATION |

| Circulating Supply Ratio | 26.35% |

| 24H Trading Volume | $61,666.31 |

| Market Dominance | 0.00069% |

Price Performance Analysis

| Time Period | Change % | Change Amount |

|---|---|---|

| 1 Hour | -0.27% | -$0.0020 |

| 24 Hours | -2.85% | -$0.0216 |

| 7 Days | -11.05% | -$0.0915 |

| 30 Days | -16.01% | -$0.1404 |

| 1 Year | -60.81% | -$1.1431 |

Key Observations:

- All-Time High: $16.445 (December 27, 2024)

- All-Time Low: $0.647 (March 9, 2025)

- Current 24H Range: $0.7222 - $0.7606

- Token holders: 526 addresses

- Exchange listings: 4 platforms

III. Platform Technology and Features

Core Innovation: Account Abstraction Implementation

Holdstation integrates native Account Abstraction on zkSync, providing users with:

- Seamless dApp Interaction: Direct integration with decentralized applications

- Cross-Chain Token Swaps: Exchange capabilities across Layer 2 and EVM chains

- Leveraged Futures Trading: Up to 500x leverage available for derivatives trading

Key Product Offerings

1. Smart Contract wallet

- Full-suite Account Abstraction implementations

- Paymaster functionality for transaction sponsorship

- Batch Transactions for optimized gas efficiency

- Spending Limits for enhanced security

- Social Recovery mechanisms

2. DeFutures Platform

- Permanent DEX on zkSync

- Leveraged futures trading capabilities

- Fast execution (within seconds)

3. A(i)gentFi - AI Agent Launchpad

- Available on zkSync and Berachain

- Allows users to collectively own and deploy revenue-generating AI agents

- Community-driven agent deployment model

4. Multi-Chain Expansion

- Primary deployment: zkSync Era

- Extended to: Berachain and Worldchain

- Enhanced security features across all chains

IV. Holdstation Professional Investment Strategy and Risk Management

Holdstation Investment Methodology

(1) Long-Term Holding Strategy

-

Target Audience: Risk-aware investors with 6-month to 3-year time horizons; DeFi protocol enthusiasts; believers in zkSync ecosystem growth

-

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Accumulate HOLDSTATION over extended periods to mitigate volatility impact given the 60.81% annual decline

- Accumulation at Support Levels: Current price near $0.73 may represent accumulated value for long-term participants, particularly relative to the all-time high of $16.445

- Ecosystem Integration Tracking: Monitor Holdstation's expansion on Berachain and Worldchain as expansion catalysts

-

Storage Solution: For extended holding periods, utilize cold storage solutions or self-custody wallets with private key control to eliminate counterparty risk from exchange hacks

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support/Resistance Levels: Identify key price zones ($0.647 ATL, $0.73 current, $16.445 ATH) for entry/exit point determination

- Volume Analysis: Monitor the relatively modest $61,666 daily volume to assess liquidity constraints that may impact execution prices

-

Swing Trading Considerations:

- Volatility Exploitation: The -2.85% daily movement presents intraday trading opportunities, though limited volume suggests wider bid-ask spreads

- Risk/Reward Ratios: Establish clear profit-taking targets at 15-25% gains given current price stability around $0.73-$0.76 range

Holdstation Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% portfolio allocation maximum; restrict position sizing given the token's 26.35% circulating supply ratio and substantial price depreciation

- Active Investors: 1-3% portfolio allocation; implement strict stop-loss orders at 10-15% below entry price

- Professional Traders: 3-5% portfolio allocation; employ hedging strategies through derivatives or stablecoin pairs

(2) Risk Hedging Strategies

- Stablecoin Pairs: Maintain USDT or USDC reserves to quickly exit positions during adverse market conditions

- Dollar-Cost Averaging Exit: Systematically reduce positions during price recoveries rather than attempting single-point liquidation

(3) Secure Storage Solutions

- Hardware Security Approach: For significant holdings, employ multi-signature wallets or hardware-backed security solutions with proper backup and recovery mechanisms

- Custody Considerations: Due to the relatively small market cap ($5.8M), centralized exchange custody carries elevated risk; prioritize non-custodial solutions

- Security Best Practices:

- Never share private keys or seed phrases

- Enable two-factor authentication on all exchange accounts

- Use whitelisting features to restrict withdrawal addresses

- Regularly audit smart contract interactions given the protocol's focus on Account Abstraction

V. Potential Risks and Challenges for Holdstation

Market Risks

- Extreme Price Volatility: The 60.81% annual decline and contraction from $16.445 to $0.73 (95.5% drawdown) indicates severe market sentiment deterioration and potential structural liquidity issues

- Liquidity Constraints: Daily trading volume of $61,666 relative to $22.1M fully diluted valuation suggests insufficient liquidity for large position accumulation or liquidation without significant slippage

- Circulating Supply Dilution: Only 26.35% of total supply circulates; future unlock events of the remaining 73.65% (22.1M tokens) could exert sustained downward price pressure

Regulatory Risks

- Futures Trading Jurisdiction Issues: High-leverage futures trading (up to 500x) faces regulatory scrutiny in multiple jurisdictions; regulatory crackdowns on leverage products could impact platform utility

- Smart Contract Wallet Compliance: Account Abstraction implementations may face compliance challenges as regulators establish clearer frameworks for self-custody solutions

- Multi-Chain Regulatory Fragmentation: Operations across zkSync, Berachain, and Worldchain create complex regulatory exposure across multiple jurisdictions

Technology Risks

- Smart Contract Vulnerabilities: Account Abstraction implementations are nascent technology; undiscovered vulnerabilities could lead to user fund loss

- Layer 2 Dependency: Reliance on zkSync's security model and liveness means Holdstation inherits infrastructure risks from its base layer

- Cross-Chain Bridge Risks: Multi-chain expansion to Berachain and Worldchain introduces bridge security risks and potential loss-of-funds scenarios

VI. Conclusions and Action Recommendations

Holdstation Investment Value Assessment

Holdstation operates at the intersection of two emerging DeFi trends: Account Abstraction wallets and AI-driven agent protocols. The platform's technical implementation on zkSync offers genuine utility through 500x leveraged futures and cross-chain token management. However, the token's 95.5% drawdown from all-time highs, combined with relatively thin liquidity ($61,666 daily volume) and an early-stage project profile, indicates substantial downside risk remains.

The current price of $0.73 provides some valuation respite compared to historical peaks, but the abundance of circulating supply dilution ahead (only 26.35% of tokens released) suggests potential for further depreciation before fundamental adoption metrics improve. Investment participation should be predicated on genuine belief in Account Abstraction adoption on zkSync and broader Ethereum Layer 2 ecosystems.

Holdstation Investment Recommendations

✅ Newcomers: Initiate with minimal allocation (0.5-1% of portfolio) using DCA strategy over 3-6 months; focus on understanding Account Abstraction technology and zkSync ecosystem before increasing exposure. Exercise extreme caution given high volatility.

✅ Experienced Investors: Establish 2-3% core positions at support levels ($0.65-$0.75 range) while maintaining discipline around stop-losses. Monitor ecosystem adoption metrics (daily active users, total value locked) rather than price action alone. Remain vigilant for lock-up expirations and dilution events.

✅ Institutional Investors: Position sizing should reflect the extremely limited liquidity; anticipated purchases of >$500,000 likely face execution challenges on current order books. Consider staked positions in the ecosystem protocols (zkSync validators/sequencers) rather than direct token exposure.

Holdstation Trading Participation Methods

- Direct Token Trading: Purchase HOLDSTATION on Gate.com and other listed exchanges; utilize limit orders to manage slippage given liquidity constraints

- Futures Derivatives: Engage with the platform's native leveraged futures functionality once comfortable with Account Abstraction smart contract interaction patterns

- Ecosystem Participation: Utilize Holdstation wallet for zkSync dApp interactions and DeFi protocol engagement; potential future rewards or governance mechanisms may benefit active platform users

Critical Risk Disclosure: Cryptocurrency investments carry extreme risk, and this report does not constitute investment advice. HOLDSTATION has experienced 60.81% annual depreciation and 95.5% drawdown from all-time highs. Investors must assess their risk tolerance carefully and never invest capital they cannot afford to lose completely. Consider consulting with qualified financial professionals before making investment decisions. The token's limited liquidity and early project stage compound risk significantly.

FAQ

Will Hamster Kombat coin reach $1?

Hamster Kombat reaching $1 is highly unlikely. The coin would need to gain over 458,000% from current levels, which is extremely improbable given market conditions and current supply dynamics.

Can holo reach $1 dollar?

Yes, it's possible. With increased adoption, network expansion, and favorable market conditions, Holo could potentially reach $1. However, this depends on long-term development progress and overall market sentiment.

Will dent reach 1 dollar?

Dent reaching $1 is highly unlikely. It would require a 475,000% increase from current levels, which is extremely improbable based on current market projections and fundamentals.

Can Sol reach $1000 USD?

Yes, Solana could potentially reach $1,000 USD. While it requires significant market cap growth, Solana's strong ecosystem development and increasing adoption create favorable conditions for substantial long-term price appreciation.

What is HOLDSTATION and what is its current price?

HOLDSTATION is a cryptocurrency token currently priced at $1.26, with a market cap of $9.97 million. It represents a digital asset within the web3 ecosystem.

What are the factors that could influence HOLDSTATION price in the future?

HOLDSTATION price will be influenced by market sentiment, trading volume, technological advancements, user adoption rates, and regulatory changes. Network activity and ecosystem developments are also key drivers.

How does HOLDSTATION compare to other similar cryptocurrency projects?

HOLDSTATION stands out for its user-friendly interface and simplicity compared to competitors. It focuses on accessible trading experience while maintaining strong market performance. The project emphasizes ease of use and intuitive design, making it attractive to both beginners and experienced traders seeking straightforward functionality.

Is Holdstation (HOLDSTATION) a Good Investment?: Analyzing the Potential Returns and Risks in the Current Crypto Market

What is AEVO: A Comprehensive Guide to the Decentralized Options Trading Platform

What is TITN: A Comprehensive Guide to Understanding This Revolutionary Technology Platform

What is HOLDSTATION: A Comprehensive Guide to the Next-Generation Decentralized Trading Platform

AERO Token Price Prediction and Market Insights: An In-Depth Analysis

A Guide to Perpetual Trading on Decentralized Platforms

Understanding the Impact of a Major Platform's Cash P2P Closure on Traders

Predicting the Next Bitcoin Bull Market Peak: Insights for 2025

Advancements in Local Growth and Regulatory Adherence in Poland's Crypto Sector

A Complete Guide to Puffer Finance: Everything You Should Know

What is MLT: A Comprehensive Guide to Machine Learning Testing and Its Applications in Modern Software Development